Payroll Accounting That Powers Financial Clarity

We provide comprehensive payroll accounting solutions that take care of the entire compensation process, from wages and taxes to benefits and deductions. Our services ensure your employees are paid accurately and on time, help your business stay compliant with legal and tax regulations, and deliver clear, detailed reports on labor costs for smarter financial planning and reporting.

How is Payroll Accounting Managed in India?

In India, payroll accounting involves calculating employee compensation, which includes salaries, statutory deductions such as Income Tax, EPF, ESI, and Professional Tax, as well as employer contributions to social security benefits like EPF and ESI.

The payroll accounting process begins with registering the organization and obtaining a TAN (Tax Deduction and Collection Account Number).

The payroll accounting process begins with registering the organization and obtaining a TAN (Tax Deduction and Collection Account Number).

Establish a salary framework, collect employee information, and process payments via direct bank transfers.

Establish a salary framework, collect employee information, and process payments via direct bank transfers.

Maintain accurate records and comply with labor laws, such as the Income Tax and EPF Acts, to ensure trust and compliance.

Maintain accurate records and comply with labor laws, such as the Income Tax and EPF Acts, to ensure trust and compliance.

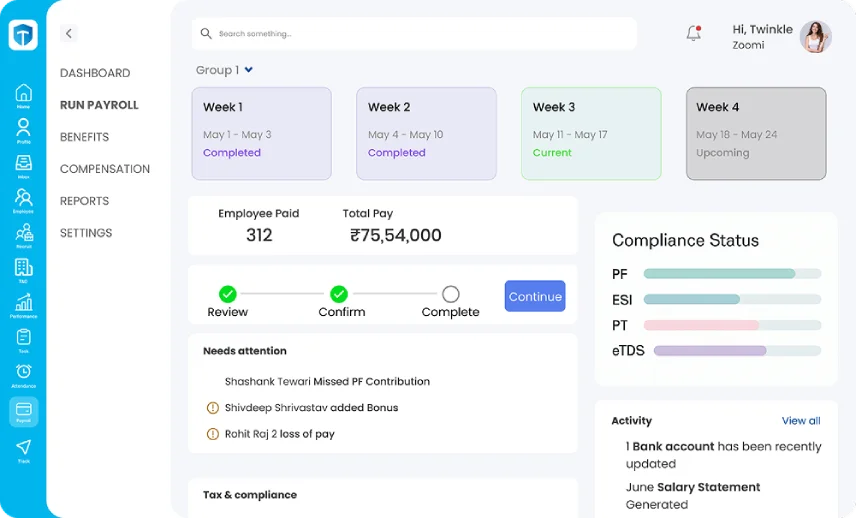

TankhaPay simplifies payroll with automation, compliance, and salary disbursement, ensuring accurate, hassle-free processing for businesses across India.

What Are the Key Steps in TankhaPay’s Payroll Accounting Workflow?

Components for Payroll Accounting

Verify Employee Documentation

Calculate Employee Net Compensation

Record Expense Transactions

Components for Payroll Accounting

Set competitive pay based on industry standards and internal budgeting.

Employee compensation includes salaries, wages, bonuses, and commission rewards.

Employee compensation includes salaries, wages, bonuses, and commission rewards.

Register business and obtain PAN, TAN, and GST for compliance.

Register business and obtain PAN, TAN, and GST for compliance.

Decide payment frequency: monthly, biweekly, or weekly.

Decide payment frequency: monthly, biweekly, or weekly.

Establish employee benefits, including insurance, EPF, ESI, gratuity, and allowances.

Establish employee benefits, including insurance, EPF, ESI, gratuity, and allowances.

Streamline compensation, benefits, and compliance with TankhaPay’s end-to-end payroll accounting solution built for growing businesses in India.

Verify Employee Documentation

Collect required forms for payroll accounting and compliance:

PAN Card and Aadhaar Details: For income tax and identity verification.

PAN Card and Aadhaar Details: For income tax and identity verification.

Form 16 / Form 12BA (Employee Declaration): For tax calculation and exemptions.

Form 16 / Form 12BA (Employee Declaration): For tax calculation and exemptions.

EPF Registration / Nomination Form: For provident fund contributions.

EPF Registration / Nomination Form: For provident fund contributions.

ESI Enrollment Form: For eligible employees under ESI.

ESI Enrollment Form: For eligible employees under ESI.

Bank Account and Direct Deposit Authorization: For salary disbursement.

Bank Account and Direct Deposit Authorization: For salary disbursement.

Other Declarations: Insurance, retirement savings, or voluntary deductions.

Other Declarations: Insurance, retirement savings, or voluntary deductions.

TankhaPay helps you seamlessly collect, verify, and manage all essential employee documents to ensure smooth, compliant payroll processing.

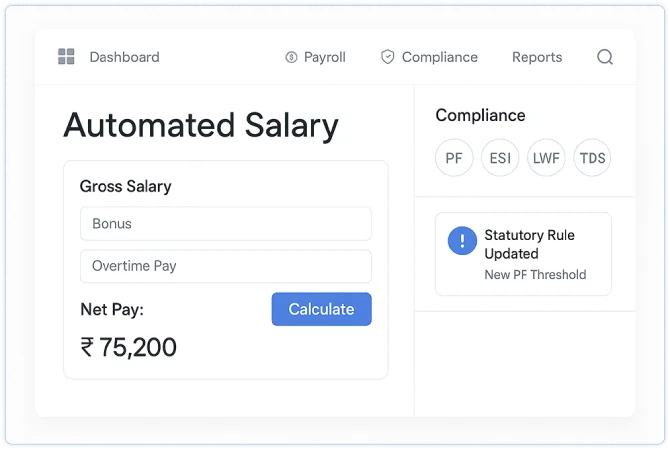

Calculate Employee Net Compensation

Compute gross salary, factoring in base pay, overtime, bonuses, and incentives.

Compute gross salary, factoring in base pay, overtime, bonuses, and incentives.

Deduct TDS, EPF, ESI, Professional Tax, and voluntary contributions.

Deduct TDS, EPF, ESI, Professional Tax, and voluntary contributions.

Determine net pay for each employee.

Determine net pay for each employee.

Calculate accurate net pay effortlessly with TankhaPay’s end-to-end payroll solution designed to handle all deductions and contributions.

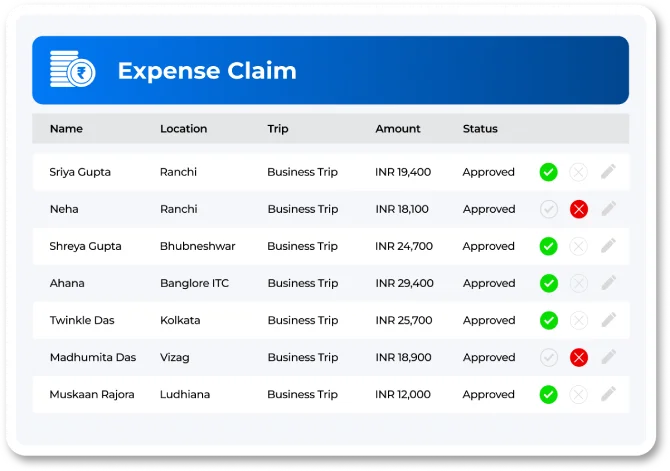

Record Expense Transactions

Maintain a clear record of payroll expenses in the accounting system.

Maintain a clear record of payroll expenses in the accounting system.

Track wages, deductions, contributions, and benefits for transparency and reporting.

Track wages, deductions, contributions, and benefits for transparency and reporting.

Deposit TDS, EPF, ESI, and Professional Tax with the respective authorities on time.

Deposit TDS, EPF, ESI, and Professional Tax with the respective authorities on time.

Generate payslips and annual statements for employees.

Generate payslips and annual statements for employees.

Retain all payroll records to comply with Indian labor laws and for audit purposes.

Retain all payroll records to comply with Indian labor laws and for audit purposes.

Maintain precise payroll records, meet compliance deadlines, and simplify reporting with TankhaPay’s reliable, all-in-one payroll management system.

Unlocking the Value of Payroll Accounting for Your Business

Payroll accounting is essential for running a compliant, financially sound, and employee-focused organization. It involves accurately tracking employee compensation, including wages, deductions, taxes, and benefits, to meet both operational and regulatory requirements.

According to the GPCI 2023 (Global Payroll Complexity Index) report, India’s payroll complexity ranking rose from 25 in 2021 to 21 in 2023, reflecting increasing regulatory and administrative obligations. As payroll processes grow more complex, businesses are discovering their strategic value beyond compliance.

Regulatory Compliance- Accurately calculates, withholds, and submits payroll taxes to ensure full compliance with all applicable tax codes and labor regulations.

Regulatory Compliance- Accurately calculates, withholds, and submits payroll taxes to ensure full compliance with all applicable tax codes and labor regulations.

Financial Integrity- Tracks payroll expenses with precision, enabling accurate financial reporting and smarter, data-driven planning for long-term business growth.

Financial Integrity- Tracks payroll expenses with precision, enabling accurate financial reporting and smarter, data-driven planning for long-term business growth.

Promoting Employee Satisfaction- Delivers timely and accurate pay, helping build employee trust, boost morale, and support a more engaged, motivated workforce.

Promoting Employee Satisfaction- Delivers timely and accurate pay, helping build employee trust, boost morale, and support a more engaged, motivated workforce.

Payroll Documents- Keeps payroll records organized and compliant, streamlining audit preparation and ensuring transparency during financial inspections or reviews.

Payroll Documents- Keeps payroll records organized and compliant, streamlining audit preparation and ensuring transparency during financial inspections or reviews.

How to Calculate Payroll Expenses?

Payroll expenses are calculated by adding together all elements of an employee’s compensation, including gross salary, bonuses, and employer-paid benefits. This total excludes deductions for employee contributions such as taxes and retirement plans, which are only factored in when determining the employee’s net pay.

Example Calculation:

Let’s assume an employee earns a gross salary of ₹1,50,000 per month. The company also contributes 12% of the employee’s basic salary (₹18,000) to the Provident Fund (PF). The employee’s own PF deduction is also 12% of basic salary (₹18,000), and their tax withholdings (TDS) total 15% of the gross wage (₹22,500). Here’s how you would calculate the payroll expenses:

- Gross Salary: ₹1,50,000

- Employer Contributions: ₹18,000 (Provident Fund)

- Total Payroll Expense: ₹1,50,000 + ₹18,000 = ₹1,68,000

- Net Pay: ₹1,50,000 – ₹18,000 (Employee PF) – ₹22,500 (Tax Withholdings) = ₹1,09,500

The payroll expense recorded by the company would be ₹1,68,000, while the employee’s take-home (net) pay would be ₹1,09,500.

Trusted by Top Businesses Across India

Join the growing community of businesses leveraging TankhaPay’s advanced technology, expert payroll support, and actionable insights.

How Can TankhaPay Help You in Payroll Accounting?

TankhaPay automates payroll, ensures compliance, and centralizes employee data, reducing admin work and improving accuracy. Backed by 25+ years of experience and trusted by 1,000+ businesses across India, it transforms payroll into a seamless and strategic business function.

- Streamline payroll operations across locations while staying fully compliant with diverse regulations.

- Simplify HR by standardizing processes, reducing administrative burdens, and accessing expert payroll support, without the need for full-time hires.

- Ensure ongoing compliance with evolving labor and payroll laws.

- Integrate attendance and leave tracking for precise payroll calculations.

- Access centralized employee records anytime via a secure, cloud-based system.

- Scale payroll solutions seamlessly as your organization grows.

Streamline your payroll accounting with TankhaPay and see how our HR technology can turn a routine task into a strategic advantage that drives your business forward.

FAQs

01. What is payroll accounting?

Payroll accounting is the organized process of calculating, recording, and managing employee compensation and related expenses. It assures timely and accurate payments to employees while effectively overseeing the company’s tax, benefit, and other payroll-related obligations.

02.How to do payroll accounting?

To execute payroll accounting, organizations need to gather employee and tax information, calculate gross pay along with all applicable deductions, and determine net income. Then record these transactions as journal entries, disburse payments to employees and tax authorities, and maintain accurate payroll records to ensure compliance and support reporting and audits.

03. What are the three types of payroll accounting?

The primary types of payroll accounting include Initial Recording (or originating entry), which captures gross wages and associated taxes; Accrued Wages (or accrued payroll), representing earnings not yet disbursed; and Manual Payments, used for off-cycle disbursements or final settlements.

04.What is the payroll accounting method?

Payroll accounting is a method of calculating, recording, and managing all financial transactions that are employee-related, including salaries, bonuses, and mandatory tax withholdings, while ensuring accuracy, regulatory compliance, and transparent reporting across the organization.