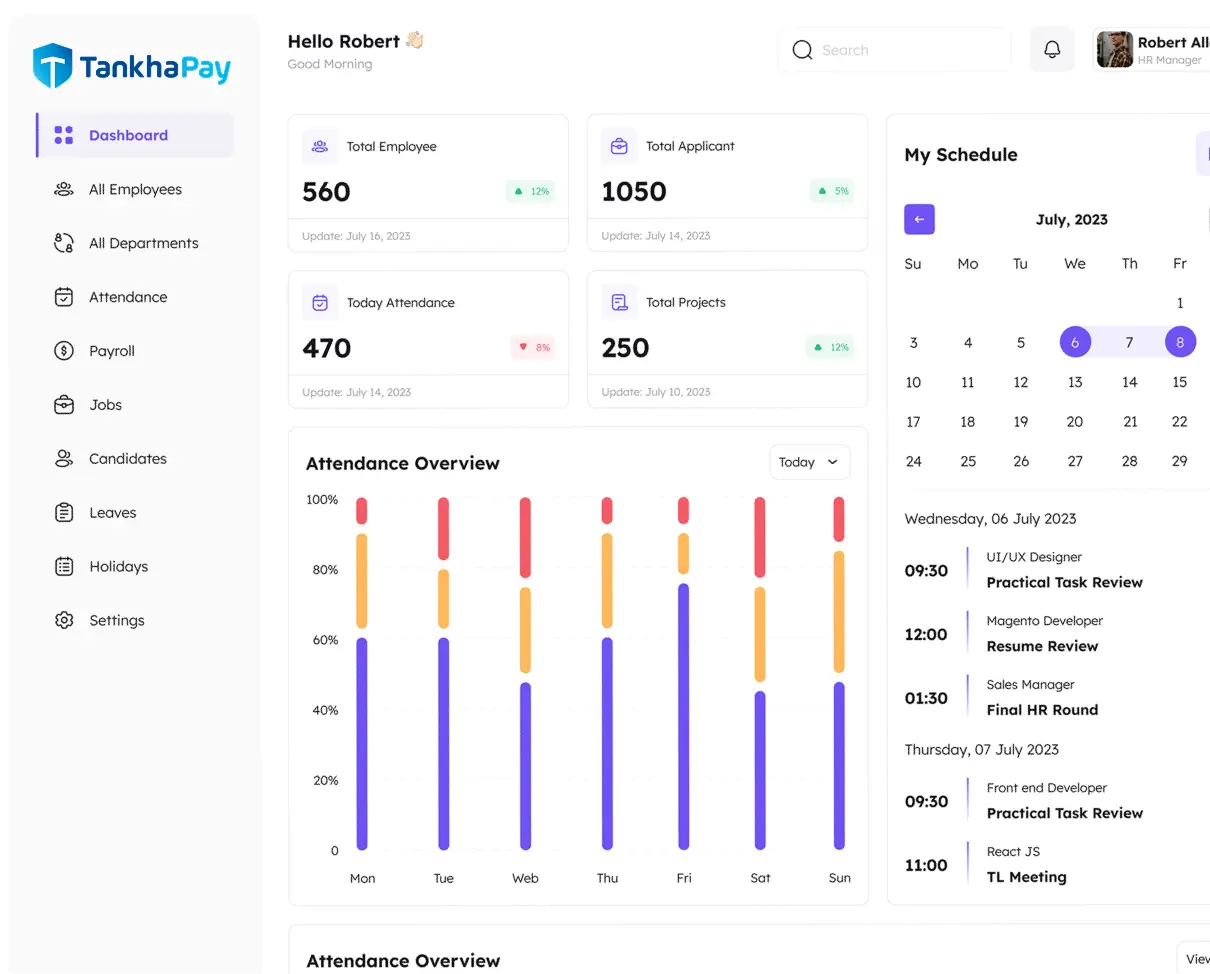

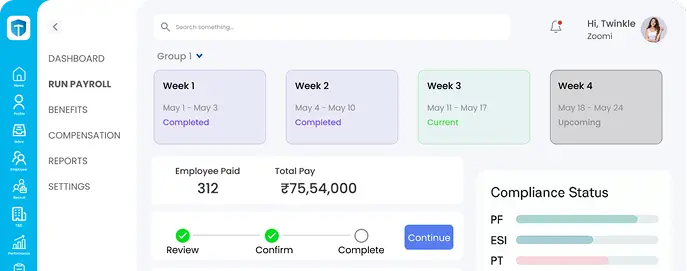

Payroll Services

Most organisations struggle with payroll due to scattered data, manual calculations, and compliance errors, leading to penalties. That’s where TankhaPay steps in. Our technology-enabled payroll services, backed by Payroll experts, ensure payroll accuracy, regional compliance, and timely payouts.