Expand Anywhere in India Without Setting Up Entities

Onboard, manage, and pay employees compliantly across multiple states of India

Offer PF and ESI benefits legally through TankhaPay as your Employer of Record—no paperwork, no hassle.

Why EOR?

Expanding your workforce across India isn’t just about hiring—it’s navigating complex laws, compliance, and HR challenges. Many companies spend more time on paperwork than growth. EOR solves this.

Compliance Made Easy

Compliance Made Easy Skip Entity Setup

Skip Entity Setup Payroll & Benefits Simplified

Payroll & Benefits Simplified

HR Burden Reduced

HR Burden Reduced Manage distributed teams without stretching HR resources.

Manage distributed teams without stretching HR resources.

EOR lets you focus on growth while we handle employment and compliance—across every state in India.

What TankhaPay EOR Does

With TankhaPay Employer of Record, expanding your team across India becomes effortless. We become the legal employer on your behalf, so you can onboard talent anywhere in India quickly, compliantly, and efficiently. You focus on the work—they focus on results—we handle the rest.

Here’s how we make it seamless:

Onboard Employees

Add talent in any state without setting up a local entity.

Manage Documentation

Employment contracts, statutory filings, and compliance handled end-to-end.

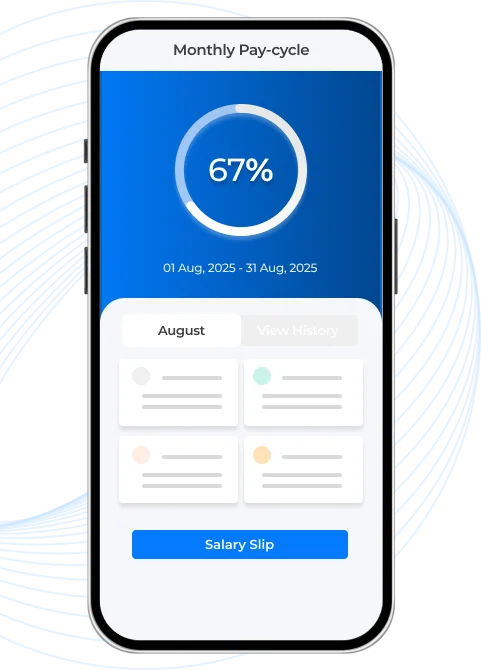

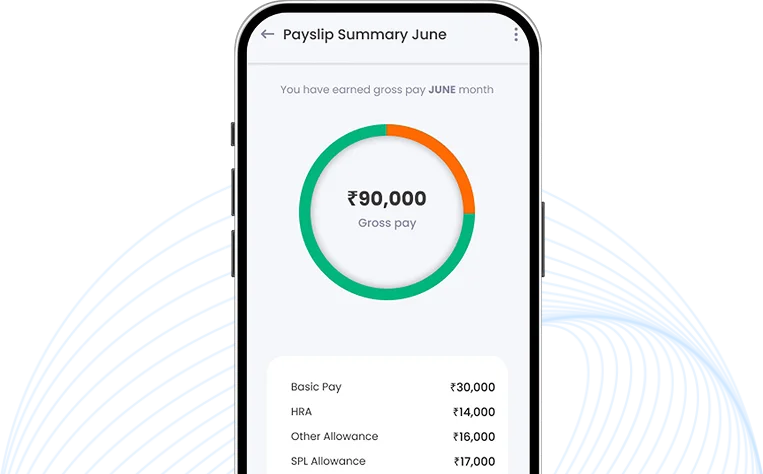

Payroll & Benefits

Timely salary disbursal, taxes, and statutory benefits—fully managed.

Compliance Across States

PF, ESIC, professional tax, LWF—all covered.

Benefits for Businesses

With TankhaPay EOR, expanding your workforce across India isn’t just easier—it drives real business growth. By letting us manage employment, compliance, and payroll, your team can focus on what truly matters: scaling and delivering results.

Onboard Employees Anywhere, Instantly

Onboard Employees Anywhere, Instantly

Reduce Compliance Risks

Reduce Compliance Risks Focus on Core Business

Focus on Core Business

Enhance Employee Experience

Enhance Employee Experience Streamline HR Operations

Streamline HR Operations Cost-Efficient Expansion

Cost-Efficient Expansion

As your business scales, DIY compliance becomes a weight you didn’t sign up for.

Why TankhaPay EOR

Let TankhaPay do the heavy lifting. With EOR, your team gets covered, and you stay stress-free, because we’ll manage every step—from adding employees to final settlement.

PAN-India Presence

Expanding your workforce anywhere in India is effortless with TankhaPay. We ensure full compliance and a smooth onboarding process, regardless of the state.

One-Stop Ecosystem

TankhaPay brings together technology and expert services to make workforce management seamless. From onboarding to compliance, we handle everything so your team can focus on growth.

Support for All Workforce Types

Whether your team includes blue-collar, white-collar, or apprentices, TankhaPay ensures a smooth onboarding and management process.

Faster Onboarding & Lower Cost

Skip the delays and high expenses of traditional entity setup. TankhaPay lets you expand quickly while optimising costs.

Dedicated HR Support

Managing a multi-state workforce is simple with TankhaPay—expert HR support and smart tech ensure payroll and compliance run smoothly.

Why It Truly Matters

EOR Keeps Things Effortless at Any Scale

TankhaPay’s EOR moves at your pace—flexible, reliable, and ready no matter your team size. It blends into your existing HR and payroll processes, providing predictable, reliable compliance every month.

How Does It Work?

Expand your workforce anywhere in India effortlessly - onboard employees compliantly with TankhaPay EOR

Get Started Today!Let’s chat about how EOR can support your people and your business, worry-free.

FAQs

01.What is an Employer of Record (EOR)?

An Employer of Record (EOR) organisation is a third-party service provider that legally employs your workforce on your behalf. While you continue to manage their day-to-day work and performance, the EOR takes care of all employment-related responsibilities such as payroll processing, statutory compliance, benefits administration, and documentation—ensuring smooth and compliant workforce management.

02.How does an Employer of Record (EOR) work?

The EOR becomes the contractual employer for legal and tax purposes, while the client company manages the employee’s day-to-day activities and performance. This allows businesses to hire talent quickly without setting up a local legal entity.

03. What services are typically included under an EOR arrangement?

EOR services usually cover employment contracts, payroll processing, statutory compliance, tax filings, employee benefits, onboarding, and termination support.

04.What is the difference between an EOR and a Professional Employer Organization (PEO)?

A PEO co-employs workers with the client company, sharing employer responsibilities. An EOR, however, becomes the sole legal employer of the worker — offering more flexibility for companies hiring across regions or countries.

05.When should a company consider using an EOR?

Organizations use EOR services when expanding to new regions without establishing a legal entity, hiring remote or international employees, managing project-based workforces, or ensuring compliance with complex labour laws.

06.How does an EOR ensure compliance with local labour laws?

An EOR stays updated with local employment regulations, manages statutory contributions, handles tax obligations, and ensures all employment contracts meet legal standards — minimizing the client’s compliance risk.

07.Can an EOR manage both full-time and contract employees?

Yes. Most EORs support multiple employment types, including permanent staff, fixed-term contracts, consultants, and freelancers — depending on local legal frameworks.

08.What are the advantages of using an Employer of Record?

The key benefits include faster market entry, reduced administrative workload, legal compliance assurance, simplified payroll, and the ability to hire talent globally without entity setup costs.

09.How is employee data handled and protected by an EOR provider?

Reputable EOR providers follow strict data security protocols, using encrypted systems and GDPR or equivalent data protection frameworks to safeguard all employee and company information.

10.What costs are involved in working with an EOR?

Pricing depends on factors like employee count, location, compensation structure, and scope of services. Most EORs charge a per-employee monthly fee that includes payroll, compliance, and administrative management.