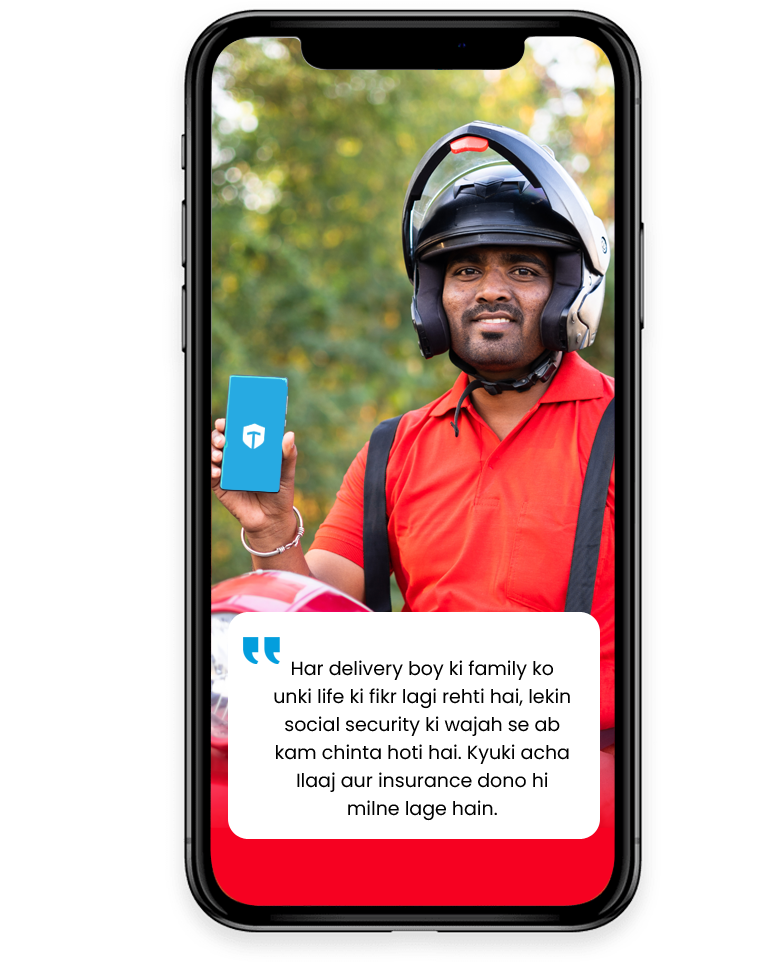

In India Social security benefits to workers are provided through government schemes like ESI and PF

Social security is the protection provided by the government to ensure the country's workforce has financial security in case of retirement, unemployment, sickness, work injury, maternity, health emergencies or loss of the breadwinner.

Social Security: A fundamental right of every worker

Medical Benefits

(ESI Benefits)

-

A person insured under ESIC can enrol all his dependents under ESIC, and can avail of cash-free medical treatments, at the assigned ESIC dispensary or referred ESIC hospital.

-

Medical Benefits include hospitalisations, medications, specialist consultations, laboratory testing and imaging, immunisations etc.

-

Maternity Benefits are provided to insured workers for up to 26 weeks and for specific amounts of time in case of complications, depending on the reason.

-

In case of temporary disablement, certain amounts of wages are payable for the duration of the disability. In case of permanent disablement, the duration is determined by the medical board.

Retirement & Insurance Benefits (EPF Benefits)

-

Members of EPF can attain a lump-sum amount on retirement.

-

Members of EPF will receive a monthly pension.

-

In case of the death of a member of EPF, the nominee is eligible for a benefit amount of up to Rs. 7 lakhs.

-

The widow/ widower of a deceased insured person is eligible for a minimum pension of Rs. 1,000/ month, and each child receives a pension amount as well.

-

A member of EPF can avail of an advance of up to 75% of the amount available in their PF account in case of unemployment.

Social Security Benefits in a Glance

This includes hospitalisation, specialist consultations, lab tests, imagery etc.

Benefits

All Dependents covered under ESI for free

Benefits

Compensation of 70% of daily average wages in case of sickness

Benefits

Maternity benefits of 26 weeks and additional benefits for specific time periods in case of complications.

Benefits

Workers can avail an advance of up to 75% of the amount in PF account. Under ESI, they can get an allowance of 50% of wages in case of layoffs.

Benefits

Compensation of wages in case of temporary and permanent disablement

Up to Rs. 7 lakhs provided to the nominee in case of death of a PF member. Monthly compensation provided to widow/widower and orphans children.

Pension

A lump-sum amount on retirement and monthly pension provided to a PF member on retirement.