Payroll Software for Accurate Salary Processing

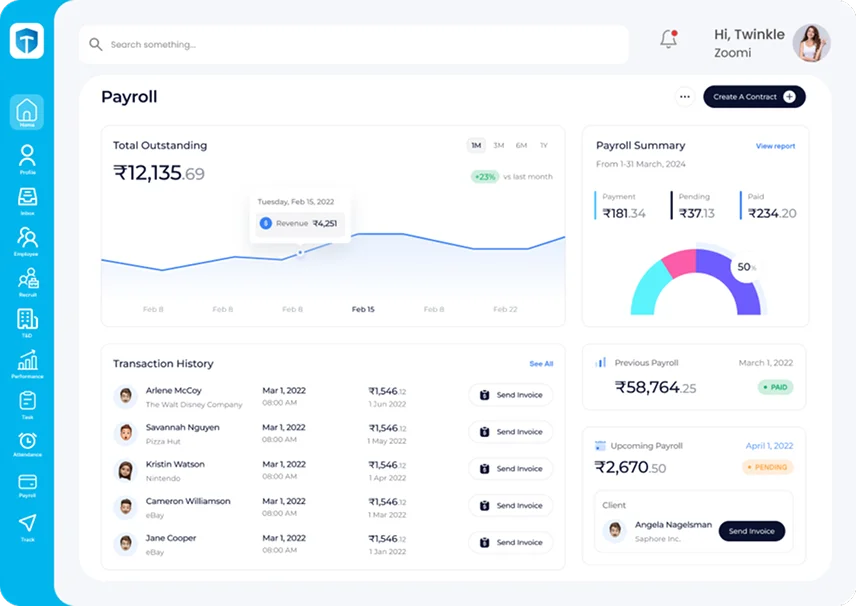

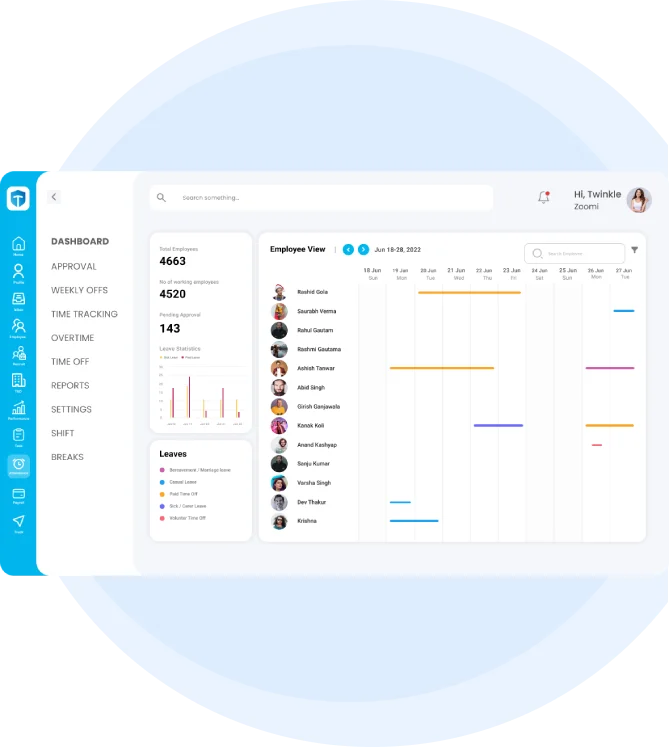

TankhaPay is at a whole new level of payroll efficiency with its cloud payroll software. Now you can start simplifying salary calculations, automating payments, and guaranteeing full compliance with legal requirements, removing the headache of manual work. It is a perfect software for growing teams and contemporary businesses that want to simply reduce processing time, fix mistakes, and seamlessly integrate with accounting, HR, and attendance tools. It ensures precise payroll management by handling PF, ESI, TDS, and all other necessary deductions, no matter how big or small your company is.

With certified payroll controls, enterprise-grade security, and an intuitive dashboard, it empowers HR teams to manage payroll effortlessly each month, making it the best payroll software for medium businesses and enterprises seeking accuracy, efficiency, and deep compliance in a single powerful platform.

What is Payroll Software?

Payroll software uses technology to handle payroll tasks like collecting employee information, calculating salaries, generating payslips, and meeting legal requirements without errors. The latest payroll tools eliminate manual work, speed up processes, and consolidate attendance, leave, benefits, taxes, and employee data into a single, secure place. Whether you manage a growing or established business, TankhaPay ensures timely employee payments in accordance with Indian legal requirements.

It simplifies payroll management, making it faster and more reliable for HR and finance teams. Cloud-based payroll systems help businesses ensure accurate payments, comply with regulations, and oversee their workforce.

Handles salary calculations, deductions, allowances, reimbursements, and overtime tasks to make payroll accurate without needing manual effort.

Handles salary calculations, deductions, allowances, reimbursements, and overtime tasks to make payroll accurate without needing manual effort. Ensures compliance with laws such as PF, ESI, TDS, Bonus Act, Professional Tax, and labor rules to reduce the risk of penalties or fines.

Ensures compliance with laws such as PF, ESI, TDS, Bonus Act, Professional Tax, and labor rules to reduce the risk of penalties or fines. Let's HR and finance teams skip repetitive work and spend more time on planning by using digital workflows and automated payroll processes.

Let's HR and finance teams skip repetitive work and spend more time on planning by using digital workflows and automated payroll processes.

Brings together attendance, leave, onboarding, salary details, tax filings, and benefits into one system to make payroll tasks easier.

Brings together attendance, leave, onboarding, salary details, tax filings, and benefits into one system to make payroll tasks easier. Calculates overtime, deductions, arrears, and variable pay to avoid errors and ensure all employees are paid every time.

Calculates overtime, deductions, arrears, and variable pay to avoid errors and ensure all employees are paid every time.

Small teams, growing companies, and large businesses can rely on it as one of the top payroll tools tailored for medium-sized firms and fast-growing teams.

Small teams, growing companies, and large businesses can rely on it as one of the top payroll tools tailored for medium-sized firms and fast-growing teams. It provides easy-to-follow audit trails, intelligent reports, and up-to-date salary details, making it trustworthy payroll management software for today's businesses.

It provides easy-to-follow audit trails, intelligent reports, and up-to-date salary details, making it trustworthy payroll management software for today's businesses.

Choosing the right payroll software does more than just handle calculations . It helps create an efficient, law-abiding, and expandable payroll base for your company. Good online payroll tools give HR teams precision, instant info, and simple compliance. They adapt to various payroll requirements, including customizable or certified software options for specialized industry needs. With the proper system in place, handling payroll can become a key benefit for your entire business rather than just a routine chore.

Why is Payroll Software Essential?

Payroll software is essential for any business today. It streamlines the entire payroll cycle, from salary calculations to compliant reporting, and helps ensure things stay accurate and transparent. As your workforce grows, handling payroll can become a slow, messy, error-prone task. A smart payroll system provides a reliable framework for managing employee payroll, automates calculations, and instantly updates compliance requirements. Payroll software enables you to process paychecks more quickly, maintain compliance with ease, and provide employees with a more seamless payroll experience, regardless of the size of your company. With advanced capabilities like cloud-based payroll software and integrated payroll accounting software, businesses can manage payroll anytime, anywhere with complete accuracy.

Automates salary calculation processes to determine base pay, overtime, incentives, deductions, and reimbursements. This eliminates payroll errors and the need for manual spreadsheets.

Automates salary calculation processes to determine base pay, overtime, incentives, deductions, and reimbursements. This eliminates payroll errors and the need for manual spreadsheets. Streamlines salary payments to ensure they are consistent and on time. This builds employee trust, boosts morale, and improves retention, while enabling smooth payroll management for permanent, temporary, and contract staff.

Streamlines salary payments to ensure they are consistent and on time. This builds employee trust, boosts morale, and improves retention, while enabling smooth payroll management for permanent, temporary, and contract staff.

Reduces legal troubles, penalties, and file errors by maintaining complete compliance with PF, ESI, TDS, Professional Tax, and changing state labor laws.

Reduces legal troubles, penalties, and file errors by maintaining complete compliance with PF, ESI, TDS, Professional Tax, and changing state labor laws.

Provides clear payroll accounting and simplifies audits. It also helps HR, finance, and leadership teams develop more effective financial plans by providing precise payslips, summaries, and MIS reports.

Provides clear payroll accounting and simplifies audits. It also helps HR, finance, and leadership teams develop more effective financial plans by providing precise payslips, summaries, and MIS reports. Lowers the effort HR and finance teams need to put in by using automated workflows, secure cloud payroll methods, and digital document handling. Teams can focus more on key projects instead of boring admin tasks.

Lowers the effort HR and finance teams need to put in by using automated workflows, secure cloud payroll methods, and digital document handling. Teams can focus more on key projects instead of boring admin tasks.

Improves how employees understand and access their payroll details. Advanced payroll tools include self-service options for checking payslips, leave records, and tax information.

Improves how employees understand and access their payroll details. Advanced payroll tools include self-service options for checking payslips, leave records, and tax information.

In today’s fast-moving business environment, relying on manual payroll is no longer enough. In addition to saving time, a specialized payroll software system improves workforce transparency, accuracy, and compliance. The correct solution helps streamline operations and provides your company with a solid, scalable foundation for payroll management, whether you choose a basic payroll tool or a cloud-based payroll software platform with sophisticated features.

Key Features of Payroll Software

Modern payroll software serves as a smart management tool that automates repetitive tasks, streamlines processes, and protects sensitive information. With its multiple advanced features, such as automatic regulatory compliance, easy access to employee attendance records, and multiple payment options. Modern payroll software minimizes manual data entry and removes the risk of errors, ensuring that every employee gets paid on time. These solutions are invaluable for HR and management, delivering dependable results whether you're handling payroll for a small business on the rise or a mid-sized company seeking the best solutions.

Salary Calculation

Payslip Generation

Statutory Compliance

Bank Transfer and Payment Integration

Reimbursements and Deductions

Leave and Attendance Sync

Full and Final Settlement

Reports and Audits

Salary Calculation

Payroll systems include calculating employee salaries, one of the basic components of most systems, but this is typically done more effectively than ever before via payroll management software that calculates fixed salary, bonuses, variable pay, reimbursements, deductions, and leave adjustments. Payroll management software can accurately calculate payroll. For all businesses, regardless if start up, medium size business, or large corporations, payroll management software provides companies with the ability to stay compliant with the law, reduce manual labour, and provide businesses with accurate payroll every month by managing both federal and state laws, attendance records, fair labor standards act, and corporate policies.

In addition to variable components like incentives, bonuses, commissions, arrears, and shift differentials, a strong payroll software automatically calculates fixed components like basic pay, HRA, and allowances.

In addition to variable components like incentives, bonuses, commissions, arrears, and shift differentials, a strong payroll software automatically calculates fixed components like basic pay, HRA, and allowances.

A payroll system with an automatic pro-rata calculation option also eases payroll processing by automatically calculating how much someone should be paid for the days they were employed, even when they joined mid-month, had an unpaid absence, or had their salary change. As a result, calculating someone's paycheck based on the number of days worked no longer requires a spreadsheet.

A payroll system with an automatic pro-rata calculation option also eases payroll processing by automatically calculating how much someone should be paid for the days they were employed, even when they joined mid-month, had an unpaid absence, or had their salary change. As a result, calculating someone's paycheck based on the number of days worked no longer requires a spreadsheet.

By integrating a payroll system with attendance tools such as biometric mobile apps, RFID, or web-based systems, information on work hours, overtime, and time off can be automatically collected. This increases accuracy, eliminates the headache of manual data entry, and guarantees that updates are reflected everywhere.

By integrating a payroll system with attendance tools such as biometric mobile apps, RFID, or web-based systems, information on work hours, overtime, and time off can be automatically collected. This increases accuracy, eliminates the headache of manual data entry, and guarantees that updates are reflected everywhere.

Modern payroll systems automatically compute PF, ESI, PT, LWF, TDS, and other required deductions according to the Indian labour law; their use reduces compliance risk, speeds up processing time, and keeps the payroll audit-ready, making them one of your options for your own company's payroll software that saves time, money and ensures accurate records as well as adherence to local laws.

Modern payroll systems automatically compute PF, ESI, PT, LWF, TDS, and other required deductions according to the Indian labour law; their use reduces compliance risk, speeds up processing time, and keeps the payroll audit-ready, making them one of your options for your own company's payroll software that saves time, money and ensures accurate records as well as adherence to local laws.

Automated pro rata calculations adjust salaries for mid-month joiners, early exits, unpaid leave, and salary revisions. This ensures fair, accurate payouts every cycle without relying on manual spreadsheets-ideal for organizations scaling with employee payroll management software.

Automated pro rata calculations adjust salaries for mid-month joiners, early exits, unpaid leave, and salary revisions. This ensures fair, accurate payouts every cycle without relying on manual spreadsheets-ideal for organizations scaling with employee payroll management software.

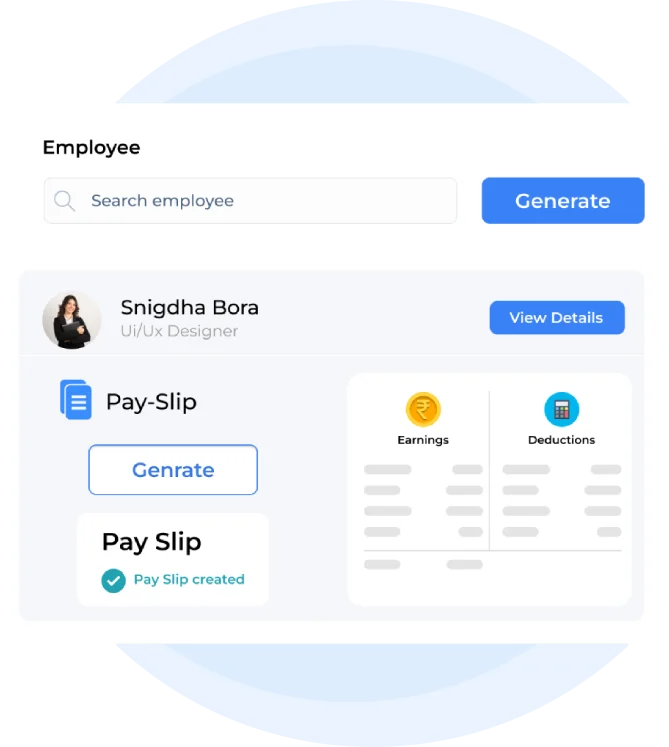

Payslip Generation

Modern payroll software makes the process of creating accurate, compliant, and expertly formatted payslips for each employee simple. The technology takes data straight from attendance, salary structures, tax computations, and regulatory deductions rather than creating salary slips by hand. Whether you use a cloud-based payroll system or a customized payroll software setup, employees can instantly access their payslips online or on mobile devices, improving transparency, trust, and overall payroll efficiency.

The software auto-calculates basic pay, allowances, overtime, incentives, and all deductions, including PF, ESI, TDS, LWF, and other statutory contributions. This make sures employees receive a clear, accurate, and compliant salary breakup every month while reducing the risk of manual errors.

The software auto-calculates basic pay, allowances, overtime, incentives, and all deductions, including PF, ESI, TDS, LWF, and other statutory contributions. This make sures employees receive a clear, accurate, and compliant salary breakup every month while reducing the risk of manual errors.

Each payslip includes a complete summary of monthly taxes and contributions. This feature, often found in the best online payroll software and certified payroll systems, helps employees understand their tax obligations while supporting smooth investment declarations and Form-16 generation.

Each payslip includes a complete summary of monthly taxes and contributions. This feature, often found in the best online payroll software and certified payroll systems, helps employees understand their tax obligations while supporting smooth investment declarations and Form-16 generation.

By using customizable templates, businesses can choose layouts, add branding, modify fields, and include additional components based on employee categories or compliance needs. Because of this flexibility, it is ideal for companies using payroll accounting software or those managing diverse workforce structures.

By using customizable templates, businesses can choose layouts, add branding, modify fields, and include additional components based on employee categories or compliance needs. Because of this flexibility, it is ideal for companies using payroll accounting software or those managing diverse workforce structures.

Employees can access their pay stubs anytime through a secure login or a mobile app. This provides clarity, reduces HR teams' workload, and complies with the latest payroll software requirements for workers.

Employees can access their pay stubs anytime through a secure login or a mobile app. This provides clarity, reduces HR teams' workload, and complies with the latest payroll software requirements for workers.

Payroll is faster, more accurate, and compliant when payslips are generated automatically rather than requiring manual formatting or calculations. Paystubs are always clear, well-organised, and prepared for audits thanks to sophisticated payroll software that also keeps employees informed and minimises administrative effort. This tool is crucial for businesses looking to expand and achieve the most dependable payroll software experience.

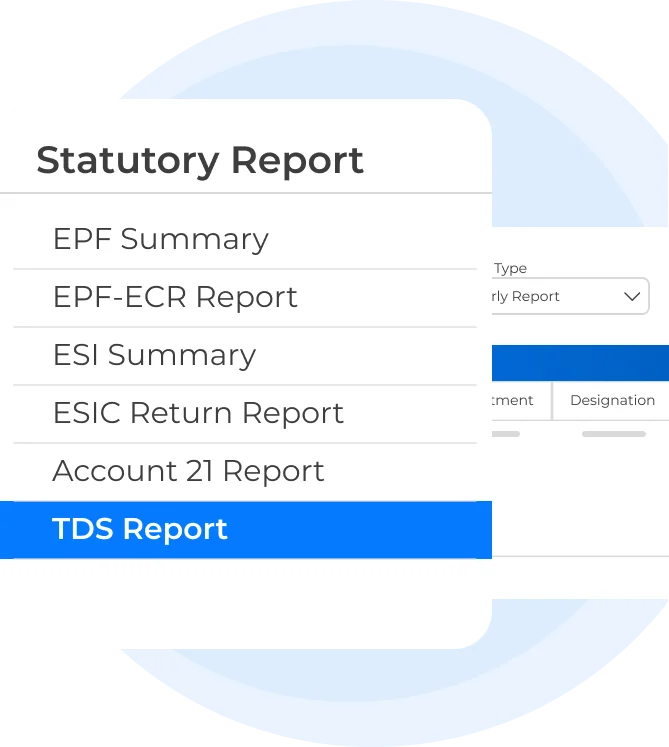

Statutory Compliance

One of the most important aspects of payroll and payroll processing is adhering to constantly evolving labor rules. By automatically applying statutory standards, precisely computing deductions, producing reports that are ready for filing, and guaranteeing that each payroll cycle satisfies state and federal regulatory requirements, a robust payroll software reduces this complexity. Modern cloud-based payroll software in India also keeps businesses audit-ready through real-time updates, automated validations, and centralized compliance documentation.

The payroll software automatically calculates PF contributions for both employer and employee, applies the correct wage ceiling, and generates monthly challans. It ensures accurate deductions, reduces manual effort, and helps businesses avoid non-compliance risks.

The payroll software automatically calculates PF contributions for both employer and employee, applies the correct wage ceiling, and generates monthly challans. It ensures accurate deductions, reduces manual effort, and helps businesses avoid non-compliance risks.

Statutory pay restrictions are important because they help determine ESI eligibility, deductions, and employer contributions. This solution is best for companies that use certified payroll software, as it easily keeps track of employee records, contribution periods, and ESI applicability.

Statutory pay restrictions are important because they help determine ESI eligibility, deductions, and employer contributions. This solution is best for companies that use certified payroll software, as it easily keeps track of employee records, contribution periods, and ESI applicability.

However, cloud-based payroll software automatically applies state-specific slabs, which is important as PT regulations can be different across Indian states. Cloud-based payroll software makes sure that deductions are accurate without needing any manual input, simplifying payroll accounting and making life easier for businesses with multiple locations.

However, cloud-based payroll software automatically applies state-specific slabs, which is important as PT regulations can be different across Indian states. Cloud-based payroll software makes sure that deductions are accurate without needing any manual input, simplifying payroll accounting and making life easier for businesses with multiple locations.

The payroll software calculates TDS on salaries based on the latest tax slabs, exemptions, investment proofs, and regime choices (old/new). It generates Form 16, monthly workings, and TDS statements, making it one of the best accounting and payroll software features for finance teams.

The payroll software calculates TDS on salaries based on the latest tax slabs, exemptions, investment proofs, and regime choices (old/new). It generates Form 16, monthly workings, and TDS statements, making it one of the best accounting and payroll software features for finance teams. LWF varies not just by state but also by role and pay bracket. The software applies correct employer and employee contributions, updates changes automatically, and prepares registers required for audits.

LWF varies not just by state but also by role and pay bracket. The software applies correct employer and employee contributions, updates changes automatically, and prepares registers required for audits.

The system prepares all compliance documents-PF ECR files, ESI contribution files, PT challans, LWF reports, and TDS summaries- ensuring your business is ready for verification at any point. This feature is especially useful for medium-sized businesses looking for reliable, customizable payroll software.

The system prepares all compliance documents-PF ECR files, ESI contribution files, PT challans, LWF reports, and TDS summaries- ensuring your business is ready for verification at any point. This feature is especially useful for medium-sized businesses looking for reliable, customizable payroll software.

Modern payroll software guarantees 100% compliance without the need for spreadsheets or manual tracking thanks to automated statutory calculations, state-specific rule changes, and error-free submissions. Integrated statutory compliance lets you stay audit-ready, avoid penalties, and maintain seamless payroll operations with total peace of mind, regardless of how big or little your company is.

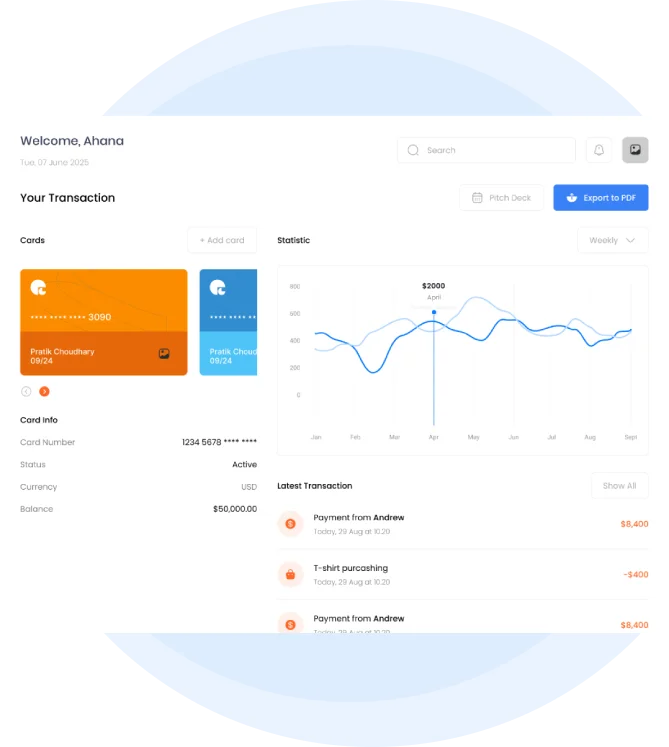

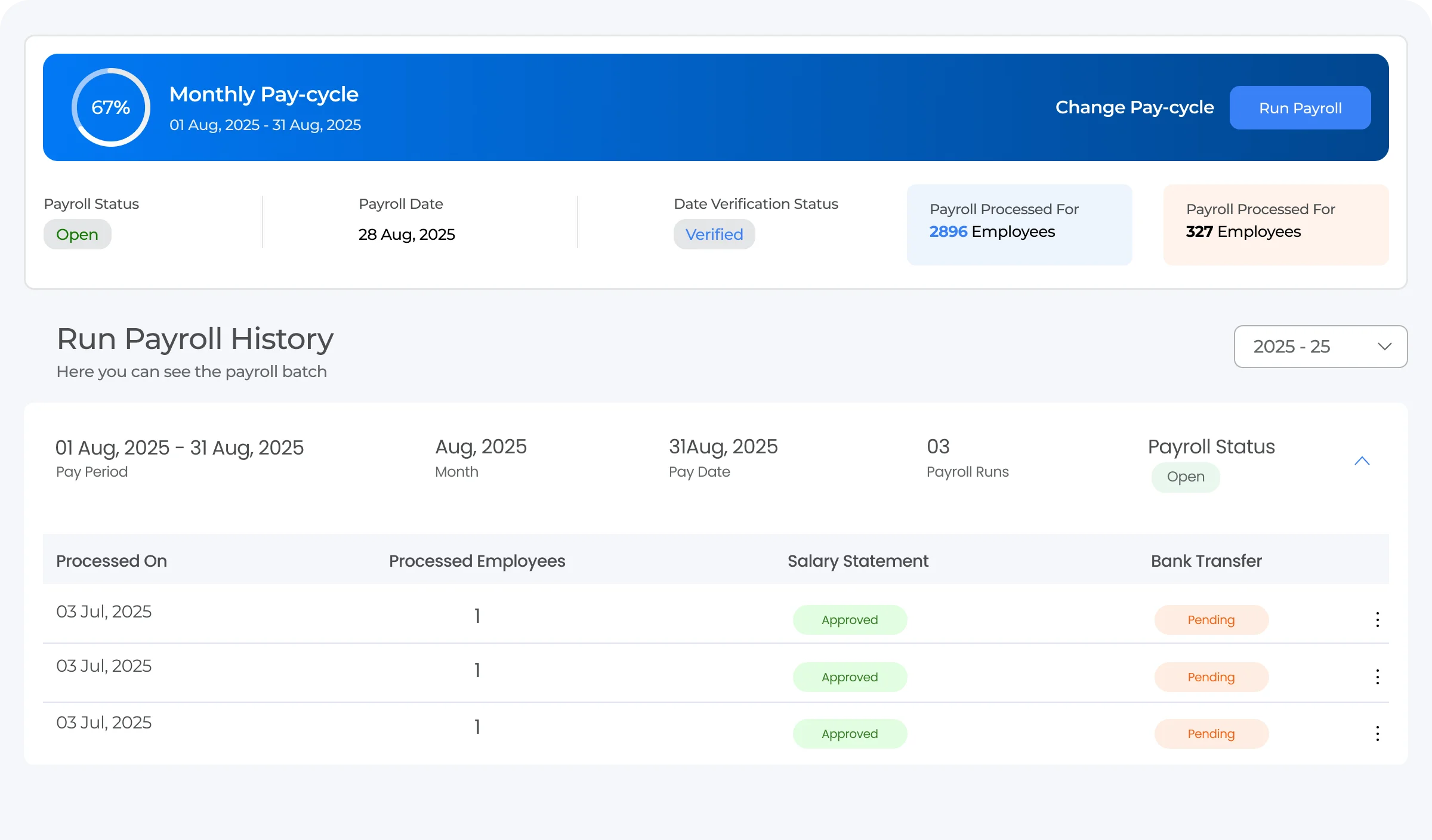

Bank Transfer and Payment Integration

Error-free salary disbursements are an absolute must, and due to direct integrations with the bank, this process is easier with modern payroll software. There is no need to mess with manual bank sheets or verify transfers every month; web-based payroll software automates bulk payments, keeps employee payoffs correct, and maintains everything in compliance with necessary financial regulations. This feature is really great for growing teams, dispersed workforces, and medium-sized businesses looking for certified payroll software to make every aspect of salary distribution smooth and trouble-free.

Generate accurate, ready-to-upload bank files for multiple banking partners in just one click. The payroll software auto-maps employee account details, salary amounts, and transaction codes, reducing manual effort and ensuring smooth, error-free payroll processing across different bank requirements.

Generate accurate, ready-to-upload bank files for multiple banking partners in just one click. The payroll software auto-maps employee account details, salary amounts, and transaction codes, reducing manual effort and ensuring smooth, error-free payroll processing across different bank requirements.

Use unique transaction reference (UTR) numbers to quickly track payment confirmations. This improves transparency and fortifies your entire payroll accounting system by assisting HR and finance departments in confirming whether each employee's compensation has been successfully deposited.

Use unique transaction reference (UTR) numbers to quickly track payment confirmations. This improves transparency and fortifies your entire payroll accounting system by assisting HR and finance departments in confirming whether each employee's compensation has been successfully deposited.

The system automatically matches completed payments with payroll records, flags discrepancies, and updates employee ledgers. This eliminates tedious spreadsheet reconciliation and provides clear, audit- friendly payroll financials.

The system automatically matches completed payments with payroll records, flags discrepancies, and updates employee ledgers. This eliminates tedious spreadsheet reconciliation and provides clear, audit- friendly payroll financials.

Choose from multiple salary payout options—IMPS, NEFT, RTGS, or direct bank APIs-making it easier for companies to manage diverse employee groups. This flexibility is a big advantage for organizations looking for customizable payroll software or the best payroll software for accountants and finance teams.

Choose from multiple salary payout options—IMPS, NEFT, RTGS, or direct bank APIs-making it easier for companies to manage diverse employee groups. This flexibility is a big advantage for organizations looking for customizable payroll software or the best payroll software for accountants and finance teams.

A robust bank integration feature not only speeds up the salary transfer cycle but also ensures accuracy, compliance, and transparency across your entire payroll process. With automated disbursals, real-time tracking, and secure reconciliation, the right payroll software empowers your business to run payroll confidently-every single month, without delays or errors.

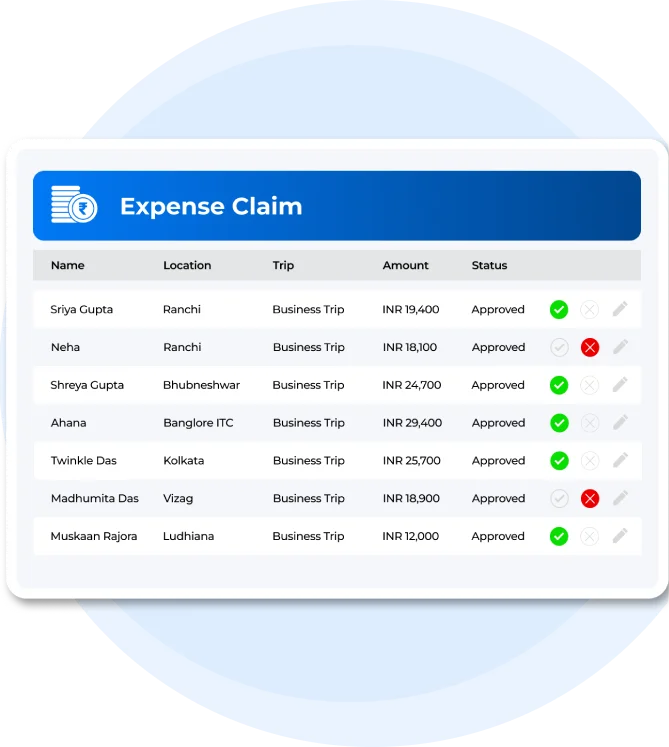

Reimbursements and Deductions

Managing employee reimbursements, deductions, loans, advances, and cost approvals becomes easier when everything runs via a single, automated payroll workflow. With cloud-based payroll software, each claim is calculated accurately and seamlessly reflected in the monthly payroll. This removes the need for manual spreadsheets and back-and-forth approvals. The result turns out to be with few errors, better payroll accounting, improved transparency, and smoother financial operations, no matter the organization's size.

Set up multi-level approval chains for travel, food, medical, or project-based expenses. Managers can review and approve claims instantly through mobile or web, ensuring faster reimbursements and a smoother employee payroll management experience.

Set up multi-level approval chains for travel, food, medical, or project-based expenses. Managers can review and approve claims instantly through mobile or web, ensuring faster reimbursements and a smoother employee payroll management experience.

From loans and salary advances to canteen deductions and asset recoveries, modern payroll systems automatically calculate and deduct EMIS each month. This eliminates the neef of manual follow-ups and ensures precise payouts without compliance risks.

From loans and salary advances to canteen deductions and asset recoveries, modern payroll systems automatically calculate and deduct EMIS each month. This eliminates the neef of manual follow-ups and ensures precise payouts without compliance risks.

You can also sync reimbursement limits, expense categories, cost centers, and approval processes with your finance policies. This way, all reimbursements adhere to internal controls and are accurately reflected in your payroll accounting software and financial systems

You can also sync reimbursement limits, expense categories, cost centers, and approval processes with your finance policies. This way, all reimbursements adhere to internal controls and are accurately reflected in your payroll accounting software and financial systems

Leave and Attendance Sync

For making sure that every compensation is computed precisely, a reliable payroll program must seamlessly synchronize attendance and leave data. Businesses can achieve 100% transparency in payroll processing, reduce errors, and eliminate manual entry by integrating biometric devices, mobile check-ins, shift rosters, and leave applications directly into the payroll system. This automatic, real-time data flow improves accuracy, strengthens compliance, and ensures workers are consistently paid accurately.

To reduce the necessity of using a manual spreadsheet, the system can automatically identify unpaid leave and salary deductions as needed. This will ensure that payroll processes are valid and compliant with labor laws and company policies.

To reduce the necessity of using a manual spreadsheet, the system can automatically identify unpaid leave and salary deductions as needed. This will ensure that payroll processes are valid and compliant with labor laws and company policies.

In this way, the software integrates payroll software with attendance system software, allowing it to retrieve information on overtime hours, night shifts, weekend shifts, and special differentials, and to calculate pay immediately. This not only prevents conflicts but also ensures that employers pay their employees fairly.

In this way, the software integrates payroll software with attendance system software, allowing it to retrieve information on overtime hours, night shifts, weekend shifts, and special differentials, and to calculate pay immediately. This not only prevents conflicts but also ensures that employers pay their employees fairly.

Attendance sync ensures that salary deductions for late marks, half-days, and early exits are automatically applied according to predefined company rules. This improves workforce discipline and makes payroll accounting software more dependable.

Attendance sync ensures that salary deductions for late marks, half-days, and early exits are automatically applied according to predefined company rules. This improves workforce discipline and makes payroll accounting software more dependable.

Cloud-based payroll software enables instant data sync from multiple branches, remote teams, field staff, and distributed worksites. This centralizes attendance and leaves data, making the system highly accurate and ideal for businesses scaling across regions.

Cloud-based payroll software enables instant data sync from multiple branches, remote teams, field staff, and distributed worksites. This centralizes attendance and leaves data, making the system highly accurate and ideal for businesses scaling across regions.

With seamless leave and attendance integration, modern payroll software eliminates guesswork, reduces payroll queries, and improves accuracy across the entire payroll cycle. Whether you operate from a single office or run multi-location teams, this feature ensures your payroll is always precise, compliant, and effortlessly automated - making it one of the best payroll software capabilities for growing businesses.

Full and Final Settlement

With the automation of the Full & Final Settlement or F&F process, from determining outstanding balances to disbursing final payments, strong payroll software ensures total accuracy and compliance. The technology manages all aspects of payroll processing, removing human error, lowering HR workload, and guaranteeing a seamless exit process regardless of an employee's resignation, retirement, or termination. Modern cloud-based payroll software in India also syncs data from attendance, leave, reimbursements, loans, and statutory records to deliver a transparent and audit-ready F&F process.

The system calculates payable or recoverable notice period amounts based on company policy, payroll rules, and employee tenure. It automatically adjusts salaries using accurate pro-rata calculations, ensuring compliance, clarity, and precision without manual payroll accounting.

The system calculates payable or recoverable notice period amounts based on company policy, payroll rules, and employee tenure. It automatically adjusts salaries using accurate pro-rata calculations, ensuring compliance, clarity, and precision without manual payroll accounting.

All earned, unused, and compensatory leaves are pulled directly from the leave management system. The payroll software calculates encashable leave amounts in accordance with organizational policy, helping maintain transparent, compliant payroll practices for all departing employees.

All earned, unused, and compensatory leaves are pulled directly from the leave management system. The payroll software calculates encashable leave amounts in accordance with organizational policy, helping maintain transparent, compliant payroll practices for all departing employees. The software auto-calculates gratuity, performance bonuses, and statutory payments in accordance with eligibility, tenure, and payroll regulations. Guesswork may end here, and statutory compliance can begin.

The software auto-calculates gratuity, performance bonuses, and statutory payments in accordance with eligibility, tenure, and payroll regulations. Guesswork may end here, and statutory compliance can begin.

Any unsettled loans, advances, asset recoveries, or policy-based deductions are fetched automatically and adjusted in the F&F statement. This keeps payroll processing clean, accurate, and fully compliant with financial and audit requirements-ideal for businesses using employee payroll management software.

Any unsettled loans, advances, asset recoveries, or policy-based deductions are fetched automatically and adjusted in the F&F statement. This keeps payroll processing clean, accurate, and fully compliant with financial and audit requirements-ideal for businesses using employee payroll management software.

Automated computations, real-time data synchronization, and workflows supported by compliance make F&F settlement quicker, more seamless, and error-free. An advanced system guarantees your HR staff saves time, prevents conflicts, and maintains complete payroll accuracy from onboarding to exit, regardless of whether you're using cloud-based payroll software or a tailored payroll software configuration.

Reports and Audits

Having better payroll software can provide organizations with GFS in the form of financial data, including transparency, rather than merely focusing on payment of salaries. HR departments, the Finance department, and other senior management teams can always be aware of the entire expenditure effectively by using credible reporting systems and maintaining accurate records with support from updated payroll reports. New-age payroll solutions can allow the creation of detailed summaries and other reports in just a few clicks of the mouse and can assist in maintaining correct payroll accounting.

Get a full breakdown of employee salaries, deductions, reimbursements, overtime, and statutory components in one consolidated report. These summaries help businesses forecast salary budgets, optimize workforce spending, and maintain accurate payroll accounting records-ideal for companies using the best payroll software for medium businesses or growing enterprises.

Get a full breakdown of employee salaries, deductions, reimbursements, overtime, and statutory components in one consolidated report. These summaries help businesses forecast salary budgets, optimize workforce spending, and maintain accurate payroll accounting records-ideal for companies using the best payroll software for medium businesses or growing enterprises.

It can auto-generate reports such as PF, ESI, PT, LFW, etc., as per state-wise compliance, and thereby save manual paperwork as well as errors. The payroll software can help all those who need certified payroll software or require error-proof operations with its auto-generated reports in fillable formats.

It can auto-generate reports such as PF, ESI, PT, LFW, etc., as per state-wise compliance, and thereby save manual paperwork as well as errors. The payroll software can help all those who need certified payroll software or require error-proof operations with its auto-generated reports in fillable formats. From monthly TDS calculations to quarterly returns and the generation of annual Form 16, the system handles everything. This feature ensures accuracy during tax audits and supports employee tax planning- especially useful for businesses opting for best online payroll software or payroll accounting software to streamline financial processes.

From monthly TDS calculations to quarterly returns and the generation of annual Form 16, the system handles everything. This feature ensures accuracy during tax audits and supports employee tax planning- especially useful for businesses opting for best online payroll software or payroll accounting software to streamline financial processes.

Every payroll action-edits, approvals, revisions, payouts- is automatically logged with timestamps and user details. These audit trails ensure full traceability, improve internal governance, and protect organizations during internal or external financial audits. It's an essential capability for companies that need a customizable payroll software with strong compliance controls.

Every payroll action-edits, approvals, revisions, payouts- is automatically logged with timestamps and user details. These audit trails ensure full traceability, improve internal governance, and protect organizations during internal or external financial audits. It's an essential capability for companies that need a customizable payroll software with strong compliance controls.

Generate reports at granular levels-per employee, team, department, project, or cost center. This helps HR and finance teams analyze trends, control expenses, and make data-driven decisions using a modern employee payroll management software setup.

Generate reports at granular levels-per employee, team, department, project, or cost center. This helps HR and finance teams analyze trends, control expenses, and make data-driven decisions using a modern employee payroll management software setup.

Modern payroll software turns payroll data into insightful information with sophisticated reporting and integrated audit support. These comprehensive reports guarantee accuracy, transparency, and total financial management, whether you're assessing monthly salary expenditures, creating compliance files, or examining past payroll activity. Because of this, the system is a vital resource for any expanding company looking for dependable, scalable, and audit-ready payroll processing.

Benefits of Payroll Software

A modern payroll software solution may help any growing company manage compensation more efficiently, wisely, and reliably. It assists HR and financial departments with removing manual labor and concentrating on strategic priorities by centralizing personnel data, automating computations, and expediting compliance activities. Regardless of the size of your business, cloud-based payroll software in India ensures accurate payroll processing, secure data management, and seamless employee experiences.

Payroll software reduces hours of manual work by automating salary calculations, statutory deductions, reimbursement adjustments, and payslip generation. This not only speeds up payroll processing but also keeps teams free from repetitive spreadsheet tasks, making it one of the best online payroll software options for busy HR departments.

Payroll software reduces hours of manual work by automating salary calculations, statutory deductions, reimbursement adjustments, and payslip generation. This not only speeds up payroll processing but also keeps teams free from repetitive spreadsheet tasks, making it one of the best online payroll software options for busy HR departments. Automated workflows prevent human errors in salaries, overtime, bonuses, and deductions. The system calculates everything consistently, ensures data integrity, and delivers precise outputs every month, perfect for businesses looking for certified payroll software or payroll accounting software with error-free results.

Automated workflows prevent human errors in salaries, overtime, bonuses, and deductions. The system calculates everything consistently, ensures data integrity, and delivers precise outputs every month, perfect for businesses looking for certified payroll software or payroll accounting software with error-free results. A robust payroll software keeps you updated with PF, ESI, PT, TDS, LWF, and state-specific tax regulations. With automated challans, filings, and audit-safe records, you stay fully compliant with the latest laws without needing constant manual oversight, ideal for companies seeking compliance-friendly employee payroll management software.

A robust payroll software keeps you updated with PF, ESI, PT, TDS, LWF, and state-specific tax regulations. With automated challans, filings, and audit-safe records, you stay fully compliant with the latest laws without needing constant manual oversight, ideal for companies seeking compliance-friendly employee payroll management software. Whether you have 10 employees or 10,000, cloud-based payroll software scales effortlessly. Add new employees, update pay structures, or expand to multiple locations without altering your core payroll system, making it the best payroll software for medium businesses and fast-growing enterprises.

Whether you have 10 employees or 10,000, cloud-based payroll software scales effortlessly. Add new employees, update pay structures, or expand to multiple locations without altering your core payroll system, making it the best payroll software for medium businesses and fast-growing enterprises.

Real-time dashboards, downloadable reports, and transparent wage breakdowns give businesses total visibility. ESS-powered clarity, which allows workers to promptly access paystubs, tax information, and leave balances via online or mobile interfaces, is another perk.

Real-time dashboards, downloadable reports, and transparent wage breakdowns give businesses total visibility. ESS-powered clarity, which allows workers to promptly access paystubs, tax information, and leave balances via online or mobile interfaces, is another perk. When a payroll system is secure, sensitive financial and employee information are protected through encryption and cloud-based backup systems. This guarantees comprehensive security against data loss; improper access; and failure to comply with existing regulations, especially for organizations using customizable payroll software India offers.

When a payroll system is secure, sensitive financial and employee information are protected through encryption and cloud-based backup systems. This guarantees comprehensive security against data loss; improper access; and failure to comply with existing regulations, especially for organizations using customizable payroll software India offers.

With the right payroll software, businesses eliminate manual errors, reduce operational costs, and ensure every employee is paid accurately and on time. From compliance automation to cloud-driven accessibility, advanced payroll solutions empower HR teams to handle payroll with confidence, efficiency, and complete transparency—turning payroll into a strategic business advantage.

Who Can Use Payroll Software?

Payroll software is for organizations of all sizes. It fits the needs of everyone, from small startups and growing MSMEs to large companies managing complex employee setups. This modern tool helps process salaries faster and follow rules while reducing the need for manual work. It adapts to shifting workforce demands and works with attendance systems to ensure accurate monthly payments that follow labor laws. Businesses aiming to grow find it useful. Cloud-based payroll software in India allows companies with multiple locations to simplify payroll handling, secure data, and make HR and finance tasks more transparent. To manage payroll , and in a future-ready way, payroll software is a must for any business.

Key Considerations Before Choosing Payroll Software

Certified payroll software is best for all kinds of organizations, from growing startups to large enterprises, as it streamlines salary management, cuts manpower intervention, and guarantees 100% accuracy in each payroll cycle. Whether it's for a few employees working in your small team or a distributed workforce across different locations in India, modern payroll software makes payroll clear, compliant, and effortless. Businesses from all walks of scale may securely grow their base and smooth their processes regarding payroll operations by enabling automatic calculations, statutory compliance, attendance integration, and employee payroll management software capabilities.

Select payroll software that can be used with ease by the HR and finance teams. Often, this means an intuitive dashboard, workflows that guide the user process, and employee self-service. This facilitates the use of the system, allowing the process to be done smoothly every time.

Select payroll software that can be used with ease by the HR and finance teams. Often, this means an intuitive dashboard, workflows that guide the user process, and employee self-service. This facilitates the use of the system, allowing the process to be done smoothly every time. The payroll software must have the facility for automatic updates of current rules relating to PF, ESI, TDS, PT, LWF, Bonus, and state-wise rules. The auto-generated challans and reports ensure accurate payroll records at all times.

The payroll software must have the facility for automatic updates of current rules relating to PF, ESI, TDS, PT, LWF, Bonus, and state-wise rules. The auto-generated challans and reports ensure accurate payroll records at all times.

Payroll software that integrates well with attendance management, leave management, accounting software, HRMS, and biometric systems is required. Seamless integrations help reduce duplicate data entries and keep all data consistent with each other. Hence, processing monthly payrolls becomes faster and error-free.

Payroll software that integrates well with attendance management, leave management, accounting software, HRMS, and biometric systems is required. Seamless integrations help reduce duplicate data entries and keep all data consistent with each other. Hence, processing monthly payrolls becomes faster and error-free.

A business needs payroll software that is flexible enough to accommodate unique models of payment. Customisable payroll software ensures that the right configuration is available to meet your needs – not the other way round. Flexible elements suit your business processes better.

A business needs payroll software that is flexible enough to accommodate unique models of payment. Customisable payroll software ensures that the right configuration is available to meet your needs – not the other way round. Flexible elements suit your business processes better. Since payroll contains sensitive financial data, the software must offer strong encryption, secure cloud hosting, and role-based access. Regular backups and disaster recovery add another layer of protection. This keeps employee payroll data safe and compliant at all times.

Since payroll contains sensitive financial data, the software must offer strong encryption, secure cloud hosting, and role-based access. Regular backups and disaster recovery add another layer of protection. This keeps employee payroll data safe and compliant at all times. The payroll software should be able to support unlimited employees, multi-location payroll, and ever-growing compliance needs. A scalable system ensures the seamless performance of operations, even while your workforce grows. This future-proofs your payroll without additional manual effort.

The payroll software should be able to support unlimited employees, multi-location payroll, and ever-growing compliance needs. A scalable system ensures the seamless performance of operations, even while your workforce grows. This future-proofs your payroll without additional manual effort.

Choosing the right payroll software is based on simplicity, compliance, scalability, and security. When your payroll process is smooth, your business will save time, reduce penalties, and provide employees with precise payments every month. Let your payroll system support your growth, not slow it down.

FAQs

01. Payroll Software vs Payroll Services: What’s the Difference?

Payroll software is an in-house tool your team uses to automate salary calculations, deductions, and payslips. In contrast, payroll services involve the processing of payroll by a third-party payroll expert who can handle the whole payroll processing, from calculations to compliance filings, on your behalf.

02.Is payroll software suitable for small businesses?

Yes, small businesses can use modern payroll software for quick and inexpensive payroll processing without hiring extra employees. They can save time and avoid errors in salary payments and other statutory deductions.

03. How often is payroll processed?

Payroll is typically processed monthly in India, but businesses can also run weekly, bi-weekly, or semi-monthly payroll depending on workforce type and company policy. Good payroll software supports all pay cycles effortlessly.

04.Can payroll software handle contract workers or freelancers?

Yes. Most of the advanced payroll systems cater to handling contract workers, freelancers, consultants, and gig workers. They can also facilitate flexible payouts, TDS computation, and varied pay, as required.

05.Does payroll software handle tax declarations and Form 16?

Absolutely. Payroll software collects employee tax declarations, auto-calculates TDS, and generates Form 16 at year-end. This reduces manual work for HR and ensures compliance-ready documentation.

06.Which features should I look for in the best payroll software in India?

Look for essential features like automated salary calculations, statutory compliance, payslip generation, attendance integration, reimbursement management, multi-location support, and secure cloud access. Customisation and reporting tools are equally important.

07.Is cloud-based payroll software more secure than traditional systems?

Yes. Payroll software that uses the cloud has benefits due to encrypted storage, access control, and backup facilities that are more secure, flexible, and reliable compared to traditional systems.

08.How much does payroll software cost in India?

The pricing depends on the features or the number of employees. The majority charge per employee per month, though some charge per month for all employees. The pricing usually ranges from affordable solutions for small teams to solutions for growing companies.

09.Can payroll software integrate with HRMS and attendance systems?

Yes. Top payroll systems integrate smoothly with HRMS modules, biometric devices, leave management systems, and accounting tools. Integration reduces data duplication and ensures accurate payroll every cycle.

10.What are the compliance requirements that payroll software must support in India?

Payroll software should have support for PF, ESI, PT, TDS, LWF, Bonus, Gratuity, Minimum Wages, state-wise requirements, and statutory challans/register. Changes can be dynamic to keep pace with changing laws and regulations.

11.Does payroll software reduce payroll errors and manual work?

Yes. Automated calculations greatly reduce errors associated with spreadsheets and ensure timely payment. The workload of payroll departments can be greatly reduced significantly with payroll software that yields accurate results.