What is Loss of Pay in Salary? Meaning and how to Calculate

LOP arises when an employee opts for an approved leave of absence from their work duties but does not receive their usual salary or wages...

Gratuity – Calculation, Eligibility and Taxation Rules

In employment, compensation extends far beyond just monthly salaries or hourly wages. Among the multiple components of an employee’s...

Advance Tax – Calculation & How to Pay Advance Tax Online?

Advance tax payment is a system where taxpayers can spread their tax obligations by making payments in multiple instalments throughout the...

Conveyance Allowance – Meaning, Limit, and Calculation

Conveyance allowance, commonly provided by organisations globally, is a prevalent employee benefit in India. Often referred to as travel...

Leave Travel Allowance (LTA) – Rules, Claims, and Eligibility

LTA is a financial benefit for all employees. It helps cover domestic travel expenses for two trips in four financial years. The LTA amount...

House Rent Allowance (HRA) – Exemption And Tax Deduction

House Rent Allowance (HRA) constitutes a vital element within the compensation structure of numerous professionals. Notably, HRA enjoys...

Professional Tax – Meaning, Slabs & Exemptions

If you go through all your payslips, you will notice the reduction with the name Professional Tax. The state you live in is responsible for...

Special Allowance – Taxation & Calculation

Special allowances emerge as pivotal components designed to cater to diverse needs within organizations. These designated sums of money...

Salary Breakup Structure – Format & Calculation

A salary breakup structure, also known as a CTC (cost-to-company) breakup structure, is a comprehensive breakdown of the various components...

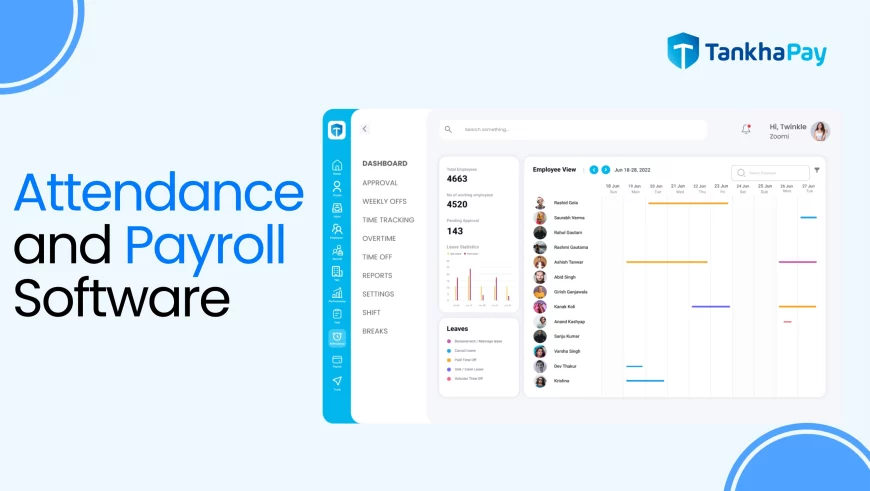

Attendance & Payroll: A Complete Guide

Attendance & Payroll are critical to every organisation, no matter what their size or scale of operation or which industry they operate...