Seamless Payroll Processing Tailored to Your Needs

We offer end-to-end payroll processing solutions designed to streamline the complex task of employee compensation. From calculating gross pay, daily wages, and bonuses to handling deductions like Provident Fund (PF), professional tax, Tax Deducted at Source (TDS), and allowances, we ensure every component of payroll is managed with precision. Our services are tailored to reduce administrative burden, improve accuracy, and support compliance, so your team gets paid correctly and on time, every time.

Is Payroll Processing the Right Fit for Your Business?

If your goal is to ensure every employee is paid accurately, compliantly, and on schedule, then professional payroll processing is exactly what your business needs. As organisations scale—whether you're a fast-growing startup or an established enterprise—the complexity of payroll increases. It is essential to depend on a payroll system that provides accuracy and efficiency each month due to several locations, a variety of employment types, changing legislation, and strict deadlines.Companies may minimize operational workload, get rid of human errors, and link payroll with HR data for smooth processes with the help of modern payroll processing. You get real-time insights, automated calculations, and strong compliance support—allowing HR and finance teams to focus on strategic growth rather than repetitive admin work.

Maintain control or outsource payroll based on your business needs.

Maintain control or outsource payroll based on your business needs. Integrate HR and payroll for data accuracy and faster decision-making.

Integrate HR and payroll for data accuracy and faster decision-making.

Reduce administrative burden while improving productivity and execution speed.

Reduce administrative burden while improving productivity and execution speed. Ensure compliance and accuracy with trusted payroll processing systems and experts.

Ensure compliance and accuracy with trusted payroll processing systems and experts.

This is where TankhaPay Payroll Software strengthens your operations. Our intelligent HR tech platform streamlines payroll processing, statutory compliance, and digital salary payments—bringing accuracy, speed, and financial control under one system. With built-in compliance, automated workflows, and expert oversight, TankhaPay ensures your employees are paid correctly, on time, and in the most cost-efficient manner—every single month.

What Steps are taken to Complete Payroll Processing?

Payroll processing is a systematic, compliance-heavy workflow that ensures every employee is paid accurately, on time, and in full alignment with statutory obligations. It involves much more than calculating monthly salaries—effective payroll requires precise data collection, validation of attendance and leaves, application of earnings and deductions, handling reimbursements, and executing tax-compliant payouts. Even a small oversight in the payroll process can trigger legal penalties, financial discrepancies, or employee dissatisfaction. To preserve accuracy, openness, and trust throughout the company, HR teams, payroll managers, and business executives must comprehend every stage of payroll processing. Whether you handle payroll internally or with a partner, understanding the precise steps enables you to streamline processes, lower manual error rates, and maintain compliance with changing legal requirements. Below, we break down the critical steps involved in completing payroll processing—clearly, efficiently, and with complete operational clarity.

Compiling Payroll Details

Payroll Calculation

Payroll Distribution & Compliance

Integrating Payroll with Attendance

Compiling Payroll Details

An accurate payroll processing cycle starts with properly compiling, validating, and organizing all employee-related information. This includes attendance data, overtime logs, leave records, salary structures, bonuses, and statutory details. When this foundation is strong, your payroll becomes faster, error-free, and fully compliant with company policies and labour laws.

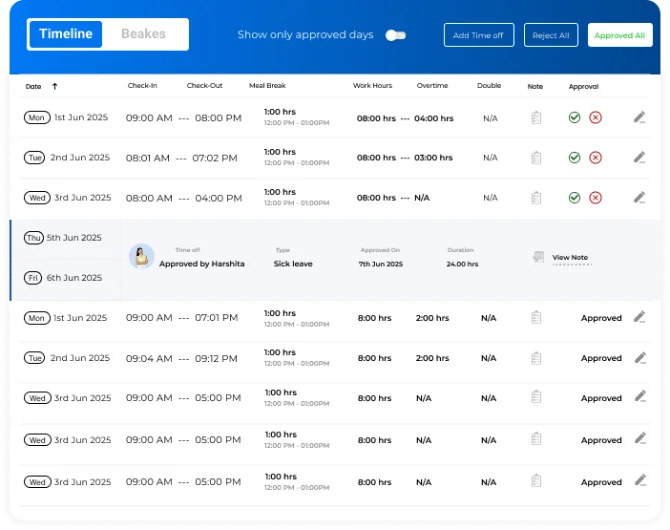

Collect complete employee work data—hours worked, overtime, leave balances, and attendance logs—to ensure accurate payroll calculations.

Collect complete employee work data—hours worked, overtime, leave balances, and attendance logs—to ensure accurate payroll calculations.

Calculate gross pay by adding base salary, overtime earnings, bonuses, incentives, and commissions wherever applicable.

Calculate gross pay by adding base salary, overtime earnings, bonuses, incentives, and commissions wherever applicable.

Keep employee records updated with the latest salary revisions, tax declarations, bank details, and personal information.

Keep employee records updated with the latest salary revisions, tax declarations, bank details, and personal information.

Ensure full compliance with statutory taxes and labour laws, including PF, ESIC, TDS, PT, and any internal payroll policies.

Ensure full compliance with statutory taxes and labour laws, including PF, ESIC, TDS, PT, and any internal payroll policies.

Prepare and verify all payroll inputs carefully to minimise errors and ensure a smooth, timely payroll processing cycle.

Prepare and verify all payroll inputs carefully to minimise errors and ensure a smooth, timely payroll processing cycle.

Accurately compiling all employee data—workdays, leave, attendance, bonuses, and deductions—makes automated payroll processing much simpler. Businesses may minimize human labor, streamline the entire process, and guarantee that each payout is handled accurately and legally with the correct payroll system.

Payroll Calculation

The foundation of efficient payroll processing is accurate payroll computation. This stage entails verifying employee data, following legal requirements, and making sure all components—from gross earnings to deductions—are computed accurately. Effective internal payroll processes, timely employee payments, and organizational compliance are all guaranteed by a dependable payroll system.

Process all payroll data including attendance, overtime, shifts, variable pay, and incentives to accurately calculate gross earnings for each employee.

Process all payroll data including attendance, overtime, shifts, variable pay, and incentives to accurately calculate gross earnings for each employee.

Apply mandatory deductions such as taxes, PF, ESI, professional tax, and benefit contributions to compute error-free net pay.

Apply mandatory deductions such as taxes, PF, ESI, professional tax, and benefit contributions to compute error-free net pay.

Verify statutory compliance ensuring PF, ESI, TDS, and other deductions are accurately calculated as per the latest payroll and labour regulations.

Verify statutory compliance ensuring PF, ESI, TDS, and other deductions are accurately calculated as per the latest payroll and labour regulations.

Record all payroll transactions in a secure payroll register for audit trails, MIS reporting, and long-term compliance documentation.

Record all payroll transactions in a secure payroll register for audit trails, MIS reporting, and long-term compliance documentation.

Review calculations before payout to minimize payroll errors and maintain accuracy in every monthly payroll processing cycle.

Review calculations before payout to minimize payroll errors and maintain accuracy in every monthly payroll processing cycle.

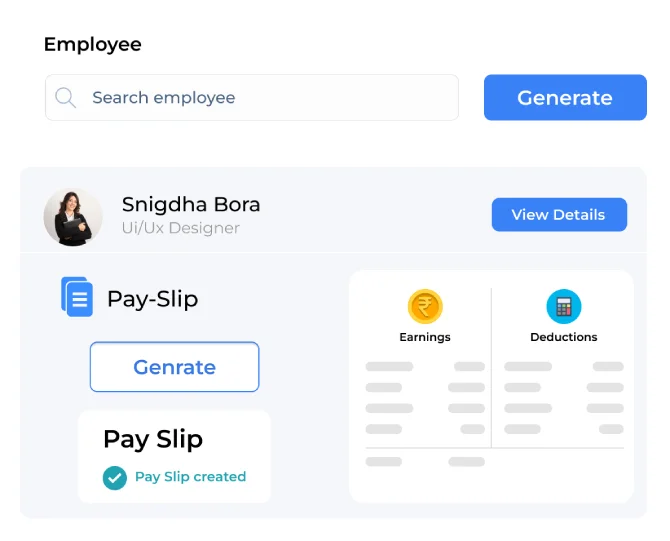

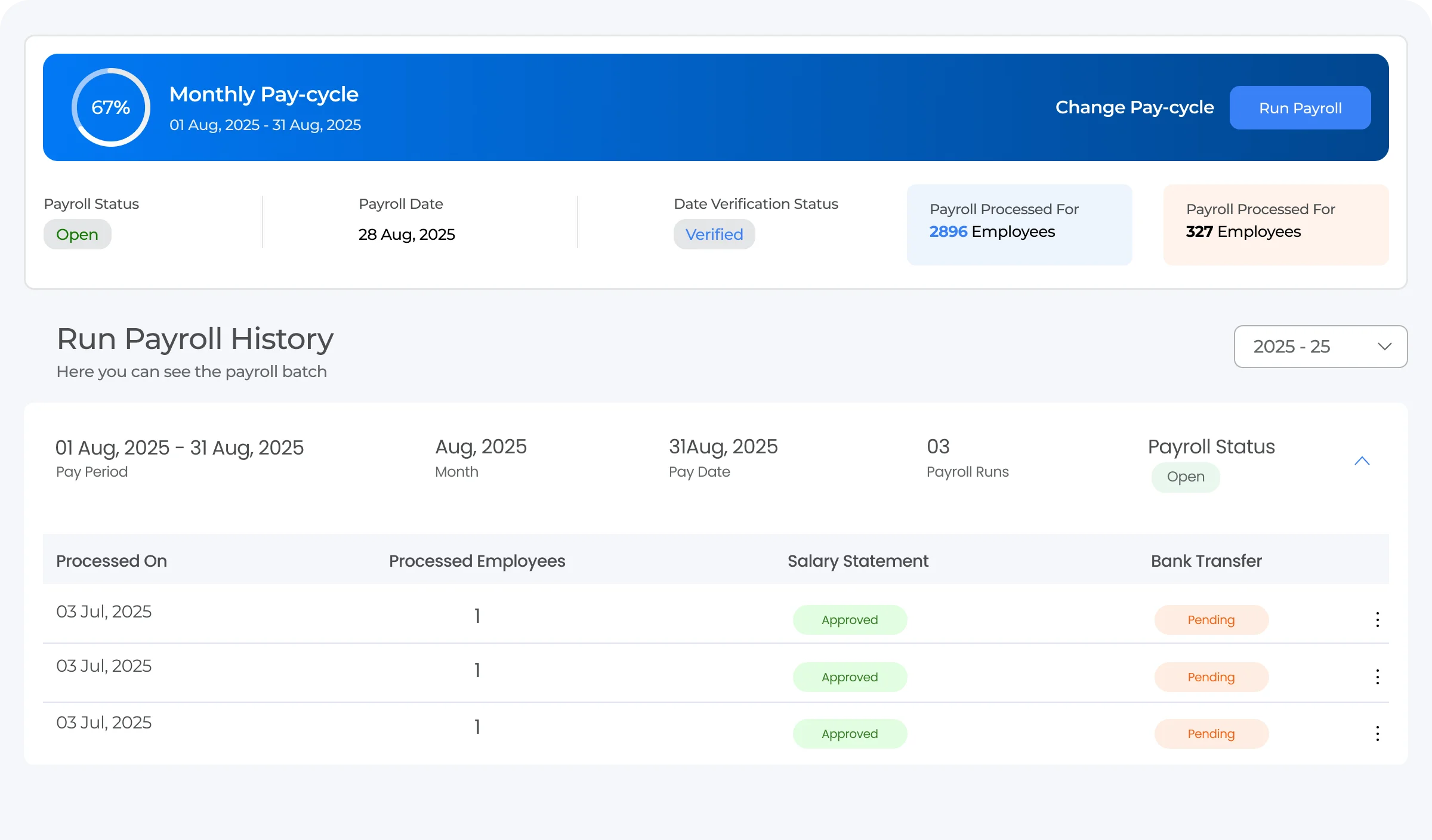

TankhaPay Payroll Software handles your entire payroll calculation cycle with precision — from validating employee data to applying correct deductions and generating compliant pay results. TankhaPay's automated payroll processing reduces human error, guarantees prompt salary payouts, and safely records each payroll transaction for reporting and audits. This guarantees a smooth and stress-free payroll experience each month while assisting your company in maintaining complete compliance.

Payroll Distribution & Compliance

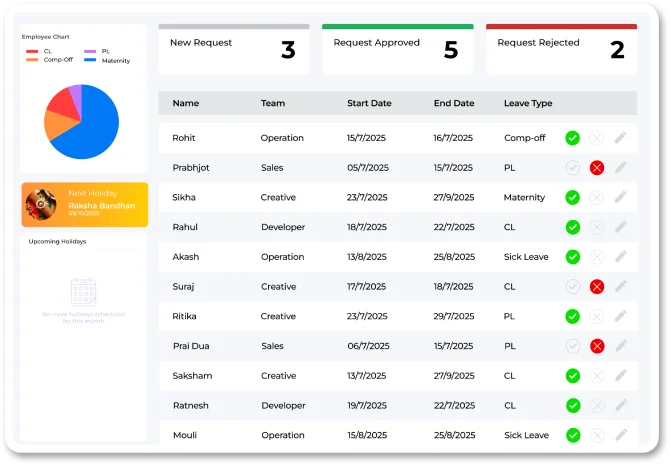

A seamless payroll distribution method keeps your company completely compliant with legal standards while guaranteeing that workers receive their payments on schedule. In addition to making payments, proper payroll processing also include creating reports, keeping track of registrations, and paying all taxes. When handled correctly, this stage improves transparency, boosts employee trust, and minimizes compliance risks for the organization.

Salaries are released through direct deposit or other approved payment modes as per the company’s payroll cycle.

Salaries are released through direct deposit or other approved payment modes as per the company’s payroll cycle.

Comprehensive payroll reports provide clear financial insights that help with budgeting, compliance, and informed decision-making.

Comprehensive payroll reports provide clear financial insights that help with budgeting, compliance, and informed decision-making.

Payroll registers capture all employee earnings, deductions, and adjustments, ensuring accurate documentation and transparency.

Payroll registers capture all employee earnings, deductions, and adjustments, ensuring accurate documentation and transparency.

Mandatory tax reports are generated and filed on time to comply with regulatory standards and avoid penalties.

Mandatory tax reports are generated and filed on time to comply with regulatory standards and avoid penalties.

Well-structured payroll reports support audit requirements and reinforce adherence to legal, tax, and financial regulations.

Well-structured payroll reports support audit requirements and reinforce adherence to legal, tax, and financial regulations.

By automating salary transfers, producing precise payroll and tax reports, and keeping thorough compliance records, TankhaPay streamlines payroll distribution. TankhaPay guarantees that every payment is precise, timely, and fully compliant with end-to-end payroll processing, secure data management, and real-time reporting—making payroll easier, quicker, and less stressful for your company.

Integrating Payroll with Attendance

Payroll processing becomes faster, more accurate, and fully automated when attendance data is seamlessly integrated into the system. With real-time syncing of work hours, leave records, and overtime details, payroll errors drop significantly, manual effort is eliminated, and every employee is paid correctly. When combined with Employee Self-Service (ESS) features—such as employees marking attendance, viewing leave balances, and updating basic information—your payroll becomes even more transparent and efficient. A well-integrated setup not only ensures compliance but also streamlines the entire payroll workflow from calculation to payout.

Define work hours, leave rules, and employee categories to maintain consistent payroll processing for full-time, part-time, contractual, and shift-based employees.

Define work hours, leave rules, and employee categories to maintain consistent payroll processing for full-time, part-time, contractual, and shift-based employees.

Choose attendance and payroll software that sync seamlessly, enabling automated data sharing and real-time updates for payroll processing.

Choose attendance and payroll software that sync seamlessly, enabling automated data sharing and real-time updates for payroll processing.

Collect accurate employee information, including salary structure, tax details, shift schedules, overtime eligibility, and bank account details.

Collect accurate employee information, including salary structure, tax details, shift schedules, overtime eligibility, and bank account details.

Add new employees to the system with complete profiles, ensuring payroll calculations begin on time without manual interventions.

Add new employees to the system with complete profiles, ensuring payroll calculations begin on time without manual interventions.

Use integrated attendance data to auto-calculate gross pay, including overtime, leave adjustments, incentives, and commissions, ensuring precise and compliant payroll processing.

Use integrated attendance data to auto-calculate gross pay, including overtime, leave adjustments, incentives, and commissions, ensuring precise and compliant payroll processing.

Our payroll software makes payroll processing effortless by fully automating attendance capture, salary calculations, statutory compliance, and payouts. With accurate real-time data, zero manual errors, and end-to-end payroll automation, businesses can ensure timely payments, seamless HR operations, and complete compliance—without any extra effort.

Improving Payroll Processing for Compliance and Accuracy in India

An efficient and compliant payroll process is essential for avoiding penalties, maintaining employee trust, and ensuring smooth business operations. In India, where labour and tax regulations change frequently, companies must streamline their payroll processing to minimize errors, delays, and compliance risks. By standardizing processes, adopting automation, and staying updated on regulatory requirements, businesses can significantly reduce administrative workload and improve accuracy.

Standardize Pay Cycles- Having multiple pay schedules for different employee groups can make payroll processing complicated and error-prone. Standardizing your pay cycle—while aligning with Indian labour laws—helps ensure consistent, timely, and accurate payroll every month.

Standardize Pay Cycles- Having multiple pay schedules for different employee groups can make payroll processing complicated and error-prone. Standardizing your pay cycle—while aligning with Indian labour laws—helps ensure consistent, timely, and accurate payroll every month.

Use Payroll Software- Implementing modern payroll software in India streamlines end-to-end payroll processing by automating salary calculations, statutory deductions, and tax compliance. This reduces manual work, eliminates calculation mistakes, and keeps PF, ESI, and TDS filings accurate and on time.

Use Payroll Software- Implementing modern payroll software in India streamlines end-to-end payroll processing by automating salary calculations, statutory deductions, and tax compliance. This reduces manual work, eliminates calculation mistakes, and keeps PF, ESI, and TDS filings accurate and on time.

Integrate Payroll with Other Systems - Accurate payroll processing and seamless data flow are ensured when your payroll system is integrated with accounting, HRMS, and attendance apps.Errors are decreased, repetitive data entry is eliminated, and financial record-keeping is enhanced by effective communication.

Integrate Payroll with Other Systems - Accurate payroll processing and seamless data flow are ensured when your payroll system is integrated with accounting, HRMS, and attendance apps.Errors are decreased, repetitive data entry is eliminated, and financial record-keeping is enhanced by effective communication.

Adopt Digital Attendance Tracking- manual timesheets might result in inaccurate working hours and are inefficient. Accurate time monitoring, fraud prevention, and a direct improvement in the quality of payroll data used during payroll processing are all ensured by using biometric or digital attendance systems.

Adopt Digital Attendance Tracking- manual timesheets might result in inaccurate working hours and are inefficient. Accurate time monitoring, fraud prevention, and a direct improvement in the quality of payroll data used during payroll processing are all ensured by using biometric or digital attendance systems.

Stay Updated on Regulatory Changes - Payroll compliance in India changes frequently due to evolving tax and labour regulations. Staying updated ensures your payroll processing remains compliant, minimizes legal risks, and protects your organization from penalties.

Stay Updated on Regulatory Changes - Payroll compliance in India changes frequently due to evolving tax and labour regulations. Staying updated ensures your payroll processing remains compliant, minimizes legal risks, and protects your organization from penalties.

Outsource to Payroll Experts - Payroll processing is made easier and full compliance is guaranteed when you work with a seasoned payroll service provider like TankhaPay. Through outsourcing, you can concentrate on your primary business operations while professionals take care of precise and timely payroll computations, legal filings, and employee payments.

Outsource to Payroll Experts - Payroll processing is made easier and full compliance is guaranteed when you work with a seasoned payroll service provider like TankhaPay. Through outsourcing, you can concentrate on your primary business operations while professionals take care of precise and timely payroll computations, legal filings, and employee payments.

Our advanced payroll software makes payroll processing effortless by fully automating attendance capture, salary calculations, statutory compliance, and payouts. With accurate real-time data, zero manual errors, and end-to-end payroll automation, businesses can ensure timely payments, seamless HR operations, and complete compliance—without any extra effort.

What Are the Different Types of Payroll Processing?

Payroll processing can be managed in several ways, depending on the size of your business, internal bandwidth, and how much control or automation you need. Choosing the right payroll method is crucial to ensure accuracy, compliance, and timely salaries for your employees. Below are the most common types of payroll processing used by businesses today:

- Do It Yourself (DIY) - Payroll is managed manually using spreadsheets or rudimentary tools in this most basic method. DIY payroll processing is extremely vulnerable to human error, computation errors, and compliance issues, even if it first appears to be cost-effective. Additionally, it takes a lot of time each month, which makes it less feasible as your team expands.

- Outsource to an Accountant - Payroll outsourcing to an outside accountant or tax adviser is preferred by many small firms. Although this guarantees basic compliance and lessens the administrative burden, you still need to manage dependencies, coordinate data, and validate inputs. Although it is still not entirely efficient, it is superior to manual processing.

- Use Payroll Software - Calculations, deductions, attendance synchronization, and legislative compliance such as PF, ESI, TDS, and more are all automated by payroll software. It guarantees more efficient payroll processing, greatly minimizes manual labor, and prevents calculation errors. However, managing exceptions and ensuring data accuracy are the responsibilities of an internal team member.

Partner with a Managed Payroll Provider - A full-service solution like TankhaPay offers complete payroll processing—from salary calculation and attendance integration to compliance filings, statutory deductions, payslip generation, and employee payments. This is the most reliable and hassle-free method, especially for businesses looking to eliminate errors, reduce workload, and maintain 100% compliance without managing the process internally.

Trusted by Top Businesses Across India

Join the growing community of businesses leveraging TankhaPay’s advanced technology, expert payroll support, and actionable insights.

How Can TankhaPay Help You in Payroll Processing?

TankhaPay makes payroll processing faster, smarter, and completely error-free by bringing every payroll activity—from attendance data to tax filing—into one automated platform. With 25+ years of payroll expertise and the trust of 1,000+ businesses across India, TankhaPay helps organizations streamline payroll, reduce manual work, stay compliant, and maintain complete visibility over employee payments.

- Automatically manage PF, ESI, TDS, Professional Tax, and 16+ statutory rules with up-to-date payroll compliance, including Form 16, challans, and statutory filings.

- Handle payroll processing across multiple locations with state-specific tax calculations, regulatory rules, and region-wise earning–deduction structures.

- TankhaPay supports every workforce category and ensures accurate payroll processing tailored to their pay structure, attendance patterns, and compliance requirements.

- Reduce dependency on internal teams with professional payroll support—without hiring full-time payroll staff.

- Whether you onboard 100 or 10,000 employees, TankhaPay automates payroll calculations, deductions, and payouts without any operational burden.

Use TankhaPay, an innovative HR and payroll software, to transform your payroll process. It guarantees compliance, reduces errors, saves time, and transforms payroll processing into a strategic role that helps your business thrive.

FAQs

01. What is the meaning of payroll processing?

Payroll processing involves managing all the tasks required to pay employees accurately and on time. This includes calculating gross wages, deducting taxes and benefits, distributing payments, and maintaining thorough records and reports to ensure compliance with legal and financial regulations. It is a vital function that supports both employee satisfaction and organizational accountability.

02.What are the different ways to process payroll?

Payroll can be managed using three primary methods, each suited to different business needs:

- Manual payroll processing, typically using spreadsheets and manual calculations.

- Outsourcing payroll to third-party service providers for external management.

- Automated payroll processing through specialized software solutions that streamline the workflow.

03. What are the benefits of automated payroll processing?

Automated payroll systems offer several advantages that improve accuracy and efficiency while balancing costs:

- Costs typically fall between manual payroll and outsourcing services, offering a cost-effective solution.

- Automation reduces the need for manual input, minimizing human errors and saving time.

- Simplifies data entry and validation, ensuring accurate payroll calculations and outputs.

- Streamlines the entire payroll process, boosting overall operational efficiency.

- Enhances compliance by automatically applying tax rules and regulations.

04.Why outsource payroll processing services?

Outsourcing payroll offers several strategic benefits despite additional costs compared to in-house processing:

- Businesses can choose between partial payroll outsourcing and fully managed payroll services based on their needs.

- Outsourcing shifts the responsibility of compliance from the business to experienced professionals.

- Payroll service providers possess specialized expertise that helps ensure adherence to complex regulations.

- Access to expert advice improves payroll accuracy and reduces the risk of compliance errors.

- Outsourcing provides peace of mind, allowing companies to focus on core business activities without payroll worries.

05.What is full-cycle payroll processing?

Full-cycle payroll processing covers all payroll activities within each pay period, ensuring employees are paid accurately and on time:

- The payroll cycle refers to the time between paydays, ranging from weekly to monthly.

- Employees record their working hours throughout the payroll cycle.

- Gross wages are calculated based on hours worked or an agreed salary.

- Required taxes and deductions are withheld from the gross pay.

- Net pay is distributed to employees through checks, direct deposit, or pay cards.

06.What documents are required for payroll processing?

A number of crucial papers are needed for payroll processing in order to guarantee precise salary computations and legal compliance. Employee onboarding paperwork, PAN and Aadhaar details, bank account details, attendance and leave records, wage structure, investment declarations, prior employment records, and evidence for tax-saving claims are examples of important documents. In order to process payroll efficiently and legally, businesses also need to keep statutory records such as EPFO,ESI, and professional tax information.

07.What are the main components of payroll processing?

The main components of payroll processing include gross salary calculation, tax and statutory deductions, net pay computation, and salary disbursement. It also covers maintaining attendance data, allowances, benefits, reimbursements, overtime, compliance filings, and generating payroll reports. Together, these components ensure employees are paid accurately while the company meets all legal and financial obligations.

08.What tools are used for accurate payroll processing?

Accurate payroll processing relies on tools like HRMS payroll software, attendance management systems, accounting software, and statutory compliance tools. Modern businesses also use automated salary calculators, digital onboarding tools, reimbursement management systems, and cloud-based payroll dashboards. Platforms like TankhaPay combine all these tools into one system for error-free payroll and compliance.

09.What are the common mistakes in payroll processing?

Common payroll processing mistakes include incorrect data entry, miscalculating overtime, missing compliance updates, wrong tax deductions, delayed filings, and inaccurate attendance integration. Many businesses also fail to maintain proper payroll records or overlook changes in employee salary structures. These errors can lead to compliance penalties, employee dissatisfaction, and financial discrepancies—making automated payroll solutions essential.

10.What is the process of payroll in HR?

HR's payroll procedure includes gathering employee information, confirming leave and attendance, computing gross pay, making deductions, figuring out net wage, and creating payslips. By timely filing PF, ESI, TDS, and Professional Tax, HR also guarantees statutory compliance. Salary distribution and keeping payroll records for audits mark the conclusion of the process. A simplified HR payroll procedure increases accuracy throughout the company and minimizes manual labor.