Track Spending Without the Back-and-Forth

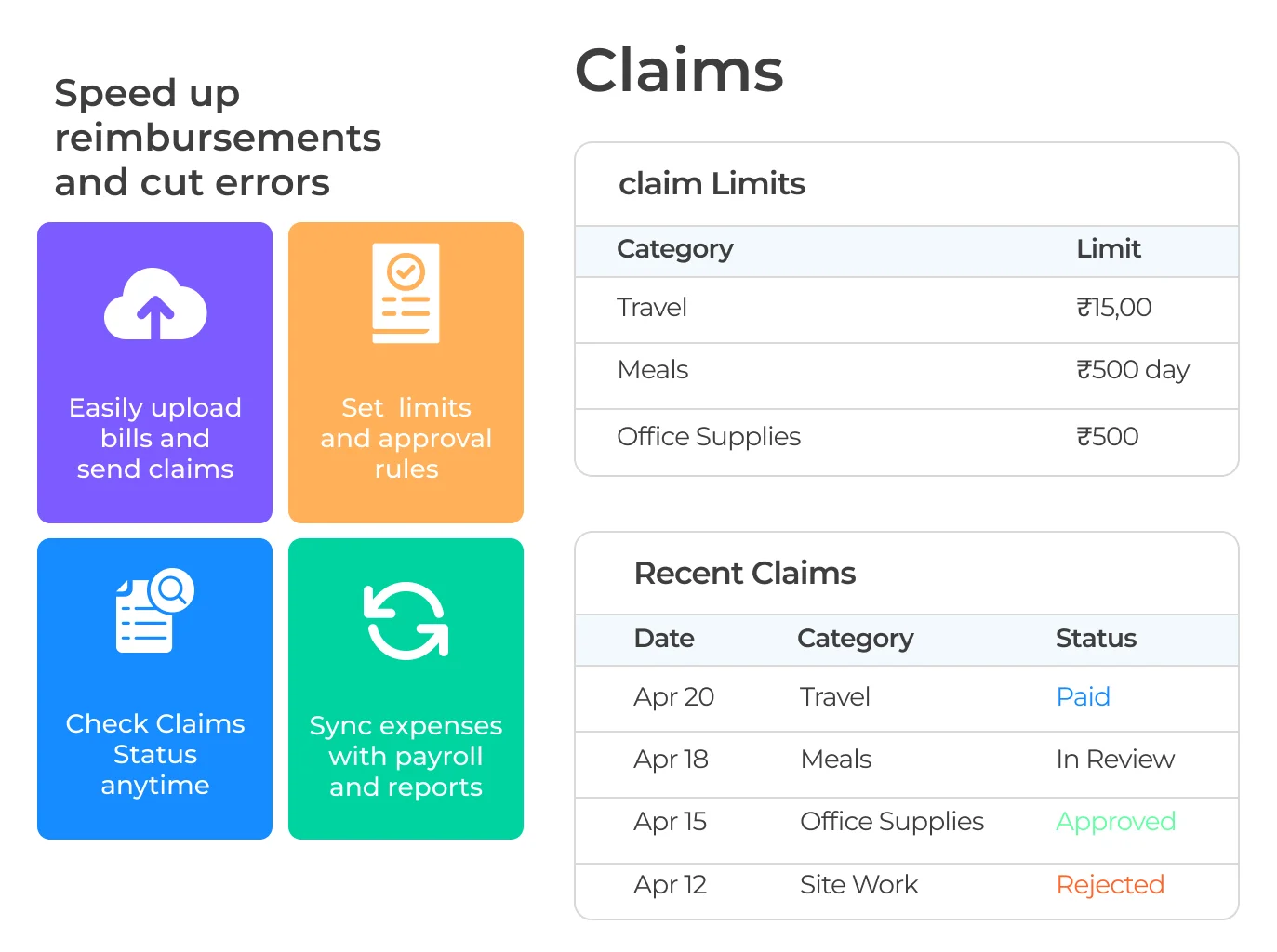

Employees can upload bills, submit claims, and track approvals—all from a single, easy-to-use platform.

Employees can upload bills, submit claims, and track approvals—all from a single, easy-to-use platform.

Skip the paperwork and emails.

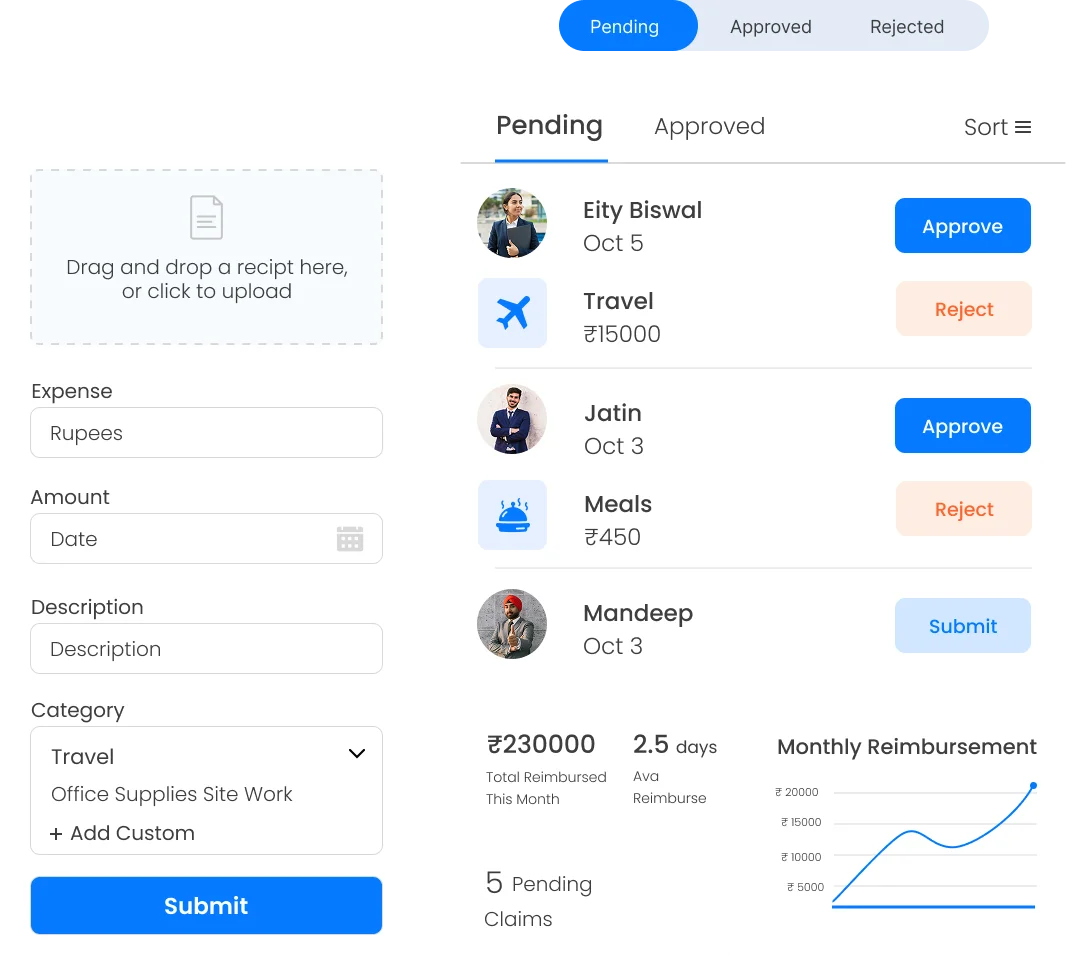

Employees just click a photo, add details, and submit expenses through the app.

Employees just click a photo, add details, and submit expenses through the app. Submit expenses for travel, meals, office supplies, site work, or any custom category.

Submit expenses for travel, meals, office supplies, site work, or any custom category. Managers can review, approve, or reject claims in real time, no manual checks or follow-ups needed.

Managers can review, approve, or reject claims in real time, no manual checks or follow-ups needed. Speed up reimbursement cycles while keeping the process clear for everyone.

Speed up reimbursement cycles while keeping the process clear for everyone.A streamlined experience that saves time for both employees and managers.

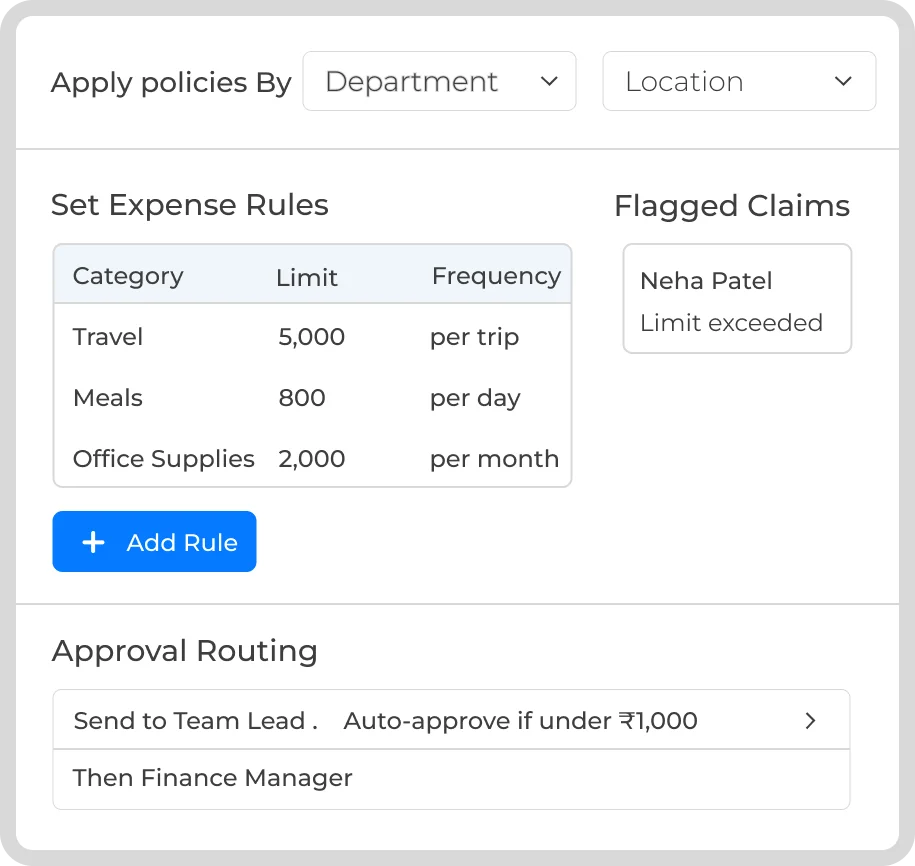

Define and enforce rules that match your organisation’s needs.

Set limits and categories for different types of expenses.

Set limits and categories for different types of expenses. Establish approval flows to route claims to the right managers automatically.

Establish approval flows to route claims to the right managers automatically. Customise policies for departments, roles, or locations.

Customise policies for departments, roles, or locations. The system automatically flags any claims that are out-of-policy or exceed limits.

The system automatically flags any claims that are out-of-policy or exceed limits. Reduce back-and-forth and make sure everyone knows what’s acceptable before they spend.

Reduce back-and-forth and make sure everyone knows what’s acceptable before they spend.Maintain control without micromanaging.

Ensure your books stay accurate and reimbursements stay on schedule.

Every approved claim automatically flows into payroll for seamless reimbursement.

Every approved claim automatically flows into payroll for seamless reimbursement. Integrate with accounting systems to keep expense records clean and up-to-date.

Integrate with accounting systems to keep expense records clean and up-to-date. Get clear, auditable records of all claims and approvals.

Get clear, auditable records of all claims and approvals. Make month-end closes and audits easier with consistent, organised expense data.

Make month-end closes and audits easier with consistent, organised expense data. Connect expenses to avoid errors and manual entry.

Connect expenses to avoid errors and manual entry.Finance is always updated with no surprises or delays.

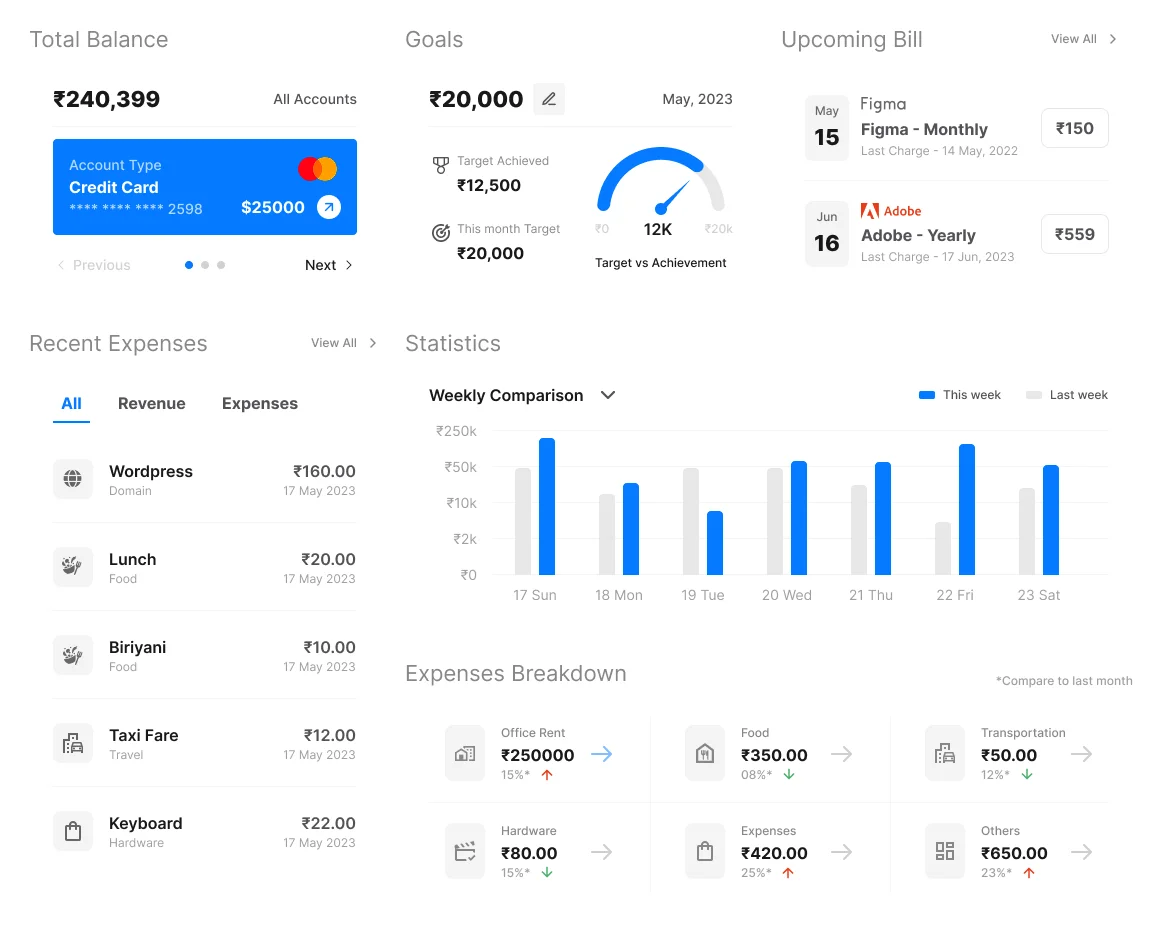

Turn expense data into actionable financial insights.

Keep tabs on spending trends across projects, departments, or staff groupings.

Keep tabs on spending trends across projects, departments, or staff groupings. Identify recurring costs, unnecessary claims, or areas for savings.

Identify recurring costs, unnecessary claims, or areas for savings. Generate detailed reports to support budgeting and forecasting.

Generate detailed reports to support budgeting and forecasting. Compare actual expenses against policies and budgets in real time.

Compare actual expenses against policies and budgets in real time. Use insights to refine policies, improve cost efficiency, and maximise ROI.

Use insights to refine policies, improve cost efficiency, and maximise ROI.Finance is always updated with no surprises or delays.

Easily upload bills and send claims

Set limits and approval rules

Check claim status anytime

Sync expenses with payroll and reports

Managing business expenses doesn’t have to be complicated. With TankhaPay, you simplify submissions, approvals, and reimbursements—all in one place. Every transaction stays transparent, compliant, and audit-ready, helping your teams save time while your business saves costs. Smarter expense management means fewer delays, fewer errors, and more control over your finances.

Simplify submissions, speed up reimbursements, and keep your finance team in control—all from one platform.

Book a DemoAn expense management system is a digital tool that automates the process of recording, approving, and reimbursing employee expenses such as travel, meals, office supplies, or client entertainment.

Employees can submit expense claims with receipts, which are automatically routed to managers for approval. Once approved, the system processes reimbursements and integrates them into payroll or accounting software.

It typically manages business-related expenses such as travel, lodging, meals, fuel, mobile reimbursements, client meetings, and other work-related expenditures.

Yes, most systems allow employees to upload receipts by scanning or clicking pictures through a mobile app, which are then automatically matched to the corresponding expense entries.

Expense policies can be predefined within the platform. The system automatically flags out-of-policy claims, duplicate submissions, or missing receipts, helping ensure full compliance.

Yes, modern platforms seamlessly integrate with HRMS, ERP, and accounting software to ensure accurate expense tracking, faster reimbursements, and smooth financial reconciliation.

Automation speeds up the approval cycle by routing claims directly to the right approvers, reducing manual errors, delays, and administrative overhead.

Yes, organizations can define category-based limits, approval hierarchies, and policies tailored to specific departments, roles, or grades.

Absolutely. Most systems provide dashboards and reports that help finance teams identify spending patterns, control costs, and plan budgets more effectively.

Leading expense management systems use secure cloud storage, data encryption, and role-based access to ensure all financial and personal data remain protected.