What is Payroll?

Payroll is basically how a company takes care of paying its people. It calculates salaries, wages, bonuses, and deductions—based on attendance, working hours, and internal policies. At a basic level, it’s about ensuring employees get paid the right amount at the right time.

Sure, payroll is about paying employees—but that’s just one part of the story. Behind the scenes, a lot is happening: tracking payments, figuring out deductions like PF or ESI, sorting out taxes, and sending the proper forms to the government. It’s not flashy work, but the system can feel the hit if anything goes wrong.

For small businesses or large enterprises alike, smooth payroll operations are necessary. A delay or mistake—like miscalculating deductions or missing deadlines—can frustrate employees and bring legal or compliance trouble.

That’s why companies rely on solid payroll systems. When done right, payroll takes a load off HR and finance teams keeps employees happy, and ensures the company stays compliant—all without unnecessary manual effort.

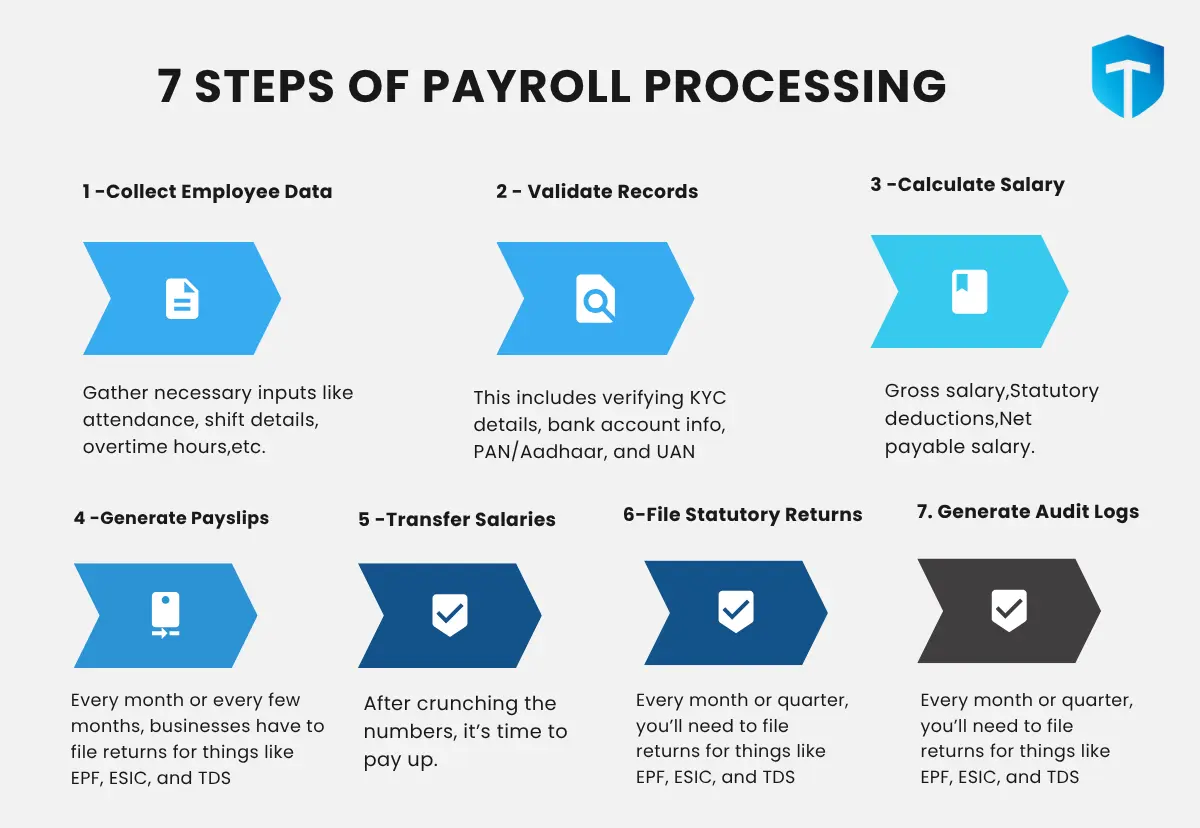

Payroll Processing: Meaning and Key Steps

Payroll processing is the step-by-step workflow through which employee salaries are calculated, verified, disbursed, and recorded. It ensures that every payout is accurate, timely, and fully compliant with applicable labour and tax regulations.

It doesn’t matter if you’re handling payroll in-house or using an external service—what matters is getting it right. When the process runs smoothly, it keeps errors (and headaches) at bay and shows your team they can count on you.

Let’s walk through what goes into processing payroll step by step.

- Step 1-Collect Employee Data:

Gather necessary inputs like attendance, shift details, overtime hours, leave balances, tax declarations, and timesheet records (for project-based or field staff). - Step 2-Validate Records:

Make sure all the employee’s data is accurate and comprehensive. This entails confirming bank account information, PAN/Aadhaar, UAN and KYC details. - Step 3-Calculate Gross and Net Salary:

Based on the employee’s CTC and inputs, calculate:

a. Gross salary (basic, HRA, allowances, bonuses)b. Statutory deductions (PF, ESI, TDS, LWF, PT)

c. Net payable salary

- Step 4-Generate Payslips:

Businesses have to file returns for things like EPF, ESIC, and TDS every month or every few months, depending on what rules apply to them. It’s not just about ticking boxes; these filings keep you compliant with the law. Missing deadlines can cause fines or other trouble, so staying on top is essential. - Step 5-Transfer Salaries:

After all the numbers are in place, the next thing is to actually pay everyone. Most businesses just transfer the salaries straight to employees’ bank accounts—usually in one go through bulk payments. It’s simple and makes sure people get paid without any unnecessary hold-ups. - Step 6-File Statutory Returns:

Every month or quarter, you’ll need to file returns for things like EPF, ESIC, and TDS—depending on what applies to your business. Staying on top of these keeps you compliant and helps you steer clear of avoidable fines. - Step 7-Generate Reports & Audit Logs:

Payroll systems can quickly create detailed reports—like salary registers, compliance filings, and audit logs—ready whenever needed. These aren’t just paperwork for compliance; they give you valuable insights for financial planning, budgeting, and keeping management in the loop. Having all this info handy makes decisions easier and audits less stressful.

What Is Payroll Software?

Payroll software is a digital tool that takes the stress out of managing employee salaries. It handles the heavy lifting—calculating salaries, applying taxes, generating payslips, and transferring salaries straight to bank accounts.

Why Do Businesses Use Payroll Software?

Running payroll manually can be time-consuming and risky. One small error in tax deduction or a delayed payment can lead to unhappy employees—and worse, penalties from the government. Payroll software reduces these risks by automating the entire process.

Compliance Made Simple

Labour laws change constantly, and manually tracking updates can be exhausting. Payroll and compliance software takes that pressure off by staying current with all changes—so you stay compliant without the stress or risk of expensive mistakes.

Accuracy Builds Trust

When employees are paid correctly and on time, trust is built. On the flip side, even a minor mistake in salary or tax can affect morale. That’s why increasingly more organisations are choosing payroll software—to ensure nothing slips through the cracks.

The Cost of Getting It Wrong

As Paul McNulty once said, “If you think compliance is expensive, try non-compliance.”

This holds for payroll. Missing a tax deadline, misreporting a deduction, or skipping a benefit can result in more than just fines—damaging your brand and employee relationships.

What are Payroll Services?

Payroll services refer to the outsourced management of all payroll-related functions—from salary calculation and disbursal to tax deductions and government compliance. Instead of handling everything manually or using just software, businesses partner with a payroll service provider who takes care of the entire process end-to-end.

These services benefit MSMEs, growing startups, or large enterprises with off-roll, gig, or contractual staff. They ensure accurate, timely salary payouts while removing the headache of legal filings, PF/ESI compliance, and payroll-related queries.

✅ Key functions covered under Payroll Services:

- Employee salaries based on attendance, leave days, and company policies.

- Payslip generation and salary disbursement

- PF, ESI, TDS, PT deductions and filings

- Handling bonuses, overtime, reimbursements

- Managing compliance with Indian labour laws

- Reporting, audit logs, and data backups

- Employee helpline for salary/tax-related queries

🆚 Payroll Software vs Payroll Services

| Feature | Payroll Software | Payroll Services |

|---|---|---|

| Who manages it? | Internal HR/Finance team. | External payroll experts |

| Level of involvement | Do-it-yourself | Done-for-you |

| Best for | Businesses with strong in-house teams | Companies looking to reduce HR load |

| Support for compliance | The tool assists, but team files return | Full compliance management |

| Employee communication | Mostly internal | Handled by the service provider (if offered) |

What are Timesheets and Why They Matter in Payroll?

Timesheets are digital or manual records that track the hours an employee works. They capture check-in/check-out times, total hours spent on tasks or projects, overtime, and even breaks. In modern businesses—especially those with shift workers, field teams, or freelancers—timesheets are critical to accurate payroll processing.

Timesheets don’t just log time; they directly influence how salaries, overtime, and deductions are calculated. When integrated with a payroll system, timesheet data helps smoothly automate pay calculations, ensuring employees are paid appropriately for the hours they work.

✅ Why Timesheets Are Important for Payroll:

- Accurate Salary Calculations: It is crucial and essential to see to it that workers are compensated from actual data and not their predictions.

- Overtime and Break Management: Helps track extra hours and ensures legal compliance.

- Project Costing: Timesheets show how much time is spent on specific tasks or departments, helping businesses control costs.

- Remote/Field Team Tracking: Perfect for distributed or mobile teams where biometric systems may not work.

- Audit and Compliance: Keeps transparent records that can support audits, labour law compliance, and employee disputes.

“Think of timesheets as the backbone of payroll accuracy—especially for businesses that don’t work on fixed 9-to-5 hours.”

Why Payroll Software Matters

Payroll software helps businesses follow tax laws and government rules. These laws often change, making manual updates difficult. Manual payroll comes with a higher risk of errors. Mistakes in tax calculations or deductions can frustrate employees and invite penalties. Even small errors—like late payments or wrong deductions—can break employee trust. They can also lead to legal issues or fines.

A good payroll system stays updated with laws and compliance needs. This helps companies avoid costly mistakes and delays. Reliable payroll software makes the process smooth for HR teams and stress-free for employees. It protects your company’s reputation and improves accuracy.

In the next section, we’ll explore how payroll software evolved, its key features, and how to choose the right one.

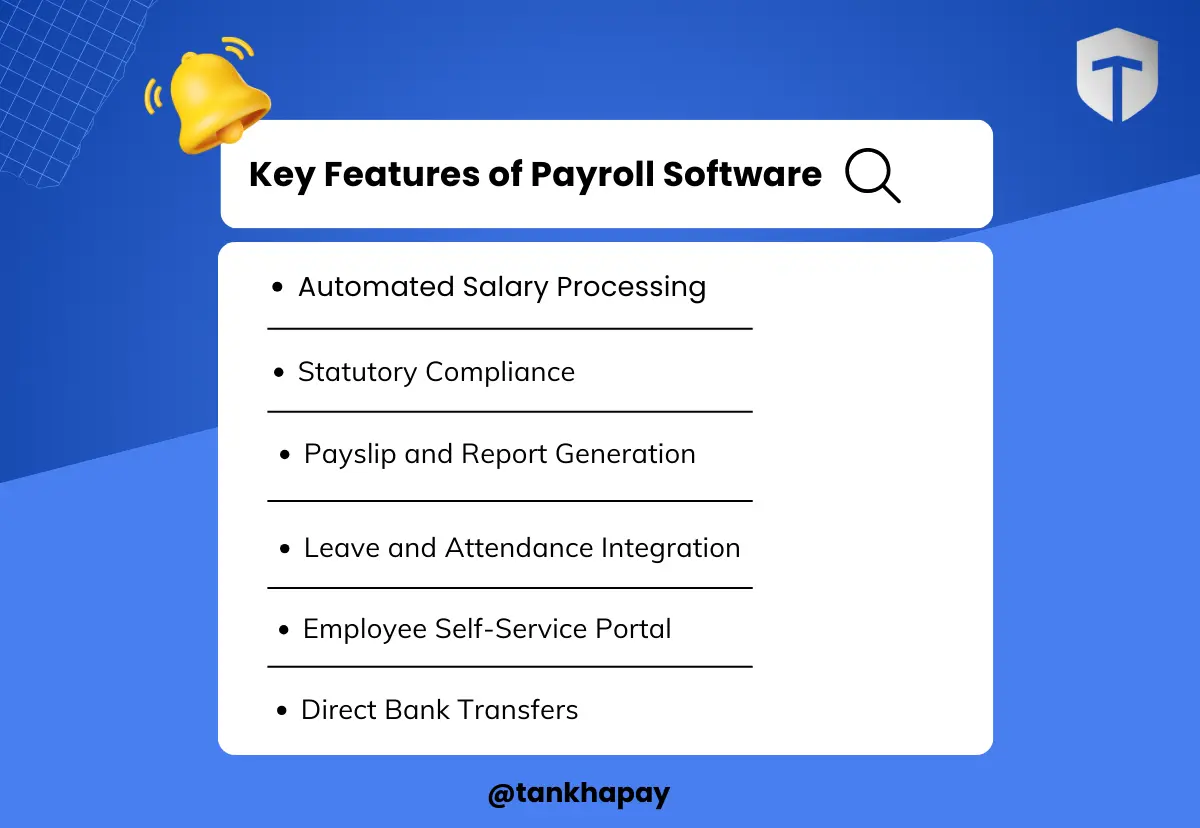

Key Features of Payroll Software

Handling salaries can take time and become stressful as a business expands. That’s where modern HR payroll software helps—it makes the process easier, faster, and less prone to mistakes.

Let’s explore key features that make it a practical and reliable solution for today’s businesses.

Automated Salary Processing

Payroll software determines salaries by looking at attendance, leaves, overtime, and deductions such as TDS, EPF, and ESI. This helps reduce mistakes you might get with manual calculations, ensuring employees get paid correctly and on time.

Statutory Compliance

Keeps your payroll aligned with Indian labour laws, including PF, ESI, Professional Tax, and Labour Welfare Fund. The software automatically updates regulatory changes to help you stay compliant without manual monitoring.

Payslip and Report Generation

Employees get easy access to their digital payslips whenever they want, while HR can pull detailed reports for audits, reviews, or just to keep things organised. This kind of transparency helps everyone stay on the same page and makes planning smoother.

Leave and Attendance Integration

The software connects with attendance machines or workforce management tools to pull accurate data. This means payroll is based on actual work hours and approved leaves, not guesswork—leading to fair and precise salary processing.

Employee Self-Service Portal

With an ESS portal, employees can view their payslips, submit reimbursement claims, and update tax declarations without constant HR support. This empowers staff and gives HR more time to focus on strategic tasks.

Direct Bank Transfers

After salaries are approved, the system can send payments to employees’ bank accounts. It also records all transactions, making audits easier and helping avoid payment delays or problems.

Top Benefits of HR Payroll Software

Running a payroll can be surprisingly time-consuming—especially when trying to stay on top of salary calculations, tax deductions, and shifting compliance rules. It is very difficult to manage and mistakes can be costly.

Many businesses are turning to a better payroll software to simplify the process. Digitizing repetitive tasks saves time and reduces the chance of mistakes. Employees benefit too – they get paid on time, have fewer hassles and can easily access their payslips whenever they need them. It’s a simple change that leads to smoother operations and happier teams.

Time Efficiency

Payrolling software handles routine tasks like calculations and salary processing. This helps HR teams save valuable time each month, which they can use to focus on things that matter more—like building employee engagement and helping people grow within the company.

Accuracy

As mentioned, one of the most significant benefits of using payroll software is its accuracy. It helps avoid mistakes in salary, tax, and compliance calculations. When payroll is accurate, employees feel more confident and trust the process—plus, it helps prevent misunderstandings or disputes.

Statutory Adherence

This helps your organization comply with Indian laws and avoid fines. Regular updates ensure that the software complies with changing regulations.

Enhanced Data Security

Cloud-based systems lower the possibility of errors like data breaches or leaks by encrypting and controlling access to critical data.

Employee Empowerment

Employees can access their records at any time through the self-service portal, which reduces HR workload and improves satisfaction.

Scalable for Growth

The best thing about payroll software is that it makes running your business easy and practical. Whether you need to pay a team of 10 people or handle a workforce of 10,000 people, it helps you manage everything smoothly and efficiently.

Payroll software also plays a vital role in building trust and keeping employees happy. It ensures salaries are paid on time, payslips are accurate, and all payroll information is easy to access. When employees see that their pay is managed correctly every month, it builds confidence in the system. This trust helps create a healthier work environment, strengthens the bond between employers and their teams, and leads to better morale, stronger loyalty, and a more motivated workforce.

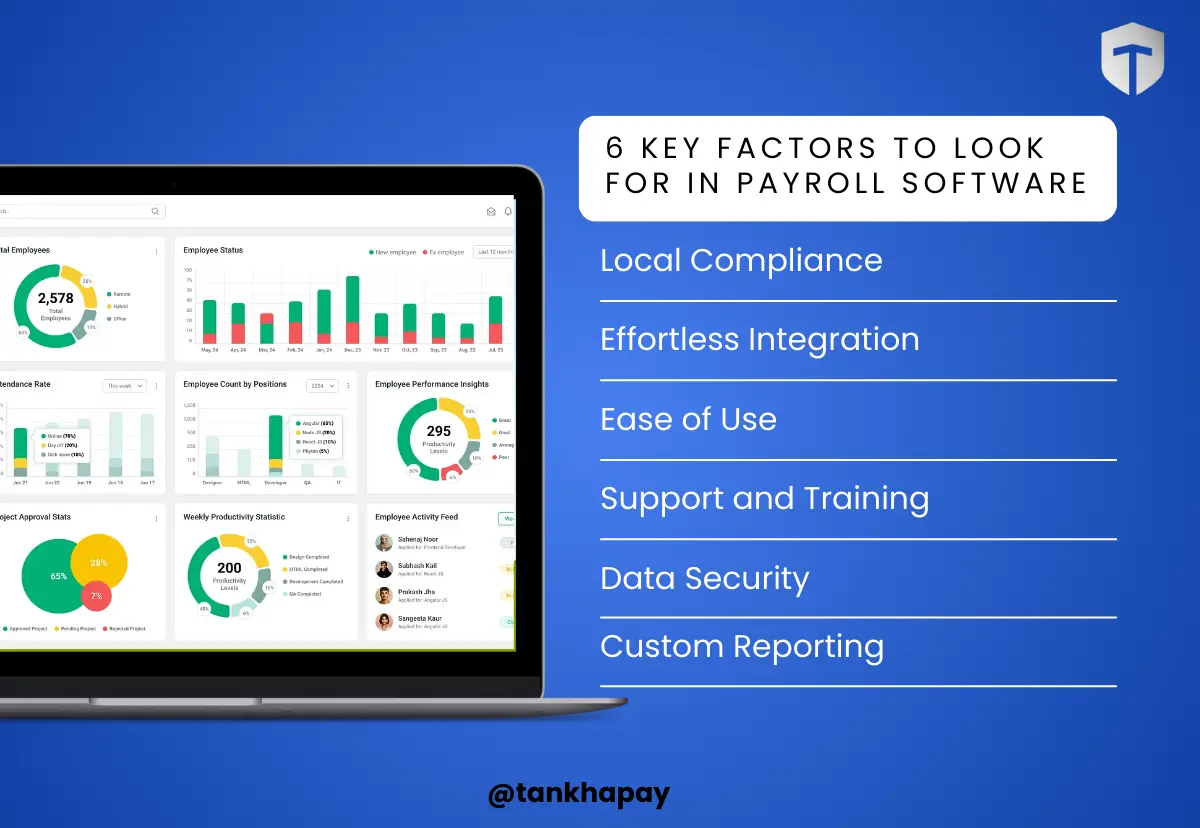

6 Key Factors to Look for in Payroll Software

Choosing the right payroll software matters for every business, whether a small startup or a growing company. A good tool can save time, reduce errors, and make work easier for your HR team and employees. Looking beyond just the basic features is essential to get real value. Consider what your business needs now—and how those needs could change as you grow.

Local Compliance:

Make sure the software provides support for EPF, ESI, PT, LWF and state-specific laws. The software should be updated regularly so that it can incorporate regulatory changes automatically.

Effortless Integration:

Look for software that works with your attendance, HRMS, and accounting tools to ensure seamless data flow and avoid duplication.

Ease of Use:

A clean, user-friendly interface increases efficiency and adoption across teams, especially in organisations with limited technical expertise.

Support and Training:

Good customer support and proper training make it easier to get started and solve any issues that come up along the way.

Data Security:

Choose systems with encryption, frequent backups, and multi-level user access to protect employee data.

Custom Reporting:

Detailed and customisable reports help with internal tracking, statutory audits, and strategic planning.

Payroll success tip: “Choose software that fits your people—not the other way around.”

The Shift Towards Smarter Payroll Management in India

As businesses grow and workforce structures evolve, so do the complexities of payroll management. From salary calculations and statutory deductions to error-free disbursals and compliance with Indian labour laws—every step of payroll processing demands accuracy and efficiency.

That’s why many businesses today are actively exploring reliable HR Tech software and professional payroll outsourcing in India to streamline operations, stay compliant, and reduce manual workload. If you’re looking for an end-to-end solution that can do both, TankhaPay offers the best of both worlds.

TankhaPay: One-Stop Payroll Solution for Modern Businesses

Whether you are a startup looking for payroll software or an enterprise that needs full-service payroll outsourcing, TankhaPay is built to meet your needs. It combines powerful HR tech with managed services—making payroll easy, compliant, and scalable for every kind of business.

From handling on-roll and off-roll staff to managing gig or field teams, TankhaPay’s system adapts to your workforce structure—while ensuring 100% compliance with Indian labour laws.

Here’s what you can expect with TankhaPay:

✅ Automated Payroll Software

Calculate salaries, handle deductions (EPF, ESI, PT, LWF), generate payslips, and make direct bank transfers—accurately and on time.

✅ Payroll Services & Compliance Support

Don’t want to manage payroll in-house? Outsource it. We process salaries, maintain compliance, and even manage payroll for off-roll or contractual workers.

✅ Attendance & Timesheet Integration

Sync biometric devices or GPS systems for precise work-hour tracking—great for remote, in-office, or mobile teams.

✅ Employee Self-Service Portal

Let employees access payslips, update KYC, and track attendance—anytime, anywhere, in their language.

✅ Secure & Transparent Platform

With enterprise-grade encryption, real-time dashboards, and audit-ready records, your data stays safe and accessible.

Whether you’re managing 10 employees or 10,000, TankhaPay simplifies the complexity of payroll and compliance—without the overhead.

Conclusion

In a nutshell, payroll is not only about processing salaries—building trust, staying compliant, and making life easier for employers and employees. As regulations evolve and teams become more diverse, handling payroll manually can make work slow and difficult and increase the risk of errors. That’s why many growing businesses are turning to tools like TankhaPay. It makes payroll practical and simple, ensures compliance, and gives HR teams and employees the clarity they need. By cutting down on manual work, you get more time to focus on your people and business.

FAQ

Is payroll software suitable for Indian businesses?

Yes, most payroll software in India is designed to follow Indian laws like EPF, ESI, and income tax rules, making them suitable for startups, small businesses, and large companies.

Can payroll software support workforce management?

Absolutely. It connects with attendance, leave, and shift records to make payroll accurate and efficient while offering insights to help with HR planning.

What is offroll payrolling?

Offroll payrolling is when a company outsources employee payroll and compliance to a third party while the employee works for the company.

What is payroll outsourcing?

Payroll outsourcing means hiring an external service provider to handle all payroll tasks for your business

Is payroll outsourcing better than using software?

Outsourcing reduces internal workload, but using a user-friendly payroll system like TankhaPay gives you control and compliance with lower long-term costs, making it a more sustainable option.