The Employees’ Provident Fund (EPF) is a powerful tool that helps several Indians save for their retirement, ensuring their financial independence even after they stop earning. It is a contribution-based scheme where the employees and employers pay a pre-fixed proportion of the wages into the EPF scheme each month. It accumulates overtime along with interest payments, creating a solid emergency and retirement corpus. It is important to keep track of the EPF balance to ensure the money is being credited correctly and to plan one’s retirement. So, how to check EPF balance?

In this blog, we help you understand how to check EPF balance through different online and offline methods.

Latest Updates

These updates demonstrate the EPFO’s commitment to expanding its services, ensuring transparency, and providing enhanced social security benefits to its members.

EPFO Witnessed 3,491 Establishments in June: In June, 3,491 establishments extended social security benefits to their employees through the Employees Provident Fund Organisation (EPFO). Additionally, the EPFO experienced a surge in membership, with 17.89 lakh new members joining. Compared to the previous month of May, there was a substantial 9.71% increase in members, indicating a noticeable uptrend in enrolment.

EPFO Sets Interest Rate at 8.15% for 2022-2023: For the financial year 2022-2023, the EPFO announced an interest rate of 8.15% on the Employees’ Provident Fund (EPF) scheme. This rate was confirmed through a circular dated 24 July 2023. EPF contributions are made by both employees and employers monthly.

Extended Deadline for Higher Pension Applications: The EPFO extended the deadline for applying for a higher pension until 26 July 2023. Members and pensioners have until 30 September to validate their application forms, with an additional 15-day window for joint option submissions.

EPFO Expands Social Security Coverage: The EPFO registered a significant increase in formal sector workers, with a 13.2% growth, totalling 13.9 million in 2022-23. In April, 1.72 million net subscribers were added, showcasing a rise in the official workforce. Notably, 54.15% of these new members fell within the 18 to 25 age group.

Taxation on EPF Withdrawals: Budget 2023 introduced taxation changes; withdrawals from EPF accounts before five years will be taxed at 20% instead of the previous 30% if the PAN card is not linked with the EPF account.

EPFO Introduces Nidhi Aapke Nikat 2.0 Programme: The EPFO launched the nationwide Nidhi Aapke Nikat 2.0 outreach programme, connecting even rural areas. This initiative aims to enhance outreach and improve services for EPFO beneficiaries.

Higher Pension Application Process Detailed: The EPFO issued a circular outlining the scrutiny process for higher pension applications, focusing on the examination of data submitted by both employers and employees. Field officials assess applications and joint options, ensuring eligibility conditions are met.

EPFO’s Membership Expansion: In November 2022, the EPFO added 16.26 lakh net subscribers, marking a 25.67% increase from October. The age group of 18-25 years constituted 56.60% of new members, and Maharashtra and Tamil Nadu contributed significantly to this expansion.

EPS E-Passbook Facility Restored: After a brief unavailability period, the EPFO reinstated the e-passbook facility, addressing concerns raised by subscribers. This facility allows subscribers to check their EPF balance online.

Full Interest Credited to EPF Subscribers: The EPFO ensured that full interest was credited to subscribers’ EPF accounts, providing transparency to subscribers. Subscribers can verify interest credits by visiting the official EPFO website.

EPFO’s Successful Membership Growth: In January, EPFO experienced a slight decrease in net employee additions compared to the previous month. However, its continuous efforts in membership expansion were evident as formal sector employees grew by 13.2%.

EPFO’s Higher Pension Application Deadline Extended: The EPFO extended the deadline for opting for a higher pension until 3 May 2023, accommodating requests and allowing eligible members ample time to apply for this option.

EPFO’s Expansion in December 2022: In December 2022, the EPFO added 14.93 lakh net subscribers, with Gujarat, Maharashtra, Haryana, Tamil Nadu, and Karnataka being the top contributing states. Notably, women constituted a significant portion of new enrolments during this period.

Development of Draft Schemes by EPFO: The EPFO established three committees to develop preliminary plans for pension, provident fund, and insurance programs under the Social Security Code 2020. These committees are working on draft schemes, aligning with the government’s initiative to expand social security benefits to various categories of workers.

EPFO’s Successful Enrolment in April: April witnessed a remarkable increase in the formal sector workforce under the EPFO, with 1.34 million net subscribers added. Additionally, there was a significant rise in female enrolment during this period, reflecting the EPFO’s inclusive growth strategies.

EPFO Facilitates Higher Pension Applications: In response to a Supreme Court order, the EPFO facilitated higher pension applications, adhering to guidelines set forth by the court. Subscribers were encouraged to apply for increased pension benefits, ensuring they received their entitled amount.

EPFO’s Higher Pension Deadline Extension: Due to requests and in compliance with the Supreme Court order, the EPFO extended the deadline for applying for a higher pension until 26 July 2023. This extension aimed to provide ample time for eligible members to opt for this option.

EPFO’s Social Security Initiatives: The EPFO implemented several initiatives to expand social security coverage, including establishing committees to develop draft schemes for various social security programs. These initiatives align with the Social Security Code 2020, aiming to encompass diverse categories of workers.

What is EPF?

Introduced in 1952, the Employees’ Provident Fund (EPF) is a widely popular government retirement and insurance scheme designed to extend social security benefits to crores of Indians and their dependents. It is a contributory scheme that ensures the financial independence and security of employees by creating a reliable source of income and a solid retirement corpus.

The EPF scheme is managed and governed by the Employees’ Provident Fund Organization (EPFO) which also manages other related schemes such as the Employees’ Pension Scheme/ EPS and Employees’ Deposits Linked Insurance Scheme/ EDLI.

Benefits of EPF

- EPF members get lump-sum payouts upon retirement along with monthly pensions to help them maintain their standard of living.

- It promotes saving among workers in the lower income brackets (monthly income of Rs.15000 and below) who may otherwise not be able to save owing to high living costs and out-of-pocket expenses.

- It ensures capital growth on the amount deposited every month into the EPF account as the funds are invested strategically in a mix of asset classes to balance risk and returns.

- The investments earn monthly interests that are determined by the government and revised annually. The compounding of interests ensures that a good retirement corpus.

- It helps create a robust emergency corpus that can be withdrawn fully after retirement or partially under certain specified conditions. This enables EPF members to face socio-economic eventualities and emergencies better, rather than falling into extreme poverty or debt traps.

- The EPF account is portable and can be transferred from one employer to another, making it easy for employees to manage their retirement savings and plan their retirement.

- Both the contributions to the EPF account are tax-deductible under Section 80C of the Income Tax Act, making it a tax-efficient investment option.

Coverage

Under the EPF scheme, all employees working in an establishment with 20 or more employees are eligible for coverage. The scheme is also applicable to certain other establishments, as specified by the government from time to time.

All those employees earning Rs.15000 or less per month as wages are eligible for enrolment into the scheme. For employees who are already EPFO members but earn more than the threshold limit, the contributions are made only up to the threshold limit and not their full salary.

The scheme covers all salaried employees, including permanent, temporary, and contractual employees, as well as apprentices. Even foreign employees who are working in India and are eligible to contribute to the EPF account can avail the benefits of the scheme.

What about those not covered by the EPF Scheme?

The scheme does not mandate other establishments to make compulsory contributions into the scheme. But employers can voluntarily contribute towards the scheme to bring about financial security for their workers.

However, individual households and their staff members such as domestic workers, drivers, temporary workers, etc. cannot benefit from the scheme as-is. This is where the TankhaPay app is helpful. It enables all kinds of employers including households, home-based businesses and small enterprises to extend social security benefits to all kinds of informal workers such as casual labourers, gig and platform workers, household staff, delivery persons and so on.

Contribution

Under this scheme, the employee’s contribution is deducted from their salary every month and deposited into their EPF account, along with an equal contribution made by their employer. The contributions made towards the EPF account earn interest at a rate set by the government, which is revised annually. The accumulated balance in the EPF account is paid to the employee at the time of retirement or in case of an emergency.

The contribution is divided in the following manner.

| Employee’s Contribution | Employer’s Contribution | |

|---|---|---|

| As a percentage of total monthly income (basic wage + dearness allowance + retaining allowance) | ||

| Employees’ Provident Fund | 12% | 3.67% |

| Employees’ Pension Scheme | 8.33% | |

| Employees’ Deposit Linked Insurance Scheme | 0.5% | |

| Admin Charges | 0.5% | |

| Total | 12% | 13% |

For certain establishments with less than 10 employees and meeting specific conditions, employers and employees can limit their contributions to 10%.

How To Check EPF Balance?

Before proceeding to understanding how to check the EPF balance, let us understand why the balance checking facility is important.

By checking the EPF balance, employees can:

- Engage in financial and retirement planning.

- Plan their taxes properly.

- Ensure that the employer is depositing the contributions on time and is being compliant.

- Detect errors, ensuring that their EPF account is accurate and up-to-date.

How to Check EPF Balance Online?

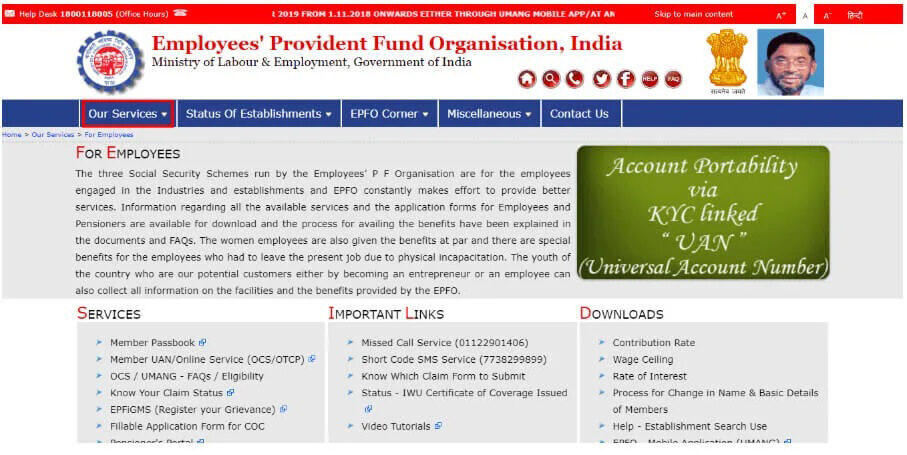

Via EPFO Portal

One of the easiest ways to check the EPF balance online is through the EPFO portal. However, the employee needs to have an activated UAN (Unique Identification Number). The UAN is the unique 12-digital number allotted to each employee upon registration into the scheme. This number remains constant even when they switch jobs or retire.

To check the EPF balance using the EPFO portal, the employee must ensure that the employer has activated their UAN.

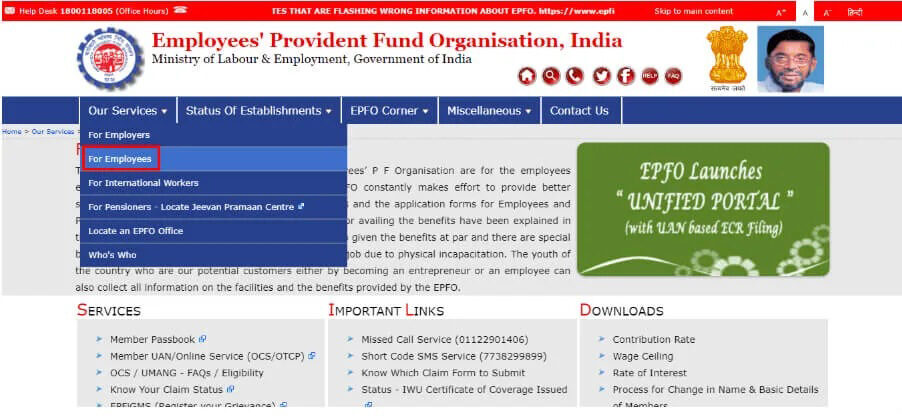

Here is how to check EPF balance using the EPFO portal:

- Go to the EPFO portal at https://www.epfindia.gov.in/

- On the menu bar, go to the For Employees option.

- Click on the Member Passbook option in the Services section at the bottom at the page.

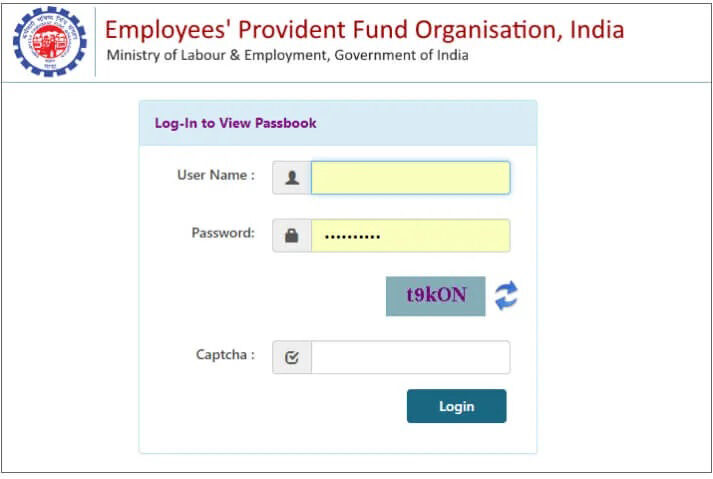

- On the page you are redirected to, enter the UAN, password and Captcha details and click Login.

- If you haven’t registered your UAN yet, you can do so by clicking on the “Activate UAN” option on the login page.

- If you haven’t registered your UAN yet, you can do so by clicking on the “Activate UAN” option on the login page.

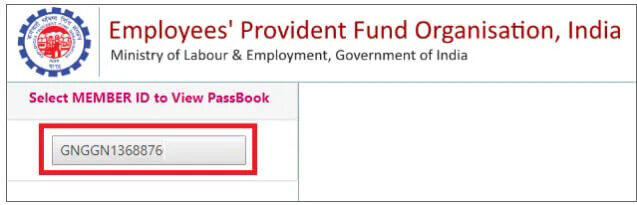

- All the EPF accounts linked to this UAN will appear in the next page, if you have multiple accounts. Each EPF account is linked to a different employer.

- Select the member ID and you will be able to view your passbook and all other relevant details.

Via Umang App

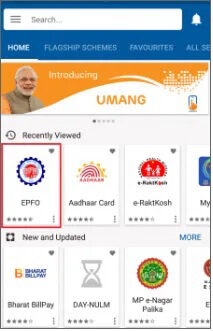

The other way to check one’s EPF balance online is through the Umang app. The UMANG (Unified Mobile Application for New-age Governance) app has been launched by the government to enable citizens to access a range of its services in a cohesive, unified manner.

The employee must have a smartphone and should have installed this app onto the phone. Here is how to check the EPF balance using the Umang app:

- Upon installation of the app, the EPFO member must register themselves with the mobile number that is linked to their UAN. This is a one-time registration.

- After registration, click on the EPFO icon from the list of services.

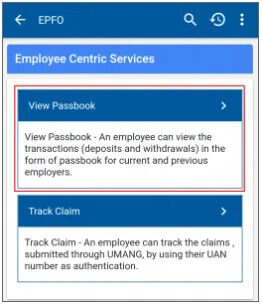

- Select the Employee Centric Services option and click on View Passbook from the list of services.

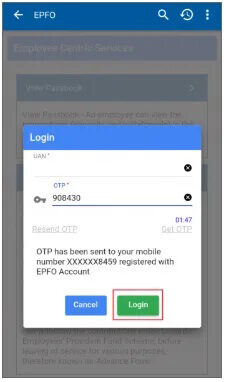

- Upon entering your UAN, click on Get OTP.

- Enter the OTP (One Time Password) received on your registered mobile number and click on Login.

- Upon logging in, you will be able to view your EPF passbook containing all relevant details about contributions, EPF balance, interest earned, etc.

How to Check EPF Balance Offline?

In addition to the online means, there are offline means through which you can check your EPF balance. These offline means are particularly important for those employees who may not have access to smartphones or the internet or may not be digitally literate to access online means.

Via SMS

One of the offline methods to check one’s EPF balance is the SMS service. The SMS service is currently available in 10 languages, namely –

- English

- Hindi

- Bengali

- Gujarati

- Kannada

- Malayalam

- Marathi

- Punjabi

- Tamil

- Telugu

However, to use the SMS service, the employee must have their UAN. Further, the UAN must be activated and linked to the bank account, Aadhar and PAN. Otherwise, the employee needs to complete their KYC first before using this service to check the EPF balance.

Here is how to check EPF balance by SMS,

- Once the UAN is activated, send an SMS to 7738299899 to check the EPF balance.

- The SMS should specify the UAN number and language preference in the following format:

- EPFOHO UAN LAN

- The UAN must be typed correctly to access your details.

- The first three letters of the language need to be specified. So, if you want the response in Punjabi, the SMS should be EPFOHO UAN PUN

- You will receive your EPF account details, balance, contributions made, etc. as an SMS in the opted language.

Via Missed Call

Using missed call is the easiest way to check one’s EPF balance. All you have to do is give a missed call to 9966044425 from your registered mobile number. You will receive all relevant information on your registered mobile number free of charge.

However, there are a few requirements you must meet to use the missed call service to check your EPF balance:

- You must have an UAN that has been activated by the employer.

- Your bank details, Aadhar and PAN need to be linked to the UAN.

- You must use only your registered mobile number to send the missed call.

If your UAN is not activated or not linked, you must request your employer to help you complete the KYC process.

Can You Check Your EPF Balance Without Registered Mobile Number?

Are you thinking how to check my EPF balance if I don’t have access to my registered mobile number? To check your EPF balance, the registered mobile number is not always necessary. It is necessary only if you are using the offline methods – missed call or SMS services.

With the EPFO portal, you can check your EPF balance using just your UAN and password. If you are using the UMANG app, you will need your registered mobile number only for the one-time registration.

How to check EPF Balance With UAN?

You can check your EPF balance using just your UAN through the EPFO portal. You will need both your UAN and registered mobile number for the one-time registration on the Umang app to check your PF balance. For the SMS service too, you need both the registered mobile number and your UAN to check your EPF balance and other details.

How to Check EPF Balance Without UAN?

It is not possible to check your EPF balance without having an activated UAN. The UAN is a unique identification number assigned to every EPF member, which is used to access all EPF-related services, including checking your EPF balance.

The UAN serves as a link between your EPF account and your employer, and it remains the same throughout your employment period. Therefore, it is essential to obtain and activate your UAN to avail yourself of the various EPF services.

However, you may not recall your UAN number but may still want to know how to check your EPF balance. In such a case, you can use the missed call service from your registered mobile number to access your EPF balance.

How to Check EPF Balance of Exempted Establishments/ Private Trusts?

Some big companies, known as exempted establishments or private trusts like Godrej, HDFC, Nestle, Wipro, TCS, Infosys, etc., have EPF deductions that don’t go to the government’s Employees’ Provident Fund Organisation (EPFO). Instead, they are managed by company-run trusts.

For employees in these exempted establishments, there’s no standard way to check their PF balance. The EPFO doesn’t offer a passbook facility for members of these exempted establishments.

Under the Employee Provident Fund and Miscellaneous Provisions Act of 1952, some big companies can oversee their own PF schemes. These companies, called exempted establishments, have their own in-house EPF trusts. They are excused from contributing to the EPFO.

Because of this setup, only the trusts managed by these companies can disclose an employee’s PF account balance. Unfortunately, there isn’t a universal method for employees in exempted establishments to check their PF balance like the standard process provided by the EPFO.

So the question arises: how can employees of such an exempted organisation check their EPF balance? There are four ways to do so;

- Check Payslips: Many large companies send electronic payslips to employees, usually via email. These payslips contain PF details, showing monthly contributions and the total PF balance. Some companies even provide a separate PF slip along with the salary slip. Employees can find their monthly contributions and overall EPF balance in these slips.

- Company’s Employee Portal: Most major companies maintain an employee portal on their official website. Employees can log in to this portal and find their EPF account balance in the designated PF section. Companies like Wipro and TCS offer this convenient online service, allowing employees to view their PF statements.

- Contact HR Department: Employees can reach out to their company’s HR (Human Resources) department. The HR team deals with employees’ PF matters and can provide detailed PF-related information. They are usually well-equipped to assist employees with their queries about PF balance and contributions.

- Track Contributions: Regularly checking their monthly payslips can help employees monitor their contributions. This helps in calculating the yearly EPF balance. To calculate the interest, employees can use the interest rate set by the EPFO. It’s important to note that a fixed sum of money (up to Rs.1,250 per month) is allocated to the EPS (Employee Pension Scheme) account.

How to Know the EPF Balance of Inoperative Accounts?

As per the notification put out by the Government of India in November 2016, the dormant or inactive accounts shall continue accruing interest as they won’t be deemed inoperative anymore. The EPFO stopped paying interest to inoperative/dormant accounts in 2011.

However, after the new progression comes into effect, all dormant accounts shall be receiving interest. The rate is set at 8.5% per annum. This interest will continue to accrue till the employee attains 58 years of age or till the date of withdrawal arrives (whichever comes first).

Accounts used to become inactive mainly because of two reasons:

- The complicated procedures for transferring EPF and employees choosing to open new accounts when changing jobs.

- The lack of communication between an individual’s current and former employers also played a significant role.

- If employees couldn’t access information about their old inactive accounts, they could contact the EPFO help desk. The balance from those accounts could then be transferred to their current one.

Is e-Nomination Process for PF Account Mandatory?

No, e-nomination process is not mandatory for your EPF account, but it is highly recommended. Through fore-nomination, you can facilitate hassle-free claim settlements and ensure that the nominee(s) receives the benefits of the accumulated EPF balance in the event of the member’s death.

The e-nomination process allows EPFO members to complete the nomination process online through the EPFO portal, eliminating the need for physical nomination forms and ensuring that the nomination details are updated and accurate.

However, if the members do not use the e-nomination facility, they can still submit their nomination details in physical form to their employer or the EPFO office. It is important to note that without proper nomination details, the claim settlement process can be delayed and lead to inconvenience for the nominee(s).

How to Submit an e-Nomination in EPFO?

- Go to the UAN member e-Sewa portal at https://unifiedportal-mem.epfindia.gov.in/memberinterface/.

- Enter your UAN, password and Captcha details and click login.

- Select the e-Nomination section under the online services tab.

- Fill out all necessary information for each of your family members you wish to nominate.

- If you are nominating more than one family member, click on Nomination Details to declare the share in total for each nominee.

- Click Submit upon reviewing entered information.

- The registered nominee details will appear in your EPF account.

Remember to regularly update and review nominee details to ensure your dependents are accurately reflected.

Conclusion

Given how important checking one’s EPF balance is, we have discussed 4 simple methods to do so. If you have more questions about the EPF scheme or extending social security benefits to your informal employees including household and office workers, download the TankhaPay app now or visit www.tankhapay.com.

FAQs on EPF Balance

Is it possible to check the EPF balance by giving a missed call without registering the mobile number?

To check the EPF balance via missed call, it must be made from the registered mobile number. It's mandatory to link your mobile number to the UAN for these services.

Can I withdraw my entire PF amount at once?

Yes, if you are unemployed for two months, you can withdraw your entire PF corpus. Moreover, after a month of unemployment, you can withdraw up to 75% of your EPF corpus. PF withdrawals are tax-exempt only after five consecutive years of EPF membership.

Is it possible for individuals to check the EPF balance of their previous organisation?

Yes, individuals can check their previous organisation's EPF balance. By logging into the EPFO portal using their Universal Account Number (UAN), they can view the balance by clicking on the respective Member ID. All previous Member IDs linked to the UAN will be visible on the portal.

Is it possible to check the EPF balance using an Aadhaar number?

No, the EPF balance cannot be checked using the Aadhaar number. Online EPF balance inquiries can only be made using the UAN.

Is it possible to check the EPF balance via SMS without linking the mobile number to the UAN?

To check the EPF balance via SMS, individuals must link their mobile number to the UAN. The EPF balance will be sent via SMS only to the registered mobile number.

Is it possible to use the PAN number to check the EPF balance?

The PAN is not required to check the EPF balance. However, for various online services, it's crucial to link the UAN and EPF.