Social security is vital in supporting workers’ well-being in India—especially in the informal and semi-formal sectors. For employers, it’s more than just a compliance box to tick. It’s a chance to offer real value to your workforce. This guide breaks down how the Indian social security system works and what steps employers can take to ensure their teams feel protected, valued, and financially secure.However, with various benefits, India’s social security system faces many challenges:

- Only 10% of the workforce enjoys structured social security benefits.

- Gig workers, contractual staff, and off-roll employees often fall through the cracks.

- Employers struggle with complex compliance requirements across multiple schemes.

- The administrative burden discourages many businesses from proper implementation.

What is Social Security in India?

Social security in India is a system set by the government to help workers during important life events like illness, retirement, maternity, job loss, or workplace injury. Key benefits include health cover and retirement savings, mainly provided through schemes like EPF and ESI. Employers are required by law to contribute to these for their workers.

To improve the challenges mentioned above, with the Code on Social Security, 2020, the government aims to bring all social security laws under one umbrella and expand benefits to gig, platform, and informal workers. For businesses, this isn’t just a legal rule—it’s also a way to show they care about their workers and are committed to being responsible and compliant.

Let’s briefly understand the various social security schemes mandated for employers and employees.

Recent Developments under Code on Social Security, 2020

The Code on Social Security, 2020, merges nine labour laws to extend benefits to gig, platform, and unorganised workers. It introduces gratuity for fixed-term employees, a social security fund, and digital tools for easier compliance.

The E-Shram Portal supports this by registering unorganised workers, issuing E-Shram cards, and enabling direct benefit transfers.

These efforts support the government’s aim to provide social security for all workers through one easy-to-use digital system.

Now, look at the primary social security schemes employers should know about.

Core Social Security Schemes Explained

Employees’ Provident Fund (EPF)

Employee Provident Fund, commonly known as PF, is a retirement savings plan where employers and employees contribute a part of the employee’s basic salary. This fund provides financial support after retirement or during key life events.

EPF contribution: 12% of basic wages + dearness allowance per employee.

Benefits beyond compliance:

- Builds financial security for employees’ future.

- Additionally, it creates trust in the employer-employee relationship.

- Also, it helps attract and keep talented employees who value long-term benefits.

Part of the employer’s EPF contribution (8.33% of wages, capped at ₹15,000) also goes into the Employees’ Pension Scheme (EPS), giving employees regular pension payments after retirement.

Employees’ State Insurance (ESI)

ESI provides medical care and financial support when employees face illness, pregnancy, or work injuries.

Employers contribute 3.25%, while employees contribute 0.75% of gross salary.

Benefits beyond compliance:

- Ensures employees get proper healthcare without financial stress.

- Also, it reduces absenteeism through preventive healthcare.

- Creates a sense of security that increases workforce loyalty.

- Moreover, Employees feel valued when their health is prioritised.

Gratuity

Gratuity is a legal employee benefit used to thank them for their long-term service. It becomes payable when an employee completes at least five years of continuous employment with the same organisation and leaves due to resignation, retirement, or any other eligible reason.

The gratuity is calculated using the formula:

Gratuity = (Last drawn basic salary + dearness allowance) × 15/26 × number of years of service

Hers, 15 represents the days’ wages for each completed year, and 26 is the average monthly working days. Gratuity is a financial benefit that supports employees after they leave an organisation and encourages long-term retention.

Maternity Benefit

The Maternity Benefit Act says employers must give up to 26 weeks of paid leave to female employees, and they must pay the full amount.

Next, let’s look at the eligibility criteria for these social security schemes.

What are the eligibility criteria for Social Security Schemes in India?

EPF Eligibility

- Mandatory for establishments with 20+ employees.

- Applies to employees earning up to ₹15,000 per month (basic + DA)

- Optional for those earning above the threshold.

- Applicable after completing 30 days of employment.

ESI Eligibility

- Mandatory for establishments with 10+ employees.

- This eligibility applies to employees earning up to ₹21,000 per month.

- Geographic applicability is limited to notified areas.

- Covers all types of employees, including contractual workers.

Gratuity Eligibility

Maternity Benefit Eligibility

*These criteria are based on current laws, as the new Social Security Code has not yet been implemented.

Knowing who qualifies under these schemes helps explain the differences between types of workers.

Core Differences Between Gig, Contractual, and Off-Roll Workers

| Type | Description | Nature of Work | Employment Relationship | Benefits (like PF/ESIC) |

|---|---|---|---|---|

| Gig Workers | Independent workers are hired for short-term tasks via digital platforms. | Task-based/Flexible | No formal employment | Usually not provided |

| Contractual Workers | Hired for a fixed period under a contract with specific terms. | Project/time-bound roles | Formal but limited-term | May or may not get PF/ESIC depending on the employer |

| Off-Roll Workers | Hired through third-party vendors/staffing agencies. | Similar to full-time roles | Technically, it is not on the company payroll | Usually covered by the agency, not the client |

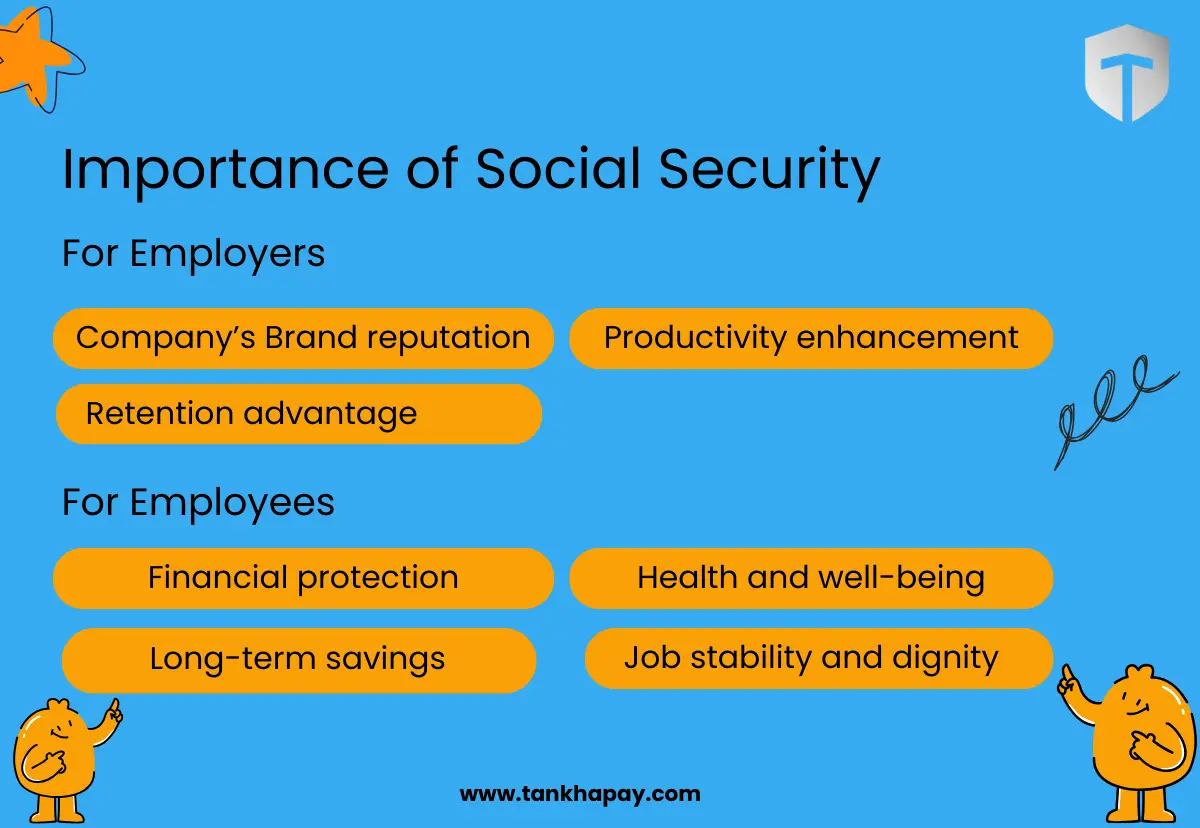

Importance of Social Security

Social security helps employers and employees more than just following the law. It provides financial protection, stability, and lasting support. Here are some reasons why social security is essential for both.

From the employer’s perspective, social security benefits the organisation with-

- Company’s Brand reputation: A non-compliant company results in harming its brand reputation, and attracting the right candidate will be challenging. A 2023 LinkedIn survey found that 68% of job seekers check a company’s compliance record before accepting a job.

- Productivity enhancement: According to research by the International Labour Organization, employees covered under comprehensive social security demonstrate 22% higher productivity.

- Retention advantage: Companies with robust social security compliance experience 31% higher retention rates than those with poor compliance records.

Similarly, employees gain from social security in many ways:

- Financial protection: Schemes like EPF and ESI give financial support during important life events like illness, maternity, disability, or retirement, helping reduce personal expenses.

- Health and well-being: ESI medical benefits provide timely healthcare, helping employees stay healthy and lowering sick leaves caused by untreated health problems.

- Job stability and dignity: Employees covered under formal social security systems feel more secure in their jobs, which boosts morale, loyalty, and motivation at the workplace.

- Long-term savings: Contributions to schemes like EPF help employees build long-term savings, promoting better financial planning for life after retirement.

- Access to government benefits: Registered workers, especially in the informal sector, can access various government welfare schemes more easily through platforms like the E-Shram portal.

How do I register for PF and ESI as an employer?

PF Registration Process

1.Prepare documentation:

- Company incorporation documents.

- PAN and Aadhaar of directors/proprietors.

- Business address proof.

- Bank account details.

- Employee details.

2. Online application:

- Visit the Unified Portal of EPFO (https://unifiedportal-emp.epfindia.gov.in/)

- Select ‘Establishment Registration’ under ‘Services’.

- Complete the application form with the required details.

- Upload supporting documents.

3. Verification process:

- Field officer may conduct physical verification

- Respond to queries if raised by EPFO.

4. Receipt of registration:

5. Post-registration steps:

- Create logins for portal access

- Set up a digital signature for monthly returns

- Configure payroll software for statutory calculations

Once PF registration is complete, employers must also complete the ESI registration process.

ESI Registration Process

1. Documentation preparation:

- Business registration certificates

- List of employees with salary details

- Office address

- Director/proprietor identification documents

2. Online registration:

- Access ESIC portal (esic.in)

- Navigate to ‘New Employer Registration’

- Complete the employer registration form

- Upload required documents

3. Verification and approval:

- ESIC may conduct premises verification.

- Address clarifications if required.

4. Registration completion:

- Receive a 17-digit employer code.

- Download the registration certificate.

5. Employee registration:

Challenges Employers Face to Maintain PF/ESIC Benefits

Social security compliance creates significant challenges for employers:

Core Compliance Requirements

1. Registration and Setup

- Establishment registration with EPFO and ESIC

- UAN (Universal Account Number) generation for each employee

- Employee registration and verification processes

2. Monthly Obligations

- Accurate calculation of contribution amounts

- EPF Electronic Challan cum Return (ECR) filing

- ESIC monthly return submission

- Timely deduction and deposit of contributions

3. Documentation and Record-keeping

- Maintenance of statutory registers

- Employee joining and exit formalities

- KYC verification and updates

4. Audit and Inspection Management

- Preparing for compliance inspections

- Responding to queries and observations

- Maintaining proof of compliance history

5. Consequences of Non-compliance

- Financial penalties of up to ₹100,000 and potential imprisonment

- Retrospective payment demands with interest

- Employee grievances and legal disputes

- Damage to company reputation

- Exclusion from government contracts requiring compliance certificates

The administrative burden is particularly challenging for companies with multiple locations or diverse worker categories.

Given these challenges, there is a clear need for streamlined social security solutions in India.

Why is there a need for a Social Security Benefits Provider in India?

India’s social security system is improving but still poses challenges for many businesses, especially small and medium ones. Complex labour laws, a large dominant informal workforce, and heavy compliance tasks make it hard to apply social security rules smoothly.

Managing registrations, monthly calculations, challan generation, and return filings across EPF, ESI, and other statutory benefits often requires a dedicated payroll or HR team—adding to operational costs. Moreover, frequent regulatory updates and multiple deadlines increase the risk of errors and penalties.

TankhaPay – India’s Only Social Security Benefit Provider

Built as a cloud-based software, TankhaPay is India’s first and only social security benefit provider that automates and simplifies the entire process of Provident Fund (PF) and Employees’ State Insurance (ESI) compliance. It brings much-needed transparency, speed, and ease to a process traditionally burdened with complexity. TankhaPay takes pride in promoting National Shram Seva, which offers ease to business and dignity to workers.

From seamless worker registration to automated compliance and real-time updates, we empower employers to meet their legal obligations confidently and clearly.

Here’s how TankhaPay simplifies social security compliance for employers.

With TankhaPay, you don’t need to get PF or ESI registration numbers. When you join the app, you are the Principal Employer, while your workers assume the role of contractual workers of TankhaPay. The app maintains all compliance for you.

What do you get?

- Salary Structuring and Payrolling

- Attendance Management

- ESI & PF Compliance Management

- ESI & PF Service Assistance

- No ESI or PF Registration Required for your Business

- Save money without hiring a full-time HR team

“Ease to Business. Dignity to Workers. That’s the TankhaPay promise.”

Discover the future of Social Security compliance:

Conclusion: A Better Way to Do Workforce Welfare

In summary, social security compliance is not just a legal need but also a wise choice for Indian employers. It helps avoid fines, keeps workers stable, improves reputation, and supports long-term business growth.

As laws become more complex, technology-driven compliance management via TankhaPay transforms difficult administrative tasks into simple, error-free operations. By using compliance automation, employers can focus resources on growing their business while ensuring employee protection.

Ready to provide social security without the headache of compliance?

Let TankhaPay handle it.

Note:

*This content is for general information and not legal advice. Employers should consult legal experts for guidance on their organisation’s compliance needs.

FAQ

Is PF a social security scheme?

The Provident Fund (PF) is a social security scheme in India. The Employees’ Provident Fund (EPF) helps employees save money for retirement and financial security. The EPFO manages it under the Ministry of Labour. Both employers and employees contribute a set part of the salary to this fund, which the employee can use after retirement, leaving the job, or in certain situations.

What is the employer contribution to EPF schemes in India?

Employers must also contribute 12% of their employee's salary package to the Provident Fund, plus a 1% administrator charge.

What is the ESI rule for salary?

ESIC contributions are primarily based on an employee's monthly salary. Generally, employees earning up to ₹21,000 per month are covered under the ESIC scheme. A part of the employee’s wage is contributed, with employees paying 0.75% and employers paying 3.25%.

What is the importance of social security?

Social security is a fundamental human right that helps protect people from life challenges and needs. It provides support during sickness, maternity, disability, death, unemployment, and old age.