Introduction to Payroll Outsourcing in India

For many companies in India, payroll outsourcing is no longer just about saving costs. Handling payroll in-house has become more time-consuming and risky, especially with teams working across states and constantly changing labour laws. That’s why more organisations are turning to payroll outsourcing to make the process easier, more accurate, and compliant. Today, top payroll providers do more than just run salaries.

They use automation along with expert checks to manage PF, ESIC, TDS, PT, LWF, and other statutory requirements. This helps HR avoid mistakes, stay audit-ready, and run payroll faster with fewer errors. Employees also get a smoother experience. Overall, payroll outsourcing lets companies focus on growth instead of paperwork. To help choose the right partner for 2025–26, this guide explains the key features, benefits, and what to look for in a payroll service.

What is Payroll Outsourcing?

The process of collaborating with outside specialists to precisely manage your business’s entire payroll and statutory obligations is known as payroll outsourcing. Instead of handling everything internally, businesses now rely on specialised payroll outsourcing companies to collect payroll inputs, calculate salaries, manage deductions, and ensure month-on-month compliance with complete accuracy. In fact, these providers take care of every detail — from loss-of-pay adjustments, overtime, arrears, and bonus calculations to statutory deductions such as TDS, PF, ESIC, Professional Tax, and LWF.

Leading payroll outsourcing services also handle the filing of PF/ESI returns, the creation of challans, the timely submission of TDS returns, and the maintenance of audit-ready paperwork in addition to processing payroll. Along with this, they offer structured payroll reports, digital payslips, and secure employee self-service access that improves transparency and reduces HR dependency.

Payroll outsourcing has consequently gained popularity. More than 70% of India’s top 500 businesses now outsource payroll in order to lower compliance risks and improve operations, according to Forbes Advisor. At the same time, small and mid-sized businesses are rapidly adopting it as well, recognising how efficiently it cuts down manual work and improves accuracy across the entire payroll process.

How Payroll Outsourcing Works in India (Step-by-Step Process)

At first glance, payroll outsourcing in India can feel overwhelming—multiple laws, frequent regulatory changes, and tight payroll timelines leave very little room for error. This is exactly why many organisations choose to work with specialised payroll outsourcing partners instead of managing everything internally. The goal isn’t just to “process salaries” but to remove the daily operational burden that payroll brings to HR and finance teams.

Payroll outsourcing helps cut down on last-minute compliance work and the need to constantly fix spreadsheets or reconcile things manually. Payroll data is processed according to a predetermined workflow, and computations, statutory filings, and reporting are handled by trained specialists. HR directors will benefit from fewer follow-ups, more efficient payroll cycles, and the assurance that compliance is being managed by experts who monitor regulatory changes as part of their main duty.

Here is a useful summary of how payroll outsourcing normally functions for Indian businesses:

-

1 Data Collection & Employee Information Setup

The procedure begins with obtaining all necessary personnel information,personal profiles, bank information, wage structures, cost-to-company components, start dates, variable pay, and so on. This foundational step ensures payroll accuracy from the beginning.

Furthermore, outsourcing companies integrate your current HR and financial systems to ensure that all payroll inputs are compatible with your organization’s structure. -

2 Attendance & Leave Synchronisation

The outsourced partner will next merge your attendance and leave data, which may come from biometric devices, mobile apps, spreadsheets, or HRMS systems.

Working hours, overtime, weekly offs, holiday calendars, and LOP (Loss of Pay) deductions are all automatically entered into payroll processing. As a result, HR is no longer need to manually reconcile numerous attendance sources each month. -

3 Salary Calculation & Earnings/Deductions Automation

Once attendance is synced, the service provider use payroll accounting software to calculate salaries with pinpoint precision.

Basic salary, HRA, allowances, overtime, variable incentives, arrears, bonuses, and other statutory deductions are automatically calculated. Because computations are rule-based and system-driven, the possibility of a human error is greatly decreased, resulting in smoother payroll runs. -

4 Statutory Deductions & Compliance Check

One of the most significant advantages of Payroll Outsourcing Services is compliance accuracy. In compliance with state and federal labour legislation, PF, ESIC, LWF, Professional Tax, TDS, and other statutory deductions are applied automatically at this stage. The system validates each employee’s eligibility, wage requirements, and deduction slabs to ensure that the payroll is completely compliant without the need for manual intervention. Given India’s continually changing labour rules, this step alone protects enterprises from penalties and audits.

-

5 Payroll Run & Validation by Experts

Payroll experts perform a comprehensive validation procedure following the completion of computations and deductions. Among the tests they perform are variability analysis, mismatch detection, CTC accuracy, overtime validation, and compliance cross-verification. Until everything is confirmed, they do not make bank transfer files, terminate the payroll run, or generate salary sheets. This expert-led verification is one of the primary reasons companies pick Indian Payroll Outsourcing Companies over internal staff.

-

6 Payroll Reports, Analytics & Approval Workflows

Once the payroll is processed, comprehensive reports are generated automatically, including salary registers, reconciliation sheets, variance reports, cost centre breakdowns, and department wise analysis.

CFOs and HR directors are well versed in budgeting data, payroll expenses, and personnel trends. Cloud-based payroll software allows authorised employees to see these data from anywhere at any time, ensuring transparency throughout the entire organisation. -

7 Statutory Filings, Challans & Monthly Compliance Completion

Finally, the outsourcing partner prepares and files all statutory returns.

This includes PF ECR uploads, ESIC filings, PT challans, TDS returns, and digital record submissions.

All filings are done within government timelines, reducing compliance risk and strengthening governance. Additionally, audit-ready documents are stored securely for future reference making the entire payroll and compliance cycle exceptionally smooth.

Why Should You Outsource Your Payroll?

-

1 Cost Savings

Payroll outsourcing greatly decreases the high operating costs involved with administering payroll in-house. Companies can outsource payroll to knowledgeable payroll outsourcing firms that already have cutting-edge systems in place rather of investing in salaries, training, software licenses, infrastructure, and risk management. As a result, companies obtain more predictable, transparent payroll operations without unforeseen overheads in addition to cutting costs.

-

2 Time Efficiency

By handing over payroll duties to professional payroll outsourcing services, organisations immediately free their HR and finance teams from repetitive, time-consuming administrative work. They might then turn their attention back to strategic initiatives like talent development, employee engagement, and organizational growth. This modification ensures more output while maintaining the accuracy of monthly paycheck.

-

3 Compliance with Local Laws

For internal teams, maintaining compliance can be difficult because Indian payroll and regulatory regulations are always changing. Payroll outsourcing firms, however, keep a close eye on state specific legislation, labor laws, and tax revisions. This guarantees that your payroll always complies with the most recent legal standards, minimizing compliance gaps, preventing fines, and maintaining your organization’s audit readiness throughout the year.

-

4 Access to Expertise

Payroll outsourcing gives you direct access to seasoned professionals who are familiar with India’s intricate regulatory environment. Additionally, these experts have years of specialized experience with multi-state payrolls, arrears, TDS, PF, ESI, PT, and LWF. Throughout all payroll cycles, their experience guarantees perfect execution, fewer mistakes, and more seamless employee experiences.

-

5 Advanced Technology

Modern payroll software is used by payroll outsourcing companies to automate computations, speed up processing, and do away with the need for spreadsheets. The system as a whole becomes more precise and effective with integrated validation checks, real-time data, and backed by cloud.

-

6 Scalability

Payroll outsourcing services can easily be expanded to incorporate new locations, regions, or job types as your workforce grows. It is unnecessary to train teams, update systems, or hire additional people. Regardless of the size of the company, payroll outsourcing firms expertly manage the added strain to ensure consistent, dependable payroll.

-

7 Risk Reduction

Payroll outsourcing considerably lowers the risk of data mismanagement, missed deadlines, compliance issues, and incorrect computations. Payroll professionals adhere to tight protocols that are supported by automated inspections, reducing operational risks for businesses. This makes payroll more accurate and reliable and helps businesses avoid fines or legal trouble.

-

8 Bridging Cultural Barriers

Payroll outsourcing considerably lowers the risk of data mismanagement, missed deadlines, compliance issues, and incorrect computations. Payroll professionals adhere to tight protocols that are supported by computerised inspections, reducing operational risks for businesses. This makes each payroll run more accurate and reliable and helps businesses avoid legal issues or fines.

-

9 Confidentiality and Transparency

Outsourcing payroll improves data security since respectable payroll outsourcing firms follow strict confidentiality protocols, encrypted systems, and role-based access controls. Payroll computations, reports, and audit trails are all completely transparent while sensitive data, including salary, tax information, and banking information, is handled securely. This equilibrium guarantees clarity and trust throughout the company.

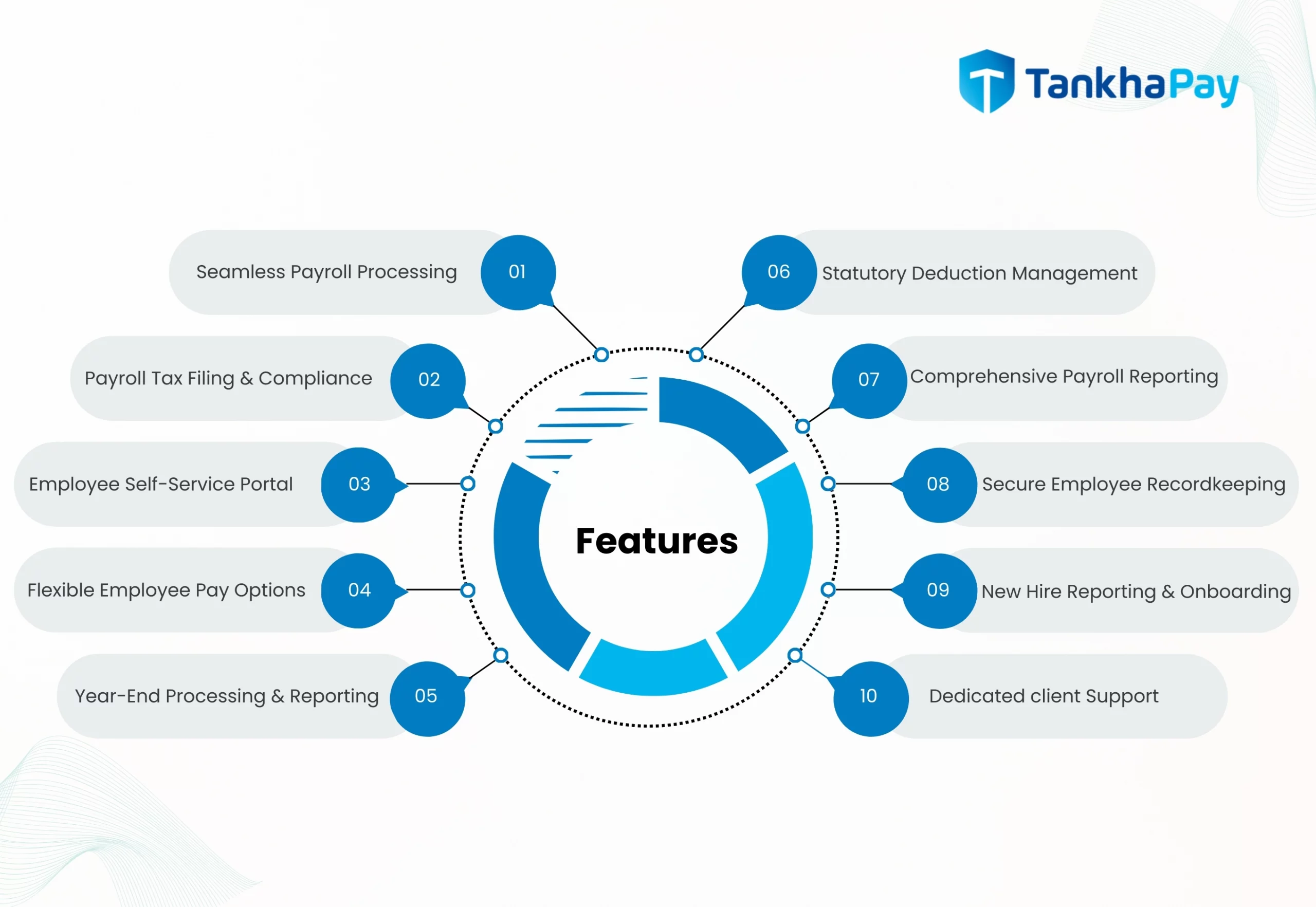

What Features Does Payroll Outsourcing Provide?

Payroll outsourcing companies offer far more than just monthly salary processing. With the right mix of experience, automation, and compliance, payroll outsourcing can make a company’s payroll much smoother, faster, and less prone to mistakes.Furthermore, these services guarantee end-to-end compliance, a simple employee experience, and total peace of mind for HR and financial teams by fusing cutting-edge payroll software with committed specialists. Because of this, companies can confidently manage their workers and remain audit-ready all year long.

1. Seamless Payroll Processing

Payroll outsourcing providers thoroughly integrate payroll data with accounting systems and labour inputs to ensure a smooth, trouble-free payroll process. Real-time synchronisation also ensures that financial data is updated quickly and avoids the need for manual updates. This ensures that each distribution is timely, accurate, and in full compliance with your company’s requirements.

2. Payroll Tax Filing & Compliance

Payroll outsourcing firms automate tax computations, TDS filings, and statutory transfers to reduce risks because labor and tax laws in India are constantly changing. Additionally, they precisely manage PF, ESI, LWF, PT, and other compliance components, guaranteeing that your payroll remains 100% compliant every month.

3. Employee Self-Service Portal

Payroll outsourcing services offer an employee self-service (ESS) portal where employees can access payslips, tax documents, declarations, and personal information anytime. This boosts transparency, minimises HR dependency, and improves the entire employee experience by providing rapid access to payroll information.

4. Flexible Employee Pay Options

Payroll outsourcing firms offer a variety of payment options to meet the demands of their diversified workforce, including NEFT, IMPS, RTGS, and salary account transfers. As a result, employees receive timely compensation in the format they desire, increasing satisfaction and decreasing follow-ups.

5. Year-End Processing & Reporting

Payroll operations may be unpleasant at the end of the year, but they are completely manageable thanks to outsourcing. Providers accurately manage Form 16, Form 12BA, annual PF/ESI returns, and aggregated reports. As a result, businesses are free to keep meeting with Indian tax authorities.

6. Statutory Deduction Management

Payroll outsourcing services ensure quick transfer to government websites while calculating and managing all statutory deductions, such as PF, ESI, Professional Tax, LWF, and TDS. This maintains your payroll audit-ready all year long and dramatically reduces compliance risks.

7. Comprehensive Payroll Reporting

Salary registers, CTC analytics, tax summaries, and financial insights are among the comprehensive payroll reports provided by outsourcing partners. These editable reports assist departments make well-informed decisions by providing management with greater insight into payroll processes.

8. Secure Employee Recordkeeping

All employee information is stored securely in compliance systems, from financial records and payroll histories to statutory documents. Everything is kept in one place, so sensitive data stays protected while still being easy to access whenever it is needed, for example during audits.

9. New Hire Reporting & Onboarding

Payroll outsourcing companies make the onboarding process much easier. Right from day one, they handle things like UAN creation, PF and ESI registration, and all the compliance setup. This means employees are ready for payroll much faster and HR teams don’t have to worry about delays or mistakes while someone is joining.

10. Dedicated client Support

Payroll outsourcing services give dependable, skilled HR and payroll professionals who offer ongoing assistance in addition to technology. These experts make sure your payroll goes without a hitch by handling escalations, revising policies, and addressing problems.

Types of Payroll Outsourcing Models in India

Payroll outsourcing in India is not a one-size-fits-all solution. Different organisations—whether startups, SMEs, or large enterprises—have different HR, payroll management, and compliance needs. Therefore, before choosing a provider, it is crucial to understand the various types of payroll outsourcing models in India. Each model offers a different level of automation, expert involvement, and HRMS integration, helping businesses decide what fits their workforce structure, internal capabilities, and expansion plans.

The main outsourcing methods that businesses frequently employ are broken down in depth below, along with how they fit with current Indian payroll software, payroll management procedures, and legal compliance.

1. Fully Managed Payroll Outsourcing

In a fully managed model, the outsourcing provider handles end-to-end payroll management, ensuring that the entire process is done with high accuracy and strict compliance.

This includes:

- Salary computation

- Attendance & leave sync

- Reimbursement cycle management

- Statutory deductions

- Challans & monthly filings

- Payslip distribution

- Helpdesk for employee queries

Since the payroll provider takes care of everything, businesses can focus on bigger HR priorities without constantly worrying about deadlines or changes in compliance. This approach works well for companies that do not want to handle payroll in-house and need a system they can rely on, where everything is transparent and accountable.

2. Tech + Expert Hybrid Model (Most Popular in India Today)

This approach combines actual human specialists with cloud payroll software, which is particularly effective for rapidly expanding businesses. While the payroll team monitors everything and ensures that nothing deviates from compliance, the program handles salaries, attendance, taxes, and reporting on its own.

This hybrid approach is popular because:

- Companies get the speed of automation

- They also get expert supervision for error-free operations

- It reduces dependency on large internal HR teams

- It balances cost with accuracy and compliance

Due to changing labour laws in India, many HR leaders now prefer this model because it gives them a strong mix of technology + manual validation.

3. HRMS + Payroll Bundle (Integrated Outsourcing)

An integrated HRMS + payroll bundle goes beyond payroll and covers the entire employee lifecycle, making it a powerful option for organisations wanting one unified digital system.

This bundle typically includes:

- HRMS

- Attendance & leave management

- Payroll software

- Employee self-service

- Document management

- Onboarding & exit workflows

- Basic performance & workforce data

Since everything is linked together, businesses don’t have to deal with problems like mismatched data, manual entries, or HR records spread across different places. It takes a lot of the admin work off their plate and sets up a solid base for managing a growing workforce.

4. Compliance-Only Payroll Outsourcing

Some businesses want to keep their internal payroll team but outsource the statutory compliance part because it is the most error-prone and time-consuming.

This model focuses on:

- PF, ESIC, LWF, PT, TDS compliance

- Monthly challans

- Government portal filings

- Returns & registers

- Audit-ready documentation

- State-wise labour law alignment

This works really well for companies that are confident handling their own payroll but still want some professional help with compliance. It is especially useful for businesses that operate in more than one state and need to make sure they are following all the rules correctly.

5. Payroll Process Outsourcing for Multi-State & Distributed Teams

As more companies in India start hiring remotely, taking on gig workers, and expanding across multiple states, they are looking for outsourcing partners who can handle these complex workforce setups. It makes things much easier than trying to manage everything on their own.

This model includes:

- Multi-state salary structures

- Differential minimum wages

- Region-specific PT, LWF, and labour law updates

- Shift-based or project-based payroll

- Regional compliance registers

- Multi-location attendance & roster sync

Because payroll laws differ widely across states, this specialised model ensures smooth payroll operations without placing a heavy compliance burden on HR teams.

6. Modular Payroll Outsourcing

Businesses can select just the modules they require with this adaptable, contemporary outsourcing approach.

Modules can include:

- Only attendance + payroll

- Only payroll + compliance

- Only tax management

- Only reporting + analytics

- Only reimbursements & F&F

This approach is cost-effective and suitable for companies with partial in-house payroll capability.

What factors matter most when selecting a payroll services provider?

Selecting the appropriate payroll provider is crucial since it has an impact on employee happiness, compliance, salary accuracy, and business operations. To ensure payroll runs well, a good supplier should employ automation, be transparent about pricing, protect your data, and have a solid understanding of compliance. When making a choice, it’s useful to consider their experience, reaction time, service quality, and interoperability with your existing HR systems. Payroll is not the only thing that the most successful payroll partners perform. You might eventually depend on them for compliance and staff management.

1. Evaluating Market Reputation and Credibility of Payroll Services Providers

A payroll provider’s reputation really shows how dependable they are. It’s better to go with partners who have a history of being accurate, delivering on time, and actually knowing what they’re doing. You can check how they perform by looking at client testimonials, case studies, and references to see if they really have a good track record.

2. Assessing Transparent and Cost-Effective Pricing Structures

Outsourcing payroll software is usually cheaper than handling it in-house, though the costs can be very different depending on the provider. It’s important to watch the prices carefully and be aware of any extra charges. When you know what you’re really paying for, it’s easier to pick a payroll service that gives good value without any surprises.

3. Maintaining Reliable Accuracy and On-Schedule Payroll Processing

Payroll errors can swiftly erode employee trust. That is why it is critical to engage with a provider who can provide correct payroll on time, every time. It is also beneficial to conduct a trial to ensure that they can handle your pay systems and schedules without difficulties.

4. Confirming Strong Data Protection and Security Frameworks

Payroll has lots of sensitive personal and financial information, so keeping it safe is very important. Make sure the vendor has proper certifications and uses strong systems. They should also do regular checks and have good security measures to protect the data.

5. Reviewing Customisation Options and System Integration Capabilities

A company that provides both HR and payroll services can make things a lot easier for a business. When HR and payroll are connected, it cuts down on manual work, makes the data more correct, and removes the need to deal with many different systems or vendors on your own.

6. Assessing the Responsiveness and Reliability of Customer Support

Payroll issues require immediate attention. Your vendor should offer prompt and dependable support, especially during payroll cut-offs. The ability to fix problems fast means staff get their paychecks right when they’re supposed to, month after month.

7. Choosing Providers with Proven Payroll and Industry Expertise

Pick a team that really knows how payroll works in India. They should understand complicated pay structures, regulations, running payroll across different states, and issues specific to certain industries. HR professionals manage payroll with care and make sure it follows all the rules.

8. Ensuring Comprehensive Compliance and Statutory Management

Payroll and compliance have to work together. Errors in PF, ESI, TDS, or Professional Tax can cause fines and slow down business operations.. Select a provider that manages all statutory filings end-to-end, so you don’t have to deal with coordination headaches while staying fully compliant.

Who Should Outsource Payroll? (Startups, MSMEs, Enterprises)

Outsourcing payroll is not just for big companies anymore. Nowadays, businesses of all sizes, from small startups to large enterprises with multiple locations, are using payroll outsourcing to make compliance easier, cut down on manual work, and make sure salaries are paid correctly. With rules and regulations in India changing all the time, more and more companies are seeing that outsourcing payroll is not just about saving money, it actually gives them a real advantage in running their business.

Startups: Focus on Growth, Not Payroll Administration

Startups need to move fast, but handling payroll and compliance manually can really slow things down, especially when founders or small HR teams are already doing a lot of different jobs. When startups outsource payroll, it takes away all the compliance stress because experts handle PF, ESIC, TDS, PT, LWF, and keep up with labour law changes. It also makes costs predictable and more affordable since there is no need to hire a full-time payroll team. Payroll management can scale easily as the company grows from a handful of employees to hundreds. Most importantly, the team can spend more time focusing on the product, growth, and funding instead of worrying about statutory deadlines every month.

MSMEs: Reduce Costs While Improving Accuracy

Large Enterprises: Standardisation, Governance & Multi-Location Control

Enterprises often have complex workforce structures — multiple cost centres, varied pay groups, shift differentials, and region-specific rules. Handling this internally demands large teams and robust systems.

This makes outsourcing an ideal solution, as enterprises get:

- Centralised payroll governance across all branches and states

- Standardised payroll processes that minimise discrepancies

- Advanced reporting and analytics for financial planning

- Expert-led statutory compliance, reducing enterprise-level risk

Most payroll outsourcing companies in India today are much more organised in how they work. They usually come with clear service commitments, proper audit support, and the ability to handle payroll for multiple entities at the same time. This helps businesses stay consistent even as they grow bigger and manage payroll at a larger scale.

Multi-Location Companies: Hassle-Free State-Wise Compliance

Businesses with offices, plants, or outlets across multiple states face the highest compliance burden. Every state has different PT, LWF, and labour law requirements, making manual payroll extremely risky.

Outsourcing helps such organisations:

- Automatically apply state-specific rules

- Maintain uniform payroll standards across all branches

- Reduce the burden on regional HR teams

- Speed up payroll cycles with centralised workflows

When a company has people working from different locations, handling payroll internally can become messy. Outsourcing helps keep things simple and clear, making sure salaries are processed correctly every month and everyone knows what to expect.

Contract-Heavy Companies

Payroll issues are a persistent problem for businesses that rely significantly on contract workers, particularly in sectors like manufacturing, shipping, retail, construction, and facility management. Managing in-house payroll is challenging due to frequent hiring and firing as well as shifting pay scales. This is made easier by payroll outsourcing. It effectively manages high staff turnover, overtime, shift-based compensation, incentives, and penalties, and assures compliance with the CLRA and labour regulations. Digital records are audit-ready, giving organisations greater control and insight over worker expenses with no effort.

In Summary

Whether it’s a startup, an MSME, or a large enterprise, payroll outsourcing helps businesses manage salaries and compliance without extra hassle. As teams grow and rules keep changing, outsourcing payroll has become the easier and smarter way to handle it in India.

Top 10 Payroll Outsourcing Companies | Payroll List (2026)

1. Tankhapay

TankhaPay is a payroll outsourcing platform designed for companies that want payroll and HR to be straightforward and manageable. Payroll, compliance, and workforce tasks are all handled by a single system rather than multiple tools. Whether the team is working remotely or in the office, employee data, attendance, shift planning, and salary processing are all done collaboratively. This facilitates enterprises’ ability to maintain organisation without having to migrate between platforms.

There is also a lot of experience behind how the platform works. TankhaPay is supported by Akal Information Systems, which has been handling payroll and compliance work in India for over 25 years and manages payroll for more than a million employees. As a result, the focus is not only on payroll but also on properly filing PF, ESI, PT, and TDS. For many firms, this eliminates the stress of working with several vendors. Payroll, compliance, and personnel management are handled together, making the total process more predictable and manageable.

Additionally, backed by 25 years of payroll and compliance expertise from Akal Information Systems—which manages more than one million employees—TankhaPay offers far more than software. Instead, it functions as a full-suite payroll and compliance partner, covering PF, ESI, PT, and TDS management while eliminating the hassle of juggling multiple vendors for payroll processing, statutory filings, and workforce management. As a result, TankhaPay distinguishes itself as one of the top payroll outsourcing options in India by combining automation with specialized services to guarantee accuracy, regulatory compliance, and continuous payroll operations.

Pros:

HR Tech and Payroll Services, Multilingual Platform, 24×7 HR Support

Ideal for:

Companies of all sizes, like big enterprises, MSMEs, government bodies, or startups, want a single partner to take care of payroll, compliance, HR systems, and apprenticeship work so that everything is handled smoothly without extra complications.

Pricing:

₹60 per user per month.

Click here to read the complete guide on Payroll Software in India.

2. factoHR

factoHR is used by firms that want payroll and HR procedures to be less chaotic and easier to handle. Instead of handling salary, attendance, compliance, and personnel records separately, they are all combined into a single system. Payroll is simple to use; attendance is automatically collected, and employee data is updated with little manual intervention from HR staff.

Location-based and contactless attendance features are particularly useful for teams that do not always operate in the same workplace. Compliance updates and data security are taken care of quietly in the background, so HR does not have to track every change. The dashboards are simple and give a clear view of payroll and workforce costs, which helps leadership understand the numbers without spending too much time on reports.

Pros:

Cloud-Based HRIS, Advanced Security

Ideal for:

Small to mid-sized companies and rapidly scaling businesses that want dependable outsourced payroll and compliance management in an integrated HR environment.

Pricing:

₹4,999 per month for up to 50 employees.

3. ADP

Many firms use ADP when payroll becomes difficult to manage internally. It allows you to manage salary processing, compliance, and basic HR activities all in one spot. Statutory work like PF, ESI, PT, and TDS is handled regularly, so teams do not have to keep chasing dates or worrying about missing filings. Since it runs on the cloud, teams can log in easily and connect it with their existing systems. Managers can also see simple payroll and workforce details without digging through reports. For most organisations, ADP works as a steady and dependable payroll setup that removes day to day pressure from HR teams.

Pros:

Seamless Integration, One-Stop Solution

Ideal for:

Large enterprises and multinational organizations seeking reliable, scalable payroll services supported by enterprise-grade technology.

Pricing:

Custom Pricing: On Request

4. Zing Hr

ZingHR offers payroll services built for mid-sized to large companies, and more importantly, its cloud platform enables complete end-to-end payroll processing with ease. It helps HR departments minimise human labour and prevent mistakes by centralising staff data, managing regulatory compliance, and automating payroll. Additionally, the platform offers organisations a single solution for their whole HR and payroll ecosystem by integrating attendance, leave, performance, and talent management. With this unified approach, and operations across India, Singapore, Australia, and other regions, ZingHR effectively supports companies managing large or geographically distributed teams.

Pros:

Cloud-Based & AI-Driven, Integrated HRMS

Ideal for:

Mid-sized and large enterprises seeking a sophisticated, integrated platform to outsource payroll while digitizing broader HR operations.

Pricing:

Custom Pricing: On Request

5. Paybooks

Many Indian businesses that want payroll to run smoothly utilise Paybooks. It handles tax computations and payroll processing automatically, saving HR staff a great deal of manual labour. Additionally, the system simply integrates with HRMS technologies, allowing attendance and leave data to flow into payroll without the need for ongoing follow ups. Because of the setup’s quickness and user friendliness, businesses can easily switch from manual payroll. Paybooks users eventually see increased compliance, fewer errors, and a more dependable and controllable payroll process.

Pros:

Quick Implementation, API-Driven Payroll Platform

Ideal for:

Small and mid-sized companies looking for payroll outsourcing that’s simple to set up, works well with their existing systems, cuts down on workload, gets the numbers right, and can scale as they grow.

Pricing:

₹2,499 per month for up to 30 employees.

6. HROne

HROne is a cloud-based HR system designed for businesses looking to streamline payroll and HR tasks. It relieves HR staff of a great deal of stress by managing employee records, attendance, leave, statutory compliance, and salary processing all in one location. The platform makes day-to-day coordination easier with features like geo-attendance, flexible shifts, simple approval flows, and mobile self-service for employees. Managers and leadership can see real-time data through clear dashboards, helping them track payroll and workforce details and make better decisions without digging through reports.

Pros:

Real-Time Dashboards, Complete Lifecycle Management

Ideal for:

Mid-sized and large organizations seeking a seamless, technology-driven solution to outsource payroll while managing broader HR operations within one integrated system.

Pricing:

₹4,950 per month for up to 50 employees.

7. Keka

Keka is a cloud based HR system that many companies use when they start moving towards payroll outsourcing. It brings payroll, attendance, hiring, performance reviews, and day to day HR work into one place, which helps reduce manual effort and mistakes. Payroll runs are automated, compliance calculations are taken care of, and employees can access their own details without depending on HR every time. Leave and timesheet management also become simpler. For leadership teams, the real time reports give a clearer picture of workforce costs and productivity, making it easier to take informed decisions

Pros:

Cloud-Based Platform, Timesheet Management

Ideal for:

Startups, small businesses, and mid-sized companies that want an efficient, connected system for outsourced payroll and better HR performance overall.

Pricing:

₹9,999 per month for up to 100 employees.

8. Zoho Payroll

Zoho People is a cloud based HR system that many companies use to manage their HR work in one place. It brings together things like attendance, leave, performance, recruitment, and employee records, which helps reduce manual effort and keeps data more accurate. Zoho People is a good supporting HR setup for companies who intend to outsource payroll. It is simple to use, grows with the business, and provides teams with a reliable HR foundation as they transition to more sophisticated, outsourced payroll processes.

Pros:

Automation of Routine Tasks, User-Friendly Dashboards

Ideal for:

Small to mid-sized companies and fast-growing businesses looking for a simple, scalable HR platform that supports outsourced payroll and centralized workforce management.

Pricing:

₹1,250 per month for up to 25 employees.

9. SumHR

SumHR provides a cloud-based platform for companies switching to streamlined payroll services. Built for speed and compliance, it uses automation to reduce manual work in payroll processing. The system handles salary calculations, tax deductions, and statutory filings while pulling in attendance, leave, performance, and employee information on one dashboard. Whether you’re an early-stage startup or a growing mid-sized team, SumHR delivers reliable payroll outsourcing through a flexible, straightforward system.

Pros:

Automated Payroll Processing, End-to-End HR Workflows

Ideal for:

Startups, small businesses, and rapidly expanding teams looking for straightforward, scalable payroll outsourcing that makes compliance easier and brings HR operations together in one place.

Pricing:

₹69 per user per month.

10. Qandle

Qandle is a mobile-focused HR platform that helps companies modernize their payroll services. The customizable modules handle payroll processing, compliance, and core HR tasks, letting businesses adjust processes to fit how they work. With an easy-to-use interface and strong mobile features, employees and managers can approve requests and manage payroll tasks from anywhere, making things run smoother and cutting down on admin work.

Pros:

Highly Customizable Workflows, Clean UI & Mobile-Friendly

Ideal for:

Modern and fast-growing businesses that need a flexible, scalable HR platform to streamline and outsource payroll services and centralize everyday HR operations.

Pricing:

₹2,450 per month for up to 50 employees.

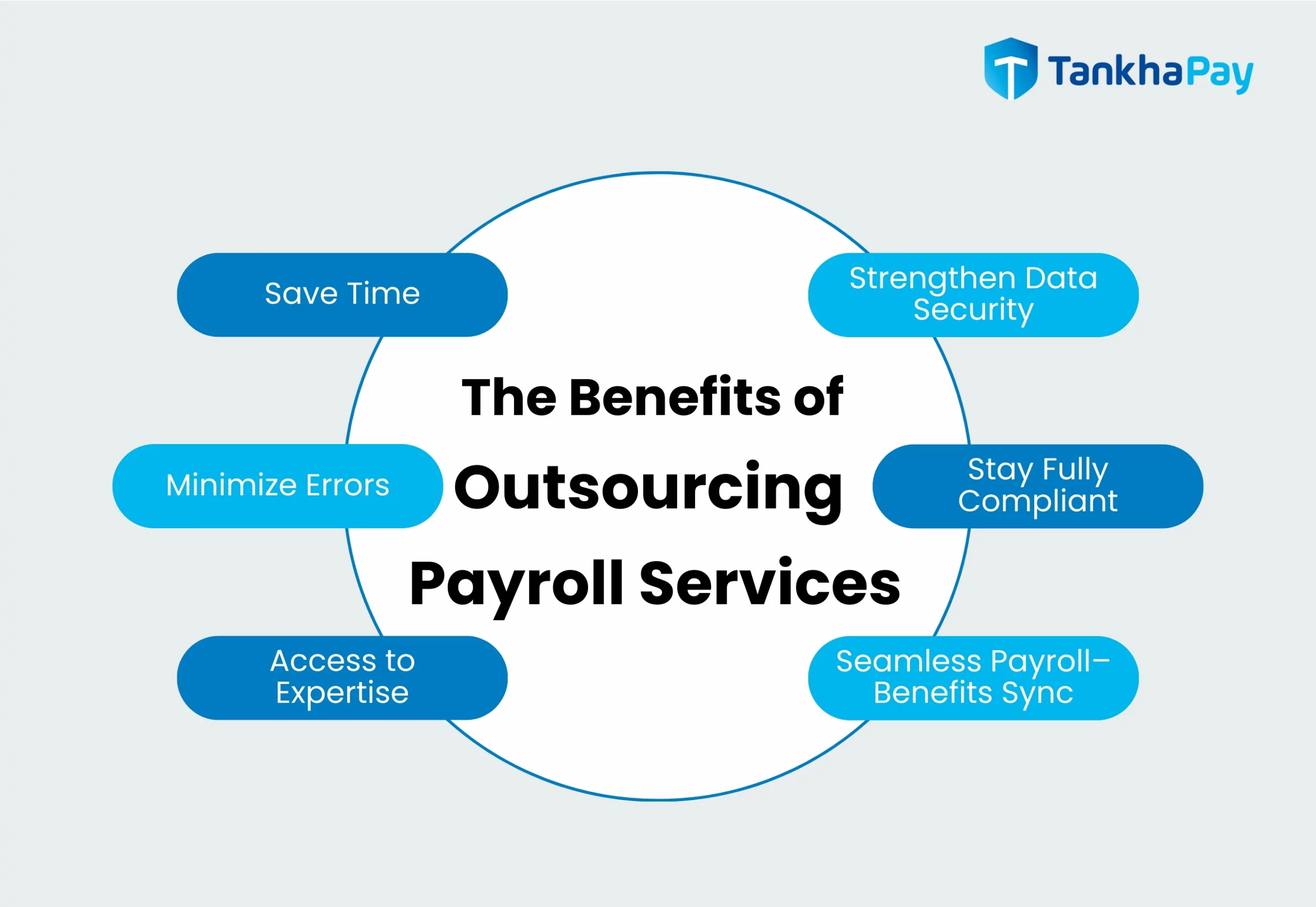

What are the Benefits of Outsourcing Payroll Services?

Payroll outsourcing has become really useful for Indian companies that want payroll done on time, correctly, and in line with all the rules, without having to hire more people. Working with experienced payroll outsourcing companies helps businesses run monthly payroll smoothly, stay on top of compliance, and give HR teams some support with expert processes. To make things easier to read and understand, the main benefits are shared below in a simple and clear way.

1. Higher Accuracy & Reduced Payroll Errors

Outsourcing significantly improves accuracy since skilled professionals handle wage inputs, attendance records, overtime calculations, arrears, reimbursements, and regulatory deductions. Additionally, each pay run is subjected to several validation checks, which lowers conflicts, increases transparency, and guarantees that workers are always paid correctly. It is quite challenging to continually maintain this level of accuracy with internal teams.

2. Lower Cost of Payroll Operations

Outsourcing provides a consistent and reasonable monthly cost as opposed to managing compliance specialists, purchasing software, and employing a whole internal payroll department. Additionally, businesses save money on training, software updates, infrastructure, and statutory filing expenses. Over time, this makes payroll outsourcing one of the most cost-efficient ways to manage end-to-end payroll in India.

3. Full Statutory Compliance Assurance

Keeping up with all the changes in PF, ESIC, PT, LWF, labour laws, and TDS can be really tough for companies. Payroll outsourcing companies handle this by keeping an eye on updates and applying them straight away in payroll. They also take care of filing PF and ESIC returns, making challans, preparing TDS reports, and keeping all the documents ready for audits. This way, businesses don’t have to worry about penalties or compliance mistakes.

4. Time Savings for HR Teams

Since payroll is one of the most time-consuming monthly tasks for HR teams, outsourcing frees them from repetitive work such as data verification, preparing salary sheets, making adjustments, issuing payslips, and coordinating with finance. As a result, HR leaders can devote more time to strategic activities like hiring, performance management, employee engagement, and culture-building.

5. Multi-State and Multi-Entity Support

Handling payroll in different locations can be difficult because every state has its own rules and attendance systems. Payroll outsourcing helps by managing all locations in one place. In order to ensure accurate and consistent salary calculations, it handles local compliance. For the business, this simplifies and increases the process’ dependability.

6. Timely & Transparent Payroll Processing

Payroll runs that are reliable and timely are among the main benefits of outsourcing. The outsourcing partner shares processing calendars, adheres to stringent deadlines, and guarantees that workers are paid on the same day each month.Additionally, self-service access, audit trails, and public reports enhance organisational credibility and employee trust.

7. Access to Domain Experts & HR Advisors

Payroll outsourcing isn’t just about calculation — it’s also about guidance. Companies have access to HR advisors, payroll professionals, and compliance specialists that are knowledgeable with industry-specific pay structures, intricate legal requirements, and best practices. This professional assistance lessens internal reliance and guarantees that each payroll choice complies with operational and regulatory requirements.

Why you should Outsource your Hr and Payroll?

- Save Time: Shifts payroll work off HR teams so they can focus on growth, operations, and core business priorities.

- Reduce Payroll Errors: Automated calculations and expert checks minimise mistakes in salaries, deductions, and statutory filings.

- Strengthen Data Security: Uses secure, encrypted systems with backups and controlled access to protect sensitive employee data.

- Ensure Statutory Compliance: Tracks PF, ESI, PT, LWF, Bonus, Gratuity, and TDS rules and manages all filings on time.

- Integrated HR Data: Links payroll with attendance, leave, claims, and benefits for accurate information across the board.

- Employee Self-Service: Lets staff check their payslips, update personal information, review tax details, and monitor attendance from their phones.

- Cost Savings: Cuts down on penalties, corrections, and admin expenses, saving money over time.

Common Payroll Challenges Indian Companies Face

Even though more companies are going digital, payroll is still one of the most complicated and error-prone tasks for Indian businesses. When companies grow across different states and hire different types of employees, the problems often get bigger. That is why many businesses choose payroll outsourcing or work with experienced payroll partners in India to make sure salaries are accurate, compliance is maintained, and payments are on time.

1. Frequent Regulation Changes and Compliance Uncertainty

Even though many businesses are moving to digital systems, payroll is still one of the trickiest and most compliance-heavy tasks for companies in India. When organisations grow across states and have different types of employees, the work only becomes more complicated. That’s why a lot of companies choose to work with payroll outsourcing services in India. These partners assist in ensuring timely salary processing, accurate computations, and compliance.

2. TDS Complexities and Incorrect Tax Calculations

One big problem for Indian employers is getting TDS right for employees, especially when salaries, exemptions, and investments are different for each person. Even a small mistake can cause disputes over Form 16 or unhappy employees. When payroll is done manually or on old systems, tax slabs may not get updated on time, which adds to the compliance risk. Payroll outsourcing companies use modern software to calculate TDS correctly, project taxes automatically, and generate Form 16 without errors.

3.Multi-State Compliance Variations

As soon as a company expands beyond one state, payroll management becomes significantly more complex. Each state has different rules for:

- Professional Tax

- Shops & Establishments

- Labour Welfare Fund

- Minimum wages

- Leave policies

Without proper tracking mechanisms, HR teams find themselves navigating multiple rulebooks every month. Consequently, many multi-location businesses prefer outsourcing to ensure all location-based rules are applied correctly during payroll processing.

4. Attendance, Shift, and Data Mismatches

Reliable attendance data is critical to payroll accuracy. Attendance systems, biometric devices, leave data, overtime approvals, and shift schedules, however, do not always sync in many organisations. This leads to:

- salary miscalculations

- incorrect overtime payouts

- disputes between employees and HR

- delays in payroll cycles

By contrast, payroll outsourcing companies typically integrate attendance and payroll software to create a single source of truth — ensuring that salary calculation is always aligned with approved working hours.

5. Errors in Statutory Reporting & Challans

Another major pain point for Indian companies is the manual preparation of:

- PF ECR files

- ESIC monthly returns

- Professional Tax challans

- Labour Welfare Fund submissions

- Quarterly TDS filings

Any errors here could result in fines, delays, or audits. Furthermore, without the proper infrastructure, keeping digital records for upcoming audits becomes time-consuming. Statutory reports are created automatically by outsourced payroll service providers, who also guarantee timely filings each and every time.

6. Scalability Issues During Growth Phases

As a company grows, its payroll workload doesn’t just increase — it becomes more complicated. More employee categories, more reimbursement types, more compliance layers, more locations, and more queries.

Most in-house teams cannot grow quickly enough to handle more employees and complex payroll. That is why many growing businesses choose to outsource. It gives them access to good payroll software, compliance support, and automated processes without needing to hire more people.

Payroll Outsourcing vs Payroll Software

When you look at payroll outsourcing and payroll software in India, both try to make payroll easier, but in different ways. With outsourcing, experts do most of the work for you. With software, your own team gets the tools to manage payroll themselves. As Indian businesses grow across states and employment types, this decision becomes even more crucial. Therefore, the best way to evaluate both approaches is to compare them side-by-side across cost, compliance, scalability, data control, and long-term efficiency.

Below is a comprehensive, SEO-optimised comparison table that highlights the key differences.

| Criteria | Payroll Outsourcing Services | Payroll Software in India (Cloud / On-Premise) |

|---|---|---|

| Who Handles Payroll? | Entire payroll is managed by external payroll outsourcing companies in India. | Payroll is handled in-house using payroll accounting software. |

| Level of Automation | High — outsourcing partners use advanced systems along with expert review. | Very high — automated payroll, tax calculations, payslips, and compliance workflows. |

| Compliance Management | Fully managed by experts, including PF, ESIC, TDS, PT, and LWF filings. | Automated calculations and reminders are provided, but filings are executed by in-house teams. |

| Cost Structure | Subscription or per-employee service fees; cost-effective for businesses with no internal payroll load. | Monthly software subscription with additional cost for internal payroll experts. |

| Scalability | Highly scalable — supports multi-state, multi-entity, and seasonal workforce changes. | Cloud payroll scales easily, but complex setups require skilled payroll staff. |

| Ideal For | Startups, MSMEs, enterprises without payroll teams, and contract-heavy businesses. | Companies with HR/payroll teams preferring in-house payroll processing. |

| Accuracy & Error Rate | Very high — dual validation using software and human checks. | High — accuracy depends on internal team expertise and data quality. |

| Time Savings | Maximum — HR teams completely offload payroll and compliance tasks. | Moderate — automation reduces effort but requires internal involvement. |

| Data Control | Data handled by outsourcing partners under strict SLAs. | Full internal control over payroll data and access. |

| Flexibility & Customisation | Limited customisation depending on outsourcing partner capabilities. | Highly customisable salary structures, pay rules, and workflows. |

| Dependence on Internal HR Team | Low — outsourcing removes most internal payroll workload. | High — internal teams manage payroll operations and exceptions. |

| Best for Compliance-Heavy Companies | Excellent — ensures error-free statutory compliance across states. | Good — depends on how effectively internal teams manage compliance updates. |

| Tech Adoption Needed? | Minimal — technology is managed by the outsourcing partner. | Required — teams must actively use payroll software. |

| Turnaround Time | Defined timelines based on SLAs. | Instant processing once payroll data is validated. |

| Employee Self-Service | Usually available depending on the outsourcing provider. | Always available in modern HR & payroll software. |

| Upfront Investment | Low | Low for cloud-based payroll; high for on-premise payroll systems. |

Future of Payroll Outsourcing in India (2025–2030 Trends)

Payroll outsourcing is gradually evolving as Indian companies expand into new states and depend increasingly on digital systems. As businesses grow, they desire fewer manual tasks, more control, and simpler procedures. And because payroll complexity keeps increasing each year, organisations are now looking for partners who can deliver not just processing support but strategic value. Consequently, the next five years will redefine how Payroll Outsourcing Services and Payroll Outsourcing Companies in India operate.

1. Deep Automation Across Payroll Cycles

In the coming years, payroll will depend a lot more on automation. Most of the routine work, like checking attendance, calculating salaries, and filing statutory returns, will be handled by systems and service providers. This will reduce manual effort and delays and make payroll easier to manage. It will also help companies handle teams spread across different locations without losing accuracy or control.

2. AI-Driven Compliance Management

Over the next few years, AI is expected to become a regular part of how payroll works. By 2030, it will help make sense of new labour laws, point out possible compliance risks, and suggest what needs to be fixed. Since regulations in India keep changing, AI-based payroll systems will help businesses stay prepared in advance instead of reacting only after issues come up.

3. Rise of Employer of Record (EOR) + Payroll Bundles

India is already witnessing a surge in EOR adoption. And as companies expand into new states or hire remote workers, combining EOR with managed payroll will become the preferred model. This integrated strategy will guarantee 100% statutory governance while enabling companies to enrol people from any location.

4. Cloud-First Payroll Operations

Furthermore, most organisations will move to cloud-based payroll operations for faster access, real-time updates, and secure collaboration across locations. Adoption of cloud computing will also facilitate hybrid work arrangements, increasing the scalability and resilience of payroll.

5. Strategic Outsourcing Instead of Just Processing

Over time, businesses will start expecting more from their payroll partners than just salary processing. They will look for guidance on compliance, clarity on costs, and useful insights about their workforce. Payroll will no longer be handled in the background as a usual task. It will gradually develop into a tool that aids businesses in better planning and decision-making.

Conclusion: Why Payroll Outsourcing Is Becoming a Strategic Priority in India

Payroll outsourcing is no longer just a back-end decision for Indian businesses. Managing payroll internally frequently results in delays, mistakes, and increased stress because compliance regulations are always changing and teams are dispersed throughout several states. Outsourcing begins to make sense at this point. Businesses receive more than simply a tool when they work with an external payroll partner.

To guarantee that pay cheques are processed efficiently each month, real payroll specialists collaborate with technology. This reduces day-to-day stress for HR teams and brings more stability to operations, allowing HR to focus on people, planning, and growth instead of constant payroll follow-ups. As remote and multi-location work becomes common, businesses also need payroll systems that can scale easily. Payroll outsourcing helps companies grow without worrying about compliance gaps or internal limitations. Whether it is a startup, an MSME, or a large enterprise, outsourcing payroll helps improve accuracy, compliance, and long-term operational confidence.

Frequently Asked Questions

Why do companies outsource payroll services?

Companies outsource payroll to reduce administrative workload, eliminate compliance risks, improve accuracy, and gain access to expert support and technology without managing payroll in-house.

What tasks are covered under payroll outsourcing services?

Most payroll outsourcing providers handle salary calculations, PF/ESI/PT/TDS compliance, challan & return filing, reimbursements, full & final settlements, payslip generation, and employee query management.

Is payroll outsourcing suitable for small businesses?

Yes. Small businesses often benefit the most because outsourcing eliminates the need for a full HR or finance team, reduces cost, and ensures error-free, compliant payroll every month.

How much do payroll outsourcing services cost in India?

Cost typically depends on the number of employees, scope of services, technology offered, and compliance requirements. Pricing usually ranges from per-employee monthly charges to bundled service fees.

Is payroll outsourcing safe and secure?

Reputable payroll outsourcing companies use encrypted systems, access controls, and strict data governance policies to protect employee and financial data. Always choose a provider with strong data-security standards.

What compliance tasks do payroll outsourcing companies handle?

Payroll outsourcing partners usually manage statutory requirements like PF, ESI, PT, TDS, Form 24Q, payroll registers, challans, digital filings, and audit-ready compliance records.

Can payroll outsourcing integrate with HRMS or attendance software?

Indeed. For smooth data flow and automated processing, the majority of contemporary vendors offer connections with HRMS platforms, biometric systems, leave modules, and attendance tools.

How does payroll outsourcing improve accuracy?

Outsourcing uses automation, standardized workflows, compliance rules, and expert verification to eliminate manual errors in attendance data, tax calculations, and salary payouts.

What should I look for when choosing a payroll outsourcing provider?

Choose a partner with strong subject experience, compliance capabilities, secure technology, clear pricing, and the flexibility to scale with your business needs.