What is payroll software in India?

Payroll software in India is a digital system designed to automate, manage, and streamline employee salary processing while ensuring strict adherence to Indian labour laws and tax regulations. In simple terms, it helps businesses calculate salaries, manage deductions, generate payslips, and stay compliant—without relying on manual spreadsheets or error-prone processes.

In India, payroll is much more than just compensation calculation. A good payroll software must accurately manage statutory components including PF, ESIC, Professional Tax, TDS, LWF, bonus payments, gratuity provisions, and leave-related adjustments. Because these rules differ by state and change regularly, contemporary HR payroll software is crucial for keeping firms compliant and audit-ready.

How does payroll software in India work?

Payroll software in India works by automating the entire salary processing cycle while ensuring strict compliance with Indian labour and tax laws. Instead of managing payroll manually across spreadsheets and emails, businesses use HR payroll software to centralise employee data, calculate salaries accurately, and generate compliant payroll outputs every month.

To better understand this, let us look at how payroll software works in a real-world Indian business environment.

Step 1: Employee & Salary Structure Setup

The process begins with configuring employee details within the payroll software. This includes personal information, PAN and Aadhaar details, bank accounts, and employment type.

At the same time, salary structures are defined based on Indian payroll rules. Basic salary, HRA, allowances, bonuses, deductions, and reimbursement components are accurately mapped to ensure tax efficiency and regulatory compliance. Once put up, this data serves as the foundation for accurate payroll processing.

Step 2: Attendance, Leave & Variable Data Capture

Next, the payroll software pulls monthly inputs such as attendance, leaves, overtime, incentives, and loss of pay. Most modern HR payroll software integrates directly with attendance and leave management systems, reducing manual errors.

As a result, salary calculations automatically adjust based on actual working days, approved leaves, or variable pay components—without repeated manual intervention.

Step 3: Automated Salary Calculation

Once the inputs are complete, payroll software in India calculates gross compensation, deductions, and net pay instantly. This involves accurate calculations for:

- Provident Fund (PF)

- ESIC

- Professional Tax

- Income Tax (TDS)

- Other statutory or company-specific deductions

Because the rules are pre-configured, payroll software ensures accuracy while adapting to salary revisions, arrears, bonuses, or mid-cycle changes seamlessly.

Step 4: Statutory Compliance & Tax Processing

One of the most important functions of payroll software is compliance management.The technology automatically applies the most recent statutory requirements and tax slabs in India.

Payroll software also generates statutory challans, return-ready reports, and compliance summaries for PF, ESIC, TDS, PT, and other relevant rules. This dramatically decreases compliance risks and ensures organizations remain audit-ready all year.

Step 5: Payslip Generation & Salary Disbursement

After final approval, payroll software generates digital payslips that clearly show earnings and deductions. Simultaneously, bank advice files are created to ensure proper wage disbursement.

Employees may now access payslips, tax information, and salary history through secure self-service portals, which improves openness and trust in payroll operations.

Step 6: Payroll Reporting & Audit Readiness

Finally, payroll software generates complete information for the HR, finance, and management departments. These include salary summaries, expense analyses, statutory registers, and audit reports.

Since all payroll data is stored securely and systematically, businesses can respond quickly to audits, employee queries, or regulatory inspections without scrambling for information.

Why This Workflow Matters for Indian Businesses

In a country with complicated labor regulations and frequent regulatory changes, payroll software in India makes payroll easier by combining automation, accuracy, and compliance into a single solution. Whether you’re a startup, a small business, or a large corporation, using reliable payroll software allows you to manage payroll efficiently while reducing operational and legal concerns.

Why do Indian businesses need payroll software today?

India doesn’t have a single payroll playbook. Workforces span factories, field roles, and remote teams; labour rules shift by state; policies keep changing; employees expect transparency. In that context, payroll software in india isn’t just a payslip engine—it’s the system that builds trust, keeps PF/ESI/PT in check, and gives leaders the control to grow without surprises. It aligns closely with the objectives of HRM, helping organizations maximize workforce potential while staying compliant. Modern payroll platforms also minimize everyday operational issues such as a miss punch in attendance, ensuring accuracy in time tracking and payroll calculations.

At its core, payroll software delivers three practical benefits that every HR team cares about.

Here’s why payroll software has become indispensable for Indian businesses:

- Regulatory Complexity

From GST and Income Tax to PF, ESIC, gratuity, and the upcoming labour codes, compliance in India is a moving target. Modern hr payroll software keeps pace with every statutory update, so businesses stay compliant effortlessly—without the last-minute scramble. - Scalability for Growing Businesses

Whether a company has 50 employees or 50,000, payroll software scales effortlessly. As organisations expand across states or industries, the software adapts without adding overheads. - Employee Satisfaction & Retention

Timely and accurate salary payments build employee trust. Self-service features like payslip downloads, tax declarations, and reimbursement tracking improve transparency and employee experience. - Cost & Time Efficiency

By automating repetitive tasks, HR teams save hundreds of hours each year, allowing them to focus on strategic functions like talent engagement and workforce planning.

In short, payroll software India is more than a compliance tool — it’s a strategic enabler that helps businesses stay future-ready.

What are the Key Features of Payroll Software in India?

Modern payroll software in India is no longer limited to salary calculation. Today, businesses require HR payroll software that can manage compliance, automate workflows, and deliver a seamless employee experience—especially in a country with complex labour laws and multi-state regulations.

The right payroll software should act as a single source of truth for salary processing, statutory compliance, attendance data, and employee records. Below are the core features every Indian business must look for when evaluating payroll software.

Why These Features Are Critical in India

HR payroll software in India must handle state-specific compliance, several wage structures, and frequent regulatory modifications, in contrast to traditional payroll solutions. Organisations typically encounter payroll delays, incorrect deductions, and compliance issues in the absence of automated features.

A robust payroll software ensures:

- Consistent payroll accuracy

- Seamless coordination between HR, finance, and compliance

- Audit-ready payroll data at all times

- Better employee trust through transparent payroll processes

| Feature | What It Covers | Why It Matters for Indian Businesses |

|---|---|---|

| Salary Processing & Payroll Automation | Monthly salary calculation, earnings, deductions, incentives, bonuses, arrears, and loss-of-pay adjustments | Ensures accurate, on-time payroll processing while reducing manual errors and rework |

| Statutory Compliance Automation | PF, ESIC, TDS, Professional Tax, LWF, gratuity, bonus calculations, and returns | Keeps businesses compliant with constantly changing Indian labour and tax laws |

| Tax Calculation & Payroll Tax Management | Income tax computation, tax regime comparison, exemptions, deductions, and Form 16 preparation | Helps employees plan taxes correctly while protecting employers from penalties |

| Geo Smart Attendance & Leave Management | Syncs attendance, shifts, overtime, leaves, and holidays directly with payroll | Eliminates data mismatch between HR, attendance, and payroll systems |

| Employee Self-Service (ESS) | Payslip access, tax declarations, leave balances, investment proofs, and personal data updates | Reduces HR dependency and improves transparency for employees |

What to Look Beyond Basic Features

Although the aforementioned elements serve as the basis, top payroll software providers also provide:

- Multi-location and multi-entity payroll support

- Integration with HRMS and accounting systems

- Secure cloud-based access and data encryption

- Scalable payroll workflows for growing businesses

This is why businesses increasingly prefer payroll software in India that combines technology, compliance expertise, and scalability—rather than standalone payroll tools.

For more information about Cloud Based Payroll Software for Accountants

Which Statutory Compliances Should Payroll Software Handle in India?

One of the most important duties for any firm in India is overseeing statutory compliance. Manual payroll computations can result in mistakes, fines, and operational delays due to the constant changes to labour laws, tax regulations, and state-specific requirements. In addition to facilitating multi-state labor law compliance and year-end filings like Form 16 and PF/ESIC reports, payroll software in India assists companies in automating compliance for PF, ESIC, Professional Tax (PT), TDS, and Labor Welfare Fund (LWF). By using HR payroll software or a payroll outsourcing services provider, companies can ensure accurate deductions, timely filings, and full compliance, freeing HR and finance teams to focus on strategic business priorities.

| Compliance Type | Employee Contribution | Employer Contribution | Key Notes / Thresholds |

|---|---|---|---|

| Provident Fund (PF) | 12% of Basic + DA | 12% of Basic + DA (3.67% PF, 8.33% Pension Fund) | Required for workers making up to ₹15,000 per month; automated challan creation is advised |

| Employee State Insurance (ESIC) | 0.75% of gross wages | 3.25% of gross wages | Applies to employees earning up to ₹21,000/month; software should generate monthly returns |

| Professional Tax (PT) | Varies by state, e.g., ₹200/month in Maharashtra for salaries above ₹15,000 | Paid by employer as per state law | Payroll software should handle state-specific PT slabs automatically |

| Tax Deducted at Source (TDS) | As per Indian Income Tax Slabs | N/A | Software calculates TDS including exemptions and deductions; generates Form 16 annually |

| Labour Welfare Fund (LWF) | ₹10–₹30/month (varies by state) | Employer contribution as per state | Software tracks contributions and generates periodic filings |

| State-wise Labour Law Compliance | N/A | N/A | Minimum wages, bonus, gratuity, leave encashment vary by state; payroll software ensures correct calculations |

| Year-end Filings | N/A | N/A | Form 16, PF & ESIC annual returns; software should generate pre-filled forms for filing |

| Audit & Regulatory Support | N/A | N/A | Detailed audit logs, compliance reports, alerts for statutory deadlines |

1. Provident Fund (PF) Contribution

PF is a mandatory retirement benefit scheme for employees in India. To guarantee long-term financial security, both employers and employees contribute a set percentage of their base pay and dearness allowance. These computations must be automated by payroll software, which must also produce challans and enable easy online submission through the EPFO portal.

- Employee contribution: 12% of basic salary + dearness allowance

- Employer contribution: 12% of basic salary + dearness allowance (3.67% to PF, 8.33% to Pension Fund)

2. Employee State Insurance (ESIC)

ESIC provides medical and cash benefits to employees earning below ₹21,000 per month. Accurate tracking of eligibility, contribution calculations, and monthly return generation is critical for compliance. Payroll software ensures this process is automated and error-free.

- Employee contribution: 0.75% of gross monthly wages

- Employer contribution: 3.25% of gross monthly wages

3. Professional Tax (PT)

PT is a state-specific tax that varies by state and is imposed on salaried workers. Payroll software must generate statutory reports for simple compliance and automatically apply the appropriate PT slab based on the employee’s location and salary.

Example: ₹200/month in Maharashtra for salaries above ₹15,000

4. Tax Deducted at Source (TDS)

TDS is deducted from employee salaries based on income tax slabs in India. Payroll software calculates TDS, considers exemptions and deductions under Sections 80C, 80D, HRA, etc., and generates Form 16 annually for employees.

- Income tax on salary as per Indian Income Tax slabs

- Automatic computation for exemptions, deductions, and Form 16 generation

5. Labour Welfare Fund (LWF)

LWF contributions are modest but required in a number of jurisdictions. Payroll software makes quarterly filings, accurately calculates amounts, and keeps track of both business and employee contributions.

- Contribution rates vary by state (typically ₹10–₹30 per employee/month)

6. State-wise Labour Law Compliance

States in India have different labour regulations pertaining to minimum wages, bonuses, gratuities, and leave encashment. Payroll software ensures compliance by incorporating these rules automatically for multi-state operations.

- Minimum wages, bonus, gratuity, and leave encashment compliance

- Automated application of state-specific rules

7. Year-end Compliance & Filings

Employers are required to file many statutory returns at the end of the year. Payroll software automates computations, pre-fills paperwork, and ensures timely submission to avoid fines. Payroll software makes this process easier by pre-filling paperwork, automating computations, and assuring timely submissions to avoid fines.

- Form 16: Annual TDS certificate for employees

- PF & ESIC annual returns through online portals

8. Audit & Regulatory Support

Payroll software should maintain detailed logs and reports to support internal and statutory audits. It should also provide regulatory alerts for upcoming compliance deadlines, ensuring no penalties or legal issues.

- Detailed audit logs and reports

- Automated regulatory alerts for compliance deadlines

What Are the Common Payroll Challenges Faced by Indian Companies?

Managing payroll in India is no small feat. Businesses often face regulatory, operational, and technological challenges that can make payroll processing complex and error-prone.

1. Frequent Regulation Changes:

One of the biggest hurdles is the constant updates to PF, ESIC, TDS slabs, professional tax, and state-specific labour rules. HR and finance teams must stay informed, and without the right tools, manual tracking can lead to mistakes, non-compliance, and penalties.

2. Multi-State Compliance Issues:

Businesses that operate in several states must adhere to different regulations on minimum wages, professional taxes, labor welfare benefits, and bonus payments. Payroll processing by hand across several sites is time-consuming and increases the risk of errors, late payments, and legal problems.

3. Payroll Errors & Penalties:

Calculation errors, forgotten deductions, and missed filings are common outcomes of manual payroll procedures. Particularly in larger businesses with intricate payroll systems, even minor mistakes can quickly turn into hefty fines.

4. Data Mismatch Between HR & Finance:

Differences in HR and finance records—such as leave, attendance, or salary data—make reconciliation difficult. Manually fixing mismatches consumes time and increases the likelihood of errors.

The good news is that adopting HR payroll software in India or partnering with a reliable payroll outsourcing services provider like TankhaPay can effectively tackle these challenges. Automated systems ensure compliance with the latest regulations, manage multi-state payroll effortlessly, reduce errors, and centralize HR and finance data—all while saving time and improving accuracy.

Payroll Software vs Traditional Payroll Methods

Manually managing payroll for Indian businesses may be dangerous, time-consuming, and error-prone, especially as compliance requirements rise and organisations move across states. In contrast, modern payroll software in India automates calculations, ensures compliance, and provides actionable insights. The following comparison highlights the key differences between traditional payroll methods and using payroll software:

| Feature / Factor | Traditional Payroll Methods | Payroll Software in India |

|---|---|---|

| Accuracy | High risk of human errors; manual calculations often lead to mistakes in salaries, deductions, and benefits | Automated calculations ensure precise salary processing, deductions, and statutory compliance |

| Cost | Lower upfront, but hidden costs include overtime for payroll staff, error corrections, penalties, and delays | Subscription or one-time cost offsets manual effort, reduces penalties, and increases operational efficiency |

| Compliance Risk | High risk due to constantly changing PF, ESIC, TDS, PT, and labour regulations | In-built statutory compliance updates ensure adherence to all central and state-specific laws |

| Scalability | Difficult to scale as employee count grows or multi-location operations increase | Effortlessly handles multi-state and multi-employee payroll with minimal manual intervention |

| Reporting & Insights | Limited reporting; requires manual consolidation and error-prone audits | Detailed reports, analytics, and dashboards provide actionable insights for HR and finance teams |

Payroll Software vs Payroll Outsourcing Services: Which Is Better?

Businesses in India frequently have to decide whether to use payroll outsourcing services or invest in payroll software when assessing payroll administration options. Both strategies have distinct benefits, and the best choice will rely on your company’s size, operational priorities, and compliance requirements.

To assist you in making an informed choice, here is a thorough comparison:

| Feature / Factor | Payroll Software in India | Payroll Outsourcing Services / Managed Payroll |

|---|---|---|

| Control & Visibility | Full control over payroll data, configurations, and processing. HR teams manage rules and approvals directly. | Limited control; the provider manages payroll, but you may access reports and dashboards. |

| Cost Implications | One-time or subscription-based software costs. Lower upfront costs for small teams but may require in-house HR expertise. | Typically higher monthly fees, but reduces the need for internal payroll staff and training costs. |

| Compliance Responsibility | Business retains full responsibility for statutory compliance, including PF, ESIC, PT, TDS, and multi-state regulations. | The outsourcing provider handles compliance, filings, and audit support, minimizing the risk of penalties. |

| Scalability & Flexibility | Scalable with cloud-based software, but requires internal HR to update processes and manage growth. | Highly scalable; providers can manage multi-state, multi-location, and diverse workforce types. |

| Accuracy | Dependent on internal HR knowledge and software configuration; errors may occur without proper tracking. | Benefit from professional payroll expertise, regular audits, and accurate reporting. |

| Integration with Other Systems | Can integrate with HRMS ess, attendance, and accounting software; setup depends on IT resources. | Usually comes as a turnkey solution with existing integration capabilities. |

| Ideal For | Startups, small businesses, or companies with strong internal HR teams looking for full control. | Growing businesses, MSMEs, and large enterprises wanting to offload payroll complexity and compliance risks. |

Key Takeaways:

- If your business wants full control over payroll operations and has the internal expertise to manage compliance, investing in payroll software in India is ideal.

- If accuracy, compliance, and time savings are your top priorities, payroll outsourcing companies like TankhaPay can provide comprehensive support, including statutory compliance, multi-state payroll, and automation.

- Many businesses adopt a hybrid approach, using payroll software for internal operations while outsourcing complex compliance or high-volume payroll tasks to a professional provider.

Conclusion:

The goals of your business, the size of your workforce, and your compliance requirements should all be taken into account when choosing between payroll software and payroll outsourcing services.TankhaPay provides a combined solution of managed payroll services and HR payroll software for companies seeking the best of both worlds, guaranteeing accurate, compliant, and scalable payroll operations.

Types of Payroll Software in India

Businesses in India can choose from a range of payroll software choices based on their size, workforce complexity, and operational requirements. Understanding the various types of payroll software will help you choose a solution that guarantees correct salary processing, statutory compliance, and efficient payroll management.

Here are the main types of payroll software commonly used in India:

1. Cloud-Based Payroll Software

Cloud based payroll software allows organizations to manage their payroll online, removing the need for on-premise equipment. It enables real-time access to employee data, automated computations, and secure storage, making it perfect for businesses with remote teams or locations. Compliance, tax standards, and labor laws are all automatically updated, reducing the need for manual involvement and errors.

2. On-Premise Payroll Systems

On-premise payroll systems are installed locally on a company’s servers and managed internally by the HR or IT team. This type of software gives users complete control over payroll data and customization choices, but it requires in-house expertise to operate, update, and assure compliance with Indian labor standards.

3. HRMS with Payroll

Many modern HRMS platforms combine payroll processing with essential HR capabilities including as attendance, leave management, performance tracking, and recruitment. Using HRMS with payroll ensures that data flows seamlessly between the HR and payroll departments, reduces data mismatch errors, and improves reporting and analytics for strategic decision-making.

4. Payroll Software with Managed Services

Some payroll software is coupled with managed payroll services, creating a hybrid solution. Payroll software automates payroll procedures, while expert teams manage compliance, multistate payroll, tax filings, and statutory reporting. This method is perfect for firms that want to combine technological efficiency with expert support, particularly those with big or distributed workforces.

Conclusion:

Choosing the right type of payroll software in India depends on your business requirements, workforce complexity, and compliance needs.For startups and small enterprises, cloud-based software or HRMS with payroll may suffice, however bigger organizations or corporations with multi-state operations can benefit from software with managed payroll services to ensure accurate, compliant, and scalable payroll processes.

Who should use Payroll Software in India?

Who Should Use Payroll Software in India

Payroll software in India is no longer simply a luxury for huge corporations; it has evolved into an essential tool for businesses of all kinds to ensure payroll compliance, accuracy, and efficiency. Here’s a breakdown of which firms will profit the most:

1. Startups

Startups usually operate with lean teams and little resources. Payroll software enables firms to automate wage computation, regulatory compliance, and reporting, freeing up HR and finance staff to focus on growth and core operations. With cloud-based or HRMS-integrated payroll systems, even small teams can manage payroll for a growing workforce without errors or delays.

2. MSMEs (Micro, Small, and Medium Enterprises)

MSMEs confront particular obstacles, such as limited payroll expertise and employees spread across multiple states. Payroll software offers accurate payroll processing, timely statutory filings (PF, ESIC, PT, TDS), and easy scalability as the firm grows. Managed payroll services linked with software can make compliance and reporting easier for MSMEs.

3. Large Enterprises

Large firms with thousands of employees require sophisticated payroll solutions capable of managing complex salary structures, multi-location compliance, and huge transaction volumes. Payroll software in India can automate massive payroll runs, track employee benefits, and provide advanced analytics, resulting in more efficient operations and a lesser risk of errors or penalties.

4. Multi-Location Companies

Payroll is rarely simple for companies that operate in several Indian states. distinct places frequently have distinct statutory deadlines, professional tax slabs, and employment laws. Manually handling all of this might soon result in compliance issues and discrepancies.

In India, payroll software enables firms with multiple locations to unify their operations under a single system. It enables HR and finance departments to handle payroll centrally while taking state-specific regulations, deductions, and reporting obligations into consideration. Companies benefit from more visibility, cleaner payroll data, and far fewer regional compliance issues as a result.

5. Contract-Heavy Organizations

Compared to standard employment models, businesses that mainly rely on contractual, temporary, or project-based workers must deal with a significantly different payroll system. Manual payroll is challenging to maintain due to variable working hours, varying rewards, and various legal requirements.

This complication is reduced by using payroll software. It guarantees the proper handling of statutory deductions, supports both on-roll and off-roll employees, and modifies payouts according to attendance or project terms. Regardless of how dynamic the employment structure is, this makes payroll more efficient, predictable, and compliant.

Conclusion:

In India, payroll software has emerged as a viable option for companies looking to streamline payroll processes and maintain compliance with minimal effort. The appropriate payroll system provides clarity and control, whether a major organization managing intricate salary systems, an MSME seeking to lessen compliance burden, or a startup attempting to create effective processes. It is equally helpful for multi-location companies handling state-specific regulations and for companies with contract-heavy workforces that require flexible yet accurate payroll administration. Payroll software lets businesses concentrate more on expansion and less on payroll issues by automating repetitive processes and lowering reliance on manual checks.

Key roles of payroll software for small business & MSMEs in India

For MSMEs and small business, payroll isn’t just a monthly admin job — it sits at the heart of how the business runs. Small HR teams and tight budgets mean manual payroll creates risk, delays, and wasted hours. A reliable Payroll Software in India changes that: it prevents compliance slip-ups, ensures people are paid accurately and on time, frees your team from repetitive work, and makes scaling far less painful. Here’s how it helps in practice.

1. Ensures Compliance Without Complexity

MSMEs often struggle to stay updated with India’s complex and ever-changing labour laws. Payroll software automates statutory deductions like PF, ESIC, PT, and TDS — helping small businesses avoid penalties and focus on growth.

2. Cuts Down on Manual Effort

Payroll no longer needs to mean endless spreadsheets and late nights. With the right software, MSMEs can handle salary processing in minutes instead of hours. This not only reduces errors but also frees up HR and finance teams to spend their energy on bigger priorities like employee growth and business strategy.

3. Optimises Costs

Hiring a large HR or finance team isn’t always feasible for MSMEs. Payroll software reduces overhead by cutting down manpower requirements, delivering cost efficiency without compromising accuracy.

4. Boosts Employee Trust

Delayed or inaccurate salary payments can damage employee morale. A reliable payroll system ensures timely, error-free payouts, giving employees confidence and trust in the organisation.

5. Scales With Business Growth

As MSMEs expand, the workforce grows, and so do compliance complexities. Payroll software provides the flexibility to easily onboard new employees and manage multi-location operations without disruption.

For MSMEs, Payroll Software in India goes beyond being just a system for salary disbursement. It helps them stay compliant with ever-changing laws, strengthens their credibility with employees and stakeholders, and frees up leaders to focus on growing the business instead of getting stuck in administrative tasks.

How to Choose the Best Payroll Software in India

Selecting the best payroll software in India involves more than just technology; it also involves long-term scalability, cost, and compliance. Indian businesses must deal with a variety of worker structures, complicated labour laws, and frequent regulatory changes. The table below helps you evaluate payroll software based on practical, India-specific criteria rather than generic feature lists.

Evaluation Criteria |

What to look for in Payroll Software |

Why It Matters in India |

|---|---|---|

| Statutory Compliance Coverage | Built-in handling of PF, ESIC, TDS, Professional Tax, LWF, gratuity, and state-wise labour laws | Non-compliance leads to penalties, notices, and audits. Payroll software must stay updated with Indian regulations automatically |

| Scalability & Workforce Flexibility | Ability to manage startups, MSMEs, and large enterprises with full-time, contractual, and gig workers | Indian companies scale quickly and often manage mixed workforce types |

| Multi-State Payroll Support | State-specific PT rules, ESIC thresholds, and labour law variations | Critical for businesses operating across multiple Indian states |

| HRMS & Accounting Integration | Seamless integration with attendance, leave, HRMS, ERP, and accounting systems | Prevents data mismatch between HR, payroll, and finance teams |

| Accuracy & Automation | Automated salary calculations, arrears, bonuses, variable pay, and deductions | Reduces manual errors and payroll rework every month |

| Data Security & Access Control | Role-based access, encryption, audit trails, and secure data storage | Payroll data is sensitive and must meet enterprise-grade security standards |

| Reporting & Audit Readiness | Payslips, statutory reports, challans, registers, and audit-ready exports | Essential during statutory audits, funding rounds, and compliance reviews |

| Implementation & Migration Support | Assisted onboarding, historical data migration, and parallel payroll runs | Smooth transition avoids payroll disruptions during changeover |

| Vendor Credibility & Experience | Proven track record, India-specific payroll expertise, and compliance knowledge | Local expertise matters more than generic global tools |

| Support & Service Reliability | Dedicated support, clear escalation paths, and compliance advisory | Payroll delays or errors directly impact employee trust |

| Pricing Transparency | Clear per-employee pricing with no hidden compliance or support costs | Helps control payroll budgets, especially for MSMEs |

Checklist: What to Evaluate Before Buying Payroll Software

It is advisable to all the businesses who looking to buy HR Payroll software, to assess payroll software in India in three categories: functionality, pricing transparency, and regulatory compliance. This thorough checklist enables firms to make informed, risk-free decisions while avoiding potential payroll or compliance difficulties.

Feature Evaluation Checklist

|

Feature Area |

What You Should Check |

|---|---|

|

Salary Processing |

Can the payroll software handle complex salary structures, variable pay, incentives, bonuses, arrears, and loss-of-pay accurately? |

|

Attendance & Leave Integration |

Does it integrate seamlessly with attendance, biometric, and leave management systems to avoid data mismatches? |

|

Employee Self Service |

Are employees able to download payslips, Form 16, submit declarations, and track attendance without HR dependency? |

|

Multi Organisation Support |

Can workers submit declarations, track attendance, download payslips, and complete Form 16 without relying on HR? |

|

Reporting |

Does it offer payroll summaries, compliance reports, cost analysis, and audit-ready exports for finance and audits? |

|

Data Security & Access Control |

Are role-based access, data encryption, and audit logs available to safeguard sensitive payroll data? |

Statutory Compliance Checklist (India-Specific)

|

Compliance Area |

Validation Questions |

|---|---|

|

PF & ESIC |

Does the payroll software automatically calculate, generate challans, and support return filings accurately? |

|

TDS & Income Tax |

Can it manage monthly TDS deductions, Form 16 generation, and tax regime changes without manual intervention? |

|

Professional Tax & LWF |

Is state-wise Professional Tax and Labour Welfare Fund compliance covered for all applicable states? |

|

Multi-State Labour Laws |

Can the system adapt to different state rules for minimum wages, working days, and statutory limits? |

|

Year-End Compliance |

Does it support year-end activities like audits, reconciliations, and statutory reports without external tools? |

|

Regulatory Updates |

How frequently does the software update itself with changes in Indian labour laws and tax rules? |

Cost & Pricing Checklist

| Costing Factors | What to Look For |

|---|---|

| Different Pricing Models | Is price per employee, per month, or packaged, and does it match your workforce size? |

| Hidden Charges | Do reports, year-end processing, assistance, and compliance filings come with extra fees? |

| Implementation Fees | Is onboarding, data migration, and setup included or charged separately? |

| Scalability Charges | Will the cost skyrocket if your personnel count or locations expand? |

| Support & AMC | Does ongoing support, compliance assistance, and system upgrades come at an extra cost? |

| Value vs Cost | Does the payroll software offer compliance assurance and automation that justify the investment? |

How Payroll Software Solves Compliance Issues

For most Indian businesses, compliance is often the toughest and most stressful part of payroll management. With multiple statutory requirements, frequent amendments to labour laws, and state-wise regulations, even a minor oversight can lead to penalties, audits, or delays in filings. This is exactly why modern Payroll Software in India has become a mission-critical tool rather than an optional upgrade.

Today’s cloud based payroll software doesn’t just automate salary calculations — it acts like a compliance shield by tracking statutory updates, validating deductions, and maintaining digital audit trails. Here’s how modern HR and payroll accounting software solves compliance challenges end-to-end:

1. Automatic Statutory Updates

One of the biggest advantages of using advanced Payroll Software in India is its ability to stay automatically updated with the latest PF, ESIC, Professional Tax, LWF, and Income Tax changes. The platform intelligently changes rules in real time, saving HR personnel from having to manually read circulars or interpret policies. In addition to lowering compliance risks, this guarantees proper payroll runs every month.

2. Accurate, Law-Compliant Tax Calculations

Tax mistakes have the potential to rapidly escalate into employee discontent or government alerts. Modern payroll accounting software handles complete TDS computations, exemptions, rebates, and tax regimes with precision. It ensures accurate monthly deductions based on the newest tax slabs, eliminating guesswork and drastically reducing payroll disputes.

3. Digital Record-Keeping for Audits

Payroll processing is only one aspect of compliance; another is keeping accurate, easily accessible records. A robust payroll management system securely stores payslips, challans, returns, and statutory documents digitally. During audits, HR and finance teams can retrieve any record in seconds, making audit compliance much simpler and stress-free.

4. State-Wise Rule Configuration

India’s payroll regulations vary widely by state — whether it’s Professional Tax slabs, minimum wages, or Shops & Establishments rules. Modern Payroll Software in India automatically applies state-wise laws based on employee location. This ensures that whether your workforce is in Maharashtra, Delhi, Karnataka, or multiple regions, your payroll remains 100% compliant.

5. Effortless Statutory Filings

Generating and submitting PF ECR files, ESIC returns, or PT challans used to be time-consuming and error-prone. Cloud based payroll software makes this process effortless. With pre-validated data and automated workflows, statutory forms can be generated in one click and submitted without delays — significantly reducing the dependency on external consultants.

6. Reduced Liability & Higher Employee Trust

When salaries, deductions, benefits, and taxes are processed transparently and lawfully, employees feel more secure. At the same time, the business is protected from penalties or compliance defaults. Modern payroll management tools provide clear breakdowns, audit logs, and consistent accuracy — building trust across the organisation.

Payroll Software in India: Trends in 2025-26

Payroll software in India has come a long way from spreadsheets and manual calculations. With businesses scaling faster, compliance frameworks tightening, and employees demanding seamless experiences, payroll software is evolving at an unprecedented pace. By 2025-26, a few clear trends are reshaping how Indian organisations — from startups to enterprises — manage payroll.

1. AI-Powered Payroll Intelligence

Payroll today is more than just catching mistakes. Modern AI-driven Payroll Software in India can learn from historical data, flag unusual patterns in real time, and even forecast future payroll costs. This allows HR and finance teams to move from reactive problem-solving to proactive, strategic planning.

2. Seamless Integration with HRMS & Workforce Systems

Payroll system software no longer works in isolation, It seamlessly interacts with performance appraisals, attendance systems, leave records, and even shift plans. This implies that employees’ hours and work habits are immediately fed into payroll, eliminating errors and saving time for HR departments.

3. Cloud-Based Payroll Platforms

For teams working across offices or from home, accessing payroll should be simple. Cloud-based Payroll Software in India lets employees check their payslips, update tax details, or submit reimbursement requests whenever they need. With mobile apps, all of this can be done right from a phone or tablet, making payroll easier to manage for everyone.

4. Compliance Built Into the System

With India’s evolving labour codes, compliance is no longer an afterthought — it’s a built-in feature of modern payroll systems. Leading platforms now auto-update statutory rules, manage state-specific variations, and generate error-free digital filings. For HR leaders, this means peace of mind and reduced risk of penalties.

5. Employee-Centric Payroll Experience

Payroll is no longer just a backend function. Companies are using payroll software to improve employee satisfaction — offering transparent salary breakdowns, self-service portals, faster reimbursement cycles, and tax-planning tools.

6. Adoption Among MSMEs & Growing Enterprises

While enterprises were the early adopters, MSMEs are now rapidly embracing payroll tech in 2025. With affordable SaaS models, even small businesses can access enterprise-grade payroll capabilities without heavy investment.

Put simply, payroll software is no longer just an “HR tool” — it’s becoming a strategic lever for compliance, cost-efficiency, and employee engagement in Indian businesses.

Integration of Payroll with HRMS & Workforce Management

In today’s fast-moving business environment, payroll software in India can no longer function as a standalone back-office tool. HR leaders and CFOs now expect a connected system where payroll, HRMS, and workforce management work together to deliver accuracy, compliance, and real-time insights. This is why modern organisations increasingly prefer cloud-based payroll software that integrates seamlessly with their HR ecosystem.

Why Integration Matters

When payroll and HR operate in silos, businesses face duplicate data entry, delayed updates, compliance gaps, and higher chances of payroll errors. Integrating HRMS & payroll software removes these friction points. Every action — from hiring to attendance tracking to exit formalities — flows into payroll automatically, ensuring error-free salary processing and better decision-making for leadership teams.

Key Advantages of Payroll-HRMS Integration

HR teams frequently spend hours reconciling data, verifying attendance, double-checking leave balances, and addressing payroll problems when payroll, HRMS, and workforce management function independently. This results in operational inefficiencies and regulatory issues in addition to slowing down payroll cycles. By integrating payroll software with a unified HRMS, organisations get a single, connected system where employee data flows automatically from one function to another. For HR leaders and CXOs, this means fewer errors, faster decision-making, and clearer visibility into workforce costs—all while building a more transparent and reliable payroll process.

1. Single Source of Truth

Attendance, leave information, overtime records, shift schedules, and employee master profiles all go straight into the payroll management module when systems are integrated. This guarantees that every pay cycle is supported by verified data, removes inconsistencies, and minimises manual labour. A single, real-time database becomes crucial for accuracy and cost control in expanding businesses.

2. Statutory Compliance Made Simple

Statutory Compliance is where most businesses face risk. An integrated system automatically tracks PF, ESIC, PT, LWF, bonus, gratuity, and state-wise labour law changes. Because HR activities like transfers, promotions, and exits are synced instantly, the payroll accounting software always has the right data for statutory deductions, challans, and returns.

3. Smarter Workforce Management

Linking payroll with workforce management provides a deeper view of staffing costs, productivity, and role-based efficiency. HR and finance leaders can analyse cost-per-employee, overtime trends, shift effectiveness, and department-level payroll insights — helping them optimise manpower planning and budgeting with far more precision.

4. Employee Empowerment

Integrated systems usually come with self-service capabilities that give employees easy access to payslips, tax projections, investment declarations, reimbursement claims, and attendance regularisation. This reduces HR workload, increases transparency, and improves the overall employee experience — something HR leaders strongly prioritise today.

5. Scalability & Flexibility

As organisations scale — whether from 50 to 500 employees or across multiple locations — an integrated cloud-based payroll software system adapts easily. New offices, new shifts, or new compliance rules can be added without disrupting operations. For fast-growing companies, this flexibility becomes a major competitive advantage.

From Transactional to Strategic

Payroll becomes a strategic role rather than a monthly administrative chore when it is integrated with HRMS and labour management. HR departments devote more effort to culture, growth, and retention and less time to manual validations. Finance teams are able to see personnel costs and compliance exposure in real time. To aid in planning and decision-making, CXOs receive precise dashboards.

Simply put, the future of payroll software in India lies in powerful, integrated platforms that unify payroll, HR, and workforce management under one roof — ensuring accuracy, compliance, scalability, and data-driven decision-making for modern businesses.

Top 15 Payroll Software in India (2025-26)

Processing payroll in India involves much more than paying salaries. Employers must calculate and remit statutory contributions, such as EPF, ESIC, PT, and LWF, among others. Manage professional tax and TDS, and keep up with frequent labour-law updates. Manual spreadsheets and ad-hoc processes increase the risk of calculation errors, missed filings and costly compliance breaches. That’s why organisations of every size—startups, growing SMEs, and large enterprises—are turning to cloud-based payroll software. These platforms bring automation, accuracy, and real-time compliance under one roof, making payroll more innovative and more efficient.

In this guide, we’ve curated the top 15 payroll software in India for 2025, covering solutions that combine compliance-readiness with employee-centric experiences. Whether you’re looking for an entry-level tool or a full-suite HRMS with advanced payroll capabilities, this list will help you choose the right fit for your business.

Quick Comparison Table: Best Payroll Software in India

|

Software

|

Best Suited For

|

Key Strengths

|

Standout Feature

|

|---|---|---|---|

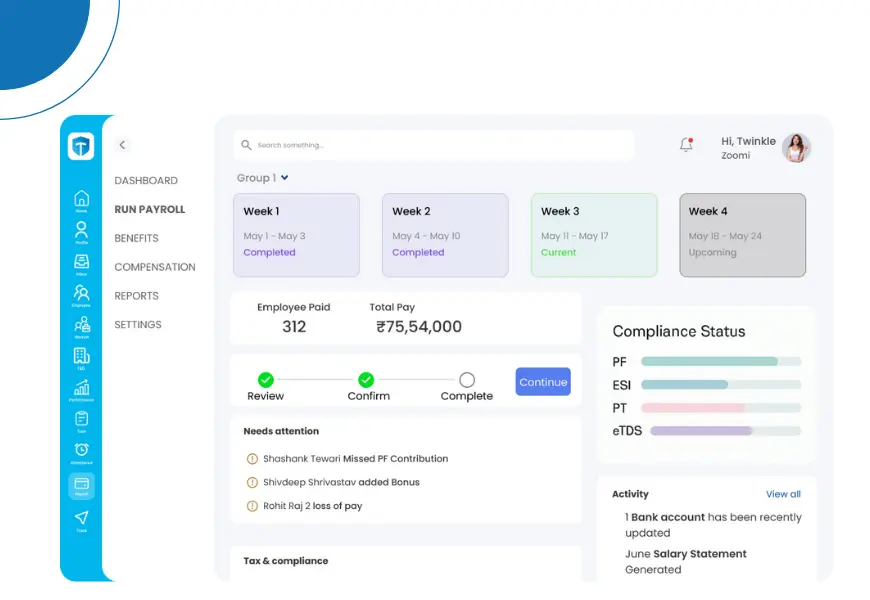

TankhaPay |

Startups, MSMEs, Large Enterprises |

End-to-end HR Tech with payroll and compliance automation, managed HR services, Employer of Record, and Apprenticeship Management. Backed by 25+ years of domain expertise. |

A one-stop platform that combines HR tech with complementary services like EOR and full HR outsourcing—something most payroll tools don’t offer. |

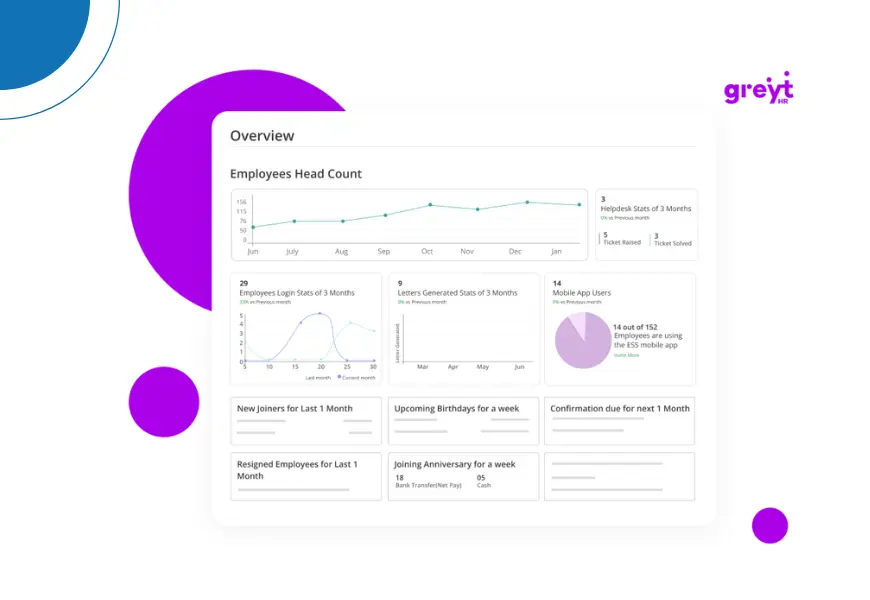

greytHR |

SMEs, Mid-sized Companies |

Known for reliability, compliance-first features, and strong leave & attendance management. |

Trusted by 20,000+ Indian businesses, making it one of the most widely adopted payroll systems. |

Zoho Payroll |

Startups, Growing Teams, Existing Zoho Users |

Intuitive UI, direct integration with the Zoho suite, and ICICI-powered payroll disbursements. |

Perfectly aligned with the Zoho ecosystem, delivering a seamless experience for businesses already using Zoho apps. |

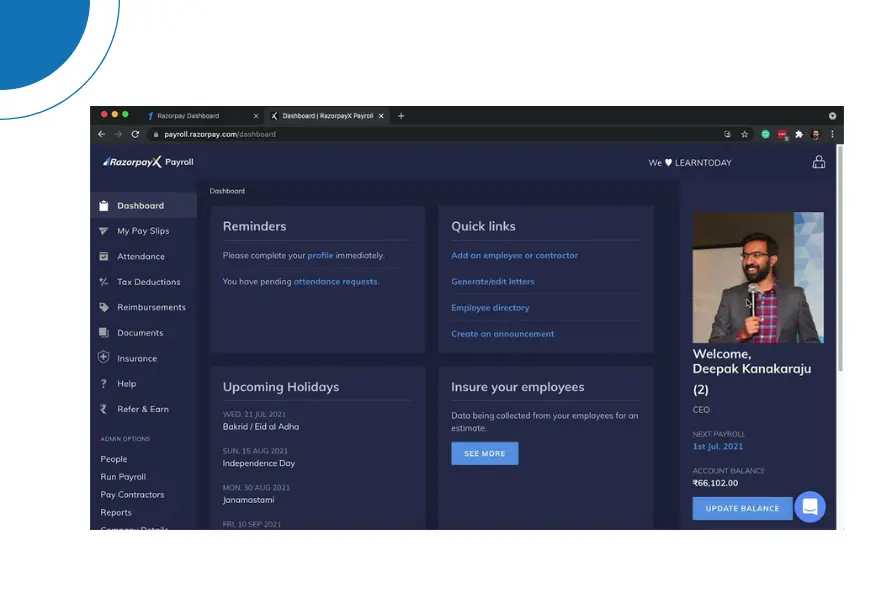

RazorpayX Payroll |

Tech Startups, Small Teams |

Fintech-led salary disbursements, automated PF/ESI/TDS compliance, and employee benefit add-ons. |

Native Razorpay integration, ensuring smooth payouts with banking-grade reliability. |

Keka HR |

Mid-to-Large Enterprises |

Comprehensive HRMS + payroll, mobile accessibility, and high configurability. |

A true employee lifecycle management platform, unifying HR, payroll, and performance under one system. |

Zimyo |

SMBs, Fast-Growing Companies |

Statutory compliance, user-friendly interface, and mobile-first design. |

Quick deployment with an intuitive, modern experience tailored for growing businesses. |

Kredily |

Startups, Budget-Conscious Teams |

Free-to-use payroll and HR tools, time tracking, and PF/ESI/PT compliance. |

Among the best free-tier payroll solutions available, lowering the barrier for startups. |

Saral PayPack |

Consultants, CAs, Multi-Branch Firms |

Specialised compliance support, multi-location payroll, and government-ready form generation. |

Strong audit trail and compliance reporting, ideal for firms managing complex payroll requirements. |

HROne |

Large Enterprises |

AI-driven analytics, multi-company payroll, and enterprise-grade HR stack. |

Enterprise scalability with a future-ready HRMS for complex organisational structures. |

Pocket HRMS |

Small to Mid-Sized Businesses |

Simplifies payroll with an AI chatbot, leave management, and built-in tax filing. |

Utilises its conversational AI assistant to provide engaging staff support. |

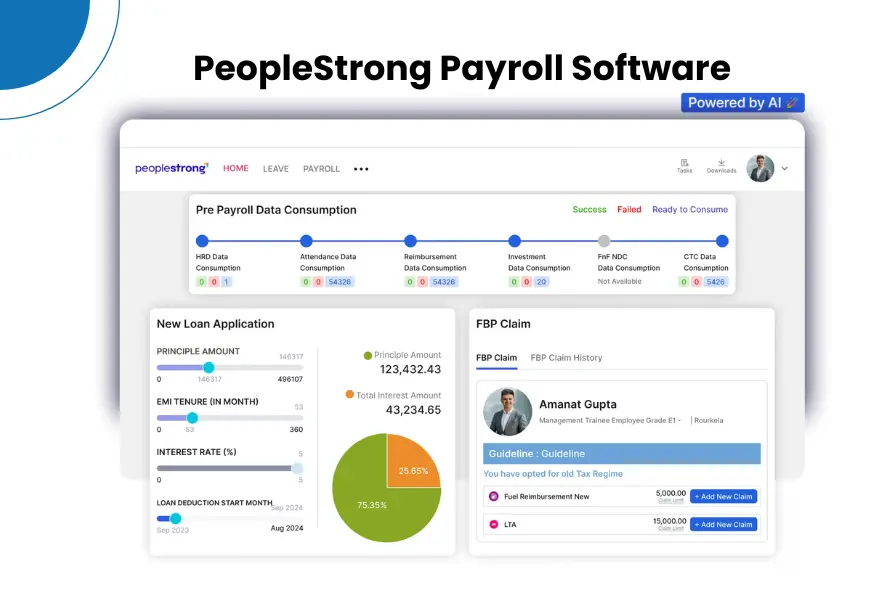

People Strong |

Enterprises, Large Corporates, Multi-Nationals |

Strong compliance framework, scalable payroll automation, and advanced workforce analytics. |

Cloud-native HCM suite with payroll deeply integrated into broader HR functions. |

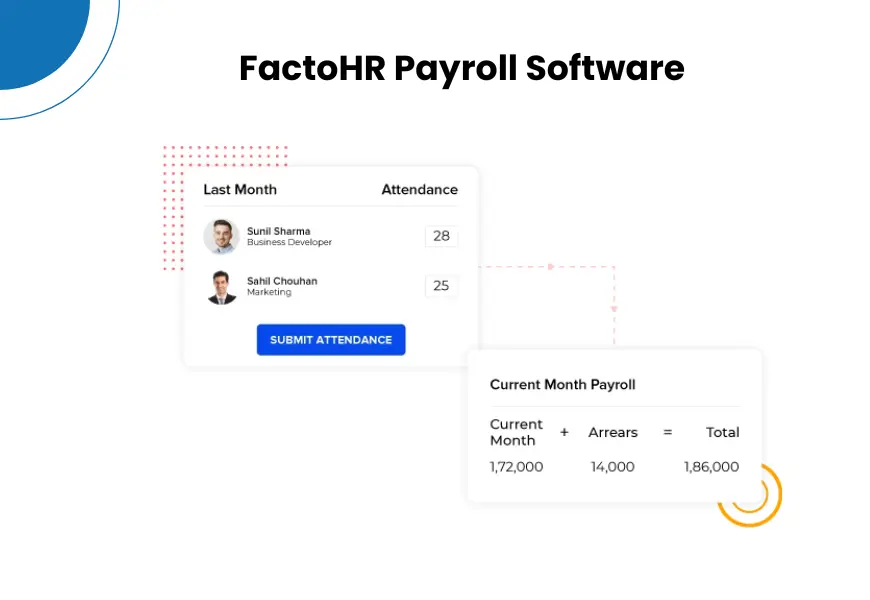

factoHR |

SMEs, Enterprises, Distributed Teams |

Flexible payroll processing, workforce management, and compliance-ready features. |

Robust mobile app for employees and managers, enabling payroll on the go. |

ADP |

Global Enterprises, MNCs |

Global labour management, compliance knowledge, and end-to-end payroll outsourcing services. |

A trusted global payroll partner with scalability for multi-country operations. |

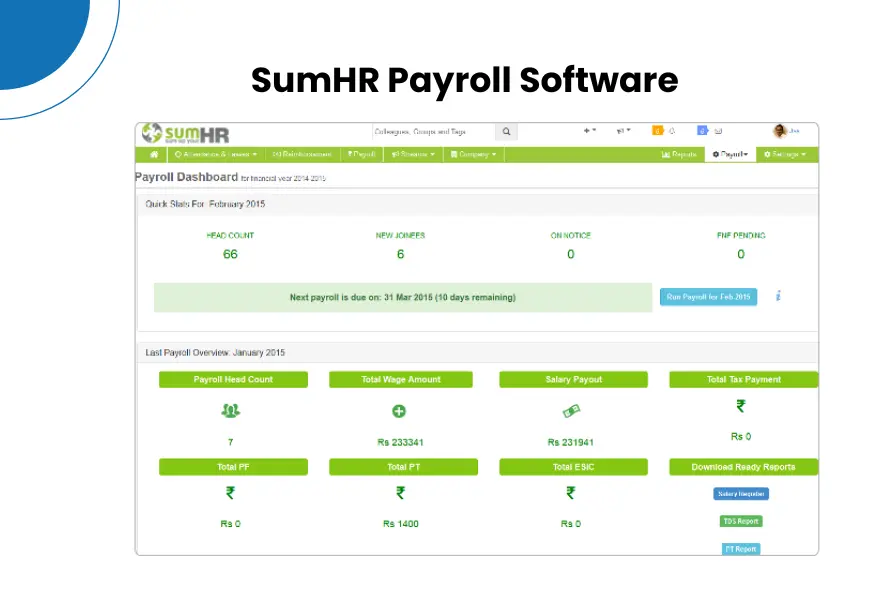

sumHR |

Startups, SMEs, Remote Teams |

Affordable HRMS + payroll solution with easy deployment and compliance automation. |

Transparent pricing model and a simple payroll experience tailored for growing startups. |

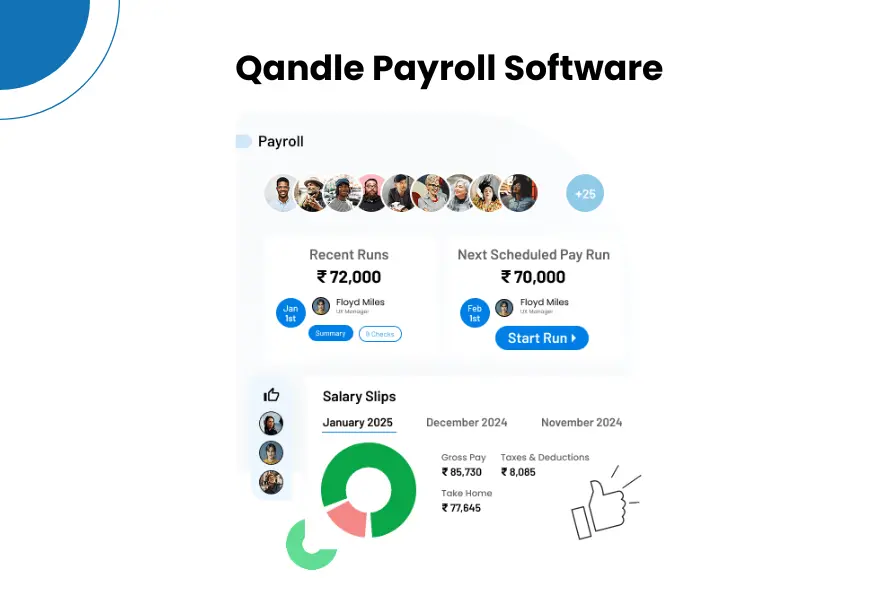

Qandle |

Modern SMEs, Agile Enterprises, Remote-First Teams |

The payroll engine can be tailored to match company policies, while HR modules connect seamlessly in the background. |

Modular design that builds a connected HR ecosystem while ensuring smooth, compliant payroll management. |

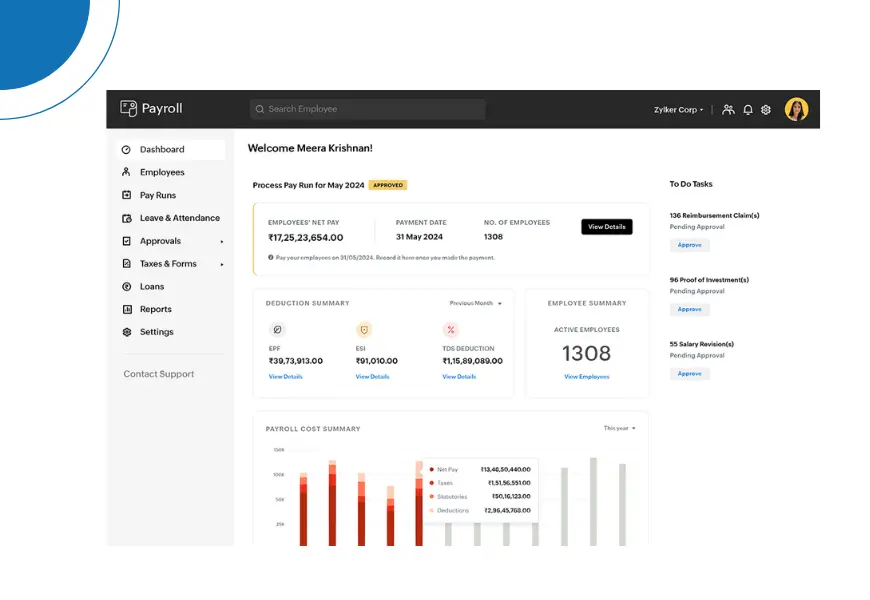

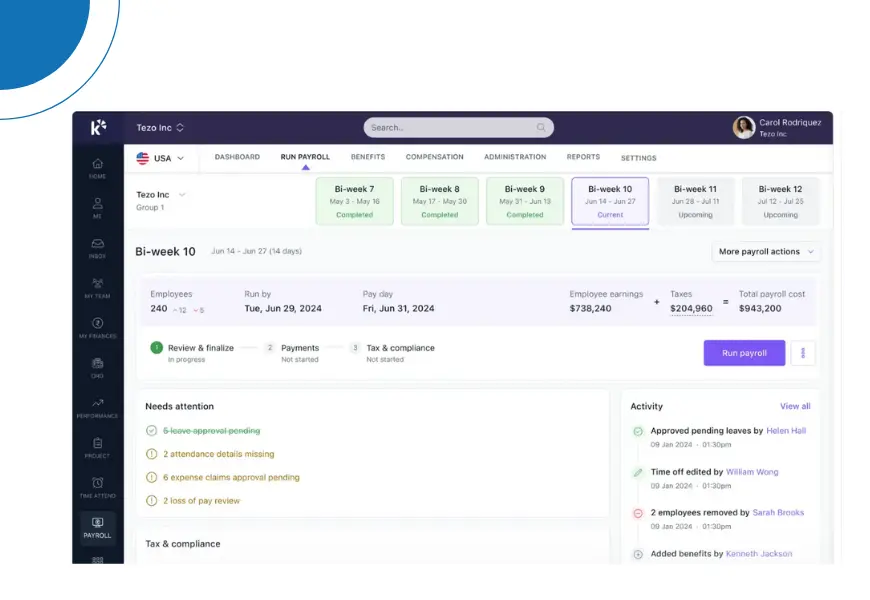

1. TankhaPay

TankhaPay is a modern cloud-based Hr and Payroll Software in India built to handle the unique compliance and workforce challenges of Indian businesses. From salary processing to statutory compliance, it simplifies every aspect of payroll—making it equally effective for startups, growing SMEs, and large enterprises. What sets TankhaPay apart is that it isn’t just payroll software—it’s a complete HR ecosystem tailored to Indian businesses.

Why TankhaPay Stands Out

- Compliance Without the Hassle – TankhaPay’s payroll automation automatically takes care of all statutory requirements, including PF, ESI, Professional Tax, and TDS. By removing manual calculations and constant follow-ups, it lets HR teams focus on meaningful work while keeping the organisation fully compliant.

- Quick and Accurate Payroll Documentation – Generating payslips, Form 16, Form 24Q, and other statutory reports is fast and hassle-free. TankhaPay ensures every document is accurate and delivered on time, reducing administrative workload and giving employees confidence in their payroll records.

- Multilingual Employee Self-Service Portal – TankhaPay’s self-service portal supports multiple languages, making it one of the most employee-friendly Payroll Software in India. Staff can view payslips, track leave, update personal and tax information, and submit reimbursements, all in their preferred language, improving engagement and transparency.

Unique Edge

Unlike most Payroll and HR software tools that stop at automation, TankhaPay delivers a full-service HR experience. Alongside its HRMS platform, it provides Employer of Record (EOR) services, Apprentice Management under NATS, and Managed HR Services. Backed by 25+ years of expertise, TankhaPay is the only solution in India that blends robust HR tech with hands-on compliance and workforce management support.

Best Suited For: Startups, MSMEs, and Large Enterprises.

2. greytHR

greytHR is a well-established Payroll Software in India and HR platform trusted by small and mid-sized businesses across the country. With a compliance-first design, it automates statutory calculations and ties payroll to leave, procedures for employee lifecycles, and attendance to increase accuracy and decrease human labour.

With a strong reputation built over years of adoption, greytHR remains a go-to solution for businesses that need accuracy, scalability, and peace of mind.

Why greytHR Stands Out

- Automates complex calculations for EPF, ESI, TDS, and other statutory deductions.

- Keeps businesses compliant with India’s ever-evolving labour laws and state-specific requirements.

- Generates detailed reports, statutory registers, and audit-ready documentation.

- Offers an employee self-service portal to improve transparency and reduce HR workload.

Ideal For: Growing IT companies, mid-sized enterprises, and SMEs that need a reliable payroll partner offering strong compliance support and streamlined workforce management.

3. Zoho Payroll

If your organization is already working within the Zoho ecosystem, extending into Zoho Payroll Software in India is seamless. The platform integrates natively with Zoho Books, Zoho CRM, and Zoho People, ensuring payroll operates as part of a unified system rather than a separate process.

Built for efficiency, it simplifies salary disbursement, compliance tasks, and reporting. The interface is straightforward, enabling teams to run payroll with confidence even without specialized expertise.

Why Zoho Payroll Stands Out

- Good user-friendly interface that requires minimal training for HR teams.

- Ensures end-to-end statutory compliance, covering PF, ESI, PT, and TDS.

- Direct integration with banks enables faster and more accurate salary disbursements.

- Fits seamlessly into the Zoho ecosystem, providing a unified platform for HR and finance operations.

Ideal For: startups, SaaS companies, and digital-first teams that prefer simple, automated payroll with built-in integration to Zoho apps.

4. RazorpayX Payroll

RazorpayX Payroll is a well-liked Payroll Software in India for startups and lean teams that prioritise simplicity and speed, since it takes a fintech-first approach to payroll management. Built on top of Razorpay’s strong payments infrastructure, the platform streamlines salary disbursals, statutory compliance, and even contractor payments—all from a single dashboard. For small teams with limited HR capacity, it reduces manual effort and ensures employees are paid on time, every time.

Why Choose RazorpayX Payroll

- On-Time Salary Transfers – Ensure employees are paid without delays through Razorpay’s strong banking rails. With instant credit options, companies can build trust and improve the employee experience.

- Effortless Compliance – Payroll compliance is automated end-to-end, covering PF, ESI, and professional tax. This reduces manual effort, avoids last-minute filing errors, and keeps businesses aligned with statutory rules.

- Flexibility for Modern Teams – Beyond permanent employees, RazorpayX Payroll is designed to handle payouts for contractors, freelancers, and gig workers. This makes it a strong fit for companies managing a blended or distributed workforce.

- Added Employee Benefits – In addition to processing salaries, this Payroll Software in India can extend support for employee benefits such as insurance and flexible pay. Bringing these features together within payroll gives employees a smoother experience while helping businesses strengthen financial wellbeing and convenience across the workforce.

Suitable For: Startups in their early stages, app-driven companies, and lean teams seeking a payroll system that is dependable, quick, and closely linked with fintech to facilitate operations.

5. Keka HR

With its comprehensive range of HR management tools and strong payroll automation, Keka has become one of the most well-known Payroll Software in India. Designed with employee experience at its core, Keka goes beyond salary processing to help businesses streamline performance reviews, track attendance, and manage the complete employee lifecycle.

Its highly configurable system makes it especially valuable for organisations that want a payroll solution tailored to their unique policies and workflows.

Why Keka HR Stands Out

- Unified Payroll, Performance, and Attendance – Keka is a leading Payroll Software in India that combines payroll, performance management, and attendance tracking on a single platform, removing the need for multiple disconnected tools. HR teams get a complete view of workforce data, enabling faster, more accurate processes and streamlined operations.

- Flexible to Your Needs – Keka adapts to your company’s policies and workflows. As a flexible Payroll Software in India, it lets you customize pay structures, leave rules, and compliance settings, giving your HR team the freedom to manage payroll without being limited by rigid software..

- Empowering Employees – The self-service portal lets staff view payslips, update tax information, track leave, and submit reimbursement requests instantly. This reduces repetitive HR queries and helps employees stay informed and engaged.

- Insights That Drive Decisions – Keka’s dashboards turn payroll, attendance, and performance data into actionable insights. Leaders can spot trends, optimize workforce costs, and make better strategic decisions based on real-time information.

Best Suited For: Rapid-growth companies, mid-sized firms, and large enterprises that need an end-to-end HRMS with payroll at its core.

6. Zimyo

Zimyo is a cloud-based Payroll Software in India designed for speed, flexibility, and simplicity—perfect for SMBs and remote-first teams. Its modern, mobile-friendly interface lets businesses set up payroll and HR processes quickly, while ensuring accuracy and compliance..

The platform is intuitive for both HR teams and employees, cutting down administrative work, streamlining approvals, and keeping the workforce informed and engaged.

Why Zimyo Stands Out

- Automated Compliance and Filings – Zimyo automatically manages statutory obligations such as PF, ESI, TDS, and more. This reduces manual work, helps avoid mistakes, and ensures your business stays compliant with regulations.

- Streamlined Employee Onboarding: The platform includes end-to-end onboarding tools, enabling HR teams to bring new hires onboard efficiently, complete documentation digitally, and get them productive faster.

- Quick Deployment for Growing Teams: With its cloud-based architecture and minimal setup requirements, Zimyo can be implemented rapidly, helping SMBs and distributed teams get up and running without IT bottlenecks.

Best Suited For: Small and mid-sized businesses, startups, and remote teams looking for a fast, flexible, and mobile-friendly HR and payroll solution.

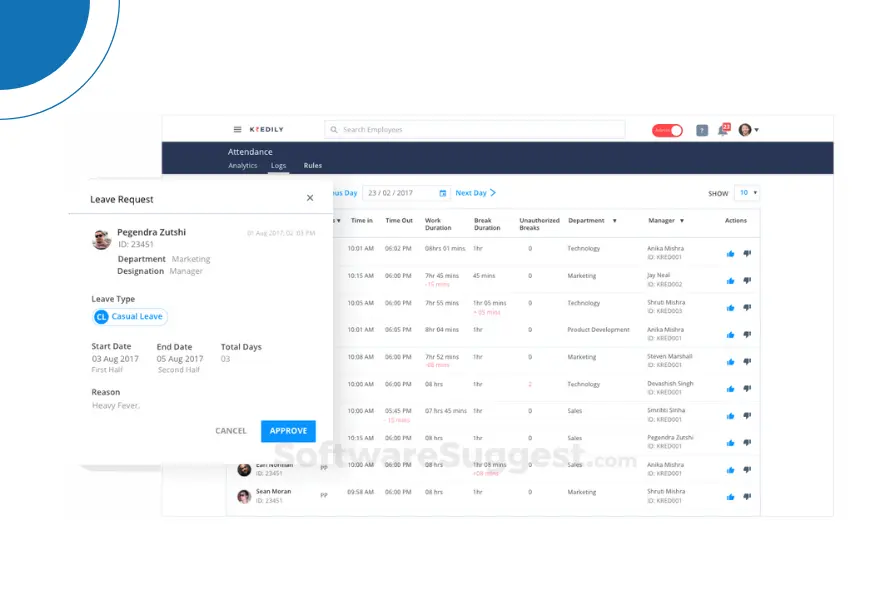

7. Kredily

Kredily is a cloud-based payroll and HR solution designed mainly for non-profits, small businesses, and startups. Teams can handle payroll, leave, and attendance without the hassle and cost of corporate systems thanks to its simplification of crucial HR processes.

Businesses may easily begin implementing HR automation using Kredily’s free-tier option and user-friendly interface while still keeping costs down and operations running smoothly.

Why Kredily Stands Out

- Cost-Effective and Accessible – Kredily offers a free payroll tier, allowing early-stage businesses to handle salaries and compliance efficiently without significant upfront costs.

- Essential Compliance Coverage – The platform handles PF, ESI, Professional Tax, and TDS, ensuring statutory adherence even for small teams with minimal HR resources.

- User-Friendly HR Tools– Kredily simplifies leave management, employee records, and basic reporting, allowing founders and small HR teams to manage workforce administration efficiently.

- Scalable for Growth– As businesses expand, Kredily offers additional features and integrations, making it easy to scale without switching platforms.

Best Suited For: Early-stage startups, NGOs, and small businesses looking for a simple, cost-efficient, and scalable payroll solution that covers core compliance and HR needs.

8. Saral PayPack

Saral PayPack is a well-known, desktop-based payroll system used by consultancies, accounting companies, and big payroll agencies. The platform is well-known for its extensive compliance features, which enable enterprises to manage complicated payroll needs with precision and efficiency.

Its wide feature set is ideal for enterprises that manage several locations, branches, or client payrolls.

Why Saral PayPack Stands Out

- Comprehensive Compliance Tools: Saral PayPack provides comprehensive compliance tools, including PF, ESI, TDS, Professional Tax, and other legislative obligations, to ensure that enterprises and consultants remain fully compliant.

- Government-Ready Reporting: The platform generates audit-ready reports and government forms, reducing errors and simplifying submissions for regulatory authorities.

- Support for Location-Specific Payroll: With flexible salary structures for different states and regions, Saral PayPack caters to multi-location businesses and clients with diverse workforce setups.

- Trusted by Payroll Professionals: Its reliability and depth of functionality make it a preferred choice for CAs, consultants, and payroll service providers managing complex payroll processes.

Best Suited For: Chartered accountants, payroll bureaus, consultants, and businesses managing multi-location payrolls that need a highly reliable, compliance-focused solution.

9. HROne

HROne is an enterprise-grade HR and payroll platform that brings HR, payroll, and analytics together on a single intelligent system. Built for large teams with complex requirements, it streamlines payroll processing, ensures tax compliance, and keeps employee records organized—all through a modern, user-friendly interface.

Key Features

- Automated Payroll, Done Right – HROne calculates salaries, statutory deductions, and compliance requirements automatically. HRs rely on the system to handle routine tasks accurately, saving time and reducing human errors.

- Actionable Workforce Insights – The platform’s smart dashboards provide an accurate image of payroll, attendance, and performance trends. This enables HR professionals to plan proactively and make informed decisions without having to dig through spreadsheets.

- Multi-Location & Multi-Entity Support – Perfect for enterprises managing teams across offices or subsidiaries.

- Custom Reporting – Generate reports tailored to your organization’s needs without complicated setups.

Best Suited For: Large enterprises and conglomerates looking for a robust, all-in-one HR and payroll solution.

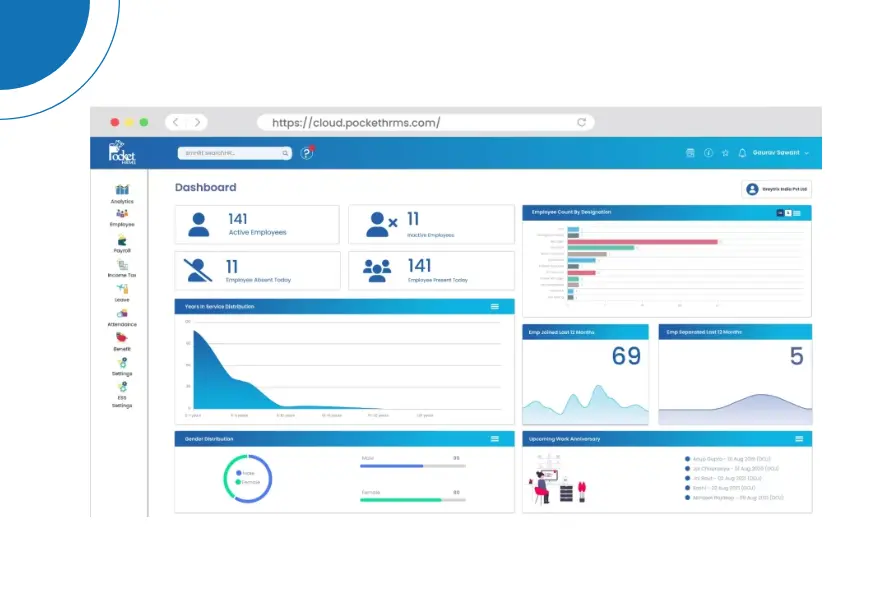

10. Pocket HRMS

Pocket HRMS is a cloud-based payroll and H platform that blends automation, AI, and employee engagement tools into a single solution. Ideal for SMEs and HR outsourcing firms, it simplifies salary processing while providing interactive dashboards and real-time insights into payroll, taxes, and compliance.

Its AI-powered chatbot enhances employee engagement by enabling instant access to payroll information, leave balances, and HR services.

Why Pocket HRMS Stands Out

-

- Simplified Tax and Leave Management – HROne automates PF, ESI, TDS, and other statutory calculations, making it easy for HR teams to stay compliant and save time on routine tasks.

- Employee Self-Service Made Easy – The interactive portal lets employees view payslips, track leave balances, and submit reimbursement requests, boosting transparency and keeping teams engaged.

- AI-Powered Payroll Assistance: The built-in AI chatbot provides real-time guidance, answers payroll queries instantly, and reduces HR workload.

- Compliance-Ready Reporting: Generates audit-ready reports, statutory filings, and salary registers, helping businesses stay fully compliant with Indian labor laws.

- Cloud-Ready and Scalable – Built for growing businesses and HR outsourcing teams, the platform deploys quickly and updates seamlessly, adapting effortlessly as your workforce expands.

Best Suited For: SMEs, HR outsourcing providers, and mid-sized enterprises seeking a modern, AI-enabled payroll platform that combines automation, engagement, and compliance in one system.

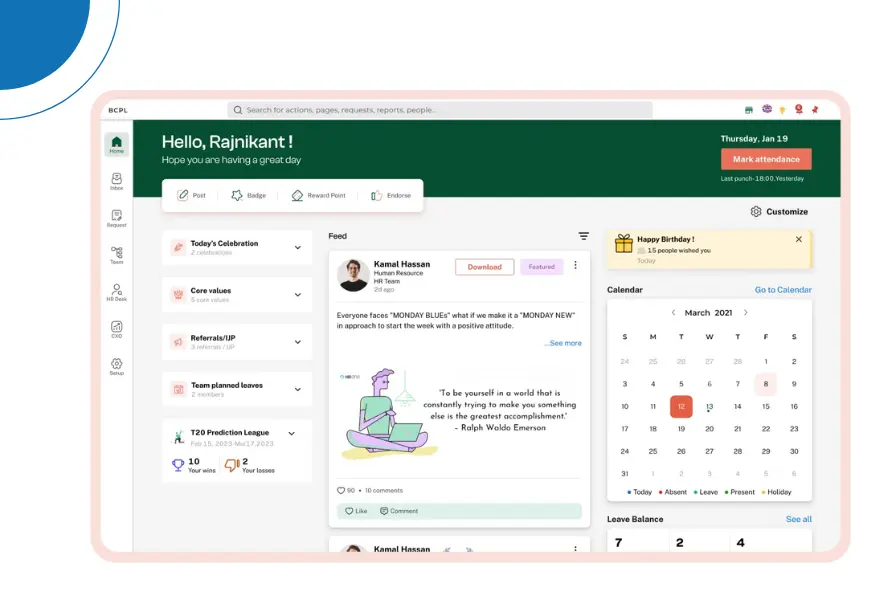

11. PeopleStrong

PeopleStrong is a comprehensive payroll and HR platform made for Indian mid-sized and large businesses. It provides HR professionals with a smooth, end-to-end solution to effectively manage the workforce by combining payroll automation, performance management, recruitment, and employee engagement capabilities.Designed for scalability, PeopleStrong is ideal for organizations seeking a unified system to manage complex HR operations while ensuring compliance and improving workforce productivity.

Why PeopleStrong Stands Out

- End-to-End Payroll and Compliance Automation: Handles PF, ESI, TDS, Professional Tax, and other statutory requirements, reducing errors and ensuring timely compliance.

- Integrated HR Suite: Beyond payroll, PeopleStrong offers modules for recruitment, performance management, learning, and engagement, making it a complete HR ecosystem.

- Employee Self-Service and Engagement: Employees can access payslips, update tax details, track leave, and engage with HR initiatives through an intuitive portal and mobile app.

- Advanced Analytics and Reporting:The platform’s user-friendly dashboards and reports make payroll data easier to comprehend. Real-time cost, attendance, and employee performance tracking enables HR teams to make better decisions more quickly.

- Scalable for Large Enterprises: Supports multi-location, multi-entity payroll, making it suitable for organizations with complex workforce structures.

Best Suited For: Mid-sized to large enterprises looking for a unified HR and payroll platform that combines automation, compliance, and employee engagement.

12. FactoHR

FactoHR is a feature-rich HR and payroll management software designed to simplify workforce administration for businesses of all sizes. Known for its scalability and mobile-first approach, FactoHR empowers organizations to automate payroll, manage compliance, and streamline HR functions—all within a single platform.Its flexibility makes it a preferred choice for companies managing both in-office and remote employees.

Why FactoHR Stands Out

- Comprehensive Payroll Automation: Automatically calculates salaries, tax deductions, and reimbursements while ensuring accurate compliance with Indian statutory laws like PF, ESI, PT, and TDS.

- Mobile-First Accessibility: Employees can mark attendance, download payslips, request leaves, and manage investments directly through the FactoHR mobile app, driving higher adoption.

- Unified HR Suite: Offers integrated modules for performance management, goal setting, onboarding, and attendance, enabling businesses to move beyond just payroll.

- Customizable Workflows: Highly configurable to suit the unique needs of startups, SMBs, and enterprises—whether it’s complex salary structures or multi-branch payroll management software India.

- Analytics and Reporting: Provides actionable dashboards with payroll, compliance, and workforce insights, supporting leaders in making data-driven HR decisions.

Best Suited For: Businesses of all sizes—from startups to mid-sized enterprises—seeking a scalable, mobile-first HR and payroll solution that simplifies workforce management while ensuring compliance.

13. ADP

Because of its dependability, scalability, and compliance knowledge, businesses from a variety of industries choose ADP, a worldwide renowned leader in payroll and HR solutions. With decades of experience, ADP offers Indian companies enterprise-grade payroll automation that combines international best practices with local statutory precision.Its ability to accommodate intricate payroll needs while providing a flawless employee experience is its strongest suit.

Why ADP Stands Out

- Global-Standard Payroll Automation: Handles multi-country payroll with precision while ensuring compliance with Indian statutory requirements like PF, ESI, PT, and TDS.

- Compliance & Risk Management: ADP is well known for its in-depth understanding of tax regulations and statutory filings, which helps businesses with large and scattered workforces avoid errors and penalties.

- Enterprise-Ready Scalability: Built for large organizations, ADP supports high-volume payroll processing software and integrates with ERP, HRMS, and financial systems effortlessly.

- Employee-Centric Features: Offers a secure self-service portal where employees can access payslips, tax statements, leave details, and more—anytime, anywhere.

- Advanced Analytics & Insights: Provides leaders with data-driven reports and payroll analytics, enabling smarter workforce and financial decisions at scale.

Best Suited For: Large enterprises, MNCs, and organizations with complex payroll structures that require global-standard compliance, scalability, and deep integration capabilities.

14. SumHR

SumHR is a modern cloud-based HR and payroll platform built for growing businesses that need flexibility, speed, and simplicity without compromising compliance. Designed with a strong focus on usability, SumHR offers intuitive modern payroll management software combined with HR essentials, making it a great choice for startups and mid-sized companies aiming to digitize their people operations quickly.Why SumHR Stands Out

- Effortless Payroll Processing: Automates salary calculations, tax deductions, and compliance filings, helping HR teams close payroll cycles accurately and on time.

- End-to-End HR Automation: Goes beyond payroll with attendance tracking, leave management, performance reviews, and employee data management in a single, easy-to-use dashboard.

- Employee Self-Service Portal: Empowers employees with access to payslips, tax documents, leave balances, and expense claims through a secure and mobile-friendly platform.

- Scalable for Growing Businesses: Whether it’s a 10-member startup or a 500-member mid-sized company, SumHR scales smoothly to meet evolving HR and payroll needs.

- Simplified Compliance: Built to align with Indian statutory norms such as PF, ESI, PT, and TDS, ensuring organizations remain fully compliant without extra manual work.

Best Suited For: Startups, SMBs, and fast-scaling teams seeking a user-friendly payroll and HR software that balances affordability with strong functionality.

15. Qandle

Qandle’s mobile-first setup makes payroll and HR tasks simple to manage on the move. Teams can handle compliance, approvals, and salary processing in one place, while employees use self-service to check payslips or apply for leave without depending on HR. This helps growing companies keep payroll smooth even as their workforce expands.Best Suited For: Agile Enterprises, Remote-First Teams

Key Strengths: Qandle is designed as a next-generation HRMS that prioritizes employee experience along with robust payroll management. It offers a flexible payroll engine, intuitive UI, and seamless integration with leave, attendance, and expense modules—making it highly adaptable for growing businesses.

Cloud vs On-Premise Payroll Software

When choosing the right Payroll Software in India, one of the biggest decisions HR leaders and CXOs must make is whether to opt for cloud based payroll software or a traditional on-premise payroll system. Both approaches have merits, but the ideal choice depends on your organisation’s scale, security needs, workflow complexity, and long-term digital transformation goals.

Today, as companies move toward automation and smarter payroll management, cloud solutions are becoming the preferred option — especially for businesses looking for flexibility, real-time access, and lower operational overheads.

Cloud Payroll Software

Payroll data can be accessed by HR, financial teams, and employees at any time and from any location thanks to cloud-based payroll software, which runs fully online. Physical servers, complicated installations, and ongoing IT upkeep are not required. This makes it particularly appropriate for contemporary businesses that place a high value on mobility, automation, and agility in payroll operations.

Key Advantages of Cloud Payroll:

It’s important to understand why cloud-based payroll has become the preferred choice for modern enterprises before discussing its benefits. As businesses scale and embrace digital transformation, the expectations from Payroll Software in India have evolved significantly. Traditional on-premise systems frequently fail to fulfil the demands of modern businesses, which include flexibility, rapid accessibility, and real-time changes. This is precisely where cloud payroll fills the void. Payroll data may be safely accessed by staff members, HR departments, and finance executives at any time and from any location, guaranteeing seamless operations even in remote or hybrid work settings. Additionally, cloud payroll reduces human labour and the possibility of overlooking legislative changes by automatically updating compliance in the background. Organisations thus gain from a system that streamlines procedures, lessens reliance on IT, and provides a payroll experience that is more flexible, economical, and prepared for the future.

1. Work on the go

HR departments may handle leave approvals, reimbursements, compliance monitoring, and pay cheque processing from any internet-enabled device with cloud payroll. Cloud access guarantees that payroll is never delayed, regardless of whether your staff is dispersed throughout several locations, remote, or hybrid.

2. Automated Compliance: Stay Worry-Free

Compliance in India changes frequently — PF updates, ESIC revisions, new tax slabs, PT variations, and more.

These legal requirements are automatically updated at the backend by cloud payroll software, guaranteeing correct deductions and filings. This minimises physical labour and shields the company from mistakes, fines, or missed deadlines.3. Lower IT Dependency

Unlike on-premise payroll accounting software that requires server maintenance, data backups, and periodic upgrades, cloud payroll runs without any infrastructure burden. All updates, patches, and security enhancements are handled by the provider — saving your IT team considerable time and cost.

4. Seamless Scalability

Cloud-based payroll software automatically adjusts to your company’s growth, from 50 to 5,000 employees. Reconfiguring systems, purchasing new licenses, or upgrading servers are not necessary. For startups, SMEs, and businesses searching for scalable, future-ready payroll administration solutions, cloud payroll is perfect due to its flexibility.

5. Enhanced Data Security

Modern cloud payroll platforms use enterprise-level encryption, role-based access, secure hosting, and automated backups — protecting sensitive payroll data far more reliably than most local systems.

6. Cost-Effective in the Long Run

With no hardware cost, no manual upgrades, and predictable subscription pricing, cloud payroll becomes a more economical choice for most organisations. It transforms payroll from a capital-intensive investment into an efficient, operational model.

On-Premise Payroll Software

On-premise payroll software refers to a payroll system installed and managed directly on a company’s internal servers. Unlike cloud based payroll software that runs online, this model gives organisations complete control over infrastructure, customisation, and data governance. Many enterprises in India — especially those with strict IT policies — still prefer on-premise Payroll Software in India because it keeps payroll operations entirely within their own security ecosystem.

This setup is often chosen by large, compliance-heavy businesses such as banks, manufacturing units, and IT/ITES organisations that want their payroll management environment to operate independently of external hosting or internet dependency. However, this greater control comes with more obligations than cloud payroll models, like system upgrades, hardware upkeep, and more operating costs.Key Advantages of On-Premise Payroll

Before delving into the advantages, it’s crucial to comprehend why, in spite of the quick transition to cloud-based payroll solutions, some Indian businesses still favour on-premise payroll software. Businesses that handle exceptionally sensitive payroll data or operate in highly regulated areas, for example, could feel better at ease with an internal structure. Additionally, while cloud-based payroll software offers unmatched flexibility and automation, on-premise payroll provides complete control over infrastructure, customisation, and data governance. On-premise systems may therefore be more in line with internal procedures for businesses with specialist payroll administration requirements, stringent IT regulations, or legacy workflows that call for more extensive system-level customisation. The decision between on-premises and cloud payroll ultimately comes down to how much control, strict compliance, and customisation a business needs.

1. Full Control Over Data