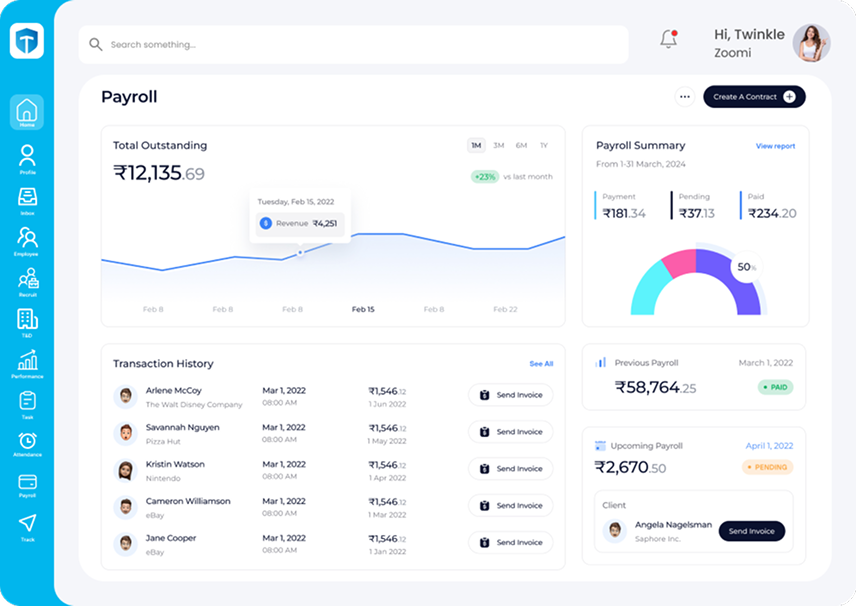

Payroll Software

Accurate, compliant, and on-time salary processing made simple.

Payroll software automates salary calculations, payments, and statutory deductions—ensuring timely pay and compliance with PF, ESI, TDS, and more.

What is Payroll Software?

Payroll software makes paying employees easier by handling everything from salary calculations and payslip creation to statutory reporting. It helps HR and finance teams save time, reduce errors, and stay compliant with labour laws, making the entire payroll process smoother and more reliable.

Simplifies complex payroll tasks

Simplifies complex payroll tasks Ensures compliance with labour laws

Ensures compliance with labour laws Reduces administrative workload

Reduces administrative workload

Integrates employee data, attendance, leave, benefits, and deductions

Integrates employee data, attendance, leave, benefits, and deductions Processes salaries accurately and quickly

Processes salaries accurately and quickly

Works for small teams or large workforces

Works for small teams or large workforces Supports efficient, transparent compensation management

Supports efficient, transparent compensation management

Why is Payroll Software Essential?

Managing payroll is essential for keeping your team happy and your business running smoothly. Getting salaries right and paying on time builds trust, while staying compliant with laws helps you avoid penalties and unnecessary stress. Payroll software ensures

Fewer mistakes in salary calculations

Fewer mistakes in salary calculations Salaries paid on time

Salaries paid on time

Stay compliant with legal rules

Stay compliant with legal rules

Get accurate payslips and reports

Get accurate payslips and reports Save time and reduce costs

Save time and reduce costs

Keep things clear for employees

Keep things clear for employees

Key Features of Payroll Software

Salary Calculation

Payslip Generation

Statutory Compliance

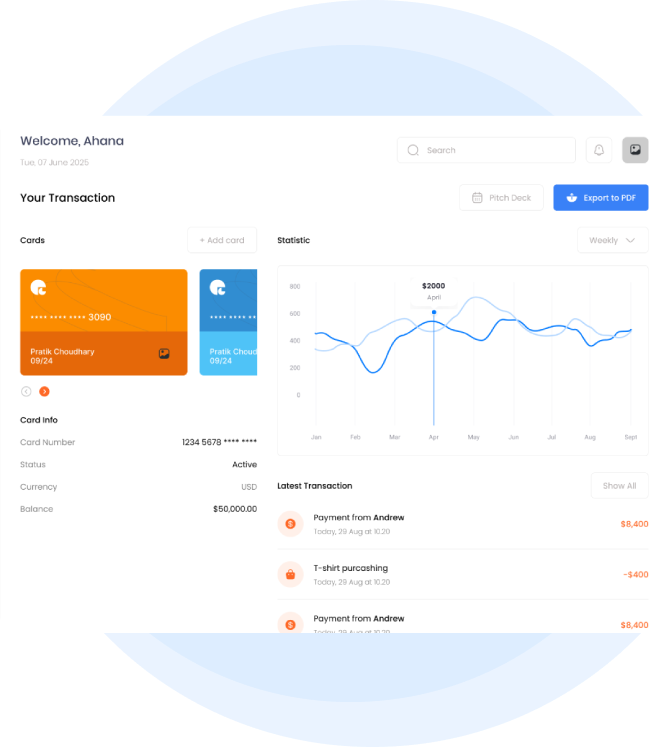

Bank Transfer and Payment Integration

Reimbursements and Deductions

Leave and Attendance Sync

Full and Final Settlement

Reports and Audits

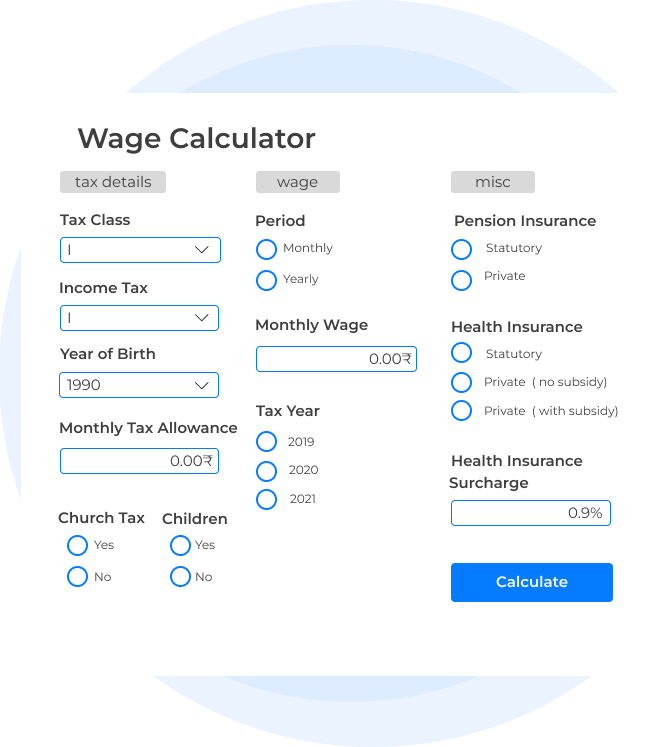

Salary Calculation

Automated salary processing based on employee data, workdays, leave, attendance, and applicable bonuses or deductions.

Fixed and variable salary components

Fixed and variable salary components

Pro-rata calculations for mid-month joiners or exits

Pro-rata calculations for mid-month joiners or exits

Integration with attendance and leave records

Integration with attendance and leave records

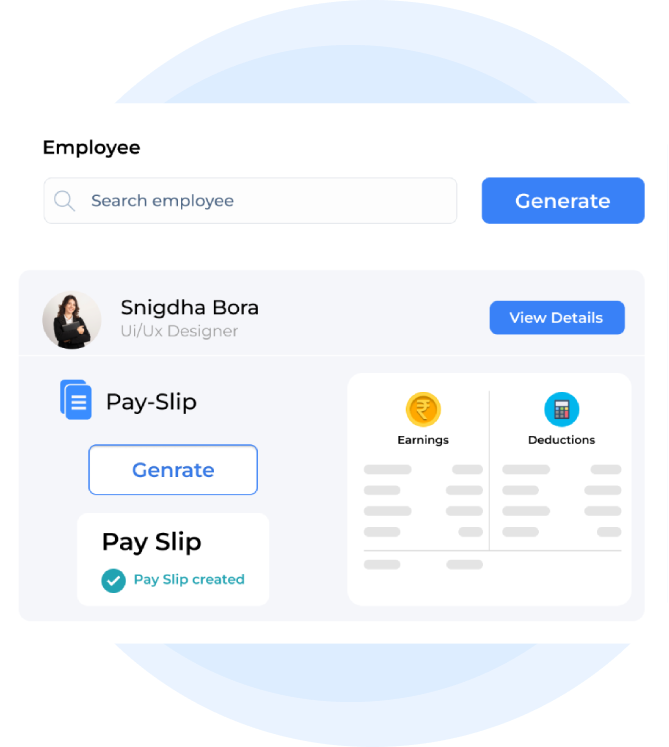

Payslip Generation

Automatically creates detailed payslips for each employee, available to download on web or mobile. It has details like

Salary breakdown with earnings and deductions

Salary breakdown with earnings and deductions

Tax and contribution summaries

Tax and contribution summaries

Custom payslip templates

Custom payslip templates

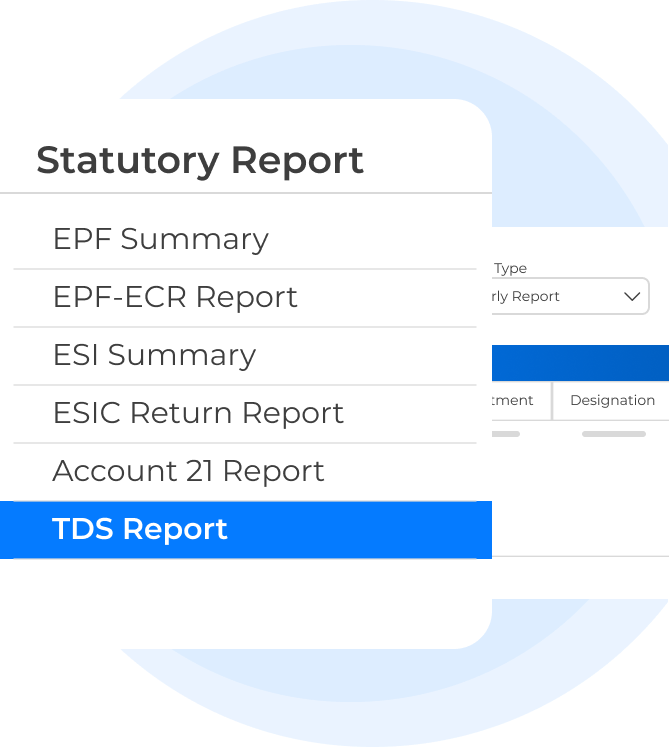

Statutory Compliance

Built-in compliance features to manage contributions and filings related to:

Provident Fund (PF)

Provident Fund (PF)

Employees’ State Insurance (ESI)

Employees’ State Insurance (ESI)

Professional Tax (PT)

Professional Tax (PT)

Tax Deducted at Source (TDS)

Tax Deducted at Source (TDS) Labour Welfare Fund (LWF)

Labour Welfare Fund (LWF)

Auto-calculations, challan generation, and filing-ready reports ensure businesses stay audit-ready.

Bank Transfer and Payment Integration

Seamless integration with banking systems to process salary transfers in bulk.

Bank-wise disbursal formats

Bank-wise disbursal formats

UTR tracking and payment status

UTR tracking and payment status

Payment reconciliation

Payment reconciliation

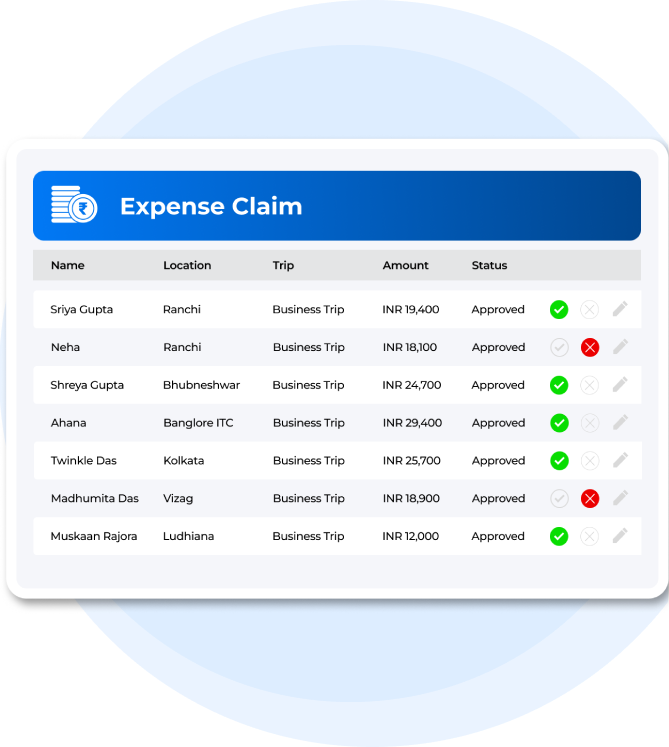

Reimbursements and Deductions

Manage claims, expense reimbursements, loans, advances, and other custom deductions.

Approval workflows for claims

Approval workflows for claims

EMI recovery and salary deductions

EMI recovery and salary deductions

Integration with finance policies

Integration with finance policies

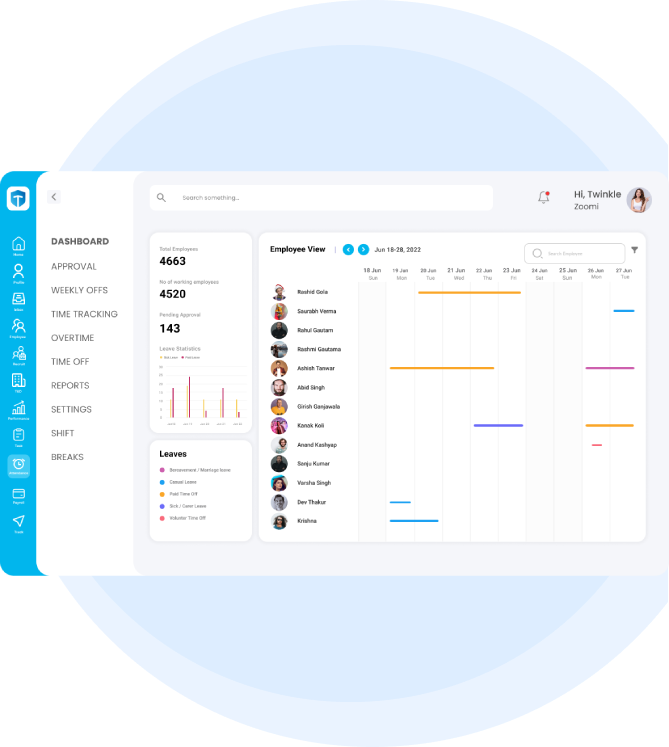

Leave and Attendance Sync

Payroll software integrates with attendance and leave systems to ensure accurate salary processing.

Auto-adjustments for leave without pay (LWP)

Auto-adjustments for leave without pay (LWP)

Overtime and shift differentials

Overtime and shift differentials

Late marks and half-day calculations

Late marks and half-day calculations

Full and Final Settlement

Automated settlement of dues when an employee resigns or is relieved.

Notice period pay

Notice period pay

Leave encashment

Leave encashment Gratuity and bonuses

Gratuity and bonuses

Final payslip and settlement report

Final payslip and settlement report

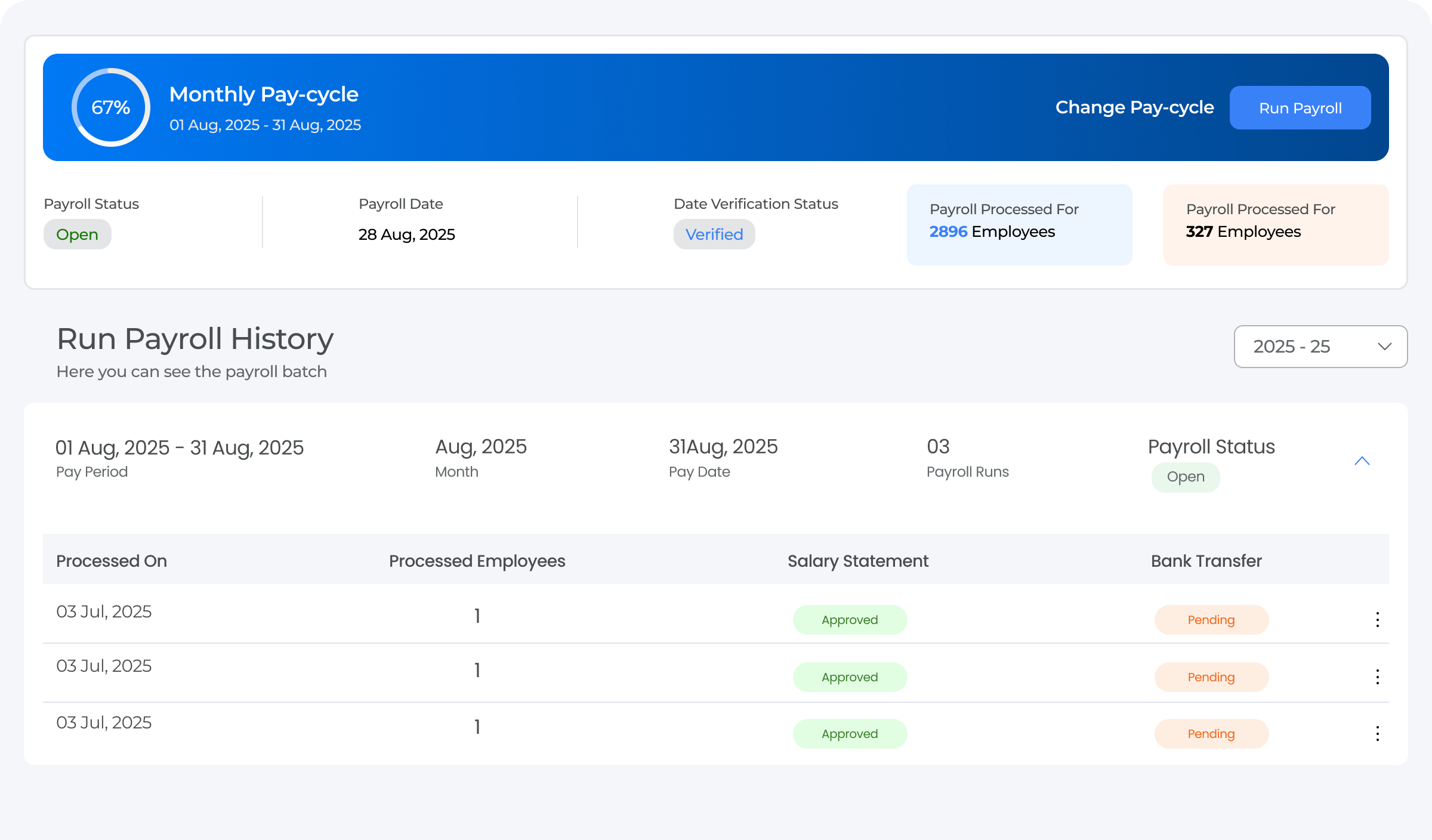

Reports and Audits

Access to detailed payroll reports for management and compliance purposes.

Monthly payroll summary

Monthly payroll summary

Statutory contribution reports

Statutory contribution reports TDS and Form 16 generation

TDS and Form 16 generation

Audit logs and payroll history

Audit logs and payroll history

Benefits of Payroll Software

Payroll software offers clear advantages that make managing salaries easier, faster, and more reliable.

Time-saving

Time-saving Accuracy

Accuracy Compliance-ready

Compliance-ready Scalable

Scalable

Transparent

Transparent Data security

Data security

Who Can Use Payroll Software?

Payroll software is a good fit for all kinds of organisations, making salary management easier and more reliable as needs grow and change.

Key Considerations Before Choosing Payroll Software

When choosing payroll software for your business, think about what will make it easy to use, secure, and future-ready.

Ease of use

Ease of use Compliance coverage

Compliance coverage Integration

Integration

Customisability

Customisability Security

Security Scalability

Scalability

FAQs

01. Payroll Software vs Payroll Services: What’s the Difference?

Payroll software is a tool used internally by organisations to manage payroll. Payroll services are outsourced providers who handle payroll processing on your behalf.

02.Is payroll software suitable for small businesses?

Yes. Payroll systems are flexible and affordable, making them a good fit for any business size.

03. How often is payroll processed?

This depends on company policy. Most organisations process payroll monthly, but some run it weekly or fortnightly.

04.Can payroll software handle contract workers or freelancers?

Yes. Many systems allow flexible configurations to manage hourly, daily, or project-based payments.

05.Does payroll software handle tax declarations and Form 16?

Yes. Payroll software typically includes TDS calculations, investment declarations, and Form 16 generation for employees.