Social security solutions for MSMEs and Startups

Leverage the TankhaPay app and seamlessly provide social security benefits of PF and ESI to your full-time, part-time or gig workers.

Request a Callback!

How giving social security to your workers can help your business

Increase Productivity by

Workers are more productive and perform better when they are less stressed about medical bills and their family's future.

Increase Loyalty by

Workers stay in the company longer, through its ups and downs, when they feel that the employer is doing the same for them.

Lower Absenteeism by

When the workers receive free and readily available medical care, can be more regular at work.

Increase Retention by

Workers tend to stay with you longer when they get social security benefits, as it helps them to be more secure about their family's future.

Improve Recruitment by

Social security benefits are the top consideration of many workers when applying for jobs.

What you get

Salary Structuring and Payrolling

Achieve precise salary structures that include PF & ESI contributions. Enjoy fully automated and stress-free payroll processing for your organisation.

Attendance Management

Effortlessly keep track of your wokers' attendance with features such as leave management and geolocation, ensuring fair and accurate payment for their work.

ESI & PF Compliance Management

Save time, money and manpower required for the cumbersome processes of PF & ESI compliance. TankhaPay offers a 360-degree solution, keeping your organisation fully compliant with PF and ESI.

ESI & PF Service Assistance

The TankhaPay team assists your workers not only in navigating the app but also in resolving any issues that they may face when accessing PF and ESI services.

No ESI or PF Registration Required for your Business

With TankhaPay, you do not need PF & ESI registration numbers. When you onboard the app, you assume the role of the Principal Employer while your workers assume the role of contractual workers of TankhaPay. The app maintains all compliances for you.

Save on the Costs of a Full-Time HR Team

Reduce expenses by eliminating the need for a full-time HR team for attendance management, salary structuring, payrolling, and compliance management. TankhaPay does it all

How does it work?

-

Your workers are on boarded on the TankhaPay app as associates

-

You being the Principal Employer, just need to mark attendance (or bypass it) and ensure sufficient balance in your TankhaPay account.

-

The app runs the payrolls as per the marked attendance, maintains compliance, and ensures that your workers are enrolled in EPF and ESIC.

-

On your specified payout date, the salaries get credited to the workers’ bank accounts.

Who is it for?

Who is it for?

Professionals & Households

Startups

Marketing Agencies

Factories and Warehouses

Online Platforms

Small & Medium Business

By paying salaries through the TankhaPay app

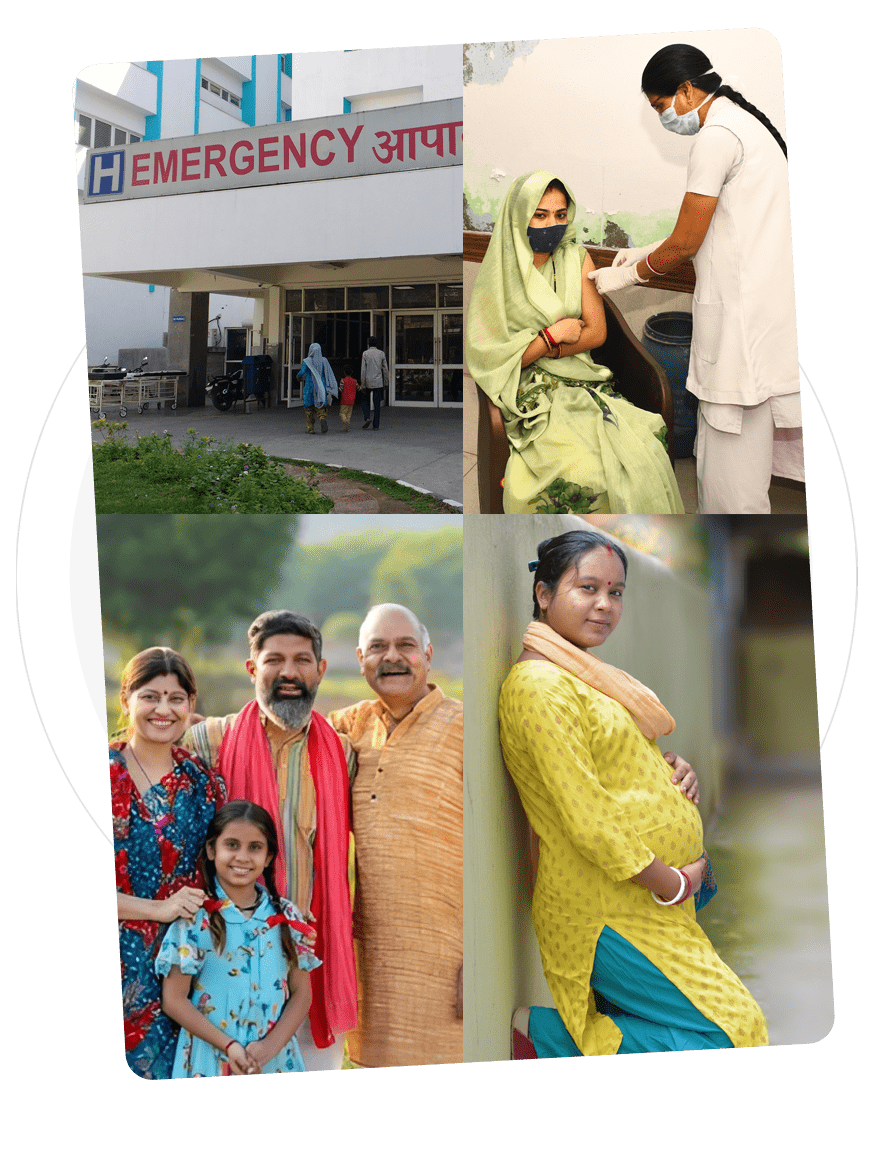

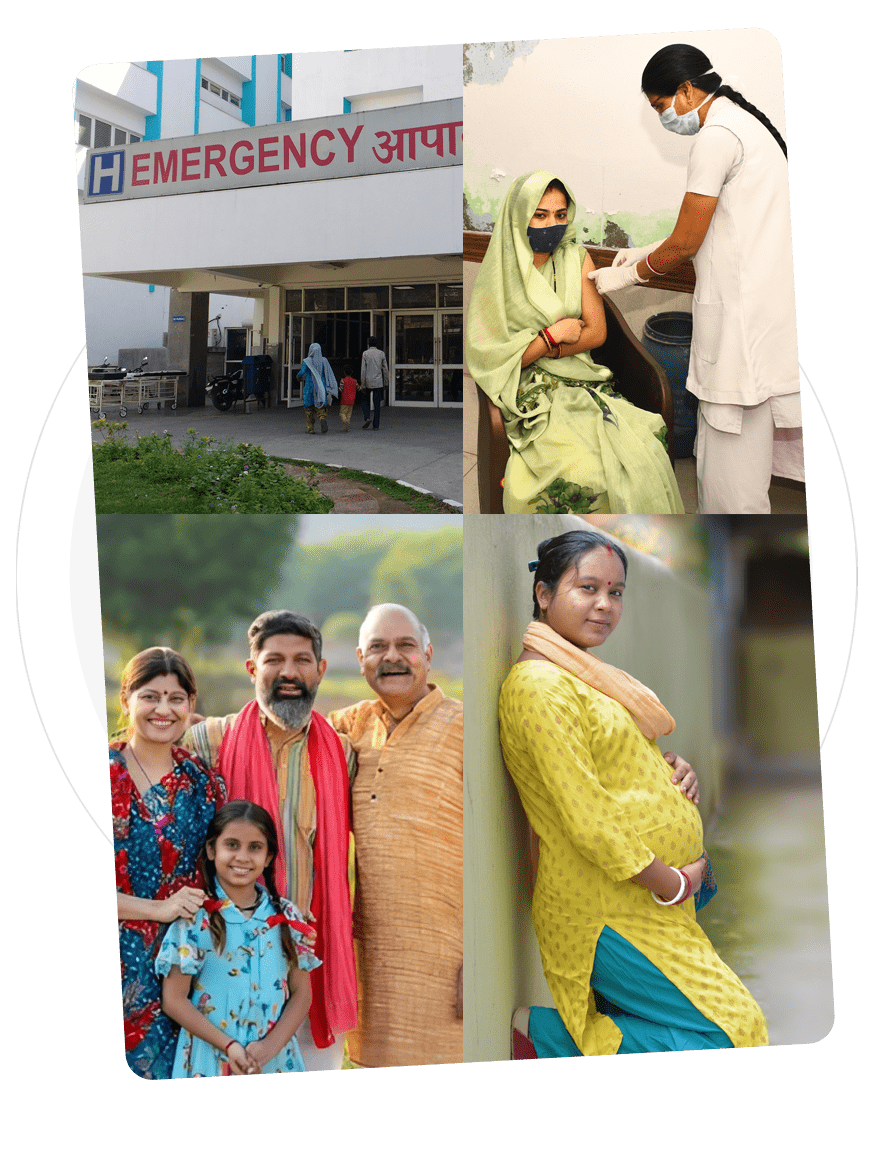

Your workers can now receive social security through government schemes of PF & ESI, which offer various benefits like-

-

Free hospitalisation, specialist consultations, lab tests, imagery etc. at ESI hospitals and dispensaries

-

All dependents covered in ESI for free

-

Maternity, disability & unemployment benefits

-

Up to Rs. 7 lakhs of insurance upon death

-

Lump-sum amount on retirement & monthly pension

Frequently Asked Questions

Paying salaries with social security ensures that your workers have a safety net in case of healthcare, retirement and mishappenings.

When your workers are socially and financially secure, they are able to give more to their jobs and are more motivated to work and be productive. They feel cared for and stay with you longer through your ups and downs. Learn More

Principal employer is the one whose employees are contracted and onboarded on the TankhaPay app. So, the employer under whom the employee is working directly is the principal employer, and TankhaPay will be the contractual employer. The worker will be on TankhaPay’s payroll, but it is your responsibility as the principal employer to provide us sufficient amounts in order for us to run the payouts and complete compliances.

Yes, you can, using the Tankha Pay app. In general, it is voluntary for such employers to provide PF and ESI to their workers, but the compliance process is cumbersome. But with the Tankha Pay app, you can now provide social security benefits to your workers, whether they be permanent, temporary or on a gig basis, through PF and ESI.

Yes, you can, using the Tankha Pay app. In general, households are not eligible to provide PF and ESI to their workers. But with the Tankha Pay app, you can now provide social security benefits to your domestic workers through PF and ESI, just like any other worker would get!

All you have to do is download the TankhaPay app! The app will ensure that all your PF & ESI compliances are taken care of without the need of registering with these government organizations.