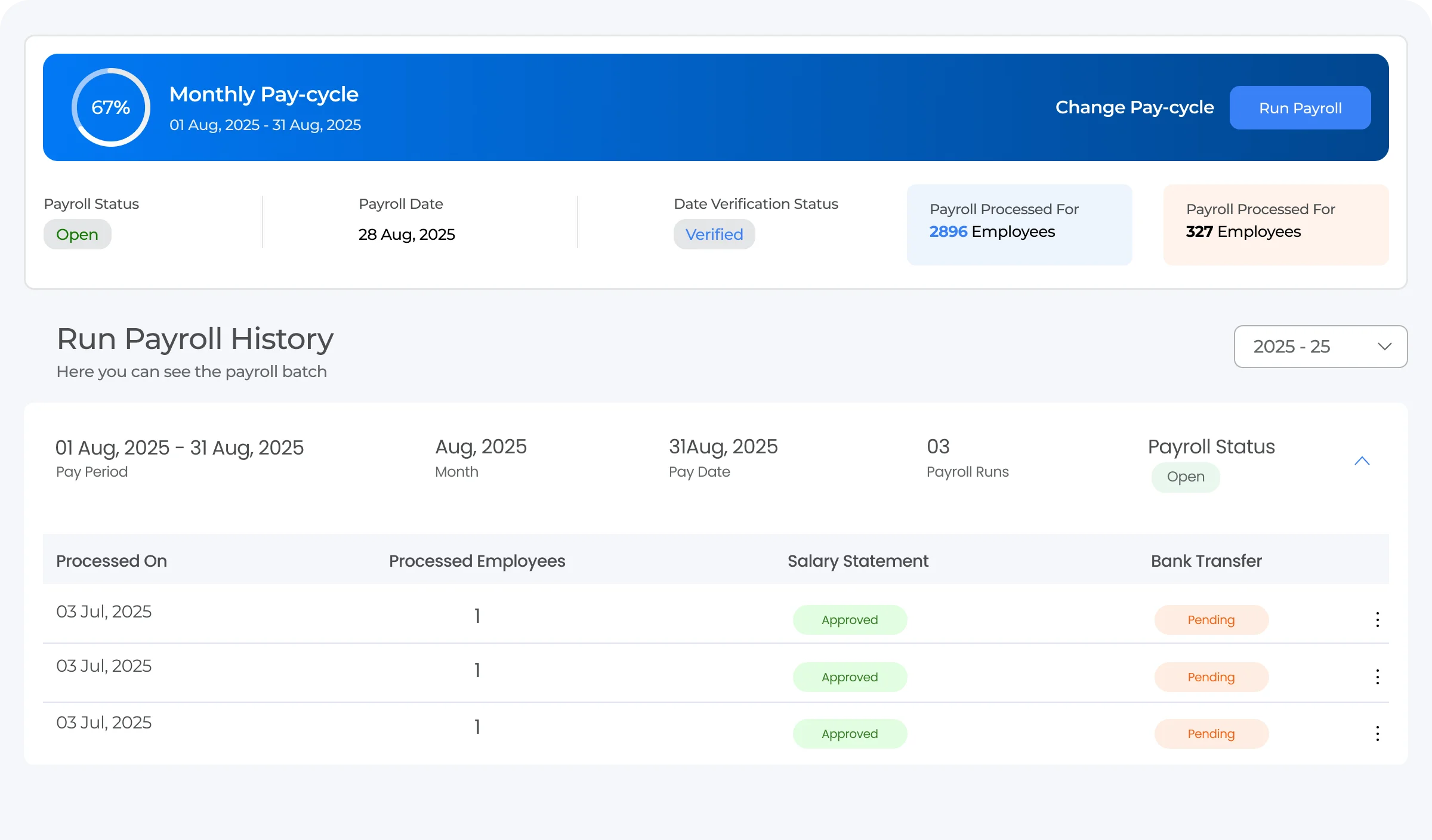

Payroll Management System

Payroll Management That Powers Growth

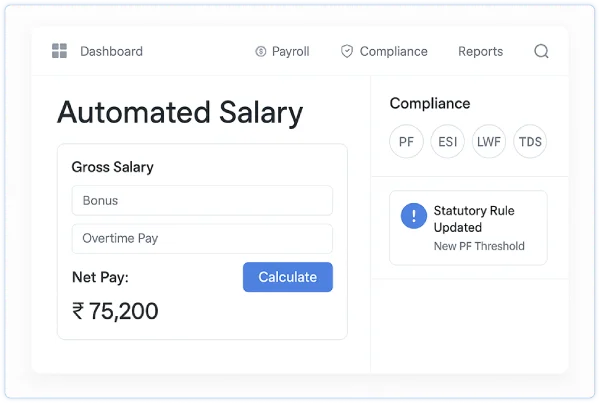

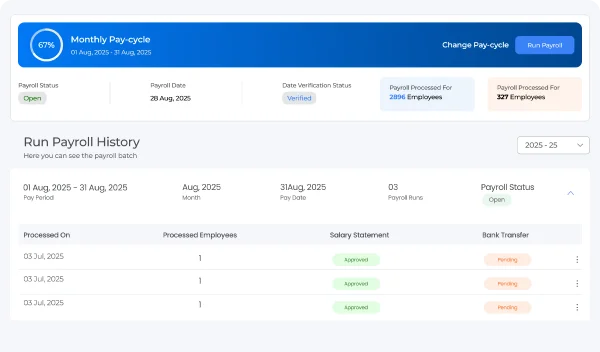

Our Payroll Management System streamlines every step of salary processing, from calculations and payments to compliance and record-keeping. Ensure employees are paid accurately and on time while meeting all statutory obligations with ease.

Learn what they are and the value they bring to your business.

A payroll management system is software that streamlines payroll by accurately calculating pay, taxes, and deductions, saving employers time, reducing errors, and ensuring regulatory compliance.

Research shows that seven out of ten employees in India feel they are frequently or occasionally underpaid.

The Economic Times HRWorld defines financial well-being as stable income, savings, and wealth creation, grounded in reliable, accurate pay that drives employee trust and retention.

Accurate Pay – Ensures timely, error-free salaries.

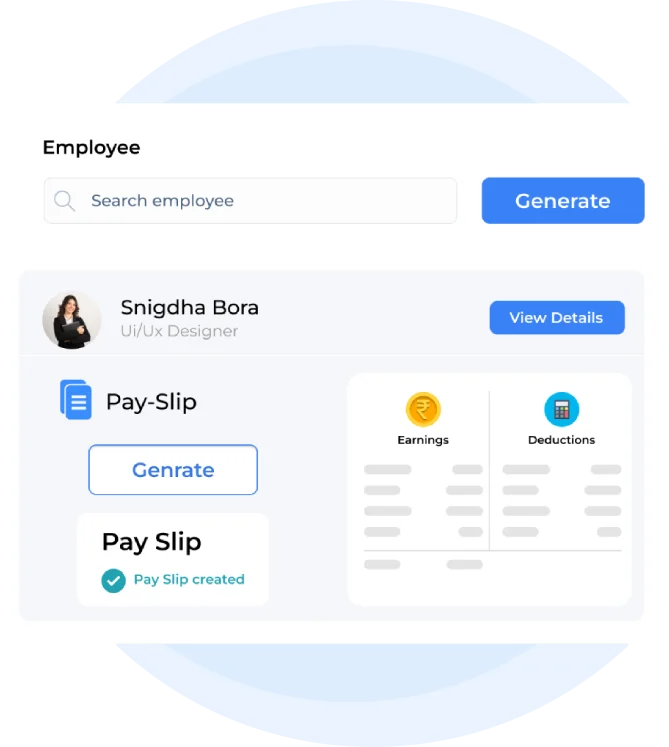

Accurate Pay – Ensures timely, error-free salaries. Easy Access – Let's employees view payslips securely.

Easy Access – Let's employees view payslips securely.

Instant Alerts – Flags issues in real time.

Instant Alerts – Flags issues in real time. Fewer Errors – Automates leave and attendance data.

Fewer Errors – Automates leave and attendance data.

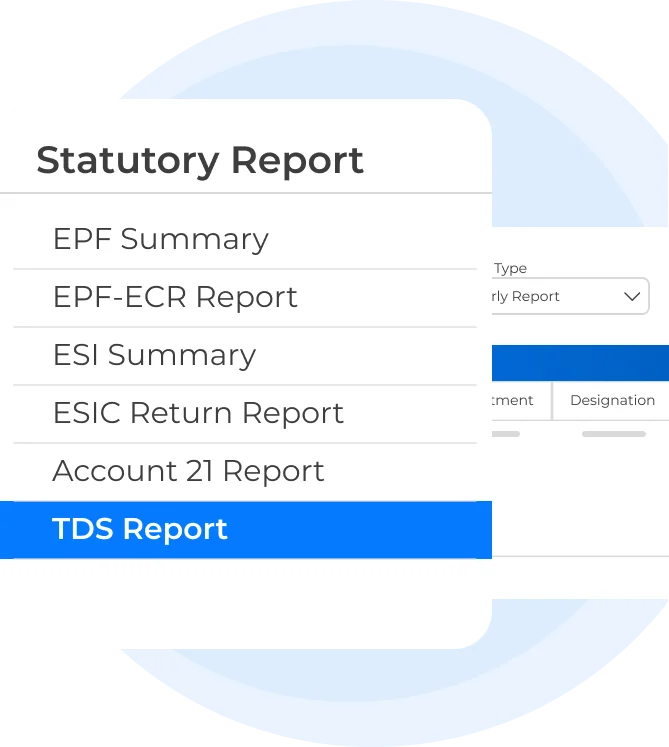

Compliance – Handles all legal deductions and filings.

Compliance – Handles all legal deductions and filings. Secure Records – Safely stores all payroll data.

Secure Records – Safely stores all payroll data.