Why Cloud-Based Payroll Software Matters for Accountants in 2026

As businesses expand across cities, adopt hybrid work patterns, and deal with constantly shifting compliance rules, today’s accountants are expected to manage much more than basic salary processing. They need accuracy, speed, and real-time statutory compliance — all without relying on outdated spreadsheets or rigid on-premise systems. This is exactly where Cloud Based Payroll Software for Accountants has become indispensable.

Accountants may instantly access employee data, statutory changes, reports, and payouts from any device at any time with cloud payroll, in contrast to traditional payroll solutions.This flexibility reduces manual errors and compliance risks while simultaneously increasing workflow efficiency.Additionally, as businesses across India demand automation, audit-ready data, and integrated financial reporting, cloud payroll solutions make it simple for accountants to support multi-state operations, ensure accuracy, and simplify payroll management.

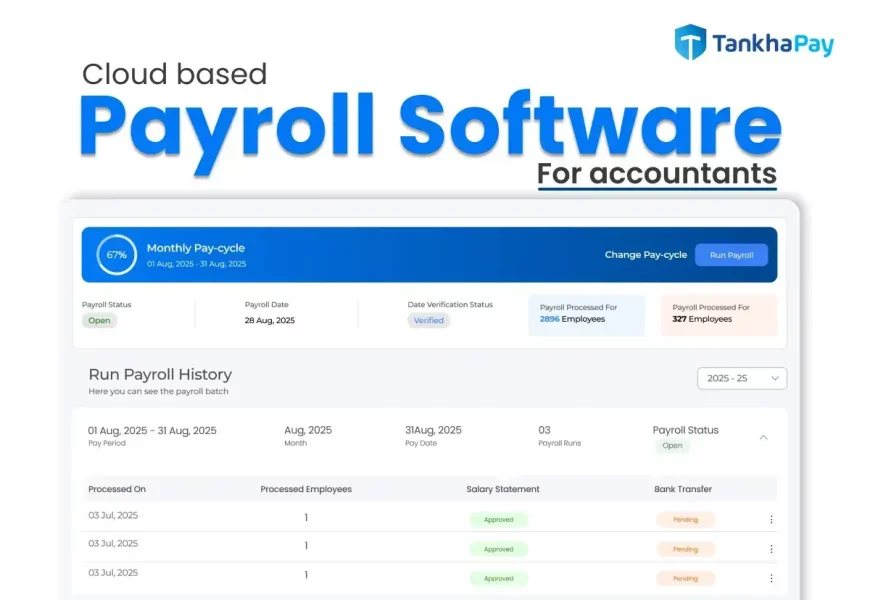

What does Cloud Based Payroll Software for Accountants mean?

Cloud based payroll software for accountants is a modern way to manage salary calculations, tax deductions, statutory filings, and employee data through secure, internet-hosted platforms. Instead of relying on traditional on-premises installations, cloud payroll systems enable businesses to access, process, and update payroll from anywhere, with automatic upgrades, real-time data, and minimal IT dependency.

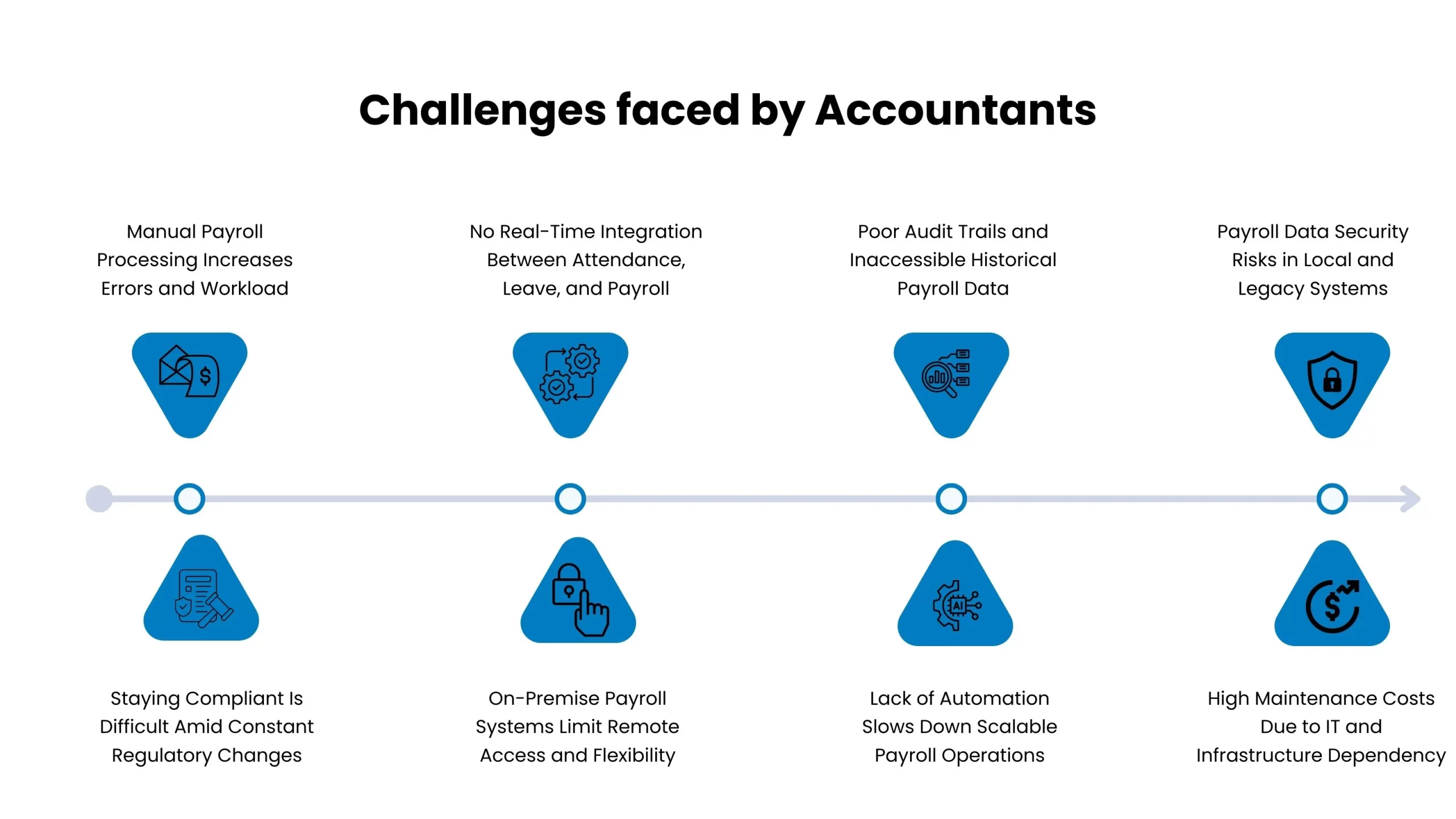

Challenges Accountants Face with Traditional Payroll Systems

Even today, many accountants still rely on traditional or on-premise payroll tools, spreadsheets, and manual calculations. While these methods may have worked years ago, they are no longer suited to India’s fast-changing payroll and compliance environment. As tax rules evolve, employee structures diversify, and businesses expand across states, accountants face growing pressure to deliver accurate, compliant, and on-time payroll management every month — something outdated systems cannot fully support.

Below are the biggest challenges accountants deal with when using traditional payroll software:

1. Heavy Manual Work and High Error Risk

Traditional payroll systems demand manual data entry across multiple sheets — attendance, overtime, arrears, deductions, and reimbursements.

This increases the chances of calculation mistakes, formula errors, and mismatch in employee records. For accountants managing multiple clients, the workload becomes even more time-consuming and error-prone.

2. Outdated Compliance and Frequent Rule Changes

PF wage limitations, ESIC thresholds, TDS regulations, professional tax slabs, and new labor standards are all examples of how India’s payroll ecosystem is continuously evolving.

Because traditional systems don’t automatically update, compliance is quite challenging. The need for accountants to manually update calculations, cross-check circulars, and edit templates raises the possibility of

- Late filings

- Incorrect challans

- Penalties for non-compliance

- Employee disputes

This is one of the biggest reasons why businesses are shifting to cloud-based payroll software for accountants.

3. Lack of Real-Time Data Sync

In older payroll systems, attendance records, leave balances, overtime, and shift schedules often remain disconnected. Without a centralized platform like HRMS ESS, accountants are forced to chase HR teams every month for updated spreadsheets, which slows down payroll processing and creates last-minute pressure before salary disbursement.

4. Limited Accessibility and No Remote Work Support

On-premise tools restrict access to office desktops or local servers.

If accountants need to verify data, access files, or run reports while travelling or working remotely, they have no option but to wait — delaying workflow and affecting client service delivery.

5. Difficult Audit Trails and Missing Historical Data

Traditional payroll software doesn’t maintain transparent audit logs or historical versions of records.

This becomes a major issue during:

- Internal audits

- Statutory audits

- Tax assessments

- Compliance checks

Retrieving past data, challans, or returns becomes painful and time-consuming.

6. No Automation for Repetitive Tasks

Tasks like TDS projections, salary revisions, LOP calculation, or arrear computation still have to be done manually.

This results in an excessive administrative burden for accountants overseeing five to fifty clients, making it challenging for them to grow their firm.

7. Security Concerns and Data Vulnerability

Local systems are prone to data loss due to:

- Hardware failures

- System crashes

- Faulty backups

- Malware

- Restricted security controls

In contrast, cloud payroll provides encryption, secure hosting, and continuous backups — something accountants increasingly prefer.

8. High Cost of Maintenance and IT Support

Traditional payroll systems require:

- Manual updates

- Server maintenance

- Software installations

- In-house IT support

This adds unnecessary overheads for both accountants and organisations.

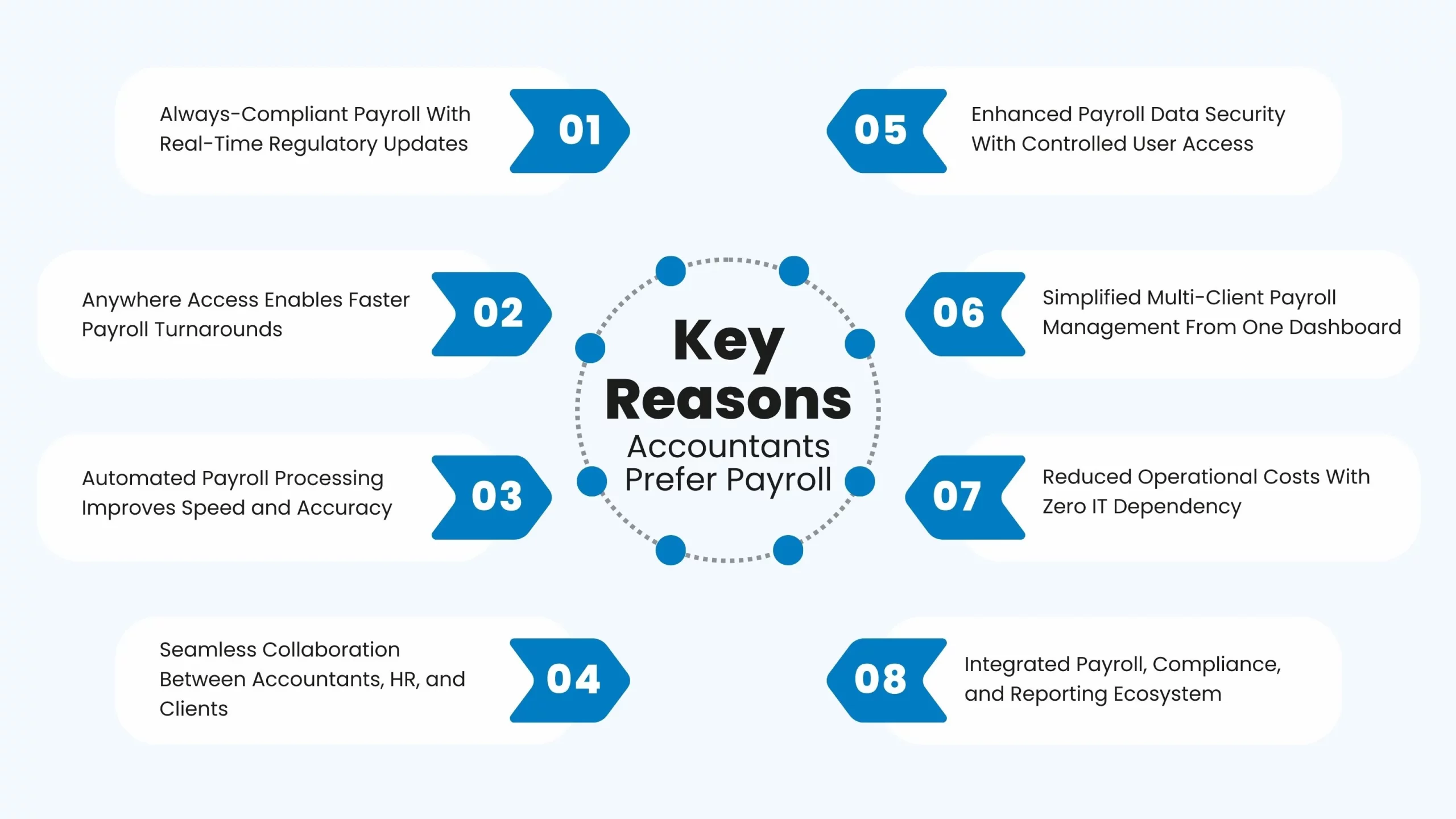

Key Reasons Accountants Prefer Cloud Payroll

Accountants in India are inevitably moving toward cloud-based systems as payroll grows more intricate and compliance-driven. The fast-paced financial operations of today simply cannot be met by traditional systems that need physical installations, manual updates, and significant IT participation. This is why cloud-based payroll software for accountants has emerged as the preferred choice, especially for firms handling multi-client payroll or businesses operating across states. Now, let’s break down the specific reasons accountants are making this transition.

1. Real-Time Accuracy Without Manual Updates

Because cloud payroll systems automatically stay current with changes in PF, ESIC, PT, LWF, and income tax regulations, accountants can work confidently without having to manually track every adjustment.

2. Anytime, Anywhere Access for Faster Turnaround

Cloud payroll provides accountants with safe access from any browser or mobile app, in contrast to on-premise payroll systems that are restricted to a single device or location. This flexibility, which provides quicker approvals, quicker adjustments, and smoother month-end closes, is essential when managing several payroll cycles at once.

3. Greater Efficiency Through Automation

Cloud platforms simplify repetitive payroll tasks like arrears calculation, TDS updates, attendance syncing, and payslip generation. By automating these workloads, accountants can process payroll in minutes instead of hours — freeing up time for advisory work and complex financial analysis.

4. Better Collaboration With HR, Finance & Clients

Since cloud payroll centralises data, HR teams, accountants, and business owners can work together in real time. Everyone sees the same attendance, salary structures, and compliance status, which eliminates back-and-forth communication and prevents data mismatches during payroll processing.

5. Stronger Data Security & Controlled Access

Accountants often handle highly sensitive financial and employee information. Cloud payroll solutions offer bank-grade encryption, role-based access, activity logs, and secure data storage. This reduces the risk of breaches, accidental leaks, or unauthorised access — issues that are common in traditional spreadsheets or local installations.

6. Faster Multi-Client Payroll Management

For accounting firms serving multiple clients, cloud payroll becomes a game-changer. It allows them to manage different organisations, statutory settings, salary structures, and reporting formats — all from a single dashboard. This improves efficiency, boosts accuracy, and scales operations without additional manpower.

7. Lower Operational Costs & Zero IT Maintenance

With cloud payroll, accountants don’t have to worry about software installations, server maintenance, backups, or system updates. Everything runs online with automatic upgrades. This reduces IT costs significantly and ensures that the payroll environment is always up to date.

8. Integrated Compliance, Accounting & Reporting

The smooth integration of cloud-based payroll software with accounting tools, HRMS platforms, and attendance systems is one of the main benefits for accountants. This guarantees audit-ready paperwork with no manual labor, streamlines reconciliation, and establishes a single source of truth for payroll data.

Note: Read about Payroll Outsourcing Services and it’s importance for an organisation.

How Cloud Based Payroll Software for Accountants Differs From Traditional / On-Premise Systems

- Unlike traditional systems installed on local servers, cloud based payroll software for accountants is hosted off-site and accessed through a web browser.

- Additionally, all maintenance, security patches, and compliance updates are handled by the service provider, reducing IT workload significantly.

- Furthermore, the cloud setup enables accountants, HR teams, finance departments, and employees to access payroll data anytime, from anywhere.

Why Modern Businesses Prefer Cloud Payroll Solutions for Accountants

- To begin with, cloud based payroll software for accountants scales easily with company growth—whether the workforce expands across cities or even globally.

- Moreover, automatic updates ensure payroll compliance stays current with PF, ESI, PT, and taxation changes without manual intervention.

- Finally, businesses save money by avoiding costly servers, IT infrastructure, and hardware maintenance, making cloud payroll a cost-efficient and future-focused choice.

Why Businesses in India Are Rapidly Adopting Cloud Based Payroll Software for Accountants

The following are the main explanations for why businesses are using cloud payroll systems more and more to empower accounting staff and expedite complete payroll procedures.

1. Automated Salary Processing

Cloud payroll software allows accountants to reduce human labor, automate wage computations, and ensure error-free processing. As a result, even during boom periods, accountants maintain stable payroll cycles, boost accuracy, and save a large amount of time.

2. Real-Time Compliance Management

3To assist accountants keep compliant, cloud payroll solutions automatically update PF, ESI, TDS, and labor legislation changes. This avoids filing errors, prevents penalties, and also supports completely compliant payroll processes without the need for extra manual effort.

3. Cost Efficient Payroll Operations

Cloud payroll eliminates the need for servers, IT personnel, and expensive installations. Accountants enjoy consistent monthly costs, full payroll features, and flexible infrastructure with subscription pricing that adjusts to match their clients’ changing business requirements.

4. Seamless Growth for Evolving Businesses

As businesses expand, cloud payroll software easily accommodate more employees and additional office locations. Payroll runs are reliable and accurate, and accountants don’t have to worry about system upgrades or capacity constraints.

5. Flexible Anytime, Anywhere Access

Cloud based payroll software gives accountants secure access to payroll data from any location. This enables smoother collaboration between HR, finance, and leadership teams—especially in remote or hybrid work environments.

6. Advanced Data Security & Protection

Cloud payroll gives accountants more security than traditional systems thanks to encryption, multi-level authentication, and audit trails. These characteristics reduce the likelihood of data breaches, illegal access, and noncompliance.

7. Integrated HR and Accounting Workflows

Cloud payroll software works smoothly with biometric systems, HRMS, ERPs, attendance, and leave modules. For accountants, this minimizes repetitive data entry, decreases errors, and promotes a simplified process between payroll and financial operations.

Tip: Learn more about HR Software in India

Who Should Use Cloud-Based Payroll Software? (Startups, SMEs, Enterprises, CAs)

For many organisations, cloud-based payroll software is now more of a need than an update. Accountants want tools that are precise, automated, and simple to use from any place as companies grow, recruit people from different locations, and adopt hybrid work. Because of this shift, cloud payroll is not limited to just large enterprises—it benefits every segment that handles payroll, compliance, and employee data. Below is a clear, human-written breakdown of who gains the most from using cloud-based payroll software and why.

1. Startups Looking for Low-Cost, Automated Payroll

Startups often operate with lean teams, and handling payroll manually slows them down. With cloud payroll, founders and accountants don’t have to maintain spreadsheets, track compliance changes, or worry about salary miscalculations.

Cloud-based payroll systems give them:

- Automated payroll runs without needing a full-time payroll specialist

- Real-time statutory compliance for PF, ESIC, PT, and TDS

- Easy onboarding as they hire their first teams

- Pay-as-you-grow pricing that fits tight budgets

For early-stage companies, this ensures payroll stays accurate and predictable from day one.

2. SMEs That Need Accuracy, Compliance & Scalability

Small and medium enterprises face the challenge of managing multiple employee categories—full-time, part-time, consultants, field staff, and more. Cloud payroll simplifies all of this with centralised dashboards and automated calculations.

SMEs benefit through:

- Single-source-of-truth for attendance, salary, and compliance data

- Reduced manual work and payroll errors

- Faster monthly payroll cycles

- Multi-state compliance support as they expand

This allows SMEs to focus on business growth while payroll runs smoothly in the background.

3. Large Enterprises Managing Multi-State & Multi-Entity Operations

Enterprises deal with complex payroll structures, multiple cost centres, unionised staff, plant-level operations, and frequent audits. Cloud payroll helps bring consistency across departments and locations. They gain:

- Centralised payroll for all branches and entities

- Standardisation of salary structures and workflows

- Audit-ready documentation and tighter governance

- Real-time reporting for finance and HR teams

- Role-based access for decentralised teams

Cloud payroll ensures that companies be compliant and transparent at scale.

4. Chartered Accountants & Accounting Firms Managing Multiple Clients

CAs, payroll consultants, and outsourced accounting firms are among the biggest beneficiaries of cloud payroll. Since they handle payroll for multiple clients, cloud systems make it easier to work fast, error-free, and securely without shuffling through files or offline software.

Accountants get:

- A single dashboard to manage all client payrolls

- Automated compliance calculations for every client

- Secure document storage and audit trails

- Faster report generation & year-end processing

- Zero dependency on client hardware or IT setups

This saves countless hours and increases their service capacity without additional effort.

5. Businesses with Distributed or Remote Workforces

Any organisation with employees working from home, on-site, or across multiple states needs payroll access from anywhere. Cloud payroll supports:

- Remote attendance capture

- GPS/location-based check-ins

- Instant access to payslips & tax documents

- Consistent payroll execution irrespective of location

This eliminates the traditional limitations of office-bound systems.

6. Firms Looking to Reduce IT Dependency

Companies that want to avoid server maintenance, hardware upgrades, and manual backups naturally prefer cloud payroll. It offers:

- Zero IT infrastructure cost

- Automatic updates and security patches

- Real-time data backups

This is especially beneficial for fast-growing companies and firms without an in-house tech team.

Final Takeaway

Cloud-based payroll software is no longer meant for only tech-driven businesses—it is essential for startups, SMEs, enterprises, chartered accountants, and multi-location companies that need accurate, compliant, and scalable payroll. Its automation, accessibility, and built-in compliance capabilities make it the preferred choice for 2025–26 and beyond.

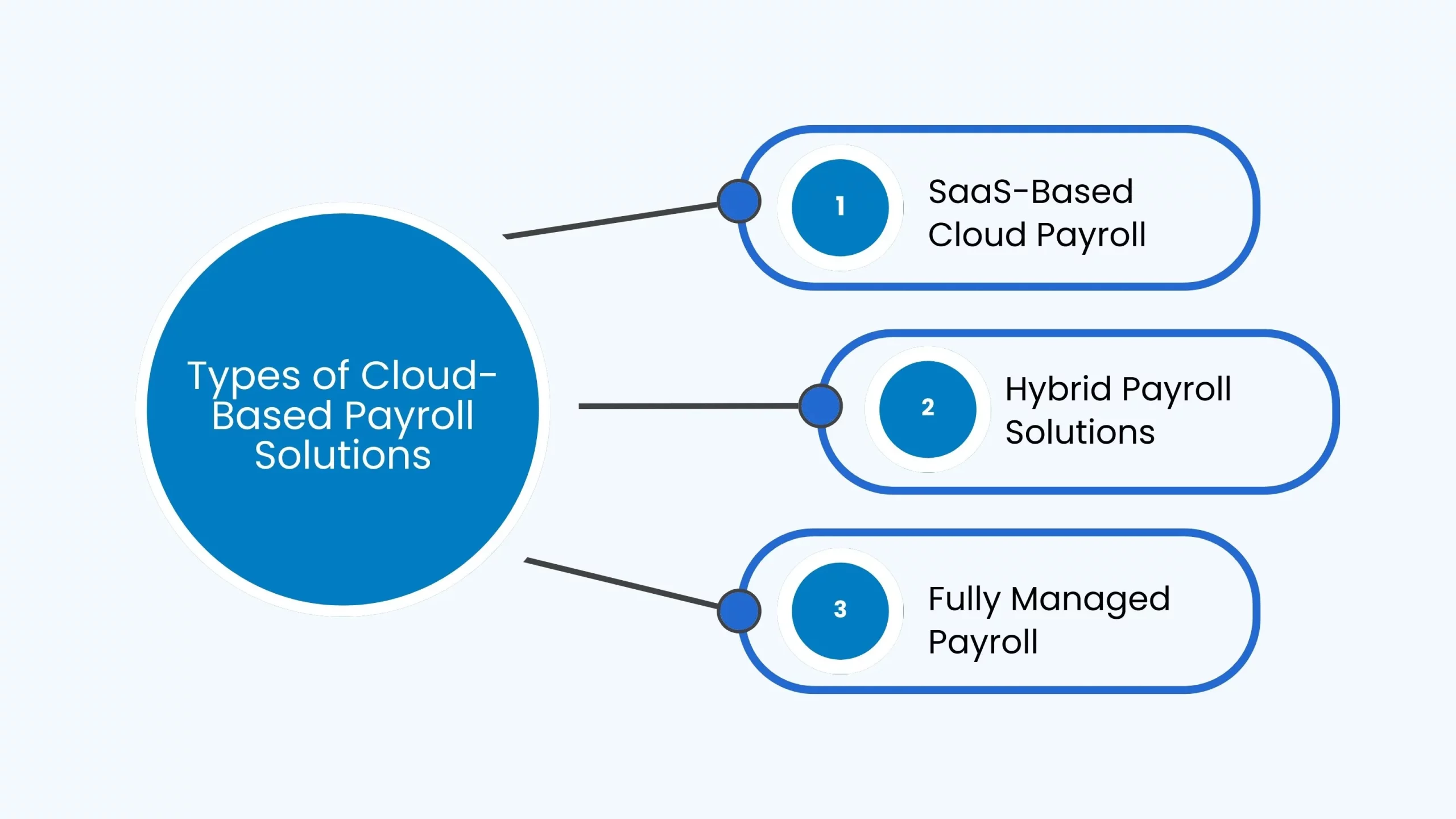

Types of Cloud-Based Payroll Solutions for Accountants (SaaS, Hybrid, Managed)

As businesses scale and payroll complexity increases, accountants often need a solution that goes beyond basic spreadsheets or traditional desktop tools. This is where Cloud-Based Payroll Software for Accountants stands out—because it offers multiple deployment models to match different levels of involvement, automation needs, and compliance requirements. Moreover, choosing the right model ensures smoother operations, faster processing cycles, and complete statutory accuracy.

Below are the three major types of cloud payroll solutions accountants typically rely on:

1. SaaS-Based Cloud Payroll (Self-Service Model)

In India, SaaS (Software-as-a-Service) payroll solutions are the most popular type. Here, all data is safely stored on the cloud, and accountants access payroll via a browser or mobile app. Upgrades, security, backups, and compliance changes are handled by the vendor, while the accountant manages payroll operations.

Why SaaS Works Well for Accountants

- Full automation: Salary calculations, TDS, PF, ESIC, PT, LWF, arrears, and reimbursements are auto-processed.

- Real-time compliance updates: The system instantly reflects new tax slabs, rates, and labour law changes.

- Cost-effective: You don’t have to invest in servers or IT staff; you just pay a monthly or yearly fee.

- Scalable: Ideal for accountants managing multiple clients or growing employee volumes.

CAs, accounting firms, SMEs, and companies requiring quick deployment with less complexity are the best candidates.

2. Hybrid Payroll Solutions (Tech + Accountant-Controlled Workflows)

In hybrid models, the cloud platform handles automation while accountants maintain partial manual control over checks, validations, and compliance monitoring. This blend of automation + expertise is perfect for organisations needing deeper customisation without losing the efficiency of cloud payroll automation.

Why Hybrid Payroll Appeals to Accountants

- More customisation: Adjust policy regulations, incomes, bonuses, deductions, approval processes, and compensation structures.

- Flexible oversight: Accountants oversee crucial components such as exception management, audits, queries, and verification.

- Improved control: Perfect for customers with multi-location payroll operations or complicated attendance regulations.

- Decreased errors: While human validation guarantees accuracy, automation minimises manual errors.

Ideal for: Businesses switching from on-premise to cloud payroll, mid-sized enterprises, and CA firms managing complex clientele.

3. Fully Managed Payroll (Outsourced Cloud Payroll Services)

Under fully managed payroll, the software provider handles end-to-end payroll management, while accountants focus on financial oversight, reconciliation, and advisory tasks. The entire payroll cycle—inputs, processing, validation, compliance filings, challans, payslips—is executed by specialists through a cloud-based platform.

Why Managed Payroll Is Gaining Popularity

- Zero operational load: The vendor manages everything—from salary computation to statutory filings.

- Stress-free compliance: PF, ESIC, PT, TDS, LWF, and state-wise filings are handled by experts.

- Audit-ready reports: Accountants get clean, validated, downloadable financial and statutory reports.

- Better governance: Eliminates missed deadlines, errors, and last-minute payroll fire-fighting.

Best suited for: Large enterprises, multi-state companies, and organisations lacking internal payroll expertise.

Final Takeaway

Whether it’s SaaS, hybrid, or fully managed payroll, choosing the right cloud-based payroll solution depends on your operational load, compliance complexity, and the number of clients you manage. For accountants, the shift to cloud payroll is no longer a trend—it’s a competitive advantage that unlocks accuracy, automation, and unmatched efficiency.

Cloud Based Payroll Software for Accountants vs Traditional Payroll Systems

Cloud based payroll software for accountants has quickly emerged as a crucial enabler of accuracy, automation, and compliance as companies modernize their financial operations. Unlike traditional systems that depend heavily on internal IT infrastructure, cloud payroll not only allows accountants to manage multi-client operations with ease but also accelerates payroll processing while ensuring end-to-end statutory compliance with evolving legal requirements. Moreover, many businesses are now searching for payroll outsourcing companies to integrate these platforms to streamline payroll administration, reduce manual errors, and eliminate repetitive tasks. As a result, this change is radically altering the way accountants assist expanding businesses, offering cloud-led payroll solutions a more intelligent, scalable, and future-ready substitute for traditional payroll techniques.

Aspect |

Cloud Based Payroll Software for Accountants |

Traditional Payroll System |

|---|---|---|

|

Hosting |

Hosted on secure cloud infrastructure fully managed, monitored, and updated by the payroll provider—ideal for accountants who need uninterrupted, error-free payroll access. |

Installed on an organization’s local servers, requiring continuous internal management, monitoring, and hardware upkeep. |

|

Accessibility |

Accessible anytime, anywhere through a web browser—allowing accountants to process payroll, check data, or generate reports remotely and in real time. |

Limited to office premises or internal networks, restricting payroll processing flexibility and slowing response time. |

|

Cost Structure |

Subscription-based pricing with predictable monthly or yearly costs—perfect for accountants who need budget clarity and no hidden IT expenses. |

Requires one-time licensing fees, costly server installations, and periodic paid upgrades, making it expensive to maintain. |

|

Maintenance |

All updates, backups, patches, and performance enhancements are handled by the provider, reducing the accountant’s IT workload. |

Maintenance must be carried out by the internal IT team, increasing overhead and delaying critical updates. |

|

Scalability |

Scales instantly as clients grow or add new employees—no additional hardware or IT support needed. |

Scaling requires new servers, increased storage, and more IT resources, making expansion slow and expensive. |

|

Compliance Updates |

Automatically updates PF, ESI, PT, TDS, and labor-law regulations—allowing accountants to stay compliant without manual tracking. |

The manual installation and monitoring of compliance upgrades raises the possibility of mistakes, missed deadlines, and fines. |

|

Security |

Uses advanced, vendor-managed security protocols including encryption, multi-factor authentication, and cloud backups—ensuring accountants work with highly secure payroll data. |

Security depends on internal IT capabilities, which may lack the sophistication and real-time protection of cloud systems. |

|

Suitability |

Best suited for accountants, payroll bureaus, small and mid-sized businesses, remote teams, and growing companies needing flexibility. |

Works for large enterprises with strong IT departments and dedicated in-house payroll teams. |

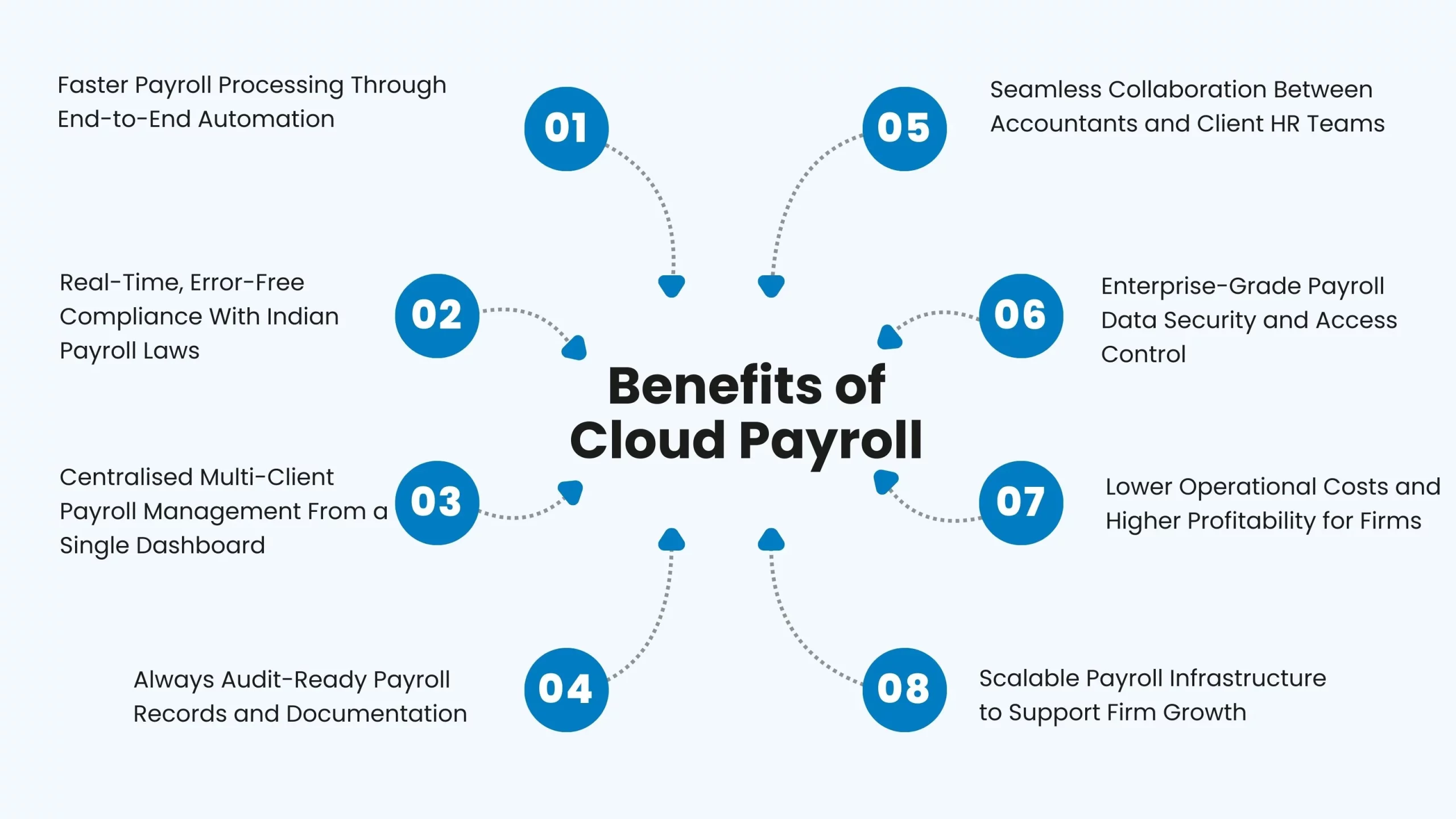

Benefits of Cloud Payroll for Accounting Firms & CA Practices

Efficiency and accuracy are essential for accounting companies and CA practices. Traditional technologies are simply unable to keep up with the increasing demands of clients, the dynamic nature of legislation, and the rise in payroll quantities. This is the exact moment when accountants have a major competitive edge thanks to cloud-based payroll software. It increases overall operational efficiency, reinforces compliance, and enhances client service delivery in addition to automating repetitive processes.

- attendance data, salary structures, and statutory deductions sync automatically

- calculations for overtime, arrears, bonuses, and reimbursements happen instantly

- processing can be done from any device, at any time

- PF, ESIC, PT, LWF, TDS calculations

- Form 16, ECR, ESIC returns, PT challans

- regime switching, projections, and tax validations

- state-wise rule updates (critical for multi-location clients)

- separate dashboards for each client

- role-based access for team members

- consolidated or client-wise reporting

- simplified switching between entities

- historic payslips & salary registers

- YTD reports, variance reports, bank statements

- statutory filings & receipts

- onboarding & exit documents

- employee self-service portals

- automated notifications for approvals

- real-time leave/attendance sync

- error-free document exchange

- enterprise-grade encryption

- role-based permissions

- secure hosting environments

- detailed audit logs

- no servers, IT maintenance, or installations

- reduced manual labour and rework

- fewer compliance mistakes (avoiding penalties)

- more capacity to handle additional clients

- different industries

- different pay structures

- different compliance needs

- different team access levels

- Customisable reports

- Export formats for auditors

- Historical data lock

- Compliance dashboards

- Employee master data

- Salary structures

- Historical payroll records

- Attendance & leave summaries

- Previous compliance filings

- Bank account details

- PF contribution rules

- ESIC eligibility

- Professional Tax slabs

- TDS calculation rules

- LWF applicability

- State-wise labour law variations

- Identify miscalculations

- Fix mapping errors

- Validate compliance deductions

- Check payslip formats

- Cross verify net salary

- Payroll registers

- TDS summaries

- PF/ESIC returns

- Reconciliation statements

- Cost allocation reports

1. Faster, Automated Payroll Processing

Cloud payroll eliminates the delays and manual errors that usually happen with spreadsheet-based or desktop systems. Accountants can process multiple clients’ payroll cycles in minutes because:

This dramatically improves turnaround time, letting CA firms manage more clients without adding manpower.

2. Accurate, Real-Time Compliance with Indian Laws

For accountants, compliance is the most time-consuming and risk-heavy part of payroll. Cloud payroll tools solve this by automating:

This ensures every client stays compliant—without accountants manually tracking every circular or rule change.

3. Multi-Client, Multi-Entity Management in One Dashboard

The majority of accounting firms manage several companies with various structures, pay cycles, and compliance needs. A payroll platform in the cloud provides:

This centralisation helps accountancy practices scale their payroll branch effortlessly.

4. Audit-Ready Documentation at All Times

Accountants frequently face difficulties when clients make last-minute requests for old challans, paystubs, or reconciliation reports. Everything is automatically stored securely via cloud systems, including:

Everything becomes searchable, sharable, and export-ready—making audits drastically smoother.

5. Improved Collaboration with Clients

Cloud payroll bridges the communication gap between accountants and client HR teams through:

Clients get full transparency, and accountants avoid repetitive clarifications—leading to faster processing and better service satisfaction.

6. Secure, Encrypted Data Protection

Accounting firms handle one of the most sensitive datasets—employee financial and identity information. Cloud payroll software provides:

This reduces the risk of data leaks and helps firms maintain trust with every client.

7. Cost Savings for CA & Accounting Firms

Adopting cloud payroll reduces overheads because:

This improves profitability without increasing operational strain.

8. Scalable Growth for Accounting Practices

Whether a firm handles 10 clients or 100, cloud payroll grows with the business. The system automatically adapts to:

This makes it easier for CA firms to offer payroll as a dedicated revenue-generating service.

Common Mistakes to Avoid When Selecting Cloud Payroll Software

Choosing Cloud-Based Payroll Software for Accountants is an important decision, especially when you’re managing payroll for multiple clients, across different states, with different salary structures and compliance rules. However, many businesses and accounting firms rush into the decision and end up with tools that create more work than they solve. To help you avoid costly mistakes, here are the most common pitfalls — and how to sidestep them smartly.

1. Ignoring India-Specific Compliance Requirements

Selecting generic payroll solutions that don’t properly handle PF, ESIC, LWF, PT, income tax regimes, and multi-state regulations is one of the worst mistakes accountants make. Despite their seeming modernity, these systems fall short when it comes to actual statutory work.

Always choose software designed specifically for Indian compliance that has auto-updates, challan generating, and return filing support.

2. Overlooking End-to-End Integration Capabilities

Many payroll errors happen because attendance, leave, and employee data sit in different systems. When payroll software doesn’t integrate with HRMS, accounting platforms, or ERP systems, accountants end up doing manual data transfers — increasing the risk of mistakes.

A good cloud payroll solution should provide attendance sync, accounting integration, and bulk data import/export to maintain accuracy.

3. Choosing Tools Without Considering Scalability

A common oversight is selecting software that works for today’s team but not tomorrow’s growth. Accounting firms handle seasonal spikes, client expansion, and multi-location operations — and the system must support all of it without breaking.

A scalable cloud payroll platform makes it easy to manage growing employee counts, new states, multiple entities, and added complexity.

4. Underestimating the Importance of Data Security

Extremely sensitive data is involved in payroll, including PAN, bank account information, salary details, and tax returns. However, a lot of businesses select technologies without considering hosting security, access control, or data encryption.

Make that the platform satisfies industry standards for secure cloud hosting, encrypted data, audit trails, and role-based access.

5. Focusing Only on Cost Instead of Total Value

Although inexpensive software may seem appealing at first, there may be hidden costs later on, such as additional fees for multi-state payroll, greater price during peak months, or additional payments for payslips.

Instead of focussing only on pricing, consider total cost of ownership (TCO), which include implementation, migration, support, compliance coverage, and long-term scalability.

6. Not Evaluating Vendor Support & Migration Assistance

Migrating payroll from spreadsheets or outdated software is not easy. Most accountants underestimate how much help they’ll need during setup, data validation, and client onboarding.

Choose a vendor that provides full migration support, guided implementation, and responsive customer service — not just automated chat support.

7. Selecting Software Without Reporting & Audit Tools

Reports, such as payroll registers, variance reports, tax summaries, year-end statements, and audit-ready exports, are crucial to accountants. However, a lot of payroll systems still don’t provide customisable reporting formats.

A strong cloud payroll system should provide:

8. Ignoring Employee Self-Service (ESS) Capabilities

Ignoring the ESS experience is an unexpected error that many accountants make. HR and accountants have the responsibility when workers are unable to download paystubs, upload proof, or complete tax declarations.

By reducing requests by up to 70%, an ESS-enabled cloud payroll platform increases overall productivity.

Final Word

By avoiding these errors, your accounting company can choose cloud-based payroll software for accountants that enhances accuracy, saves time, lowers compliance risk, and promotes long-term scalability. Making informed decisions not only makes payroll easier, but it also builds your practice’s trust with clients.

Cloud Payroll Implementation Checklist for Accountants

The way accountants handle documentation, compliance monitoring, and salary processing can be completely changed by implementing cloud-based payroll software. However, each accounting company or CA practice needs to adhere to a systematic checklist in order to ensure a smooth transition. This ensures that the payroll system meets organisational requirements, operates accurately, compliantly, and scalably, and integrates easily with existing tools. Below is a helpful, accountant-friendly checklist to help you implement cloud payroll effectively the first time.

1. Define Your Payroll Objectives Clearly

Accounting teams must determine their goals prior to onboarding any cloud payroll system.

Clarity directs the entire implementation process, whether it’s lowering manual labour, streamlining statutory compliance, enhancing accuracy, or facilitating multi-company payroll.

2. Map Your Current Payroll Workflow

Many implementation delays occur because firms skip this step.

Document how payroll is currently handled — data collection, attendance, salary components, deductions, reimbursements, and compliance filings.

This helps the vendor customise the payroll setup to match your accounting requirements.

3. Gather All Employee & Payroll Master Data

Cloud payroll software requires clean, updated data for setup. Prepare the following in advance:

A seamless, error-free migration is ensured with accurate data up front.

4. Standardise Salary Structures & Components

Since cloud payroll automates salary computation, accountants must ensure that all components — basic, HRA, allowances, deductions, variable pay, overtime, bonuses, and arrears — are standardised and mapped correctly.

This also makes statutory calculations more predictable and consistent.

5. Set Up Attendance & Leave Integrations

The majority of payroll problems are caused by inconsistent attendance records.Therefore, accountants need to make sure that the cloud payroll software connects to biometric systems, HRMS platforms, and attendance devices correctly. This creates a single source of truth for monthly data.

6. Configure Statutory Compliance Settings

To avoid penalties and errors, configure:

This arrangement needs to be exact because compliance is the foundation of Indian payroll.

7. Test the Payroll Run Before Going Live

Always run a parallel payroll cycle for at least one month.

This helps accountants:

8. Train HR Teams, Clients & Internal Staff

After the system goes live, a little training goes a long way. Everyone involved in payroll — whether it’s your internal team, the client’s HR staff, or support executives — should know how the new workflow actually functions. This entails knowing how to use the employee self-service capabilities, track compliance filings, sync attendance, add monthly inputs, and download reports. The process runs more smoothly when everyone is familiar with the fundamentals, and accountants spend a lot less time resolving minor problems.

9. Secure Role-Based Access & Permissions

To maintain confidentiality, accountants must set proper access controls.

Cloud payroll allows granular permission settings — HR teams, accountants, finance managers, auditors, and employees should get access only to what they need.

10. Set Up Reporting, Audits & Documentation

Preparing audit-ready documentation ensures the firm can justify payroll decisions anytime.

Cloud payroll systems offer reports like:

Accountants should configure and test these reports early.

11. Go Live With a Controlled Rollout

Once everything is tested, accountants can begin the official rollout.

It’s always better to onboard one entity or client first, track performance, and then gradually shift more accounts to the cloud payroll system.

How to Identify the Best Cloud Based Payroll Software for Accountants in India

Use this focused checklist to evaluate the best payroll solutions and ensure you pick a cloud based payroll software for accountants that fits your organisation’s structure, compliance needs, and growth goals.

1. Start with your organisation’s size and workforce structure

First, identify if your organization is tiny, mid-sized, or enterprise-level. Due to its simpler deployment and quicker setup, cloud based payroll software for accountants is most effective for businesses with up to 250 employees. Conversely, large organizations with multiple branches or sophisticated structures may require a more comprehensive HRMS or hybrid payroll solution for greater management and scalability.

2. Evaluate your payroll complexity

Next, analyse the level of payroll complexity you handle. If your organisation manages multi-state Professional Tax, frequent variable pay, overtime, arrears, or shift-based calculations, you must choose best payroll software in India that supports these workflows natively. Accountants should not rely on manual overrides or external spreadsheets to complete payroll each month.

3. Review statutory compliance coverage

Since compliance is a critical responsibility for accountants, ensure the software includes automated support for TDS, PF, ESIC, PT, bonus, gratuity, and Form 16 generation. Additionally, cloud based payroll software for accountants should offer automatic labour law updates to eliminate compliance risks and reduce manual monitoring.

4. Assess documentation & employee data workflows

Furthermore, choose a solution that simplifies documentation such as investment declarations, POI submissions, Aadhaar/PAN collection, UAN/ESIC onboarding, and digital verifications. Support for regional languages can be useful when accountants manage payroll for distributed or blue-collar teams.

5. Analyse pricing transparency & hidden costs

Before finalizing the software, evaluate all pricing models—especially per-employee-per-month (PEPM) plans. Compare these with licence-based or on-premise pricing. Consider setup fees, data migration charges, and support costs so you know the exact long-term financial commitment.

6. Review service quality and vendor credibility

Finally, accountants should make sure the vendor has a robust support staff in India that is knowledgeable about regional payroll regulations. Examine service-level agreements, ticket resolution schedules, uptime guarantees, and ask companies that are comparable to yours for recommendations. This guarantees that you will always get trustworthy help when payroll problems occur.

Essential features accountants must expect from cloud based payroll software for accountants

When an accounting team searches for cloud based payroll software for accountants, they’re not just buying pay runs — they’re buying reliability, auditability, and time-back. The following feature checklist focuses on what accountants care about day-to-day, and how each feature reduces risk, manual work, and month-end stress.

1. Attendance & Leave Integration — single source of truth

Why accountants care: eliminates manual timesheet reconciliation and incorrect payouts.

What to expect: seamless sync with biometric devices, web/mobile attendance, shift rosters and leave policies. Auto-pull attendance into payroll runs so variable hours, overtime and shift allowances are calculated without spreadsheets.

2. Flexible salary structures, variable pay & arrears handling

Why accountants care: real businesses have complexity — allowances, reimbursements, variable incentives and arrears.

What to expect: native support for multiple pay components, dynamic formulas, retroactive calculations for arrears, and proper PF/ESIC treatment of allowances. Avoid manual overrides (or at least have auditable override logs).

3. Complete statutory compliance automation (India-specific)

Why accountants care: compliance errors cause penalties and reputational risk.

What to expect: automatic PF, ESIC, TDS, PT calculations; ECR/Challan generation; Form 16 / 24Q generation; state-wise professional tax rules; and timely statutory updates pushed by the vendor. A clear audit trail for every statutory transaction is essential.

4. Employee self-service (ESS) & mobile payroll app

Why accountants care: reduces support tickets (payslip requests, tax declarations) and speeds up data collection.

What to expect: secure employee portal/app for payslips, tax declaration, investment proofs upload, leave requests, and bank details updates. ESS should log timestamps for audit and reconciliation.

5. Bank & payment gateway integrations (bulk payouts)

Why accountants care: bank reconciling and salary payouts must be fast and error-free.

What to expect: direct integration with corporate bank bulk-payout files (and popular payment gateways), auto-mapped NEFT/RTGS/UPI files, and easy export of payout reports for reconciliation.

6. Integrations: HRMS, ERP & accounting systems

Why accountants care: avoids duplicate data entry and reduces reconciliation gaps between payroll and books.

What to expect: native connectors or API capability for HRMS (employee master sync), accounting software (auto-posting salary journal entries), and ERPs. Good integrations cut month-end close time significantly.

7. Reporting, analytics & audit-ready exports

Why accountants care: accurate MIS reports and audit support.

What to expect: customizable reports (salary register, head-wise cost, department reports), export to Excel/CSV/PDF, and audit logs that show who changed what and when. Dashboards with variance analysis and headcount cost trends are a plus.

8. Role-based access, encryption & audit trails

Why accountants care: payroll data is sensitive — both auditors and leadership expect controls.

What to expect: role-based access control (RBAC), multi-factor authentication, field-level permissions, encrypted data at rest and in transit, and immutable audit trails for payroll changes.

9. Scalability & multi-state / multi-location support

Why accountants care: as clients grow, payroll must not break — especially for multi-state statutory differences.

What to expect: easy employee onboarding across locations, configurable state rules, and the ability to handle hundreds to thousands of employees without architecture changes.

10. Implementation, migration & vendor support (critical for accountants)

Why accountants care: a bad migration ruins confidence.

What to expect: vendor-led data migration support, sample parallel-run cycles, documented SLA for ticket resolution in India, dedicated onboarding/training for accounting teams, and local compliance advisory when regulations change.

11. Transparent pricing & TCO visibility

Why accountants care: they often evaluate cost vs. manual work saved.

What to expect: clear PEPM (per employee per month) pricing, disclosure of setup/data migration costs, support costs and any additional charges for reports/integrations. Provide TCO examples (annualized) to show business value.

Statutory Compliance Automation: A Must-Have for Accountants

Managing statutory compliance is one of the most time-sensitive and error-prone responsibilities for accountants. With constantly changing PF, ESI, Professional Tax, TDS, and labour laws across different states, manual tracking often leads to delays, penalties, and filing mistakes. This is why cloud based payroll software for accountants now comes with built-in statutory automation—helping accountants maintain 100% accuracy, eliminate manual monitoring, and stay effortlessly compliant round the year.

1. Automatic Statutory Calculations (PF, ESIC, LWF, PT, TDS)

Modern payroll software designed for accountants must handle every statutory requirement without any manual Excel work. This includes:

* PF – Automated 12% calculations, statutory wage caps, voluntary PF, and support for exempted PF trusts

* ESIC – Auto-detection of eligibility and contribution calculations based on revised wage limits

* Professional Tax (PT) — accurately compute PT using the state’s current slabs and employer rules (examples: West Bengal, Telangana, Maharashtra, Karnataka), and automatically apply any slab updates.

* Labour Welfare Fund (LWF) — apply the correct contribution amounts and payment frequencies per state, and generate the required reports for filings.

* TDS — manage rent receipts, investment declarations and exemptions, calculate HRA impacts, and produce monthly tax projections with clear side-by-side comparisons of the old vs. new tax regimes.

The software must automatically update these calculations whenever the government revises any rule or threshold.

Why accountants care:

No more manually tracking wage limits, slab changes, exemptions, or tax regime updates—everything runs accurately and compliantly in the background.

2. Ready-to-File Statutory Returns & Challans

One of the most tedious and dangerous tasks for accountants is physically preparing statutory returns. Accountants are required to produce files in forms that are precisely recognized by PF, ESIC, PT, LWF, and Income Tax portals on a monthly, quarterly, and annual basis. File rejection, delays, or penalties may result from even a minor formatting error. By producing all statutory files quickly and in the appropriate uploading formats, a trustworthy cloud-based payroll program for accountants should remove this strain.

A strong payroll system should generate:

* PF ECR file (in the exact text format required by EPFO)

* ESIC contribution file with correct IP numbers and wage details

* State-wise PT return files (including slab variations and due-date mapping)

* LWF return reports with state-specific rules

* Form 24Q (quarterly) with data structured for TRACES

* Form 16 (Part A & Part B) automatically generated and employee-ready

* TDS challans with auto-filled tax details, surcharge, cess, and deductions

All of this should be available in one click, with zero manual edits or adjustments needed.

Why accountants care:

One-click statutory returns mean zero formatting errors, faster filing cycles, easier audits, and significantly reduced compliance stress — especially during month-end or quarter-end workloads. With all statutory files prepared in the right formats, accountants can upload them directly to the portals and finish their filings on time—without digging through spreadsheets or double-checking formulas.

Pro tip: Pick a payroll tool that maintains a calendar of all statutory deadlines and alerts you before each one. It’s a simple feature, but it goes a long way in preventing missed or last-minute filings.

3. Multi State Payroll Management

As companies open offices or hire staff in different states, payroll rules get complicated. Every state in India has its own professional tax, labour welfare fund norms, minimum wages, holiday calendars, and attendance policies — and those differences must be handled correctly each payroll cycle. Handling these manually—especially across a large workforce—often leads to errors, delays, and state-wise compliance gaps. A strong cloud based payroll software for accountants must be able to manage these differences automatically, without requiring separate spreadsheets or manual overrides.

Your software must support:

* State-wise PT slabs, updated automatically as rules change

* State-specific LWF configurations, with correct employer/employee contributions

* Region-wise attendance, shift, and holiday calendars, mapped separately for each location

* Multi-state TDS handling, especially for employees who move between branches or work on deputation

* State-based cost center or department segmentation to simplify accounting, budgeting, and MIS reporting

Example:

A company with employees in Bangalore, Hyderabad, and Mumbai will have three different PT slabs, different LWF deduction rules, and three separate regional holiday calendars. Your payroll platform should manage all of this seamlessly without manual intervention.

Why accountants care:

Multi-state automation eliminates the need for manually segregating employees, maintaining multiple rule books, or tracking separate calendars. Accountants can process payroll for a distributed workforce with confidence, knowing every employee—regardless of location—is paid accurately, consistently, and fully compliant with local regulations.

Pro tip: Choose a platform that automatically applies state rules based on work location as well as employee transfer history.

4. Real-Time Tax Projections & Regime Switching

Tax calculation becomes especially complex for accountants during the year-end cycle when employees evaluate whether the old tax regime or the new tax regime benefits them more. Manually preparing comparison sheets, recalculating TDS, and updating payroll each time an employee switches regimes can consume massive time. This is where a smart cloud based payroll software for accountants adds real value by automating these tax simulations in real time.

A good payroll platform must offer:

* Real-time tax projections for both regimes, showing employees exactly how much tax they’ll save under each option

* Side-by-side comparison reports (Old Regime vs New Regime), simplifying tax counselling for accountants

* Automatic payroll recalculation when an employee switches regimes mid-year or mid-month

* Integrated proofs validation workflow, ensuring declarations and deductions are processed correctly for employees choosing the old regime

Why accountants care:

This automation reduces hours of manual recalculations and employee consultations between December and February — the busiest tax months. With accurate projections and automated adjustments, accountants avoid errors, maintain compliance, and handle tax season with far less stress.

Pro tip: Choose software that lets employees view these projections in their self-service app. It drastically cuts down queries coming to the payroll desk.

5. Digital Proof Collection, Validation & Audit Trail

Managing investment proofs manually is one of the most time-consuming and error-prone parts of payroll. Chasing employees for documents, verifying them one by one, and updating payroll data manually often leads to delays, mismatches, and compliance gaps. A robust cloud based payroll software for accountants should streamline this entire process with digital proof management that works smoothly across web and mobile.

Modern payroll software should include:

* Mobile-friendly proof upload, allowing employees to submit documents instantly without email back-and-forth

* Automatic categorization of proofs into sections like 80C, 80D, HRA, rent receipts, donations, home loan interest, etc.

* Checker–verifier workflows so different team members can review, approve, or reject proofs with clear segregation of duties

* Audit logs for every submission and approval, giving complete visibility over who reviewed what and when

* Automatic update in payroll once proofs are validated, ensuring correct TDS computation without manual re-entry

Why accountants care:

Digital proof collection removes paperwork, eliminates chances of missing documents, and builds a fully traceable audit trail. This makes audits effortless, reduces disputes with employees, and ensures TDS is calculated accurately based on fully verified declarations. Most importantly, it saves countless hours during the peak investment-proof season.

Pro tip: Choose a system that also sends automated reminders to employees — it dramatically improves proof submission rates and reduces last-minute rush.

6. Compliance dashboard & alerts

A modern payroll platform should include a compliance dashboard that highlights upcoming risks and deadlines so accountants can act before issues escalate. Key items the dashboard should surface:

* Employees approaching or crossing PF wage thresholds (so contribution changes are handled correctly)

* ESIC eligibility changes for employees based on salary movement

* State-wise Professional Tax / LWF filing deadlines and upcoming due dates

* TDS variance alerts where tax withholdings differ from projections or past patterns

* Missing investment proofs or incomplete employee declarations that impact tax computations

* Unfiled returns, pending challans, or filings that are due soon

Why accountants care:

These proactive alerts cut down on last-minute firefighting. Instead of discovering a compliance gap during an audit or at month-end, accountants can resolve exceptions through the month, avoid penalties, and keep payroll cycles smooth and predictable..

7. Historical data lock & audit readiness

Historical Data Lock & Audit Readiness

For accountants, one of the biggest challenges is maintaining clean, untampered, and traceable payroll records — especially when audits or statutory inspections come up. A cloud based payroll software for accountants should automatically lock each month’s payroll data after processing, ensuring that no one can modify the numbers without leaving a digital trail. This creates a single source of truth that accountants can rely on during audits or reconciliations.

Key capabilities to look for:

* Monthly payroll freeze so past data cannot be altered accidentally or intentionally

* Frozen data snapshots capturing salary, tax, attendance, and contributions exactly as processed

* Downloadable audit logs that show who made what change and when

* Archive of statutory registers like PF, ESI, PT, TDS, Form-24Q, etc., all neatly organized month-wise

* A clear, time-stamped history of payroll corrections, if any adjustments were made in later months

Why accountants care:

Auditors expect complete transparency and traceability. Locked historical data removes the risk of discrepancies, ensures evidence-based reporting, and speeds up audit cycles. Most importantly, it safeguards accountants from compliance disputes by proving that payroll was processed accurately and responsibly.

Pro tip: Choose a system that keeps these records for 7+ years so you’re always prepared for retrospective audits.

Conclusion

Is your payroll system keeping pace with your goals? Modern cloud payroll systems give the precision, regulatory certainty, and flexibility that growing enterprises need to stay ahead. Leave archaic processes behind and walk into a smarter, more efficient approach to manage payroll that produces actual outcomes.

TankhaPay, our cloud-powered HR platform, streamlines daily workflows, consolidates employee information, and empowers better business decisions. Book your free TankhaPay demo today and experience how smarter HR can transform your business!

Amazing piece of article. Being an accountant I was researching a blog from a long time that tells me about the impact of cloud based payroll software for us.

Very well structured! Commendable job team…

Insightful and very helpful for choosing the right payroll software.

A fantastic piece of an article for accountants. I liked a few of the very unique headlines on this blog.