LOP arises when an employee opts for an approved leave of absence from their work duties but does not receive their usual salary or wages for that specific duration. This circumstance commonly occurs when an employee utilises all available paid leave options, such as vacation days or personal leave, and requires additional time off for personal reasons or unforeseen circumstances.

Loss of Pay signifies a period where an employee voluntarily forgoes their regular compensation due to extended leave beyond the scope of their accrued paid time off. It is a practice implemented when individuals need time away from work but have exhausted their paid leave allowances. Let’s unravel the nuances of LOP and understand how it balances employee needs and organisational policies.

What is the Full Form of LOP?

The full form of LOP is Loss of Pay. Loss of Pay is a distinctive aspect of employee leave that merits a comprehensive understanding.

Here are key points for better understanding about LOP:

- Unpaid Leave: LOP categorically denotes a form of unpaid leave where employees forego their regular salary or wages for the duration of their absence. This absence from work is not compensated, distinguishing it from periods of paid leave.

- Authorised Absence: Typically, LOP is a result of an approved and authorised leave of absence granted by the employer. The approval is contingent upon the employee’s request and adherence to the company’s leave entitlement policies. The reasons prompting LOP can vary, encompassing personal emergencies, extended travel, sabbaticals, or other specific circumstances.

- Exhaustion of Paid Leave: The occurrence of LOP is directly linked to the depletion of an employee’s available paid leave, including vacation days, sick leave, or other accrued balances. Once these paid leave balances are exhausted, any subsequent time off is classified as LOP.

- Duration and Conditions: The duration and conditions governing LOP are subject to company policies, employment contracts, and applicable labor laws. Employers typically establish guidelines and procedures for requesting and approving LOP, encompassing advance notification and the submission of appropriate documentation or reasons for the requested leave.

- Impact on Benefits: Given its unpaid nature, LOP may have implications for certain employee benefits. Health insurance coverage, retirement contributions, and other benefits linked to regular salary or wages may be affected during the LOP period. Employees are encouraged to consult their employer’s policies and benefit plan documents to discern how LOP specifically influences their benefits.

- Reinstatement and Return to Work: Following the LOP period, employees are generally expected to return to work, resuming their regular duties and responsibilities. The terms for reinstatement and the resumption of regular pay are typically outlined in the company’s policies or employment agreements.

In navigating LOP, effective communication and coordination between employees and employers are important. Employees should adhere to established procedures and requirements, while employers are urged to institute clear policies and guidelines that encompass the implications of LOP on benefits and employment status. This ensures a harmonious approach to managing leaves of absence within the organisational framework.

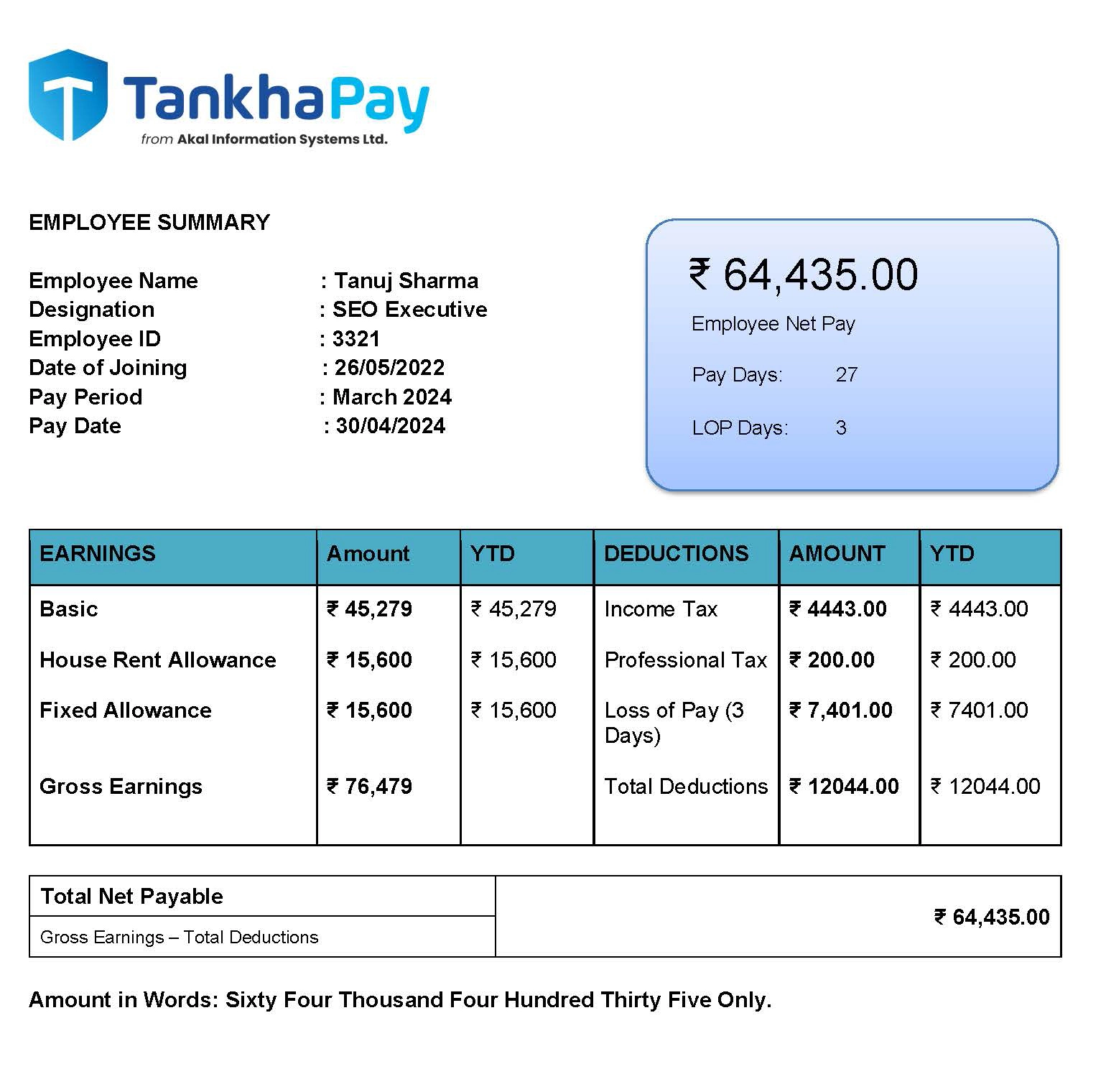

Sample of Salary Slip with Loss of Pay Days

While processing their payrolls, you must provide salary slip or payslip to employees containing salary breakdown, including their LOP days on the payslip. This helps them to better understand the effect of their leave on their salaries and understand payroll calculations accurately.

Factors Counting for Loss of Pay (LOP) in Salary

Several factors contribute to calculating Loss of Pay (LOP) within an employee’s salary framework. Understanding these elements is crucial for both employees and employers. Here are key factors influencing LOP in salary:

- Employment Contract Length: The length of the employment contract plays a pivotal role in LOP calculations. Employees on annual contracts may see their yearly pay considered when LOP assessments are conducted. Corporate policies often dictate the specific terms regarding contract-based LOP.

- Nature of Working: Certain industries are deemed vital and involve inherent risks to employees. In such cases, individuals working in these industries may not be eligible for LOP. This is a consideration based on the nature of the job and the potential impact on the well-being of the workforce.

- Scale of Pay: The scale of pay also influences LOP considerations. Employees in high-level positions may not always have the same scope for availing LOP as those in lower positions. The hierarchical structure within an organisation can impact the eligibility for and extent of LOP for different roles.

- Discretion of the Company: Companies reserve the right to exercise discretion when granting LOP. Factors such as prolonged illness exceeding six months, a poor attendance record, or an employee’s inability to meet the company’s job requirements may lead to the approval of LOP. This discretion is exercised to balance employee needs with organisational demands.

Formula for Calculation of Loss of Pay (LOP)

Loss of Pay (LOP) can be calculated using a straightforward formula based on the employee’s effective one-day salary. Here’s the formula and an illustration:

Loss of Pay Calculation Formula:

LOP = Effective one-day salary of an employee x Number of days employee has taken leave

Effective one-day salary of an employee:

Effective one-day salary = Total monthly salary of an employee / Number of days in a month

Example

Suppose the monthly salary of an employee is ₹ 90,000.

LOP when the number of days in a month is 30

Effective one-day salary = ₹ 90,000 / 30= ₹ 3,000

So, if an employee takes leave for a certain number of days, the LOP is calculated by multiplying ₹ 3,000 by the number of leave days.

Taking weekends into account (assuming 4 weekends in a month)

Number of days on the weekend = 4 x 2 = 8 days in a month

Effective one-day salary (accounting for weekends)= ₹ 90,000/22 = ₹ 4090

So, if an employee takes leave considering weekends, this is calculated by multiplying this effective one-day salary by the number of leave days.

Using this formula, the organisation can accurately determine the financial impact of an employee’s leave on their salary, considering variations in the number of working days in a month and accounting for weekends if necessary.

Causes of Loss of Pay (LOP)

Loss of Pay for employees can be attributed to various causes, each influencing an individual’s financial compensation. Here are some common reasons:

- Illness or Injury: Employee health is a significant factor affecting attendance and work continuity. If an employee falls ill or sustains an injury due to an unforeseen accident, it often leads to a loss of pay. This can encompass various situations such as sickness, maternity leave, and other unforeseen circumstances affecting an employee’s ability to work.

- Unauthorised Absence: Instances of unauthorised absence, where employees take leave without providing prior notice or approval, can result in a loss of pay. Such unauthorised absences not only disrupt workflow but may lead to fair pay reductions, impacting employee morale and potentially causing long-term legal complications for both the employee and the organisation.

- Other Reasons: Employees may need to take leave for a range of personal reasons. This could include attending to family issues, scheduling doctor’s appointments, handling bank visits, or dealing with emergency situations. While these reasons are valid, they contribute to Loss of Pay as the employee is not actively working during this period, leading to a reduction in their monthly payout.

Understanding these causes helps organisations and employees manage leave policies, foster open communication, and address the financial implications associated with absences. Employers may establish clear guidelines and procedures to handle different situations, while employees can be proactive in communicating their needs and adhering to company policies to mitigate the impact of Loss of Pay.

What is LOP reversal, and how is it done?

The process of reimbursing salary deductions made due to an employee’s previous absence or leave without pay is called LOP (Loss of Pay) reversal. This is done when an employee provides a genuine justification for their leave, such as medical purpose, leave approval after salary deduction or in the error of payroll processing.

Here are some points to remember before raising the request for LOP reversal

- Employee Request: The employee has to submit a formal request for LOP reversal, providing the documents that support the reason mentioned in the request, such as medical certificates or email records of approved leave.

- HR and Manager Approval: The approval of HR and reporting manager’s is required to initiate the process of LOP reversal.

- Adjustment of Payroll: Make necessary actions in the payroll processing software to ensure that the deducted amount will be adjusted or reimbursed in the next payroll cycle.

- Disbursement Conformation: Once the process is done, the employee receives the conformation regarding the adjustment of salary reflected in their account.

How to Avoid LOP in Salary Slips?

Avoiding Loss of Pay in your salary slip is essential for maintaining financial stability and meeting your monthly budget. Here are steps to prevent this:

- Communicate Leave in Advance: Ensure that you communicate your leave well in advance to the management or designated authority. This allows them to plan accordingly, either by adjusting schedules or assigning replacements for the days they’ll be absent. Proactive communication helps in avoiding LOP in the salary slip.

- Compensate Lost Time Timely: If you find yourself needing to take LOP due to an emergency, make an effort to compensate for the lost time. Consider working extra hours on weekends or taking overtime on specific days to make up for the time taken off. This not only helps in avoiding financial loss but also reduces any potential tension or burden on the employee.

- Track Leave at Regular Intervals: Regularly check your leave balance to stay informed about your available leave days. If there is an instance of LOP, make efforts to compensate for it promptly. On the other hand, if you have a leave balance remaining, consider taking a break when necessary to rejuvenate and maintain a healthy work-life balance.

- Avoid Unnecessary Leaves: Be mindful of taking unnecessary leaves, as this can impact both productivity and salary. Utilise your leave days judiciously and only when necessary or when you have sufficient leave balance. This practice helps prevent unnecessary Loss of Pay in your salary slip.

FAQs on Loss of Pay (LOP)

How is LOP salary calculated?

LOP salary is calculated by using the formula: (Total Wage/Total no. of days in a month) X No of days worked. For example, if there are 26 scheduled working days in a month, an employee will lose 1/26 days salary for each day of LOP instead of 1/31 days.

Can I take Loss of Pay leave?

Yes, Loss of Pay (LOP) leave refers to a situation where an employee takes a day off by applying for leave but does not work. In such cases, no payment is given, and the absence is calculated on a calendar day basis. This scenario may occur when an employee does not have sufficient leave but is granted permission to remain absent.

What is the impact of LOP on earnings?

The impact of Loss of Pay (LOP) on earnings is significant. When an employee takes LOP, their earnings are affected as they do not receive their regular salary or wages for the days they are absent from work. This can lead to a reduction in monthly income.

Are LOP and LWP interchangeable terms?

Yes, LOP (Loss of Pay) and LWP (Leave Without Pay) are often used interchangeably. Both terms refer to situations where an employee takes an authorized leave of absence from work but is not entitled to receive regular salary or wages during that period.

What is the difference between Loss of Pay (LOP) and Leave Without Pay (LWP)?

Leave Without Pay (LWP)

- Definition: Leave availed with prior consent and approval from designated authority.

- Salary Deduction: No amount is deducted from the employee's salary if there is sufficient leave balance.

- Approval Process: Requires approval before taking the leave.

Loss of Pay (LOP)

- Definition: Leaves taken without approval from the manager or not following organisational norms.

- Salary Deduction: The employee is not compensated for the absence, resulting in a deduction from the salary.

- Approval Process: Typically taken without prior approval, violating established leave procedures.

What is the effect of Loss of Pay (LOP)?

Loss of Pay (LOP) has a direct impact on an employee's financial compensation, as they are not compensated for the days they are absent. This results in a reduction in their monthly salary, affecting their overall income and potentially creating financial challenges.

How do you track time and attendance virtually?

Tracking time and attendance virtually can be done easily. Here is how:

- Employ time-tracking tools and software that allow employees to log their working hours, breaks, and time off. These tools often integrate with payroll systems for accurate record-keeping.

- Implement virtual attendance systems that enable employees to clock in and out digitally. These systems can capture attendance data, making it easier to monitor and manage working hours.

- Encourage employees to self-report their working hours and any leave taken through designated platforms or communication channels. This fosters transparency and helps in maintaining accurate records.

- Conduct regular check-ins with team members to discuss work progress and address any discrepancies in attendance records. Generate reports from tracking systems to ensure accuracy.

- Clearly communicate virtual time and attendance policies to all employees. Ensure they understand the procedures for reporting leave, working hours, and any relevant guidelines.