Processing salaries manually every month can be both time-consuming and liable to costly errors. HR teams often find themselves burdened by spreadsheets, double-checking figures, and managing compliance deadlines, leaving less time for strategic initiatives that add value.

Payroll automation offers a smarter, more strategic solution. By leveraging artificial intelligence and advanced payroll technologies, businesses can streamline processes, enhance accuracy, and maintain compliance with evolving regulations. A 2025 EY report reveals that over 60% of Indian employers are integrating AI into compensation analysis, benchmarking, and payroll forecasting, indicating that payroll automation is transforming HR from an administrative function into a strategic driver of growth and efficiency.

What is Payroll Automation?

Payroll automation transforms payroll management by simplifying complex workflows, lowering manual effort, and ensuring accuracy and compliance. Organizations can process payroll faster, minimize errors, and allow HR and finance teams to focus on strategic initiatives that boost productivity and growth, by automating repetitive tasks.

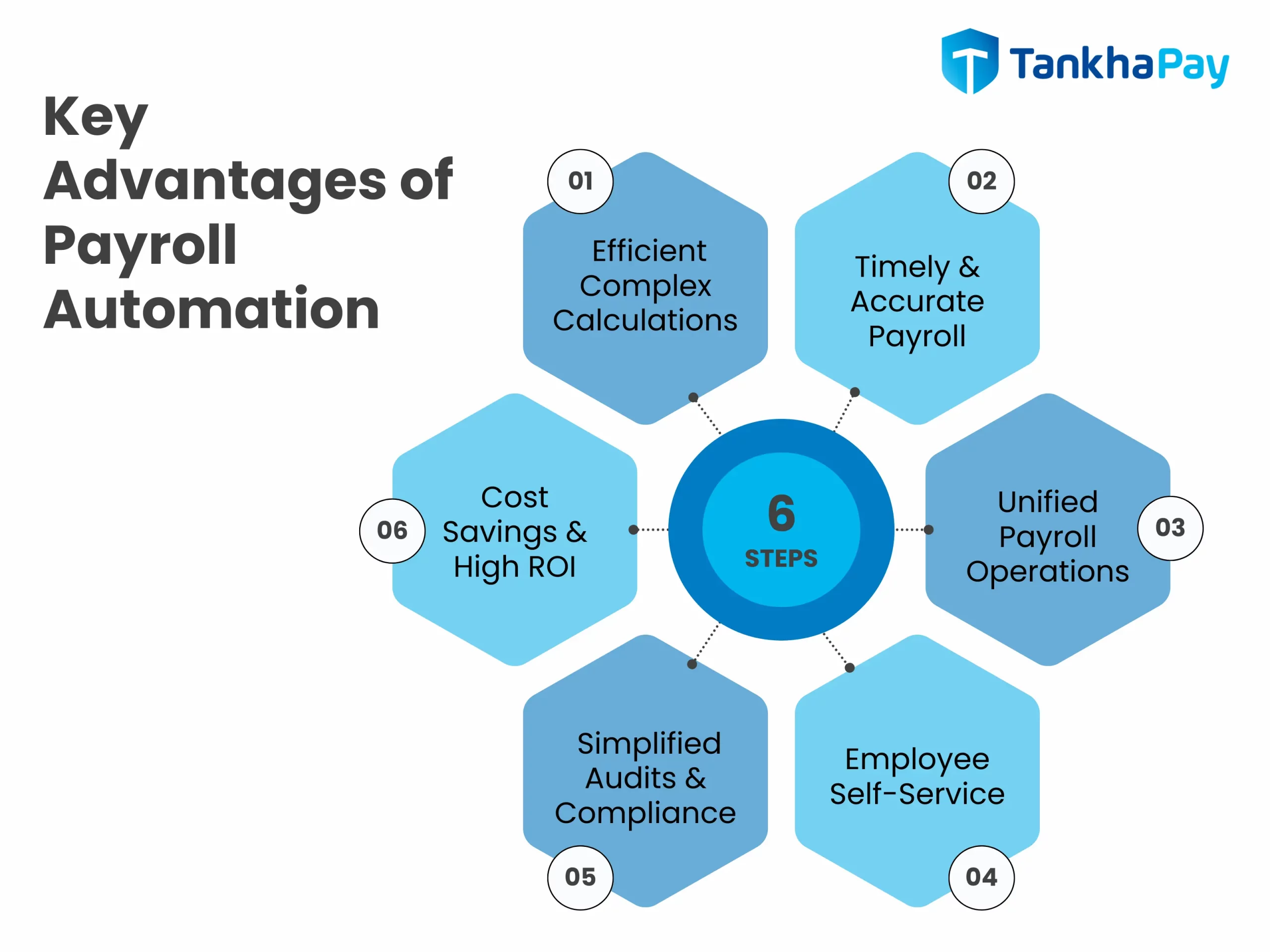

What are the Key Advantages of Payroll Automation?

Payroll automation does more than just replace manual tasks, it optimizes workflows, reduces errors, and turns payroll into a strategic organizational asset. Unlike traditional resource heavy manual payroll processing, automated systems save time while maintaining precision and accuracy.

-

Manage Complex Payroll Calculations Efficiently

Automated payroll softwares can efficiently manage tax brackets, overtime, and benefits allocations. They automatically update in response to changing rules and regulations, ensuring regulatory compliance. This reduces errors, eliminates manual adjustments, and allows payroll executives to focus on more important tasks.

-

Ensure Timely and Accurate Payroll Every Cycle

Payroll delays frustrate employees and disrupt financial planning, with many organizations making hundreds of off-cycle corrections annually. Automated payroll ensures every pay cycle is processed on time, accurately handling headcount changes and last-minute adjustments seamlessly.

-

Reduce Administrative Complexity with Unified Payroll

Payroll involves much more than salary calculations, compliance, record updates, and reporting; these tasks add to the workload. Payroll automation systems centralize these tasks, improving efficiency and visibility, while enabling HR and finance teams to leverage payroll data strategically for better decision-making.

-

Enhance Employee Self-Service and Transparency

Automated payroll systems provide employee self-service portals, allowing them to access pay slips, update their personal information, and track tax filings. According to the American Payroll Association, 83% of employers provide this, which reduces HR workload, increases transparency, and empowers employees to manage their payroll information efficiently.

-

Simplify Payroll Auditing and Compliance

Payroll errors pose significant financial and legal risks. Payroll automation systems feature robust auditing tools that detect discrepancies, streamline corrections, and maintain detailed tracking, ensuring payroll data is always audit-ready and reducing the compliance workload for HR and finance teams.

-

Cost Savings with Payroll Automation

Initial savings result from reduced processing time, fewer errors, and the elimination of compliance penalties. In the long term, advantages include lower HR staffing needs, fewer error corrections, and improved employee retention. Deloitte reports payroll automation can deliver 300–500% ROI in the first year by reducing processing time, errors, and compliance penalties, highlighting how automation drives efficiency and cost-effectiveness.

Calculating Return on Investment (ROI) for a 100-Employee Company in India-

Current Manual Costs:

- Payroll processing time: 208 hours annually × 2,050/hour = 4,26,400

- Error correction costs: 8 errors × 20,500 = 1,64,000

- Compliance penalties: 2 late filings × 12,300 = 24,600

Total Annual Cost: ₹6,15,000

Automated System Costs:

- Software subscription: 2,95,200 annually

- Implementation: 1,23,000 one time

- Training: 41,000 one-time

Total First Year Cost: ₹4,59,200

Annual Savings: ₹6,15,000 – ₹4,59,200 = ₹1,55,800

ROI: 34% first year, 52% ongoing

|

Quick Facts As per the LiftHCM, platforms that leverage artificial intelligence to monitor attendance and payroll have reduced payroll errors by up to 70 percent. By leveraging AI with biometric and geolocation tools, businesses can automate payroll, track attendance, and identify irregularities in real-time, thereby boosting accuracy and efficiency and enabling HR teams to focus on growth-driven initiatives. |

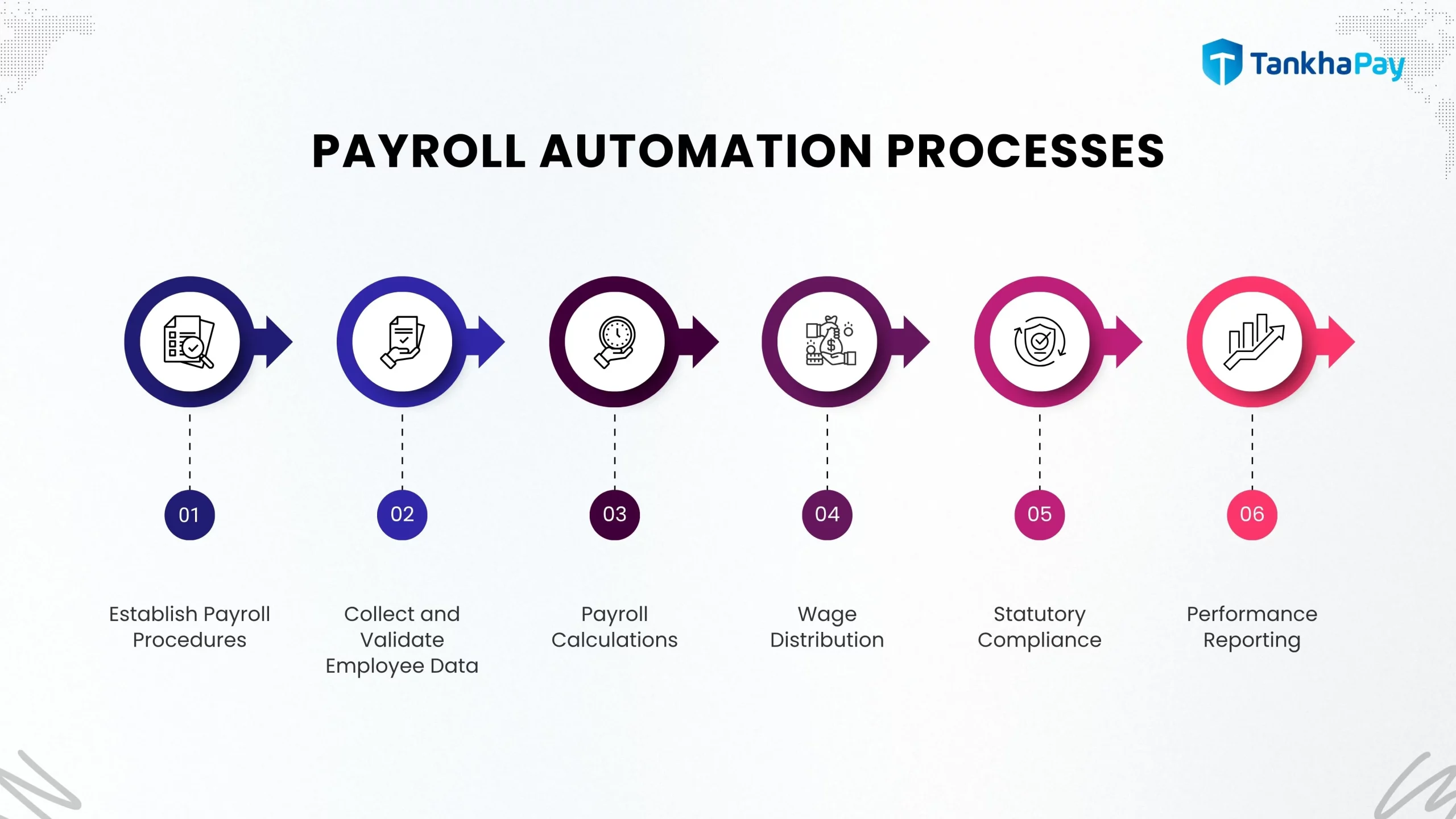

How Payroll Automation Streamlines Payroll Processes?

Before implementing payroll automation, enterprises should identify high-value use cases, address process bottlenecks, and determine necessary data integrations. With management approval, they can adopt cloud-based solutions, either standalone or enterprise-wide, to streamline payroll and HR processes efficiently. Payroll involves multiple sub-processes before, during, and after payout, all of which can be digitized through automation to ensure a seamless and efficient employee experience.

- Establish Payroll Procedures

Salary calculations are guided by company-specific HR policies that cover attendance, leave, overtime, and reimbursements, as well as statutory requirements such as provident funds, pension schemes, and income tax regulations. Payroll automation software allows these rules to be easily configured, while fully automated workflows ensure that any changes to policies are properly requested, reviewed, and approved.

- Collect and Validate Employee Data

Accurate payroll depends on employee-specific data, including designation, attendance, hours worked, salary structure, investment declarations, and performance/appraisal information for calculating variable pay. Special allowances, benefits, overtime, and leave encashments must also be captured. Secure API integrations make it easy to sync data from existing enterprise systems.

Tip: Replace fragmented legacy HR tools with a unified HRMS, such as TankhaPay, which automates payroll, attendance, performance, and leave management, ensuring seamless data flow and accurate, timely payouts.

- Payroll Calculations

Payroll automation software accurately calculates all components of an employee’s CTC, including basic salary, house rent allowance, travel allowance, and other allowances, based on the preconfigured salary structure. It also manages statutory deductions such as EPF, ESI, professional tax, and TDS, ensuring compliance with regulatory requirements and reducing manual errors.Tip: With TankhaPay, employees can submit reimbursements via mobile, and automated workflows ensure quick HR approval, keeping payroll seamless and efficient.

- Wage Distribution

Payroll automation guarantees the timely crediting of net salaries directly into employee bank accounts. It also generates detailed payslips automatically, outlining the breakdown of all payout components. Employees can conveniently access their payslips through intuitive self-service portals, enhancing transparency and reducing administrative follow-ups.

- Statutory Compliance

Payroll software automates statutory deductions, including EPF, pension contributions, professional tax, and TDS, ensuring all payments are prepared and submitted on time. Accounting teams can complete payments online through government portals and upload receipts directly into the payroll system, simplifying compliance tracking.

Year-end obligations, such as generating TDS certificates and Form 16 for employees, are also automated. This reduces manual effort, minimizes errors, and ensures complete adherence to regulatory requirements. - Performance Reporting

Payroll automation applications generate industry-standard reports and visual dashboards, enabling management to monitor salary expenses, business costs, and trends in CTC and hiring over time. These insights support informed decision-making and strategic workforce planning.

Tip: Leveraging a unified HRMS like TankhaPay allows organizations to harness HR data with AI-driven analytics, helping predict attrition, optimize bonuses, and plan salary hikes more effectively.

–

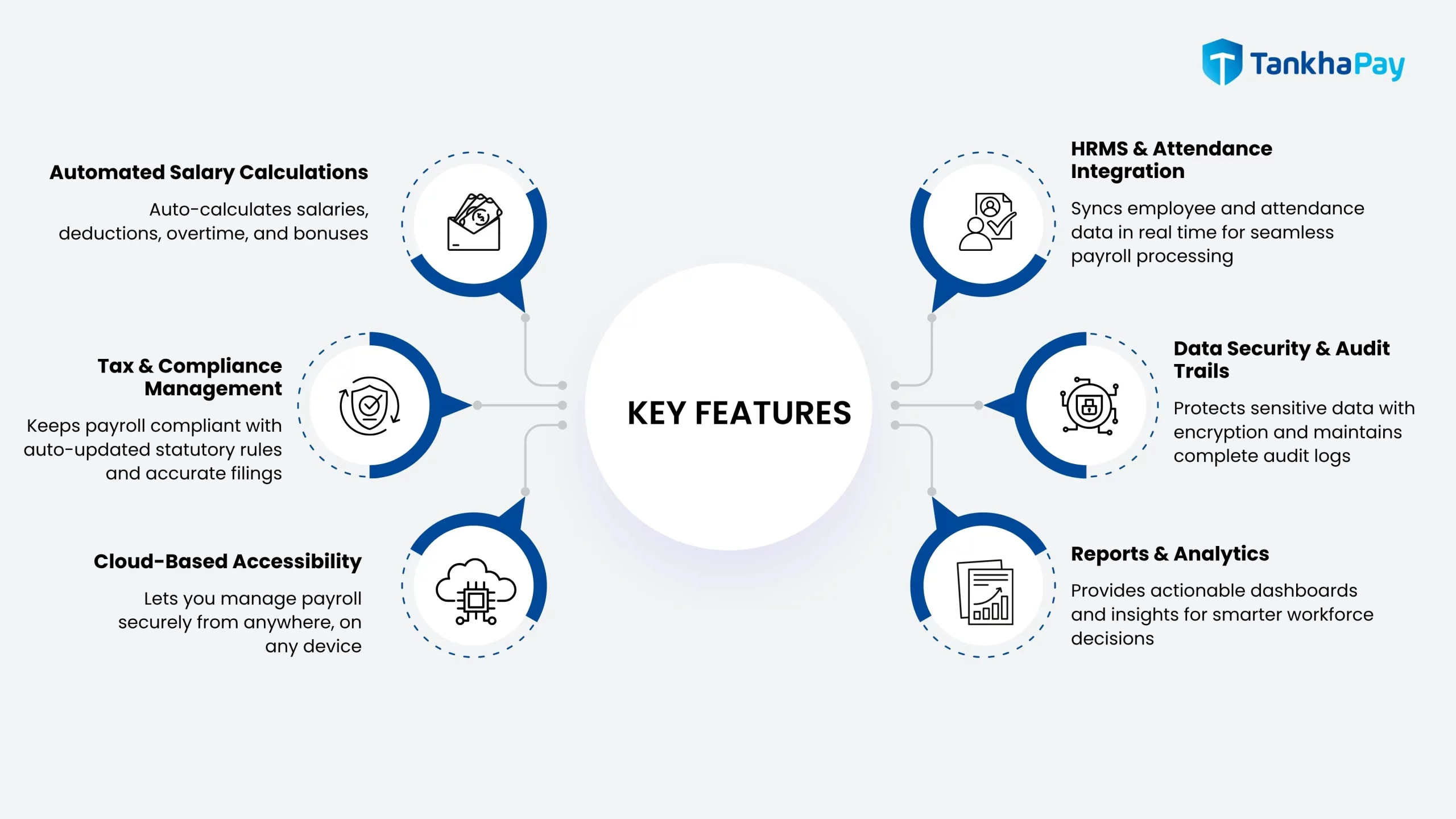

What are the Key Features of an Automated Payroll System?

Automated payroll systems streamline salary processing, ensure tax compliance, integrate with HR and attendance tools, provide secure cloud access, maintain audit trails, and deliver actionable analytics. These features reduce errors, save time, and support strategic, data-driven business decisions.

- Automated Salary Computation for Accurate and Timely Payroll

The system automatically calculates salaries, taking into account overtime, bonuses, deductions, and allowances. It eliminates manual spreadsheets and errors, ensures consistency, and accelerates payroll cycles. This allows HR teams to focus on strategic initiatives rather than routine calculation tasks.

- Tax and Compliance Management to Stay Legally Secure

Automated payroll platforms are regularly updated to stay compliant with federal, state, and local tax regulations. They calculate liabilities, manage filings, and generate compliance reports. This reduces audit risks, ensures regulatory adherence, and helps organizations maintain confidence in accurate and lawful payroll operations.

- Cloud-Based Accessibility for Anytime, Anywhere Payroll Management

Cloud-based payroll systems used in payroll outsourcing services provide authorized users with secure access to payroll information from any device, at any location. This level of flexibility supports remote and distributed teams, reduces the burden of system maintenance, enables automatic updates, and ensures seamless scalability. As a result, organizations can manage payroll efficiently and reliably without the limitations of on-premise infrastructure.

- Seamless Integration with HRMS and Attendance Systems

Integration with HRMS and attendance systems ensures accurate, real-time employee data, time records, and compensation details. This reduces duplicate entries, minimizes errors, and aligns payroll processing with workforce management, resulting in smoother operations and improved organizational efficiency.

- Strong Data Protection with Clear Audit Records

Payroll systems protect sensitive employee and financial data through encryption, access controls, and detailed audit trails. Every action is logged, ensuring accountability and regulatory compliance, safeguarding the organization, and fostering trust among employees, management, and external auditors.

- Custom Reports and Analytics for Strategic Decision-Making

Modern payroll systems offer custom reports and analytics to track labor costs, trends, and productivity. Tailored dashboards provide insights for better decision-making, enabling leadership to optimize workforce planning, reduce costs, and leverage payroll data as a strategic business tool.

Emerging Trends in Payroll Automation in India

India’s payroll automation landscape is rapidly evolving as organizations embrace technology to simplify complex HR processes. The growing integration of AI, cloud computing, and analytics in payroll management is helping companies process salaries faster, minimize compliance risks, and gain actionable workforce insights.

Payroll Automation Adoption Among Indian Businesses, Especially MSMEs

Indian businesses, especially MSMEs, are increasingly adopting payroll automation to streamline salary management, reduce errors, and ensure compliance with tax and labor laws. As of September 2025, India has 6.82 crore registered MSMEs employing 29.77 crore people, many of which leverage affordable, cloud-based payroll solutions for efficiency and scalability.

Expansion of Payroll Automation Companies in India

The payroll software industry in India is experiencing significant growth, driven by the increasing adoption of automated payroll solutions by businesses. Automation not only reduces errors and ensures compliance but also streamlines salary processing, boosting the demand for efficient payroll management platforms.

Market Highlights According to a Market Research Report:

- The Indian payroll service market size was valued at over $1.66 billion in 2024 and is projected to reach $2.39 billion by 2029.

- Compound Annual Growth Rate (CAGR): ~7.49% during 2024–2029.

Key Players in India:

- TankhaPay, GreytHR, Zoho Corporation, Keka, HROne, ZingHR

- Other notable providers: Razorpay, sumHR, ADP, Pocket HRMS

With payroll automation reshaping the HR landscape, India’s payroll software market is poised for sustained expansion, offering businesses smarter, faster, and more compliant payroll management solutions.

Rising Government Attention Toward Digital Compliance Initiatives

The Indian government’s focus on digital compliance is enhancing transparency and efficiency across industries. Through the Jan Vishwas 2.0 initiative, decriminalization via digital processes, self-declaration mechanisms, and a unified compliance framework are fostering trust-based governance, streamlining regulations, improving business operations, and ensuring continued protection of worker rights.

Comparison Between Manual Payroll Processing and Automated Payroll Software

| Parameter | Manual Payroll | Automated Payroll |

|---|---|---|

| Required Time | Each pay cycle can take several hours or even days because data entry and calculations are performed manually. | With payroll software, processing and calculations are automated, reducing the time required to just a few minutes. |

| Risk of Error | High risk of errors, as mistakes in payroll calculations, deductions, and data entry occur frequently. | Low risk, since automation improves accuracy and minimizes human errors. |

| Compliance | Manual payroll requires ongoing updates to keep up with changing tax laws and regulations. | Automated payroll systems automatically incorporate tax rule changes, helping maintain compliance with regulations. |

| Scalability | Scaling is challenging, as adding new employees substantially increases the workload. | Easily scalable, with the system accommodating additional employees seamlessly as the business grows. |

| Employee Experience | Access is limited, with employees frequently depending on HR for pay stubs and payroll updates. | Through an employee self-service portal, staff can access pay stubs, receive updates, and gain greater transparency. |

| Security | Spreadsheets and paper-based systems carry risks of lost files, fraud, and unauthorized access. | Sensitive payroll data is safeguarded through data encryption, role-based access, and comprehensive audit trails. |

| Integration | Operates as a standalone system, necessitating duplicate data entry across HR and accounting platforms. | Integrates directly with accounting ledgers and HR software, eliminating the need for duplicate entries. |

| Cost Efficiency | Costs are higher because of payroll team labor, errors, and the risk of penalties. | Lower costs result from streamlined administrative processes and greater accuracy. |

How to Set Up Payroll Automation for Your Business?

Selecting the right payroll automation partner can be a challenging process, requiring thorough research, significant time, and substantial investment. However, the right solution can simplify the process entirely, saving you both effort and resources.

- Opt for a payroll solution that is user-friendly and intuitive. Platforms such as TankhaPay can be set up in under an hour with minimal configuration, allowing payroll disbursement in just a few clicks.

- Ensure payroll integrates seamlessly with your existing HRMS system. This automatic synchronization reduces duplicate data entry, minimizes errors, and streamlines payroll processes across HR and finance functions efficiently.

- Prioritize compliance with payroll laws and regulations. Payroll is heavily regulated, and non-compliance can be costly. Choose a solution that stays current with all legal and regulatory requirements.

- Select a payroll solution that meets all your business needs. Identify the processes you want to automate and ensure your chosen tool provides those features, as well as additional capabilities, to support growth and efficiency.

- Select a cloud-based payroll system that incorporates robust security measures. Features like encryption, secure access controls, and regular backups protect sensitive employee and payroll information from unauthorized access or data breaches.

- Select a payroll provider offering reliable, responsive customer support. Timely assistance with setup, troubleshooting, and ongoing management ensures smooth payroll operations and minimizes disruptions for HR and finance teams.

What Makes TankhaPay the Right Choice for Payroll Automation?

TankhaPay empowers organizations to automate payroll, streamline HR operations, and ensure compliance, transforming these critical functions into strategic business advantages. With over 25 years of experience serving more than 1,000 startups, SMEs, large enterprises, and government organizations, TankhaPay combines cutting-edge technology with expert HR guidance to simplify processes, enhance accuracy, and save valuable time.

- Automated Payroll and Compliance: Accurate salary processing and ongoing statutory compliance, supported by our experienced HR professionals.

- Smart Hiring and Onboarding: Streamline recruitment with an advanced Applicant Tracking System, ensuring seamless onboarding experiences.

- 24/7 Virtual HR Support: Dedicated HR experts available around the clock to help you optimize HR operations.

- Employee Engagement and Transparency: Empower employees with self-service portals for access to records, payslips, and leave management.

- Cost and Time Efficiency: Reduce HR expenses by up to 33% and save over 12 hours per pay cycle by eliminating manual payroll and administrative tasks.

- Proactive Compliance: Stay ahead of evolving labor laws and regulations with timely updates, avoiding penalties and operational disruptions.

- Scalable Solutions: Effortlessly expand payroll and HR capabilities as your organization grows, with centralized, cloud-based employee records accessible anytime.

Experience smarter, faster, and fully compliant payroll automation and HR management with TankhaPay. Book your free demo today to see how we can turn payroll and HR into strategic business enablers.

Conclusion

Payroll automation is transforming HR from a transactional function into a strategic driver of growth. By streamlining processes, enhancing accuracy, ensuring compliance, and improving employee experience, businesses can reduce administrative burden, minimize errors, and save costs. Adopting automated payroll solutions empowers HR teams to focus on strategic initiatives that drive productivity, efficiency, and long-term organizational success.

Frequently Asked Questions

What are the advantages of payroll automation?

Automating payroll saves time by handling repetitive calculations and payments automatically, ensuring easier compliance with labor laws, reducing the risk of errors, and allowing HR and finance teams to focus on strategic initiatives instead of manual tasks.

What are the features of automated payroll?

Automated payroll solutions provide a comprehensive range of capabilities, including centralized employee data management, automatic salary calculations, secure payment processing, and detailed reporting. They can also handle complex scenarios, such as shift-based schedules, varying pay cycles, streamlined approval workflows, and customizable access controls, to protect sensitive payroll information.

What is the difference between manual payroll and automated payroll?

Manual payroll requires hands-on effort for every step, from data entry to calculating wages, taxes, and deductions. Automated payroll uses software to perform these calculations efficiently and accurately, often integrating with other systems such as time-tracking tools and accounting platforms, significantly reducing human error and administrative effort.

How does automation help HR?

Payroll automation frees HR teams from repetitive tasks, such as data entry and report generation, allowing them to focus on strategic priorities, including talent acquisition, employee engagement, retention, and workforce planning.

How is AI used in payroll?

AI enhances payroll processes by detecting anomalies, predicting compliance risks, optimizing tax calculations, and automating repetitive tasks. It helps organizations operate faster, more accurately, and proactively manage regulatory and operational risks.

What is the best software for payroll automation?

Leading payroll automation software includes TankhaPay, GreytHR, Zoho Payroll, Keka, HROne, and ZingHR. The right choice depends on your organization’s size, payroll complexity, team structure, and compliance requirements.

Very informative post! The right attendance and payroll software can simplify workforce management by syncing attendance, leaves, and salary processing all in one place. It really helps businesses save time and avoid manual errors. Great insights!