ESI (Employee State Insurance) is a government scheme, as per the ESI Act, 1948. It provides social security benefits to workers and is managed by the Employee State Insurance Corporation (ESIC). Employers should register their establishment with ESIC and provide the details of their workers to include them in the scheme.

The government has set up specific rules and regulations for the same. However, employers find it overwhelming to follow the complex rules. It can be hard to understand ESI eligibility for employers and provide the necessary documents without expert help.

What Is the Eligibility for ESI Registration?

A person employed in an establishment/ factory/ shop with over 10 employees is eligible for ESI benefits under Section 2(12) of the ESI Act, 1948. All workers in various industries and sectors and their dependents are eligible to receive ESI medical benefits from ESIC-run hospitals and dispensaries.

Women employees with less than Rs. 21,000/- and Rs. 25,000/- (people with disabilities) monthly salary have the eligibility for maternity benefits under ESI Act. They can claim medical and cash benefits and paid leave for pregnancy (pre & post-delivery), medical termination, miscarriage, and adoption.

Who is eligible for ESI Registration?

- Shops and stores

- Movie theatres and entertainment centres

- Private educational institutions

- Newspaper establishments (the ones which are not covered under the Factory Act)

- Restaurants engaged only in sales

- Transport establishments offering road motor services

Documents Required for ESI Registration

The employer has to provide a copy of the following documents to register for ESI. Since the registration process is performed online, a soft copy (digital/ electronic) of the documents should be uploaded to the ESIC website.

- A cancelled cheque

- A copy of the bank statement

- A copy of the licence issued to run the establishment

- The establishment’s financial statement copy

- Lease contract copy

- Power bill’s copy (latest)

- Board members’ decision copy

- ID proof (PAN and Voter ID) of each director/board member/ partner

- A duplicate certificate of registration/ incorporation

- List of employees/ workers directly employed by the establishment

Additional documents may also be required in certain cases. Those are as follows:

- Employee insurance ID and appointment date (if the worker is already registered for ESI)

- Employee’s name, address, birth date, bank account details (account number, IFSC, bank branch name), spouse/ father’s name, mobile number, email ID, etc., are asked along with employer ID, previous employer details, company name, and address (if the workers are not registered for ESI by their previous employer)

ESIC Online Registration Process

The ESIC (Employees’ State Insurance Corporation) has transitioned from manual to entirely online registration. This streamlined approach ensures efficiency and accessibility for employers. Below, we present a step-by-step guide to the ESIC online registration process:

Step 1: Logging into the ESIC Portal

- Access the ESIC portal and opt for the ‘Employer Login’ feature.

- Click on ‘Sign Up’ to commence the registration process.

- Furnish the requisite details and submit the form.

Step 2: Confirmation Mail

- Post form submission, an email confirmation is dispatched to the registered email ID and mobile number.

- The email contains pertinent details such as the username and password for employer and employee registration under the ESIC scheme.

Step 3: Employer Registration Form-1

- Log in using the provided credentials and access the ‘New Employer Registration’ section.

- Opt for the appropriate ‘Type of Unit’ from the dropdown menu and click ‘Submit.’

- Complete the ‘Employer Registration – Form 1’ by entering unit details, employer particulars, factory/establishment information, and employee details.

- Upon form completion, click ‘Submit.’

Step 4: Payment for Registration

- Following the submission of Form-1, a notification prompts payment of the initial contribution.

- Click on ‘Pay Initial Contribution’ and select the ‘Online’ option.

- Note the provided ‘Challan Number’ and proceed to the payment gateway.

- Choose the payment mode and input the required amount.

Step 5: Receipt of Registration Letter

- A system-generated Registration Letter (C-11) is dispatched to the employer’s email after successful payment of six months’ advance contribution.

- The Registration Letter serves as a valid proof of employer registration, featuring a 17-digit Registration Number.

What Are the Benefits of ESI Registration?

ESIC (Employee’s State Insurance Corporation) registration offers many advantages for both employers and employees, fostering a comprehensive and humane approach to employee well-being. The multifaceted benefits encompass:

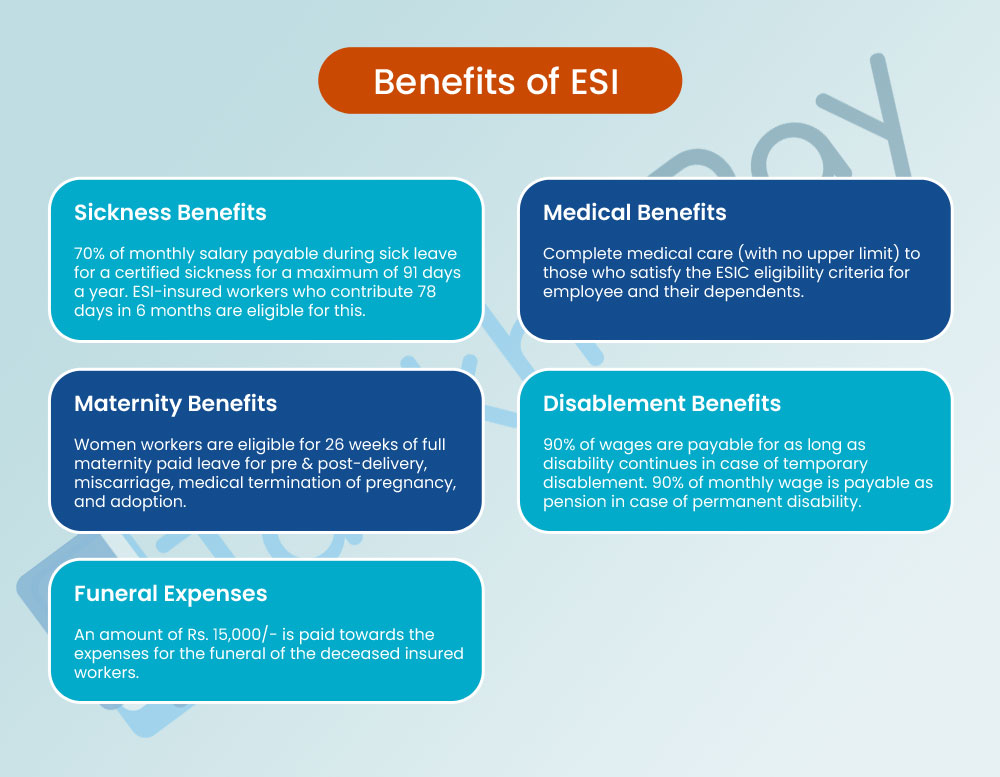

1. Sickness Benefits

70% of monthly salary payable during sick leave for a certified sickness for a maximum of 91 days a year. ESI-insured workers who contribute 78 days in 6 months are eligible for this. For employees suffering from long-term diseases, the Extended Sickness Benefit is eligible for up to 2 years in an ESB period of 3 years.

2. Extended Sickness Benefits

In cases of severe and prolonged illnesses such as 34 malignant diseases, employees can receive extended sickness benefits for up to two years, at a rate of 80% of their wages.

3. Enhanced Benefits for Family Planning

Employees undergoing sterilisation for family planning receive enhanced sickness benefits equivalent to their full wages. This extends to 7 days for Vasectomy and 14 days for Tubectomy.

4. Medical Benefits

Complete medical care (with no upper limit) to those who satisfy the ESIC eligibility criteria for employee and their dependents. Permanently disabled and retired workers can avail of ESI medical benefits by paying Rs. 120/- as a premium per year.

5. Retirement Benefits

Retired employees and their spouses can continue to enjoy medical benefits by paying a nominal annual premium of Rs.120.

6. Maternity Benefits

Women workers are eligible for 26 weeks of full maternity paid leave for pre & post-delivery, miscarriage, medical termination of pregnancy, and adoption.

7. Death Benefits

In the unfortunate event of an employee’s demise due to employment-related injury or occupational hazards, dependents receive 90% of the deceased employee’s wages as a monthly payment.

8. Temporary Disablement Benefits

Employees facing temporary disablement due to employment injury receive 90% of their wages until the disability persists.

9. Permanent Disablement Benefits

Those experiencing permanent disablement receive 90% of their wages monthly, determined by the extent of loss of earning capacity, as certified by a Medical Board.

10. Funeral Expenses

An amount of Rs. 15,000/- is paid towards the expenses for the funeral of the deceased insured workers. The dependent or the eldest surviving family member (the person who incurs the funeral expenditure) can apply for the amount through the ESIC website.

ESIC registration, thus, emerges not only as a statutory obligation but also as a humane commitment to the holistic well-being of the workforce, ensuring financial security and healthcare support across various life stages.

Compliances After ESIC Registration

Post ESIC (Employee’s State Insurance Corporation) registration, an establishment is obligated to adhere to specific compliances and file requisite returns. These obligations are crucial for ensuring seamless operation and adherence to regulatory standards. The mandatory compliances include:

- Attendance Register Maintenance: The establishment must diligently maintain an attendance register to record the attendance of all employees. This serves as a fundamental document for compliance and internal record-keeping.

- Register of Wages: A comprehensive register of wages for workers should be meticulously maintained. This register is vital for transparent documentation of salary details and ensures compliance with ESIC regulations.

- Inspection Book: An inspection book must be kept, providing a record of any inspections carried out on the premises. This facilitates transparency and regulatory compliance during official inspections.

- Monthly Return and Challan Submission: Within the first 15 days of the succeeding month, the establishment is required to submit monthly returns and challans. This includes providing details of employees, their attendance, and the corresponding contributions to the ESIC.

- Accident Register: A register documenting any accidents occurring on the premises is mandatory. Accurate recording of accidents is essential for compliance and facilitates a proactive approach towards workplace safety.

Returns to be Filed after ESIC Registration

After ESIC registration, employers are mandated to file ESI returns on a half-yearly basis. The necessary documents for filing these returns include:

- Register of Employee Attendance: A comprehensive record of employee attendance is essential for filing accurate returns.

- Form 6 – Register: This form serves as a crucial document for maintaining essential records related to the employees covered under ESIC.

- Register of Wages: The register of wages, showcasing details of remuneration paid to employees, is a prerequisite for filing returns.

- Accident Register: Recording details of any accidents that occurred on the business premises is vital for safety compliance and is integral to the returns filing process.

- Monthly Returns and Challans: Submission of monthly returns and challans is an ongoing requirement post-registration, ensuring continuous compliance with ESIC norms.

The ESI Act – Definition of Establishments

According to the ESI Act, an establishment is defined as an organized group of men or women or an institution, irrespective of the location. Any establishment (including stores and shops) has to register for ESI if it employs 10 or more workers (20 workers in some states) with a maximum monthly salary of Rs. 21,000/- (and Rs. 25,000/- for people with disabilities).

The Supreme Court said that ESI Act is beneficial to workers and that the term ‘shop’ should be interpreted broadly to cover as many establishments as possible. Hence, a location where a commercial transaction (sale/ purchase) takes place can be classified as a shop. If such a shop has 10 or more workers, it has to be registered with ESIC.

While all consultancy companies, estate service providers, advertising and liaison agencies, movie theatres, educational institutions, etc., are eligible for ESI registration, a private commercial hospital, and a Chartered Accountant’s office are not covered under the term.

In the ESI scheme, workers and employers contribute a fixed portion of the workers’ salary towards medical and monetary benefits for the worker. ESI applies to male and female workers in different sectors. The employer contributes 3.25% of the total monthly salary payable to the worker, and the worker contributes 0.75% of their monthly salary. This amount will be collected and paid to ESIC as a premium for the social security benefits offered under the scheme.

Why Use TankhaPay App to Provide ESI Benefits to Informal Workers

Registering for PF and ESI can be complicated, even when the process is done online. However, employers cannot avoid ESI registrations and risk legal action. The best choice is to use the TankhaPay app to become ESI and EPF-compliant without wasting time and resources on registrations and verifications.

TankhaPay streamlines the process to eliminate paperwork and legal risks. An employer using the TankhaPay app to pay social security benefits to workers will automatically be compliant and avoid penalties.

Furthermore, the TankhaPay app helps you track employee attendance, structure salary, and automate salary payments. The TankhaPay team will also assist workers to access their PF and ESI benefits directly through the app. No more worrying about compliance, records, and ESI returns. Everything is seamlessly managed by the TankhaPay app.

You can pay PF and ESI social security benefits to informal workers, temporary staff, part-time employees, etc., even if you have less than 10 workers. All kinds of employers, including (but not limited to) households, can provide social security benefits to their workers through TankhaPay.

Frequently Asked Questions (FAQs)

How to Get ESI Card Online?

To obtain an ESI card online, follow these steps:

- Log in to the ESIC portal using your credentials.

- Find the section related to printing the ESI card.

- Enter the necessary employee details for whom you want to generate the ESI card.

- Once the details are entered, generate and download the ESI card. You can usually find an option to download the card in PDF format.

How to Apply for ESI Amount?

The ESI amount is automatically calculated based on the employee's salary, and there is generally no separate application process for it. Employers contribute a percentage of the employee's salary to the ESIC fund, and employees also contribute a smaller percentage. These contributions collectively form the ESI amount, which is utilised to provide health and medical benefits to covered employees.

Who is Eligible for ESI?

Employees earning less than a specified wage limit (as defined by ESIC) and working in a covered establishment are eligible for ESI benefits. The eligibility criteria may vary, and it's essential to check the latest guidelines issued by ESIC.

What is the Registration Fee for ESI?

There is no specific registration fee for ESIC. However, employers and employees contribute a percentage of the employee's salary to the ESIC fund. The contribution rates are set by the ESIC and are subject to periodic revisions. It's advisable to check the latest rates and guidelines on the official ESIC website or contact the ESIC office for the most up-to-date information.

What is the ESIC family members’ eligibility age?

The eligibility age limit for family members applies only to unmarried daughters and sons (up to 25 years of age) and minor brothers/ sisters. Other dependents like spouses, infirm sons/daughters, and parents are eligible to be dependents irrespective of age.

What is the ESI coverage limit per employee?

The wage limit coverage for ESI per employee is Rs. 21,000/- per month and Rs. 25,000/- per month for people with disabilities. Employees earning more than this amount as a monthly salary are not eligible for ESI coverage.

How to claim ESIC benefits?

ESIC benefits can be claimed in two ways:

- Medical benefit: The worker and dependents can visit the ESI-run hospital/ dispensary for treatments and medication

- Cash benefit: The worker can avail of cash benefits for sickness, injury, unemployment, disability (temporary & permanent), maternity, vocational course, physical rehabilitation, and funeral costs (claimed by dependents)

What is the list of diseases covered under ESIC?

The list includes 34 diseases classified into 11 categories.

- Tuberculosis, Leprosy, Chronic Empyema, and AIDS (infectious diseases)

- Malignant Diseases (neoplasms)

- Diabetes Mellitus-with proliferative retinopathy/diabetic foot/nephropathy (metabolic/ nutritional/ endocrine diseases)

- Immature Cataract with vision 6/60 or less, Detachment of Retina, and Glaucoma (eye diseases)

- Cirrhosis of the liver with ascites/chronic active hepatitis (digestive system diseases)

- Schizophrenia, Endogenous depression, Manic Depressive Psychosis (MDP), and Dementia (psychoses)

- Bronchiectasis, Interstitial Lung Disease, and Chronic Obstructive Lung Diseases (COPD) with congestive heart failure (Cor Pulmonale) (chest diseases)

- Coronary Artery Diseases- Unstable Angina, Myocardial infarction with ejection less than 45%, Congestive Heart

- Failure- Left & Right, Cardiac Valvular Diseases with failure/complications, Cardiomyopathies, and Heart disease with surgical intervention along with complications (cardiovascular diseases)

- Monoplegia, Hemiplegia, Paraplegia, Hemiparesis, Intracranial Space Occupying Lesion, Spinal Cord Compression,

- Parkinson’s disease, and Myasthenia Gravis/Neuromuscular Dystrophies (nervous system diseases)

- Dislocation of vertebra/prolapse of the intervertebral disc, Non-union or delayed union of fracture, Post Traumatic

- Surgical amputation of the lower extremity, and Compound fracture with chronic osteomyelitis (orthopaedic diseases)

- More than 20% of burns with infection/complication, Chronic Renal Failure, and Reynaud’s disease/Burger’s disease (other diseases)