The salary slip, also known as a payslip, serves as an official document outlining an employee’s earnings and deductions. Each month, employees receive salary slips from their employers, detailing essential information such as the company’s name, the employee’s designation, location, and bank details.

Within the salary slip, there are key components. Earnings, including basic pay, dearness allowance, house rent allowance, medical allowance, and special allowance, are outlined. Additionally, deductions such as professional tax, tax deduction at source, and employee provident fund are also specified. It’s important to note that these details can vary from one company to another.

In this blog, we’ll delve into the significance of the salary slip or pay slip, explaining its importance in the financial context. We’ll also provide insights into how to create a simple salary slip format using Excel, a commonly used tool for such tasks. Furthermore, we’ve curated various salary slip formats in Excel, Word, and PDF for your convenience, ensuring you have a range of options to choose from.

To simplify payroll and automate the generation of salary slips, many companies now rely on the Best HR Software in India.

What is Salary Slip?

A salary slip can be defined as a document that contains the details of an employee’s salary. These details include the basic pay, bonuses, deductions, etc., that are given to the employee every month by the employer. The employees often get soft copies of the same and sometimes are given hard copies as well.

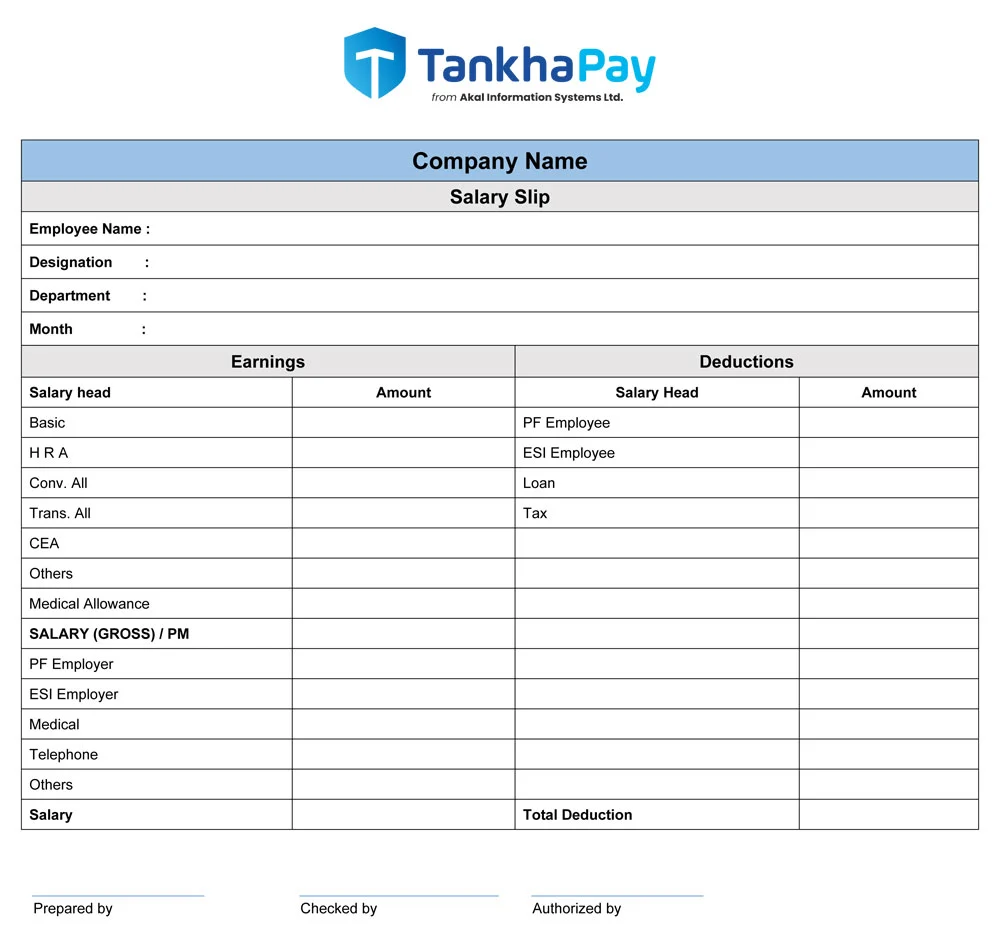

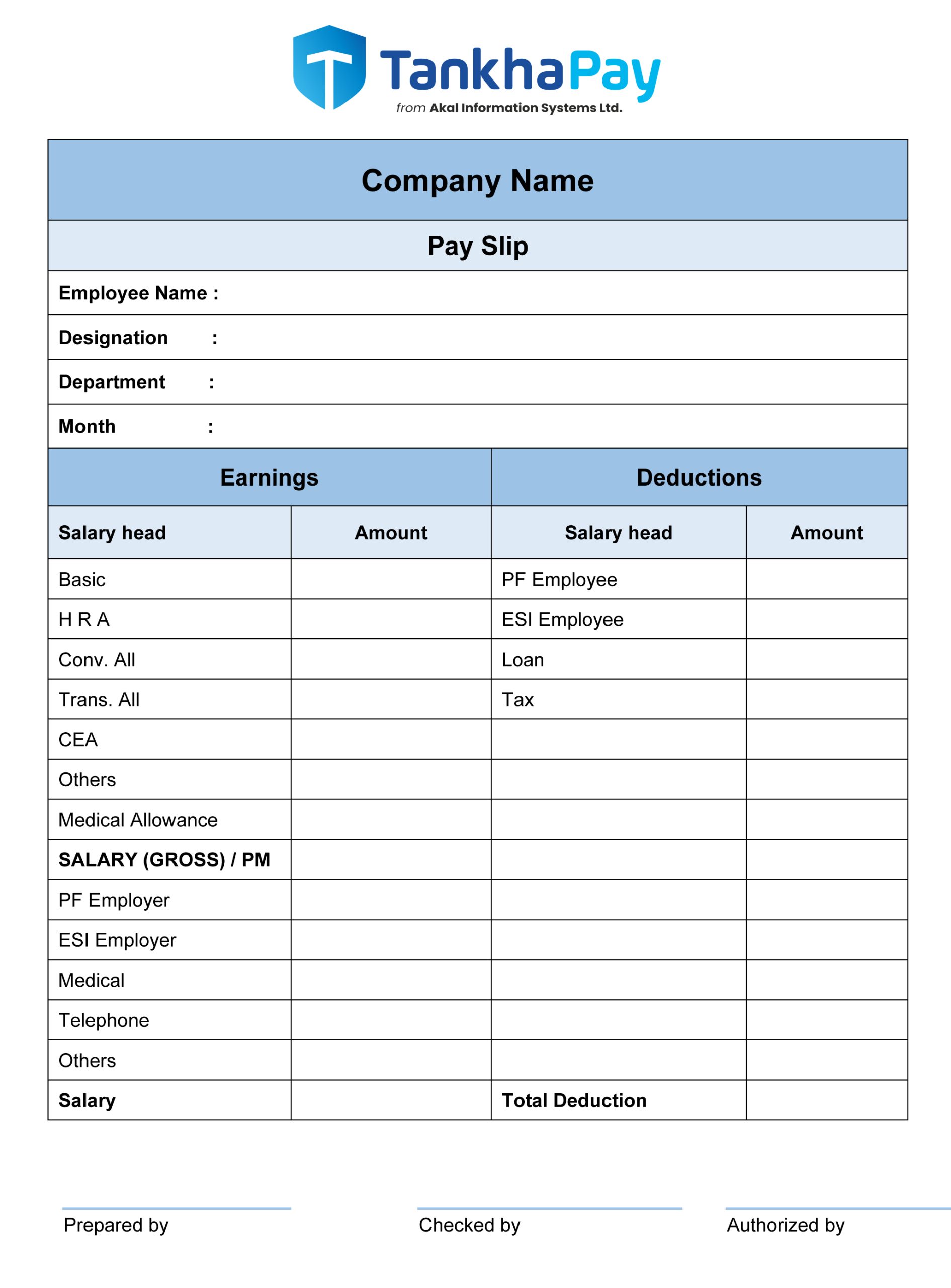

Sample of Salary Slip Format

The structure and contents of a payslip or salary slip may vary based on the company or the location.

Download Different Salary Slip Format

| Formats | Files |

|---|---|

Salary Slip Format in Excel |

Download |

Salary Slip Format in Word |

Download |

Salary Slip Format in PDF |

Download |

Components of Salary Slip Format

Every month, employees receive their salary slips or pay slips, yet comprehending the intricate details of a salary slip often proves challenging. It’s not just a document for loan applications; it holds substantial importance in various aspects of financial management.

- Informed Job Switching: Understanding your salary slip empowers you to compare job offers effectively. By deciphering the components, you can make informed decisions when switching jobs, ensuring you get the best deal.

- Tax Optimisation: A detailed grasp of your salary slip allows you to optimise your tax liability. By identifying the deductions available, you can strategically plan your finances, minimising your taxable income and maximising your savings.

- Grasping Savings: Within the confusing jargon of a salary slip lie details about your forced savings, such as contributions to the Employee Provident Fund (EPF) and Employee State Insurance (ESI). Understanding these deductions helps you comprehend your overall financial commitments and savings.

In the salary slip’s income section, essential components include the Basic, constituting 35-50% of the salary. At junior levels, Basic is higher, while as employees progress, other allowances increase. Organisations often maintain a lower Basic to prevent topping up the allowance pay. Basic, 100% taxable, appears first in the earnings section.

A salary slip isn’t just a list of numbers; it’s a blueprint of your financial dealings with your employer. Mastering its format and components is pivotal for making sound financial decisions and ensuring you’re in control of your earnings and investments.

Basic Salary

This core element serves as the bedrock of an employee’s income structure. While it constitutes a significant portion of the salary, its taxable nature necessitates careful financial planning. At entry levels, basic pay tends to be relatively higher, gradually giving way to other allowances as one climbs the organisational ladder.

Dearness Allowance (DA)

Dearness Allowance (DA) is a dynamic component directly influenced by the cost of living adjustments due to inflation. Its variations cater to diverse locations, ensuring fair compensation relative to the local economic conditions. Although taxable, DA attempts to balance the employee’s purchasing power against rising prices.

House Rent Allowance (HRA)

House Rent Allowance (HRA) accommodates employees residing in rented accommodations. Its tax exemptions, calculated based on rent paid, provide financial relief. The exemptions, governed by specific percentages and rent-payment criteria, empower employees to optimise tax savings based on their living arrangements.

- For rented homes: 50% (metros) or 40% (others) of Basic.

- Tax exemption criteria:

- Actual rent paid minus 10% of pay (Basic + DA).

- Actual HRA received.

- 50%/40% of (Basic + DA) based on city.

Conveyance Allowance

Commuting is a daily reality for employees. Conveyance allowance acknowledges these expenses, offering tax exemptions up to a certain limit. For many, it represents an essential financial relief, making the daily journey to work more financially manageable.

Exempt up to ₹ 1600/month or actually received in earnings.

Medical Allowance

Catering to healthcare needs, medical allowance assists employees in covering medical expenses. Tax exemptions, contingent upon the submission of medical bills, encourage employees to maintain their health and well-being. The allowance underscores the employer’s commitment to employee welfare.

Exempt up to ₹ 15,000/year if proof is submitted.

Leave Travel Allowance (LTA)

Leave Travel Allowance (LTA) is a testament to the employer’s acknowledgement of employees’ need for leisure and family time. Offering tax benefits for travel, LTA fosters a healthy work-life balance. Its block-based calculation aligns with employees’ travel aspirations, ensuring periodic opportunities for rejuvenation.

Special Allowance

Special allowances act as powerful motivators, encouraging employees to excel in their roles. While fully taxable, they signify the organisation’s recognition of exceptional performance. These allowances are often tailored to individual job roles, acknowledging and rewarding specific skills and achievements.

Understanding these components sheds light on your salary slip, demystifying the financial intricacies within.

Deductions

- Provident Fund (PF): PF acts as a valuable savings tool for employees, managed under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. Employees contribute a fixed percentage of their salary, matched by the employer, forming a secure fund managed by the Employees Provident Fund Organization.

- Professional Tax: This state-imposed tax is levied on all citizens earning income, varying in amount across states. It’s a mandatory contribution that individuals make from their earnings, ensuring financial support for state initiatives.

- Tax Deductible at Source (TDS): TDS represents the amount deducted from a salary at the source of payment. The entity making the payment deducts this tax, ensuring compliance with tax regulations. The recipient of the income is accountable for this tax, streamlining the taxation process.

- Employee State Insurance (ESI): Employee State Insurance (ESI) is a social security scheme that safeguards employees during challenging circumstances. ESI deductions are calculated based on the gross salary paid to employees. According to the ESI Act, the employer contributes 3.25% of the wages, while the employee contributes 0.75% of the wages to the contributory fund. This joint contribution creates a financial safety net, ensuring that employees have access to essential benefits and medical care when they need it the most.

Formulas of Salary Slip Format

Below, we have tabulated some of these set Excel formulas of Salary Slip or Pay Slip Format. It will help you to calculate the Gross earnings along with the deductions.

| Particulars | Formula |

|---|---|

| Taxable Income | Gross Salary – Deductions |

| CTC= Total salary package of the employee | Gross Salary + EPF + Gratuity + Others |

| Gross Salary | Basic Salary + HRA + Other Allowances |

| Net Salary | Basic Salary + HRA + Allowances – Income Tax – Employee’s Provident Fund – Professional Tax |

CTC vs. Gross Salary

Here is the fundamental difference between CTC and Gross Salary:

| CTC | Gross Salary |

|---|---|

| CTC stands for Cost to the Company and encompasses the comprehensive expenditure a company incurs while employing an individual. | The gross salary constitutes the total payment made to an employee before tax deductions while also accounting for deductions like the Employee Provident Fund (EPF) and Employee State Insurance (ESI). |

| This includes incorporating direct benefits, indirect perks, and savings contributions in the overall package offered to the employee. | This sum is derived by subtracting elements such as provident fund, ESI, gratuity, and income tax from the Cost to the Company (CTC). |

If you’re evaluating how businesses manage payroll at scale, it helps to understand who provides these services. You can explore our curated list of payroll outsourcing companies in India to see how organisations handle payroll processing and compliance professionally.

Why are Salary Slips or Pay Slips Important?

Salary slips can be very crucial in the professional world. They serve as the legal proof of you being a salaried employee. It would be of great help to always keep them safe as you would with other significant documents.

Here are some other reasons:

Proof of Employment

Pay slips are important documents in professional environments and other official situations. If you are applying for travel visas, university admissions, or undergoing background checks, a salary slip can help validate your background. They verify someone’s work experience, outline their job role and provide a record of their career progress and history.

Strategic Income Tax Planning

Beyond their role in employment validation, salary slips serve a critical purpose in income tax planning. The provision of a detailed breakdown of earnings and deductions, these documents empowers employees to strategise their tax liabilities effectively. From basic salary to allowances and deductions such as Professional Tax, EPF, and TDS, salary slips offer insights that enable individuals to calculate TDS returns accurately. Furthermore, they aid in maximising benefits from tax deductions, rebates, and allowances within the legal boundaries stipulated by the Income Tax Act of 1961. Effectively managed tax planning ensures financial prudence and enables individuals to navigate the complexities of the taxation system with confidence.

Navigating Salary Negotiations and New Employment Opportunities

Salary slips become invaluable assets during salary negotiations and when exploring new employment opportunities. When engaging in negotiations with prospective employers, past salary slips provide a tangible foundation for discussions. They offer a clear historical perspective, enabling employees to advocate for equitable compensation based on their previous earnings. In the realm of new employment, HR personnel often request these documents for verification purposes, ensuring transparency and credibility in the negotiation process.

Facilitating Financial Transactions and Credit Management

Beyond their role in employment and taxation, salary slips are pivotal in facilitating financial transactions and credit management. When individuals apply for loans, credit cards, mortgages, or other forms of borrowing, financial institutions demand concrete evidence of a stable income. Salary slips offer this assurance, showcasing an individual’s ability to meet monthly payment obligations. They not only set credit limits but also serve as a crucial eligibility criterion for various financial products. In essence, salary slips simplify personal finance management, enabling seamless financial transactions and fostering responsible credit practices.

Why Do You Need a Salary Slip?

A Salary slip is much more than a document showing how much you earn in a month; it also serves as proof of your employment and Income in a organization or government sector. And its crucial documents serve multiple aspects of your financial and professional life.

Given below are the elements that describe the importance of salary slip.

Employment and Income proof

A salary slip is a document that proves your employment and how much you earn monthly. It becomes essential when you apply for

- Seeking a new job (When joining a new Organization, it’s essential to show your previous salary slip, which acts as proof of your early employment and monthly Income).

- When you apply for any loan—personal, car, or home—the bank will ask for your salary slip. It shows that you earn regularly every month and can pay your EMIs on time, which makes you look reliable in the eyes of the lender.

- Immigration processes – when you want to work outside of your country, when you apply for visas, there is a need for a salary slip.

Helps in Tax Filing (ITR)

Salary Slip contains brief information about Gross salary: “Tax deductions (TDS), Provident Fund (PF) contributions, Professional tax, HRA, and allowances – This Information is essential for filing income tax returns. Also, check your eligibility for the deduction under 80C, 10 (13A), etc.

Salary Disputes and Transparency

If any dispute arises regarding your monthly pay, dedication, or bonus, your salary slip acts as written proof of all transactions made by your employer.

It helps in the payroll management process to settle disputes arising based on payroll and also creates transparency in the payroll process. And protect employees and employers if any misunderstanding happened

Insurance and Government Schemes

Salary slips are also essential to availing government scheme subsidies such as EPF, ESIC, PMJJBY, etc. They help verify whether your Income falls within the salary bracket defined by the government, making you eligible for these benefits.

Hike Negotiations and Job Switches

If you decide to switch your job at your current company or ask for a salary hike, your salary slip is required to:

- Your Salary Slip works as proof of your last drawn salary

- Justify the Expected Salary

Salary slip accuracy is closely linked to how payroll is managed behind the scenes. To learn how end-to-end payroll operations and statutory filings are handled, take a look at our detailed guide on payroll outsourcing services.

Common Mistakes in Salary Slips

Even though salary slips are official documents, it does not mean that they are always 100% accurate. Sometimes, they contain errors that may lead to confusion, tax issues or even legal complaints. To avoid all these issues, you must review your salary slip every month to ensure that all the details are accurate. Here, we mention the common mistakes to rectify

- Incorrect Personal Details – Check the spelling of your name, Employee ID, and PAN card that is error-free.

- Earnings – Check your basic salary, HRA, and Bonus not updated as per your latest package

- Rectify Wrong Deductions – Extra or wrong deduction in PF, TDS or professional tax, which leads to misunderstanding.

- Misreported in Net Salary – Sometimes, the credited amount in your salary account does not match the amount mentioned in your payslip due to rounding or calculation errors.

- Leaves or Missing Pay Days – If your paid or unpaid leaves are not correctly shown on your salary slip, it can result in incorrect salary deductions and confusion at the end of the month.

In Conclusion

Salary slips are crucial documents for all employees to have. But, 93% of Indian employees are unorganised and hence do not get salary slips. They thus cannot avail of loans as they need proof of employment. With the TankhaPay app, employers can not just provide PF & ESI to their workers but also salary slips, which are available to download on the app. So, what are you waiting for, download the TankhaPay app today or visit www.tankhapay.com for more information.

FAQs on Salary Slip Format

What is the salary slip rate?

The salary slip rate refers to the frequency at which you receive your salary slip. Typically, it aligns with your salary payment cycle, whether monthly, bi-weekly, or otherwise. Confirm this with your HR department for accurate information.

How do I get a salary certificate?

Proof of salary is exactly what it sounds like, proof of the amount you get paid for your job. It is usually validated through your salary slip, bank statements reflecting salary credits, or a salary certificate issued by your employer. Banks, landlords, or any institution requiring this proof will generally accept one of these documents.

How do I verify my salary?

To verify your salary, you can provide your salary slip, bank statements showing salary credits, or request a salary certificate from your HR department.

How can I download my salary slip?

Check if your company provides an employee portal or HR software. If so, log in to your account, navigate to the payroll or salary section, and you should find an option to download your salary slip. If not, a quick request to HR should get you the digital copy you need.

Are Salary Slips Confidential?

Yes, salary slips are confidential documents. Employers are bound to protect their employees' financial information, ensuring it's accessible only to authorised personnel and the respective employees.

What Role Does a Salary Slip Play in Taxation?

Salary slips play a vital role in taxation, serving as proof of income. They aid in calculating taxable income, allowing individuals to file accurate income tax returns and claim deductions as applicable.

How Does Overtime Reflect on a Salary Slip?

Overtime earnings are typically detailed separately on a salary slip, showcasing the extra hours worked and the additional pay received, ensuring transparency in the payment structure.

What Should I Do if There’s an Error on My Salary Slip?

If you notice any discrepancies or errors on your salary slip, it's essential to immediately bring them to the attention of your HR or payroll department for rectification to avoid future complications.

How Long Should I Keep My Salary Slips?

It's advisable to retain your salary slips for at least a few years. They can serve as valuable references during tax audits, loan applications, or for any financial inquiries that may arise in the future.

Also Read

- What is Salary Certificate?

- What is Loss of Pay in Salary?

- How to do Salary Negotiation?

- Salary Breakup Structure

What’s up, every time i used to check weblog posts here early

in the break of day, as i enjoy to find out more and more.

You ought to be a part of a contest for one of the greatest sites on the net.

I most certainly will recommend this blog!

Wow, this piece of writing is great, my younger

sister is analyzing these things, therefore I am going to inform her.

I like it when folks get together and share

opinions. Great website, continue the good work!

Great read—clear and informative. A salary break up calculator is extremely useful for employees and HR teams to plan compensation better, and this post explains its benefits very well.